Data source: raw financials FactSet and Morningstar, calendarized and cleaned with Multiples

Graphics: made with PowerPoint

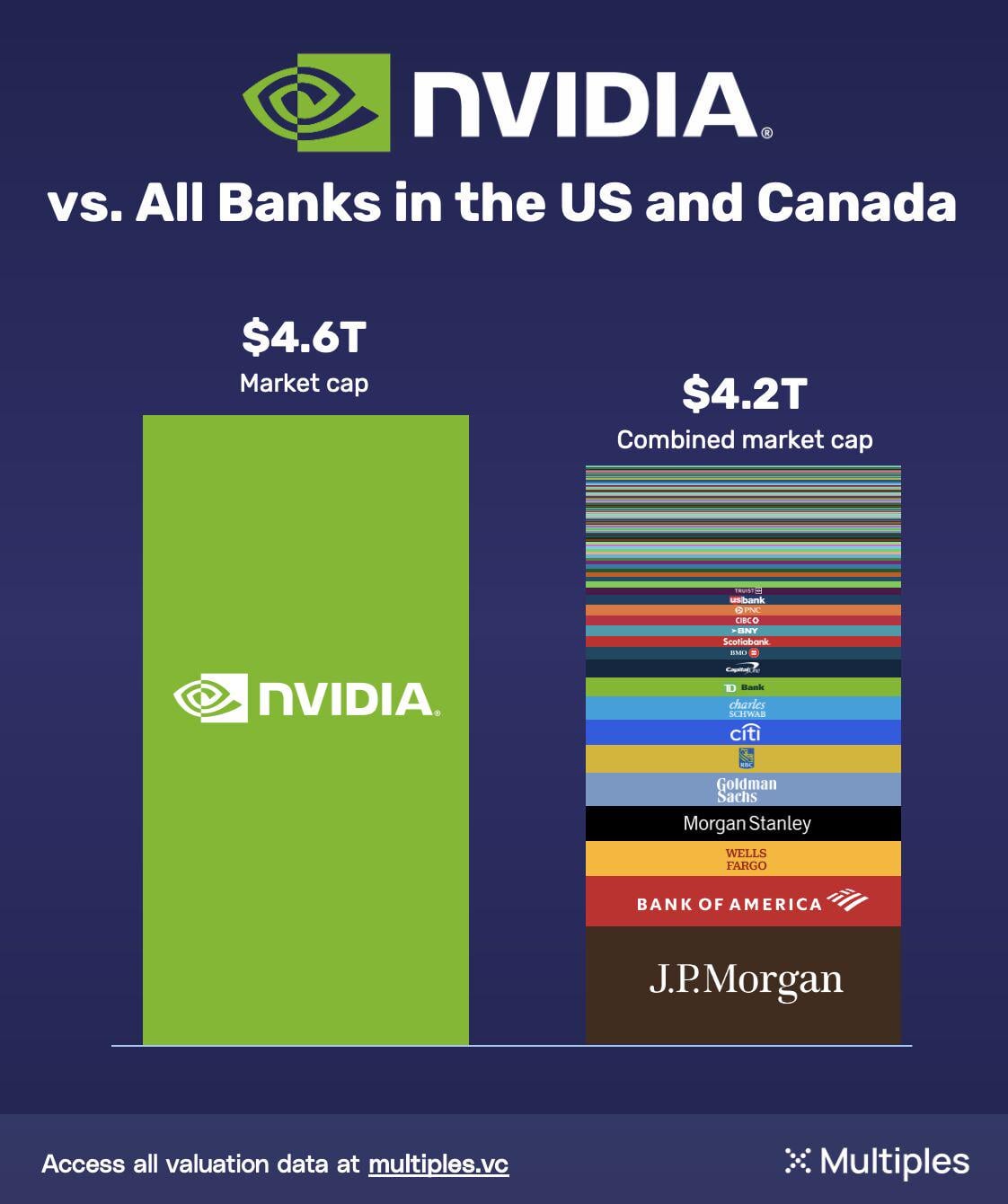

Includes all publicly traded both commercial and investment banks in the US and Canada.

Posted by alex-medellin

![[OC] NVIDIA is now bigger than all banks in the US and Canada combined](https://www.europesays.com/wp-content/uploads/2025/10/bnyu5o68bhvf1-1122x1024.jpeg)

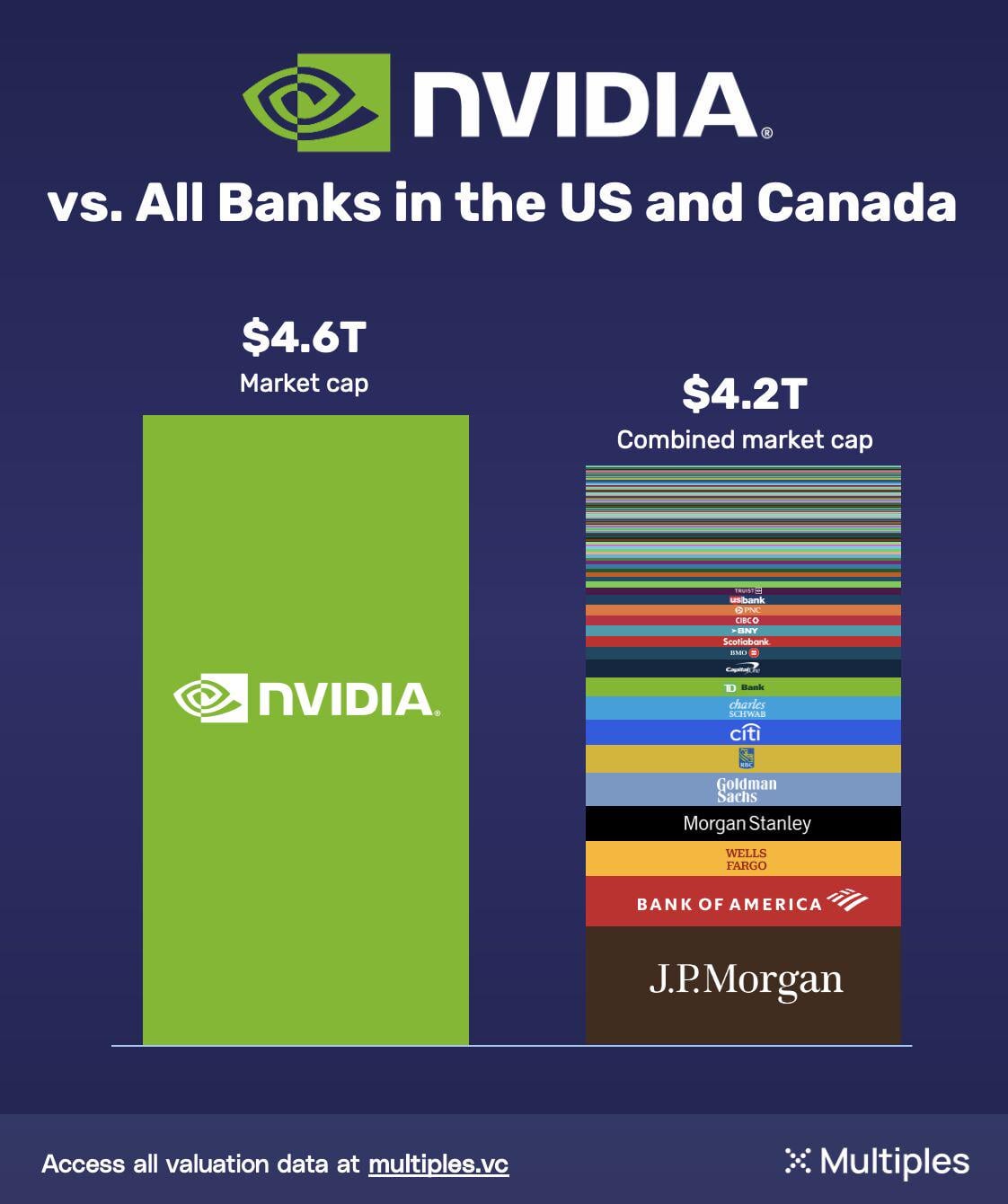

Data source: raw financials FactSet and Morningstar, calendarized and cleaned with Multiples

Graphics: made with PowerPoint

Includes all publicly traded both commercial and investment banks in the US and Canada.

Posted by alex-medellin

45 comments

Banks normally take money from other people and use it for their profits.

NVIDIA is now 16% of Us gdp

Definitely no ai bubbles round here…

Banks main job is keeping customer data as most banks don’t even hold much cash in bank vaults. Which to be fair most tech companies can do that job now days better than banks.

But the real answer is probably AI is the hype right now and greed.

Any smart investors with assumptions when the bubble will pop?

The only people who get rich in a gold rush are the people selling the shovels…

Man his leather jacket is gonna get so much fancier

Now do Carvana (middle man with elevator) vs car producers

So we know we’re in a bubble. And we know that time in the market beats timing the market.

So why do I feel like cashing in all of my ETFs and holding fire?? Surely now is the time?

Have North American bank companies thought about getting into chip designing ? What are they stupid?

This looks so familiar

https://preview.redd.it/om8kn3nvghvf1.png?width=1200&format=png&auto=webp&s=549f5c5cde16caf3ec95ca7c8c68baed25027770

Now we just need the same but for profit to get some idea in how reasonable that evaluation is.

Really happy I sold at $120

In this day and age, market cap is just a popularity measure.

This is why I put all my money in to graphics cards instead of savings or investments.

I will admit, the wife’s not too happy about it, says it takes up too much room, but it’ll be worth it in the end!

Teaching rocks to think is more valuable in 2025

I don’t think NVIDIA is that overvalued.

They are by far the best graphics card producer.

The need for computational power will be growing fast in the future.

And Ai isn’t going away after the bubble.

Sure there will be decreases demand for some time after. But it will come back up.

Its a real company with a real product.

Markets are not marketsing

JPMorgan’s assets alone are $4.6 trillion

This is a reasonable visual, but stating the NVDA is “Bigger” than ALL USA/CAN banks is a bit misleading. Market cap seems to be thrown around a little too often to define too much.

Why are people looking at this and concluding we’re in a bubble? You can replace Nvidia with Apple here and the chart will look very similar, but no one says apple is a bubble.

Don’t worry guys, AI is defo worth the concept of finance or medicine. Nothing to see here I don’t know why you even mention it.

How can the common man profit off of the bubble bursting?

Market cap is a very poor measure for measuring the total value of a company, especially across sectors

Market cap is the value of the shares, not the company (assets etc). It has potential growth priced into it. Banks aren’t exactly growth stocks.

If Nvidia diversifies now while they’re strong, they’ll weather the pop easily enough. If they hold the reins and don’t do anything with it before the bubble bursts, that’s their own fault.

If I was running Nvidia, I’d buy some banks, crypto exchanges, research think tanks, a variety of electronics fabrication companies including flash storage, pharma development (drug formulation via AI), etc; things that can feed back into the main business and will be needed in the future regardless of the bubble.

So will hurt a bit when this crashes 😀

Shirley it can’t fail for it is big?

… but dramatically more volatile.

Correction: the NVIDIA BUBBLE is now bigger than …

Gen Z is about to experience their first bubble burst.

I’m grabbing the popcorn.

Now add the derivative market

90s dot com bubble

2020s AI bubble 🤣

When this bubble pops the human toll is going to be so massive. We are really propped up by a company that makes nothing in the US.

On the bright side, they might go back and start making good graphics cards again.

The thing is NVIDIA can literally not build them out fast enough. They are also building up GPU cloud services as well. GPUs are not sitting idle either. Companies have only really started with things such as MCP roll outs etc. The data center build put will slow down but demand for GPUs etc wont we have barely scratched surface for how AI is gonna be used

Yeah that is going to be one nasty bubble pop. 40 trillion off the map overnight. Let’s see how the GOP and bankers will fail to work through that mess

And still there piece of shit soft ware doesn’t work half the time

This shit is not going to end well.

There is alot of overlap between marketcaps between banks and the company they invest in. Not a good chart honestly.

AI bubble? What AI Bubble?

Infinitely more useful than them…. Bubble or not is different discussion

This is gonna hurt when it pops up

Nvidia being valued so high is such a joke lol. Great company but clearly not in real terms more valuable than say apple, Microsoft, Google.

Most obvious single stock bubble going

Lol @ all the people that think this is a good thing.

Comments are closed.