This article first appeared on GuruFocus.

To pre-face, I believe tariffs are a double-edged sword but right now it seems Century Aluminium (NASDAQ:CENX) is the one winning. If you haven’t kept up with the ever-changing Trump tariff plans then as of June all non-domestic aluminium products face a 50% tariff. Midwestern spot premium shot up nearly 100% overnight. CENX raised guidance for the year but hinted that the full effects will come next year. Shares are trading at a cheap level compared to the growth you are getting. Make no mistake here, this is a tariff play more than anything. I’m betting on the administration being hardstuck on these rates for the next 3 years and I plan on capitalizing on it too.

CENX is a vertically integrated aluminium company. It became this in 2023 when it acquired a 55% stake in the Jamalco smelter and mine in Jamaica. The deal opened up a supply chain of bauxite which gets turned into alumni which then gets turned into aluminium and sold off. Operations is a joint venture with the Jamaican government, but CENX buys all of the bauxite and alumina produced there for market price. Just 2 months after the acquisition there were some issues at the factory which disrupted production. It continued into Q1 2024 but it seems it has settled down now.

The sustaining capital needs is $10 million, but CENX has invested $15 million additional to get production to max capacity. We can work backwards and estimate the mine capacity, since the Jamacla smelters have a 1,4 million tonne capacity. Generally speaking you need about twice the amount of bauxite to make alumina, based on a 92% average recovery rate. So the mine has about a 3 million tonne capacity. This makes it one of the largest in the country as total country production is about 4,5 million tonnes. Reserves sit at 29 million which gives it a 9.6 year life span. Not that much frankly. But CENX has the capital to invest in new mines and secure supply ($40.7 million cash and $58 million trailing OCF).

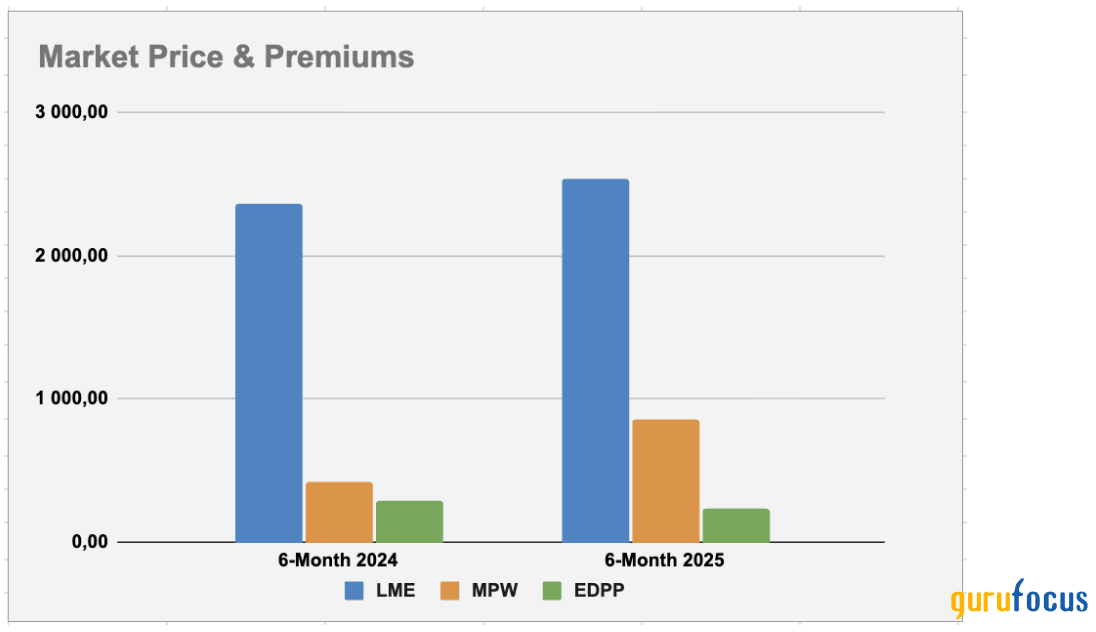

There are three types of prices we have to consider when looking at aluminium companies. These are: LME, MPW and EDPP. The first refers to the global price of aluminum, the others for the regional premiums added on. The Midwestern Premium MPW is the highest one, and the one growing the quickest, up 105% on a 6-month basis. EDPP is for the European Union zone and has instead fallen slightly. Europe has strong aluminium supply chains so the need to pay higher premiums is unnecessary. Demand has also wavered which has impacted prices as well.