Bond traders on Friday were less fearful of the Zions Bank $50 million loan default and sent yields just a tad higher back to 4%.

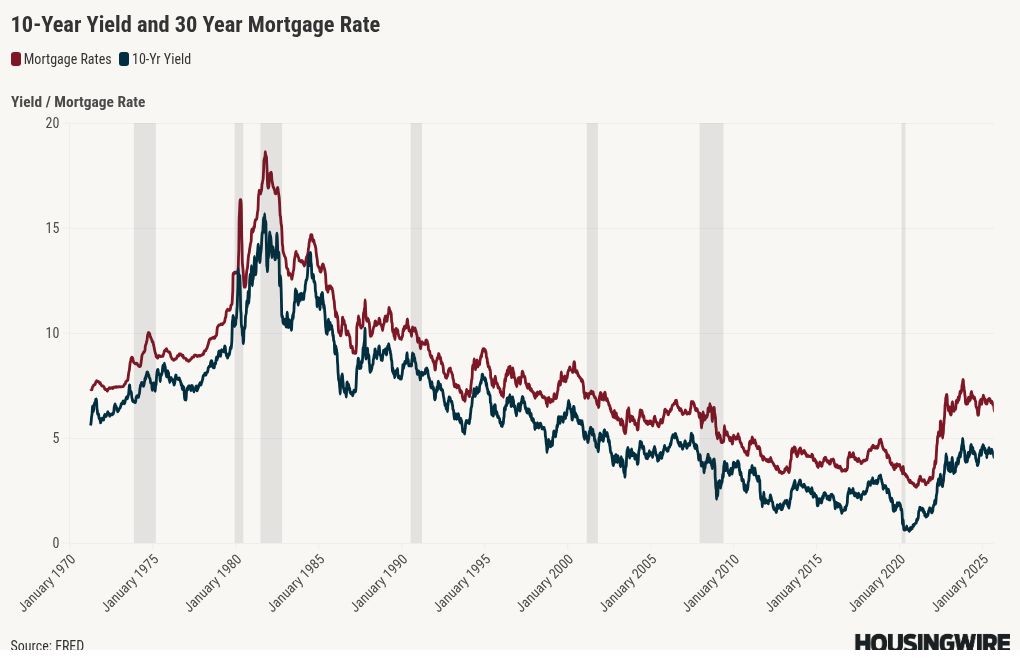

On a recent episode of the HousingWire Daily podcast I talked about why mortgage rates were near the low of the year, despite so many people giving reasons this wouldn’t happen. Remember, 65%-75% of where mortgage rates and the 10-year yield can go in any economic cycle is still Federal Reserve policy. Below is a chart of what I call the slow dance between the 10-year yield and the 30-year mortgage rate, which explains the relationship between the two data lines.

Given what we’ve seen so far this year on mortgage rates, the economy and the bond market, can mortgage rates go lower from here and hit the bottom end of my forecast for 2025?

Reaching the lower end of my 2025 forecast

In my 2025 forecast, I anticipated the following ranges:

Mortgage rates between 5.75% and 7.25%

The 10-year yield fluctuating between 3.80% and 4.70%

We are approaching my lower-end forecast for 2025. The 10-year yield closed below 4% Thursday and reached as low as 3.94% in overnight trading. This follows the low in April when the 10-year yield dropped to 3.87% during overnight trading after the Godziilla tariffs were announced.

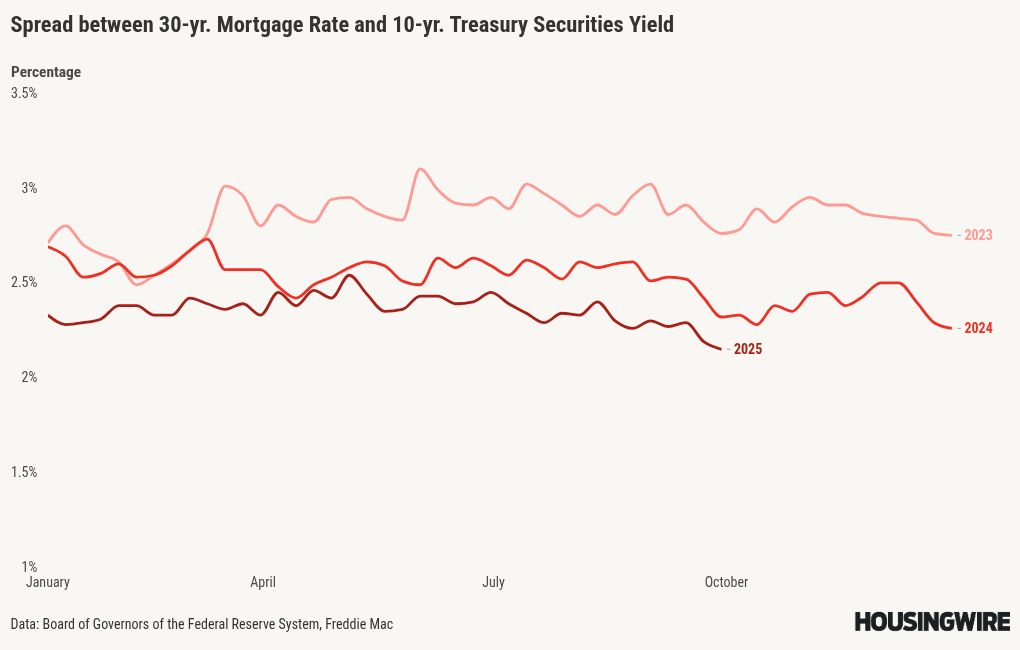

Mortgage rates on Thursday were priced at 6.23% according to Mortgage New Daily pricing, and Polly locked rate data was at 6.36%. A lot of the softening labor market and Fed rate cuts have been priced in and mortgage spreads have improved almost to my peak level of improvement for 2025.

So what will it take to get mortgage rates lower and hit the bottom end of my 2025 forecast?

1. Weaker economic and labor data

2. More Fed members sounding dovish

3. A stock market pullback, which could drive money into bonds as well

4. Mortgage spreads improving even a little during any of the events above

The low in mortgage rates this year was 6.13% and a lot of things have taken us here in a year where a lot of people were looking for much higher rates. For the rest of the year, the four factors above could get mortgage rates to the lowest level of the 2025 forecast range.

Conclusion

The markets have already factored in a significant number of rate cuts and the fact that the labor market is softening but not collapsing. This is important because even the most dovish Federal Reserve presidents have indicated that Fed policy remains modestly restrictive. Currently, the conversation around Fed policy is leaning towards achieving a neutral stance rather than being accommodative.

If the labor market does break and the Fed’s language shifts to reflect that situation, it could provide the ideal scenario for mortgage rates to reach my low of 5.75% and even go lower. The fact that the labor market is softening but still not breaking explains why mortgage rates have not fallen to 5.75% — even with the softer labor data and the 10-year yield trading at 4%.