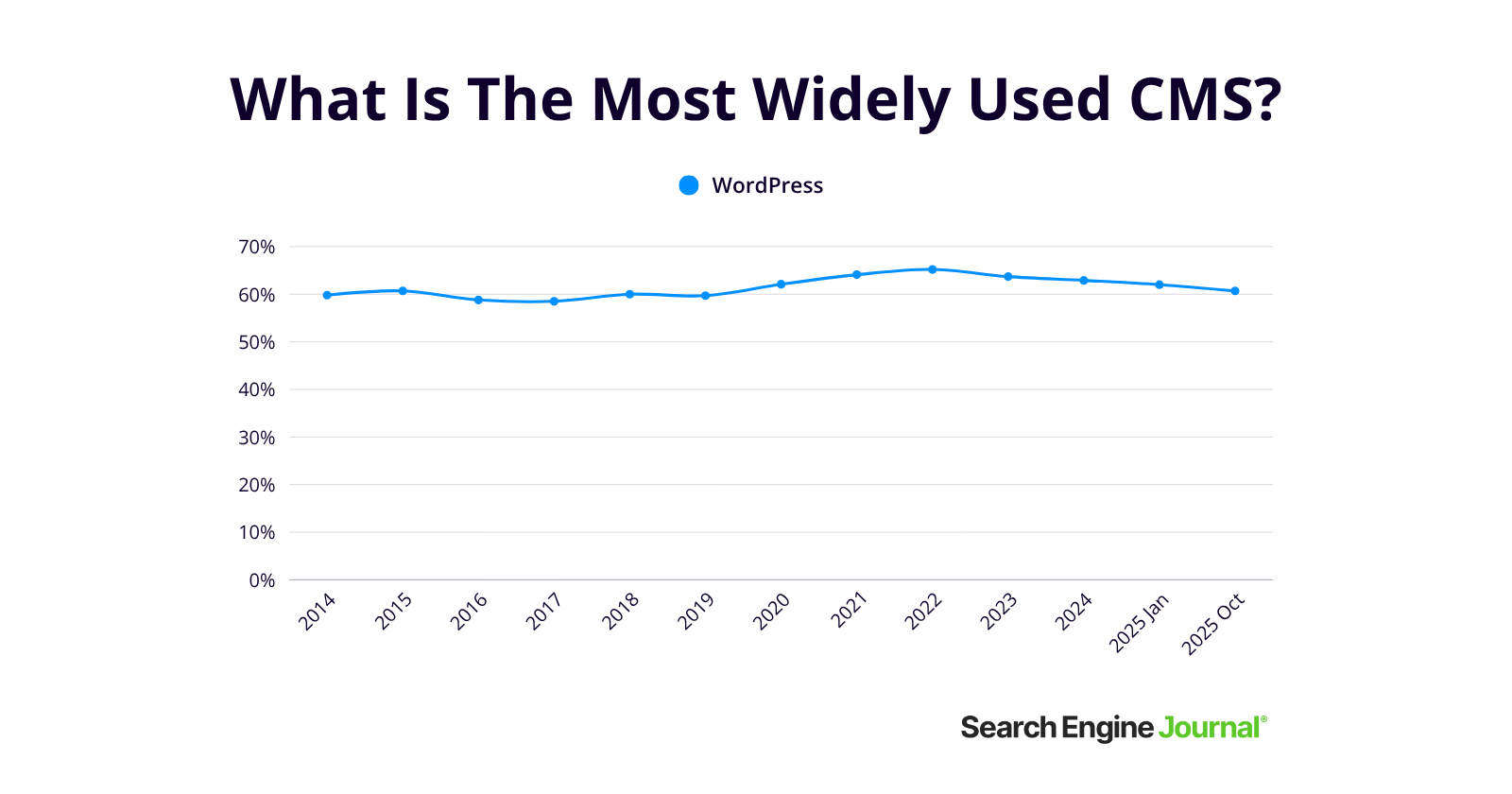

WordPress remains the dominant force in content management systems, powering 43.3% of websites surveyed and holding a 60.7% share among sites using a CMS, according to W3Techs (October 2025). That is still a commanding lead, but it marks a sustained decline from its peak of 65.2% in 2022 and is back to the same level as 2018, prior to the pandemic boom.

For executives and technical teams, this shift signals more than a market statistic.

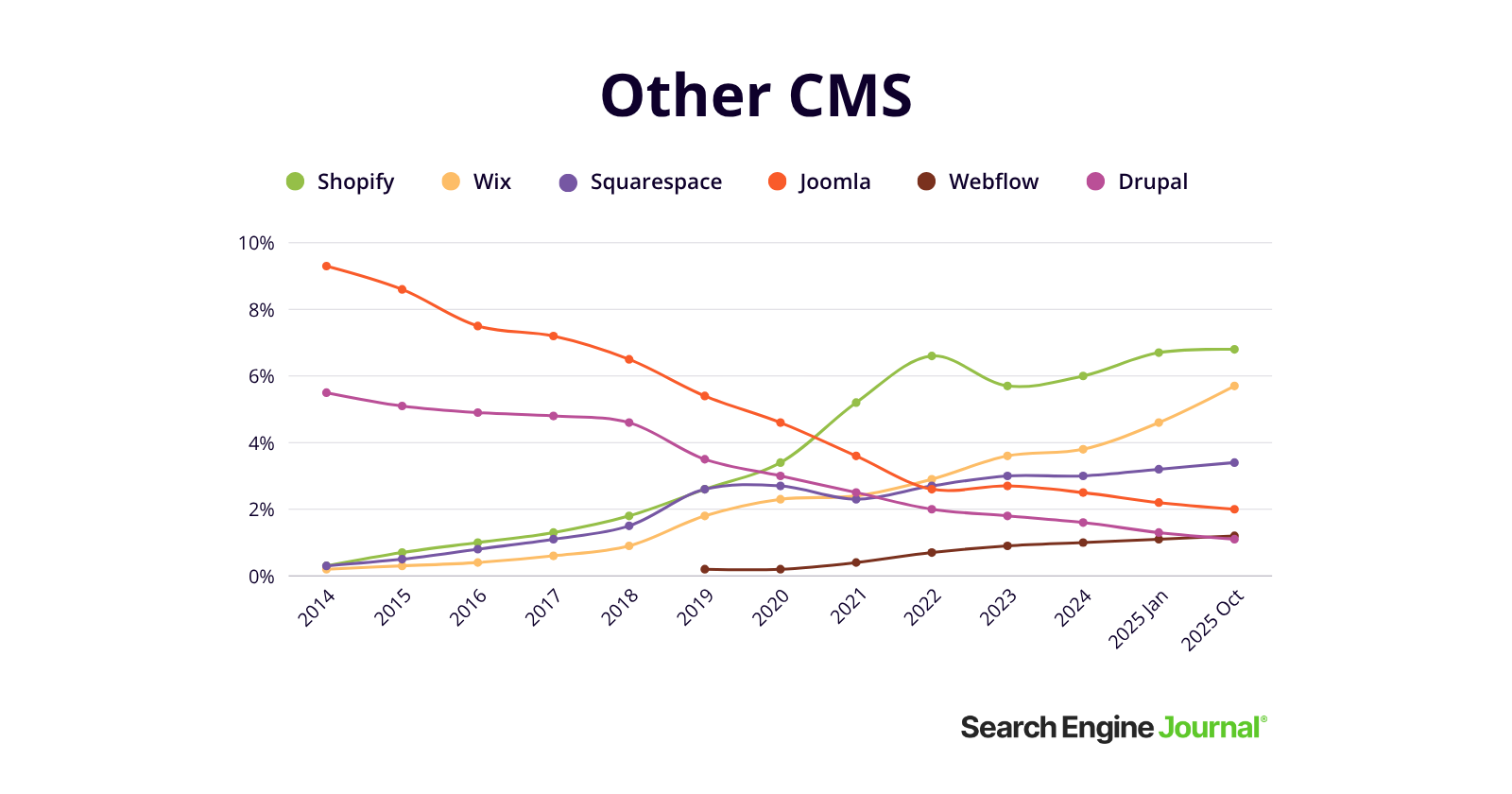

As WordPress shows its first significant slide in two decades, SaaS competitors like Shopify, Wix, and Squarespace are steadily gaining ground, offering businesses simpler, managed solutions with lower technical overhead. At the same time, the share of websites running without any CMS has dropped to 28.6%, which continues the broader industry trend toward structured platforms and hosted builders.

It means that choosing the right CMS today is less about preference and more about a strategic decision, with measurable impact on site performance, security, costs, and scalability.

This report breaks down the current CMS landscape, compares the top platforms, and outlines how the latest shifts influence platform strategy and technical execution.

How Large Is The CMS Market?

According to W3Techs, 71.4% of websites have a CMS, and Netcraft reports over 281 million domains.

From this, we can assume that the current market size for content management systems has risen to over 200 million websites.

Top 10 CMS By Market Share (Globally), October 2025

CMS (as of October 2025)

Launched

Type

Market Share

Usage

No CMS

28.6%

1

WordPress

2003

Open source

60.7%

43.3%

2

Shopify

2006

SaaS

6.8%

4.8%

3

Wix

2006

SaaS

5.7%

4.1%

4

Squarespace

2004

SaaS

3.4%

2.4%

5

Joomla

2005

Open source

2.0%

1.4%

6

Webflow

2013

SaaS

1.2%

0.9%

7

Drupal

2001

Open source

1.1%

0.8%

8

Tilda

2014

SaaS

1.1%

0.8%

9

Adobe Systems

2013

Open source

1.0%

0.7%

10

Duda

2008

SaaS

1.0%

0.7%

Data from W3Techs, October 2025. (WooCommerce and Elementor are not listed in the table above as they’re WordPress plugins and not standalone CMS platforms.)

*Graphs are separated due to the dominance of the WordPress market share.

WordPress

WordPress remains the most widely used CMS, a position it has held since its launch in 2003. Its usage across all websites grew by 105% from 2014 to 2022, cementing its role as the default platform for much of the web.

But its long-standing growth curve is now in a downturn; we’re seeing a market share decline of nearly seven percentage points in the last three years. It’s a trend that could continue as easier-to-use platforms gain ground and some users report frustrations with plugin compatibility, core updates, and security management.

Read more: Should You Still Use WordPress?

Shopify

As the second-most popular CMS today, Shopify’s market share stands at 6.8% and is used by 4.8% of all websites surveyed.

Its strength is no accident: Shopify consistently performs well in Core Web Vitals benchmarks, making it competitive even in technical metrics.

From an SEO and business perspective, this means that Shopify offers executives a CMS option designed to support both performance and long-term growth.

Wix

Wix has made one of the more noticeable gains this year, now powering 4.1% of websites surveyed. The platform’s steady climb reflects broader market traction among small businesses. Case in point: A Reddit business owner notes its convenient and user-friendly features.

For executives, the takeaway is clear: Wix is positioning itself beyond a lightweight website builder that consistently invests in branding and platform capabilities, making it a viable contender for mid-market adoption.

Squarespace

Squarespace has shown steady growth over the past decade, with its CMS market share growing from 0.3% in 2014 to 3.4% today, with 2.4% of websites surveyed now using the platform.

Its growth could be attributed to the increasing demand for low-maintenance, design-forward platforms.

Read more: WordPress Vs. Squarespace – Which One Is Better?

Joomla, Webflow, And Drupal

Joomla and Drupal were among the top 3 until 2021, and since then, they have seen a steady decline in market share, now accounting for only 2.0% and 1.1%, respectively. This shift likely reflects a broader trend where more user-friendly, SaaS-based platforms capture the attention of small businesses and non-technical users.

At the same time, Webflow has emerged as a contender, climbing to 1.2% of the CMS market share. Its growth reflects demand for design-led platforms that allow businesses to streamline development without heavy technical dependencies, with professionals noting speed as a real differentiator.

No CMS

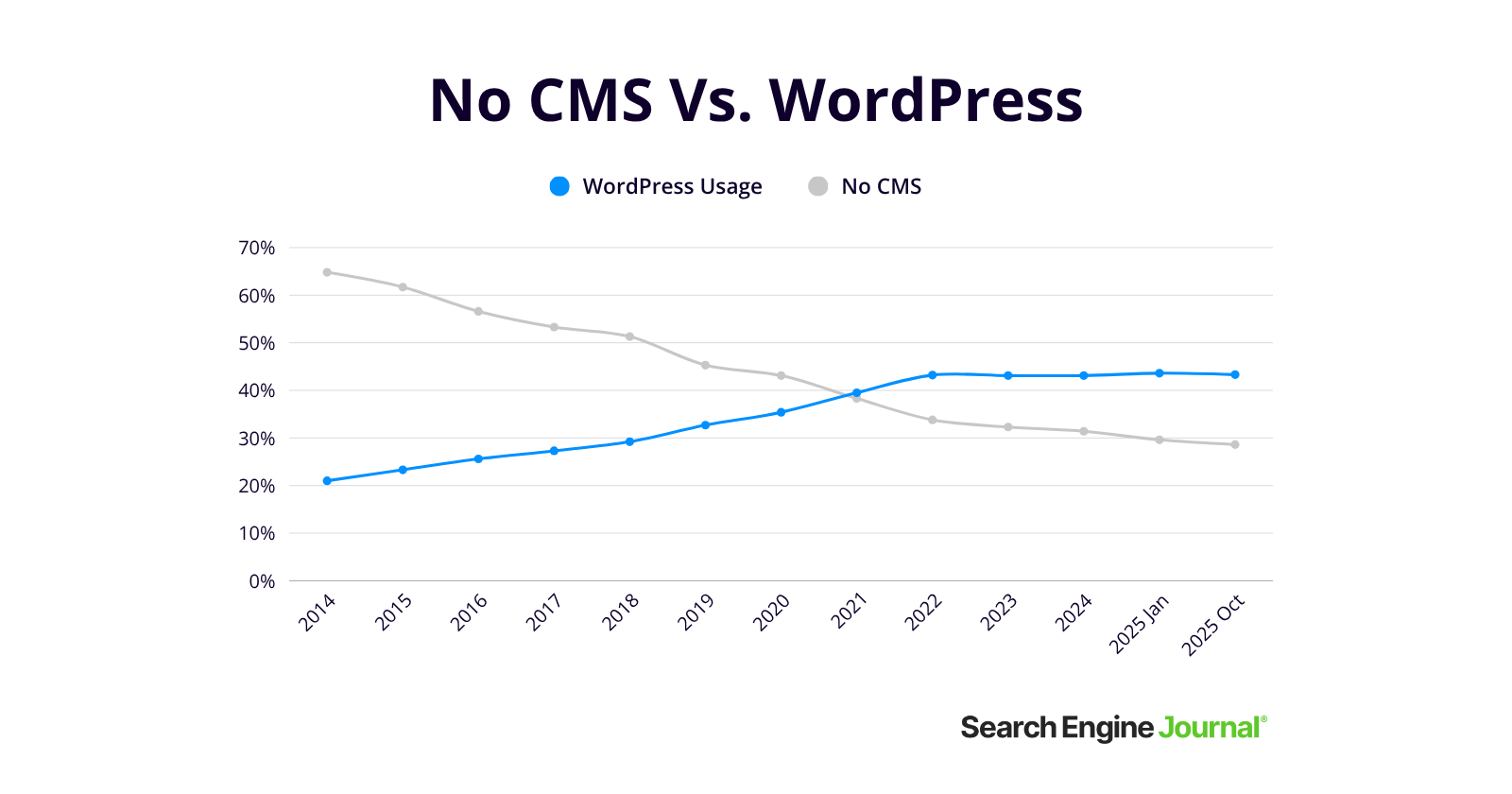

Between 2024 and October 2025, websites operating without a CMS dropped by 2.8 percentage points, continuing a trend away from custom-coded solutions. During the same period, websites using WordPress grew by just less than 1%.

The decline in “no CMS” websites signals an ongoing trend toward more structured, manageable platforms for site creation.

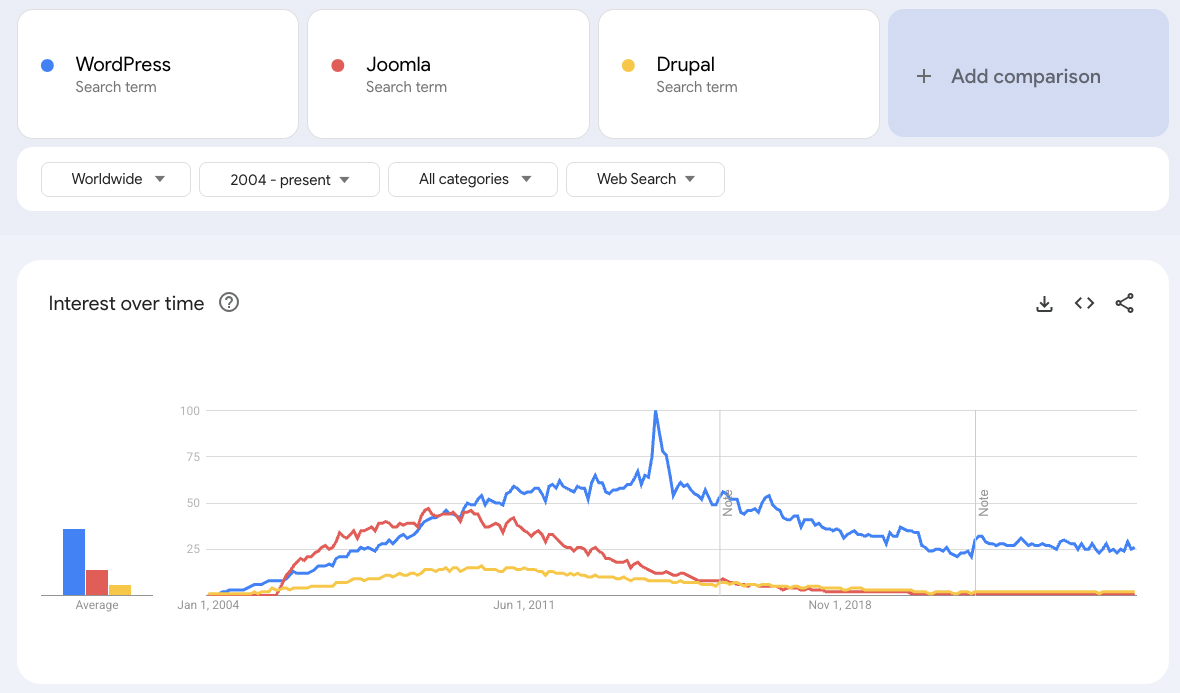

WordPress Vs. Joomla Vs. Drupal Market Share

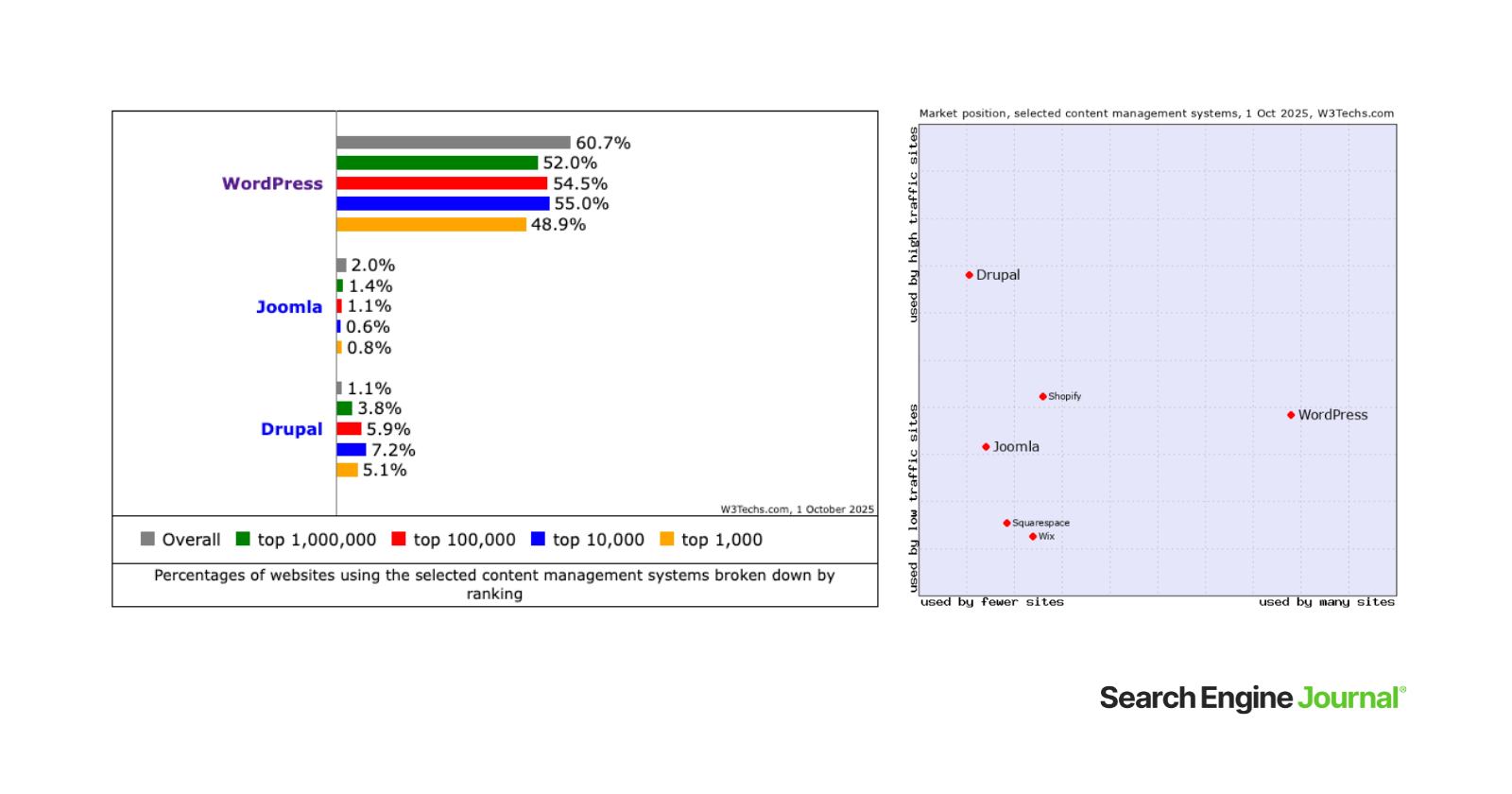

Screenshot from W3Techs, October 2025

Screenshot from W3Techs, October 2025Since 2024, Joomla has decreased its market share by 20%, while Drupal has declined by 31%. Together, they once held almost 15% of the CMS market share in 2014 – now that figure sits at just over 3%.

They’ve slipped from the No. 2 and No. 3 spots to No. 5 and No. 6, overtaken by faster-growing platforms like Wix and Squarespace in 2022.

Joomla, in particular, had strong momentum early on – briefly surpassed WordPress in search interest until around 2008, according to Google Trends – but it hasn’t kept pace with modern platform demands.

Screenshot from Google Trends, October 2025

Screenshot from Google Trends, October 2025Why did these popular content management systems decline so much?

It’s most likely due to the strength of third-party support for WordPress with plugins and themes, making it much more accessible.

The growth of website builders, such as Wix and Squarespace, indicates that small businesses want a more straightforward managed solution, and they have started to nibble on market share from the bottom.

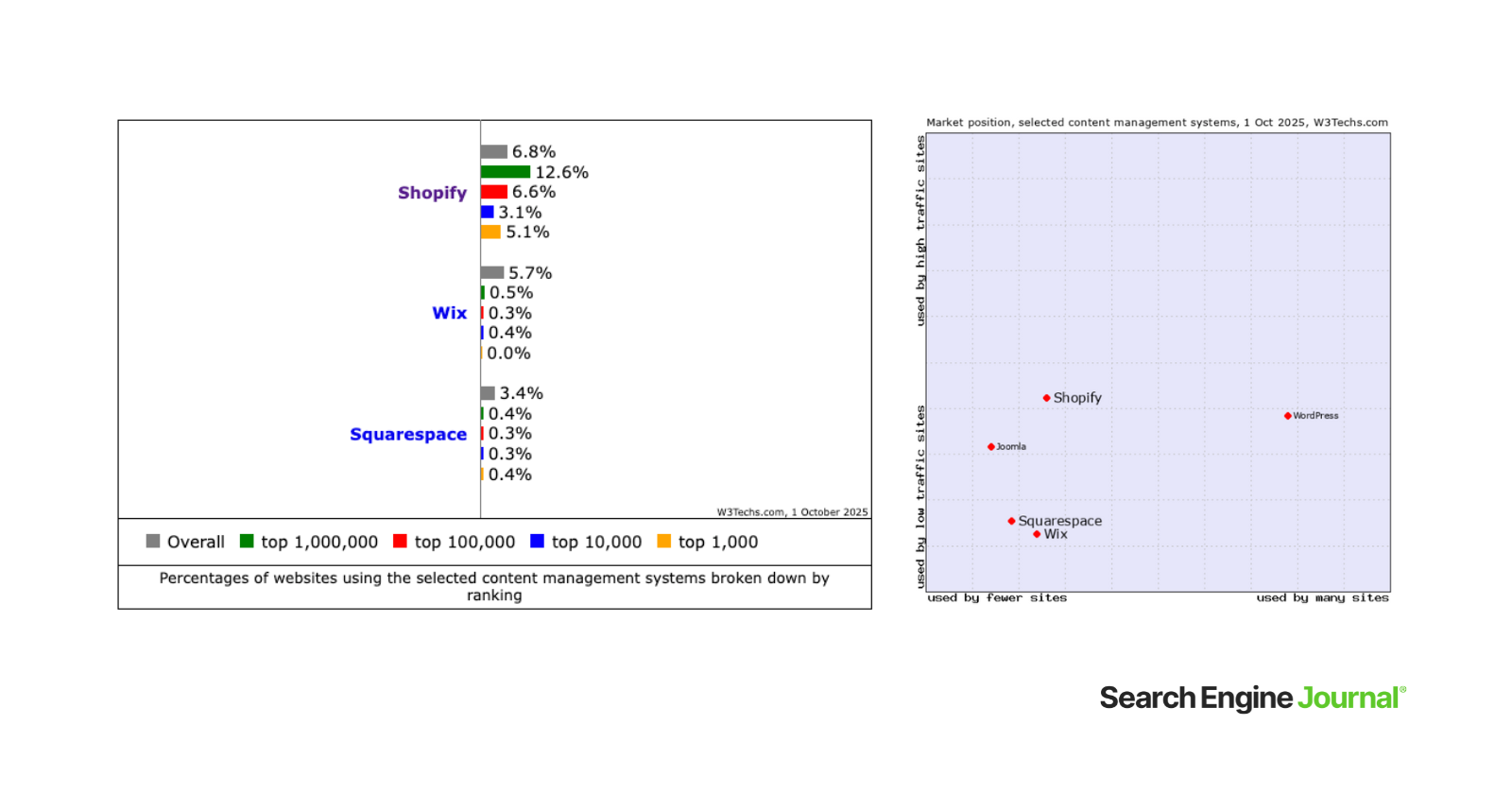

Website Builders Market Share: Wix Vs. Squarespace

Screenshot from W3Techs, October 2025

Screenshot from W3Techs, October 2025Over the full period from October 2024 to October 2025, the market share of:

Shopify grew by 4.6%.

Wix grew by 32.6%.

Squarespace rose by 9.7%.

If we look at the website builders, their growth is a strong indication of where the market might go in the future.

SaaS web builders such as Wix and Squarespace don’t require coding knowledge and offer a hosted website that makes it more accessible for a small business to get a web presence quickly. No need to arrange a hosting solution, install a website, and set up your own email. A web builder neatly does all this for you.

WordPress is not known as a complicated platform to use, but it does require some coding knowledge and an understanding of how websites are built. On the other hand, a website builder is a much easier route to market, without the need to understand what is happening in the back end.

Read more: Wix Changed How Websites Are Built And Why You Should Pay Attention

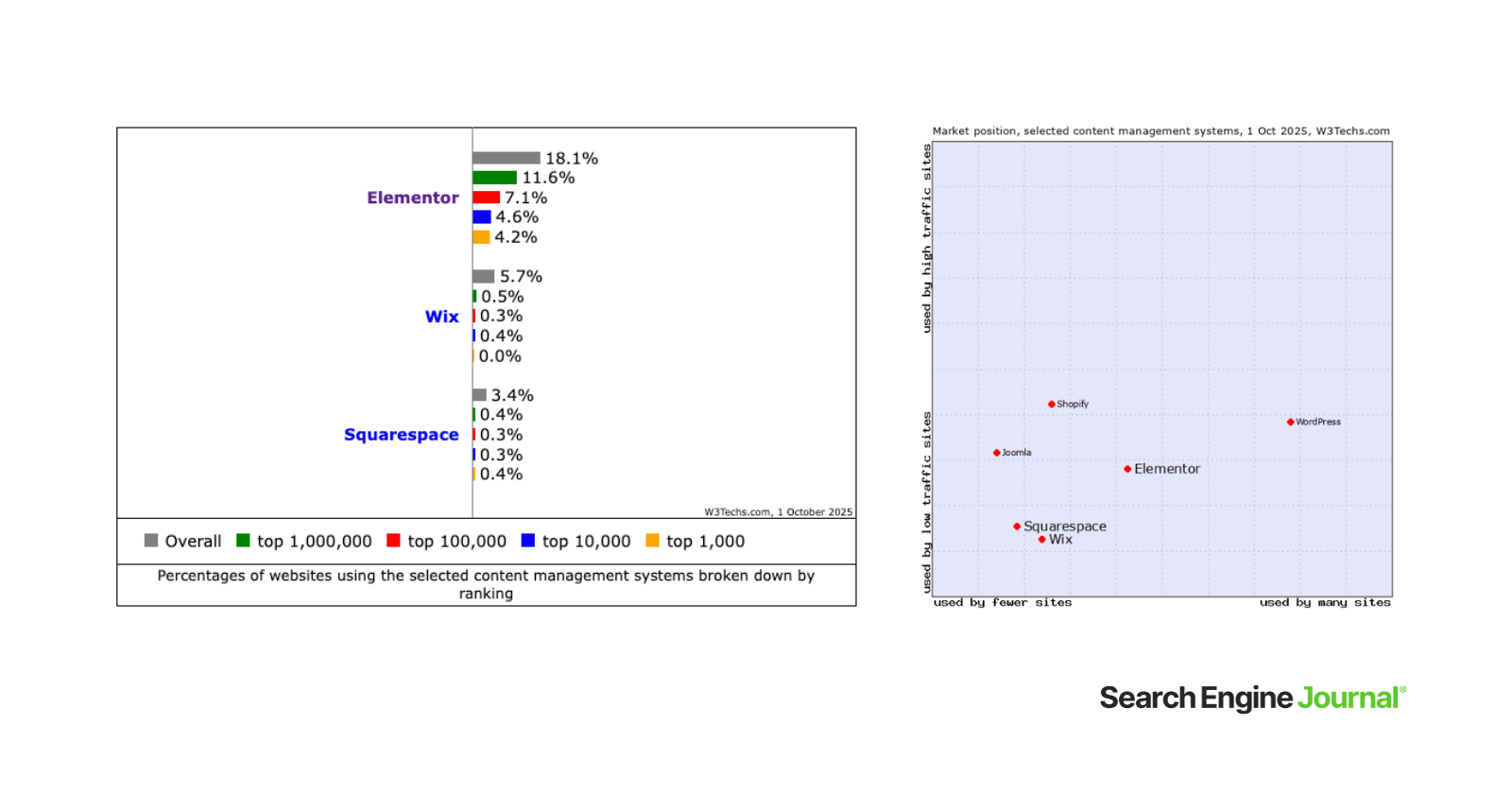

Elementor

Elementor is the most widely used WordPress page builder, installed on 18.1% of all websites with a known CMS and 12.9% of all sites surveyed (not shown below) – more than Wix and Squarespace combined – though it functions as a plugin within WordPress, not a standalone CMS.

Screenshot from W3Techs, October 2025

Screenshot from W3Techs, October 2025While not a CMS on its own, it’s a major player in shaping how WordPress is used. However, because it’s a third-party plugin and not a CMS, it isn’t listed in the top 10 CMS above.

If we compare the volume of traffic to the number of CMS, we can see that WordPress is in the golden section, up and to the right, clearly favored by sites with more traffic.

Based on usage among higher-ranked domains, Joomla fits into a niche of fewer installs but more high-traffic sites, indicating that more professional sites are using it.

Squarespace and Wix are to the left and down, highlighting that they are installed on fewer sites with less traffic. It strongly indicates that they are used more by small websites and small businesses.

Elementor bridges the gap between the two and has the weight of the WordPress market share, but is used by sites with less traffic. This means the appetite is growing for drag-and-drop, plug-and-play solutions that make having a web presence accessible for anyone. This is the space to watch.

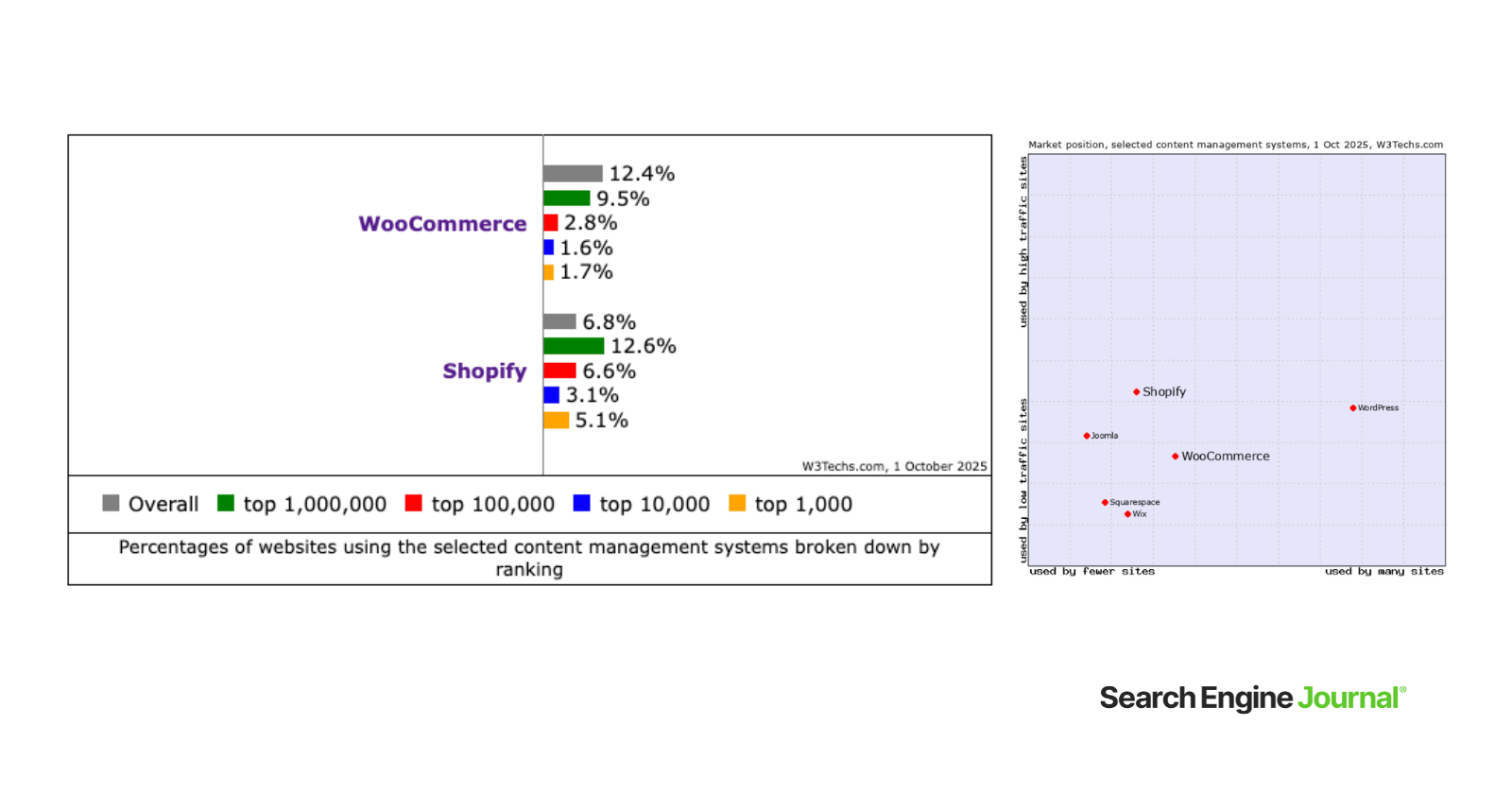

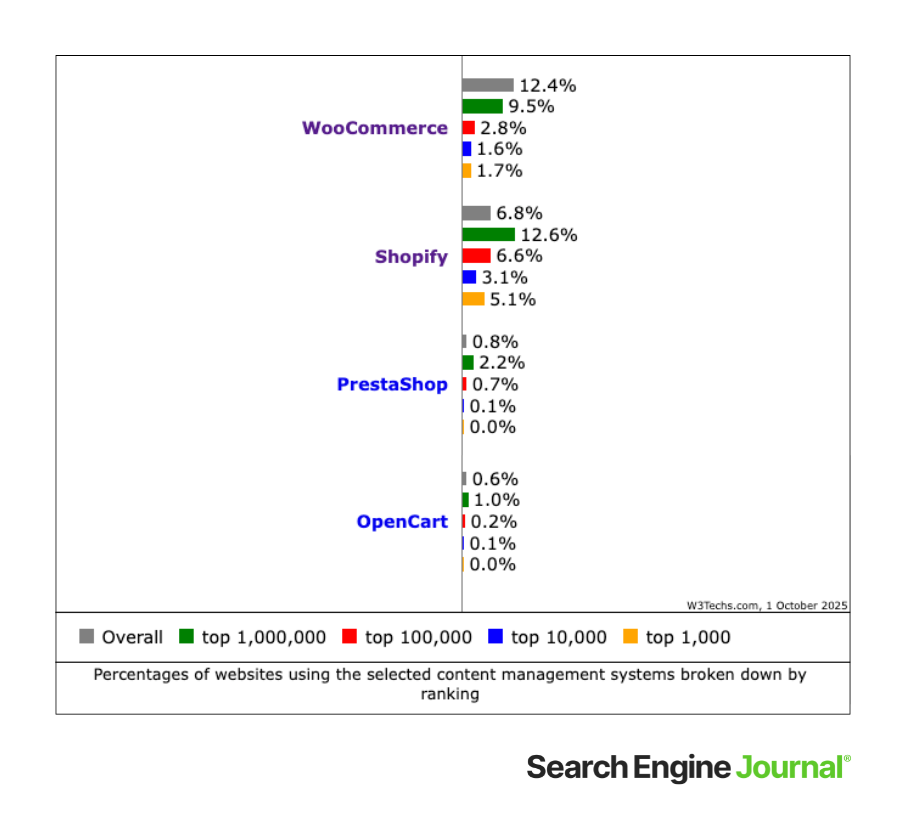

Ecommerce CMS Market Share: WooCommerce Vs. Shopify

Screenshot from W3Techs, October 2025

Screenshot from W3Techs, October 2025WooCommerce has a market share of 12.4%, while Shopify has 6.8%.

The ecommerce CMS space echoes a pattern similar to that of website builders. WooCommerce powers 8.9% of all existing websites, making it the most widely adopted ecommerce plugin by far. It doesn’t appear in W3Techs’ top CMS list because it is a WordPress plugin, but it’s a key factor in WordPress’s enduring popularity.

Looking at the distribution, we can see a clear pattern emerge. In comparison to other ecommerce CMS platforms, WooCommerce is dominant.

It has more market share than its competitors combined: Shopify (6.8%) + PrestaShop (0.8%) + OpenCart (0.6%) = 8.2% market share.

Screenshot from W3Techs, October 2025

Screenshot from W3Techs, October 2025Smaller sites might favor WooCommerce, but it has the WordPress platform’s weight for market access and, therefore, more installs, much like Elementor.

Shopify surged during the pandemic, with market share growing by 52.9% from 2020 to 2021 and then 26.9% from 2021 to 2022, outpacing every other platform. After a dip in 2023, it recovered in 2024 and has since leveled off, holding steady at 6.8% this year.

Why Does CMS Market Share Matter For SEO And Business Strategy?

As the market fragments, these shifts affect everything from site architecture, plugin availability, and technical SEO flexibility.

WordPress continues to lead, but its gradual decline marks a turning point. SaaS competitors such as Shopify, Wix, and Squarespace are steadily gaining traction, offering streamlined platforms that appeal to most businesses.

If more SMBs are switching to website builders, understanding the limitations and intricacies of these platforms for SEO could be a competitive advantage. CMS adoption determines how efficiently teams can build, secure, and optimize sites at scale.

Shopify now runs on 4.8% of all websites surveyed (not just sites with a CMS). With its increasing market share, specializing in Shopify SEO could be a strategic move for an SEO professional.

Wix and Squarespace are growing, too. As more small businesses adopt these platforms, getting fluent in their ecosystems could set you apart in a crowded market.

The reality is that WordPress remains the largest and most competitive ecosystem, but the growth curve has shifted toward challengers. This means one thing for business leaders and SEO professionals: an opportunity to diversify expertise.

Understanding the strengths and limitations of various CMS platforms can inform strategic decisions and align with evolving market demands.

More Resources:

All data collected from W3Techs, October 2025, unless otherwise indicated. See the W3techs methodology page for where the data is gathered from.

Featured Image: Paulo Bobita/Search Engine Journal