We’ve found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Viasat Investment Narrative Recap

To invest in Viasat, shareholders need to believe in the company’s ability to translate rising government and commercial demand for secure, resilient satellite communications into sustainable revenue, while managing the financial strain of large capital projects. The recent U.S. Space Force prime contract award does buoy medium-term growth visibility in defense, but it does not materially change the most immediate catalyst for Viasat: successful launches and operational ramp-up of its ViaSat-3 satellites. The biggest near-term risk remains elevated capital expenditures, which continue to pressure free cash flow and constrain profitability, and these factors are unchanged by recent news.

Of the recent company announcements, Viasat’s launch timeline for ViaSat-3 Flight 2 in October 2025 is most relevant. The project’s execution will be closely watched, as timely and effective deployment of new satellites is pivotal for unlocking additional bandwidth, serving new markets, and improving earnings, all key elements investors are focused on in the current outlook.

However, despite these promising advancements, investors should be aware that Viasat’s leverage and free cash flow are still heavily pressured by ongoing and planned capital spending…

Read the full narrative on Viasat (it’s free!)

Viasat’s narrative projects $5.0 billion revenue and $534.2 million earnings by 2028. This requires 2.9% yearly revenue growth and a $1.13 billion increase in earnings from -$598.5 million today.

Uncover how Viasat’s forecasts yield a $26.14 fair value, a 27% downside to its current price.

Exploring Other Perspectives VSAT Community Fair Values as at Oct 2025

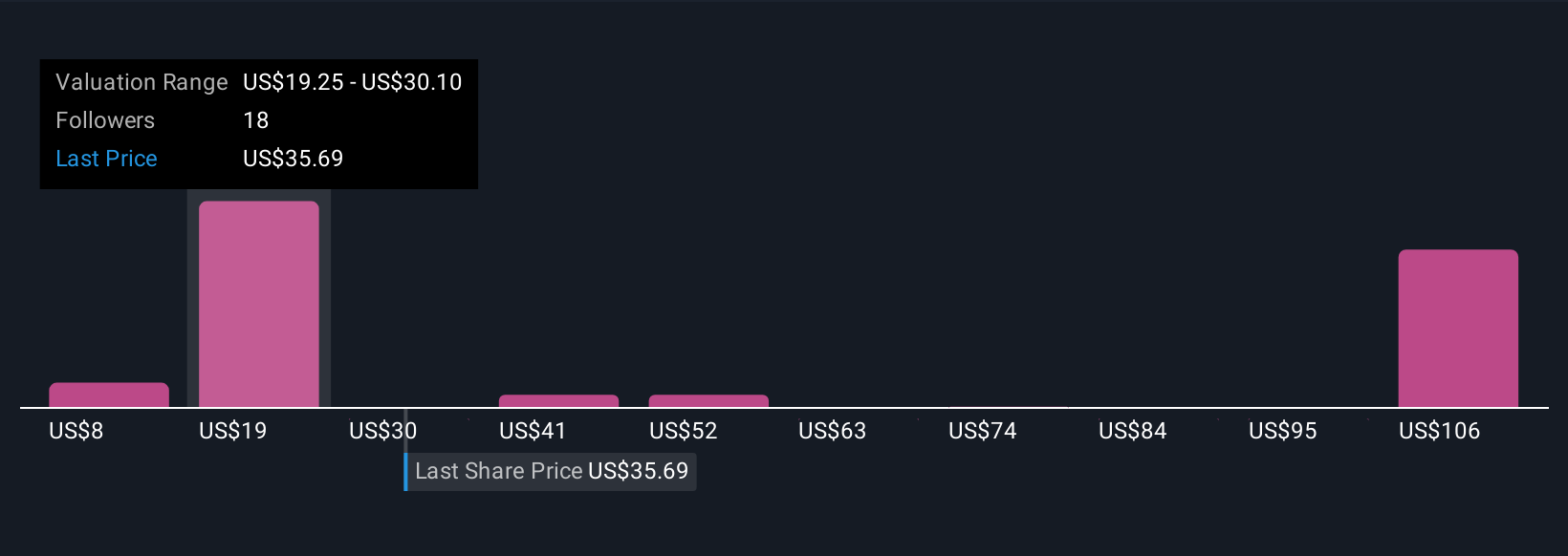

VSAT Community Fair Values as at Oct 2025

Ten individual fair value estimates from the Simply Wall St Community range widely from US$8.40 to US$116.92 per share, showing no consensus on Viasat’s potential. As operational execution on capital-intensive projects remains a core risk, explore how others balance optimism about growth with the realities of current financial pressures.

Explore 10 other fair value estimates on Viasat – why the stock might be worth over 3x more than the current price!

Build Your Own Viasat Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don’t miss this chance:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com