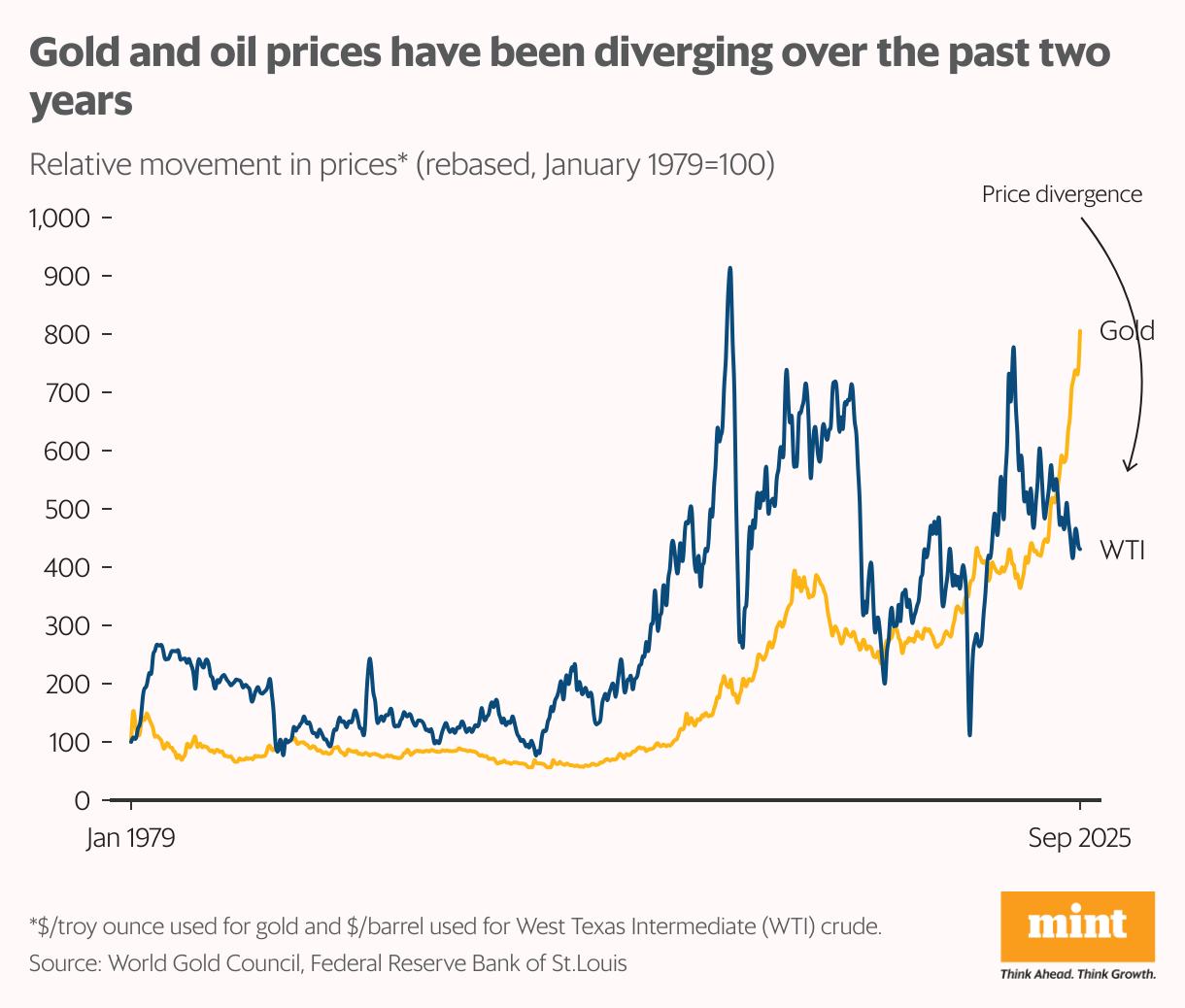

Not surprisingly, investors are piling into gold. The price of gold has soared, and is now over $4,000 per ounce. What is surprising, though, is the opposite response of oil—the price of crude has dropped by more than 40% since early 2022, when it crossed $100 per barrel in the wake of the Russian invasion of Ukraine. Oil markets do not seem to be pricing uncertainty in the same way as gold.

Historic risk barometers

Historically, there has been a great deal of co-movement between gold and oil prices, especially in times of crisis. The relationship is not perfect—there are leads and lags, and even occasional divergence. Gold prices barely moved when Iraq invaded Kuwait in 1990, but oil prices shot up.

Similarly, as the global financial crisis unfolded from September 2008, gold was more stable than oil. In 2014–2016, oil prices plunged as US shale extraction led to a supply glut, but gold prices were range-bound. Notwithstanding these episodes, both prices usually react sharply to global uncertainty.

Gold is a safe-haven asset; its price goes up in times of inflation, war, pandemics, or geopolitical uncertainty. The price of crude oil is linked to demand and supply; it declines when economic activity slows, as slower growth means lower demand for fuel. Therefore, gold and oil prices are both barometers of risk: gold responds to general economic anxiety, and oil to concerns about growth or oil supply.

Soaring gold-oil ratio

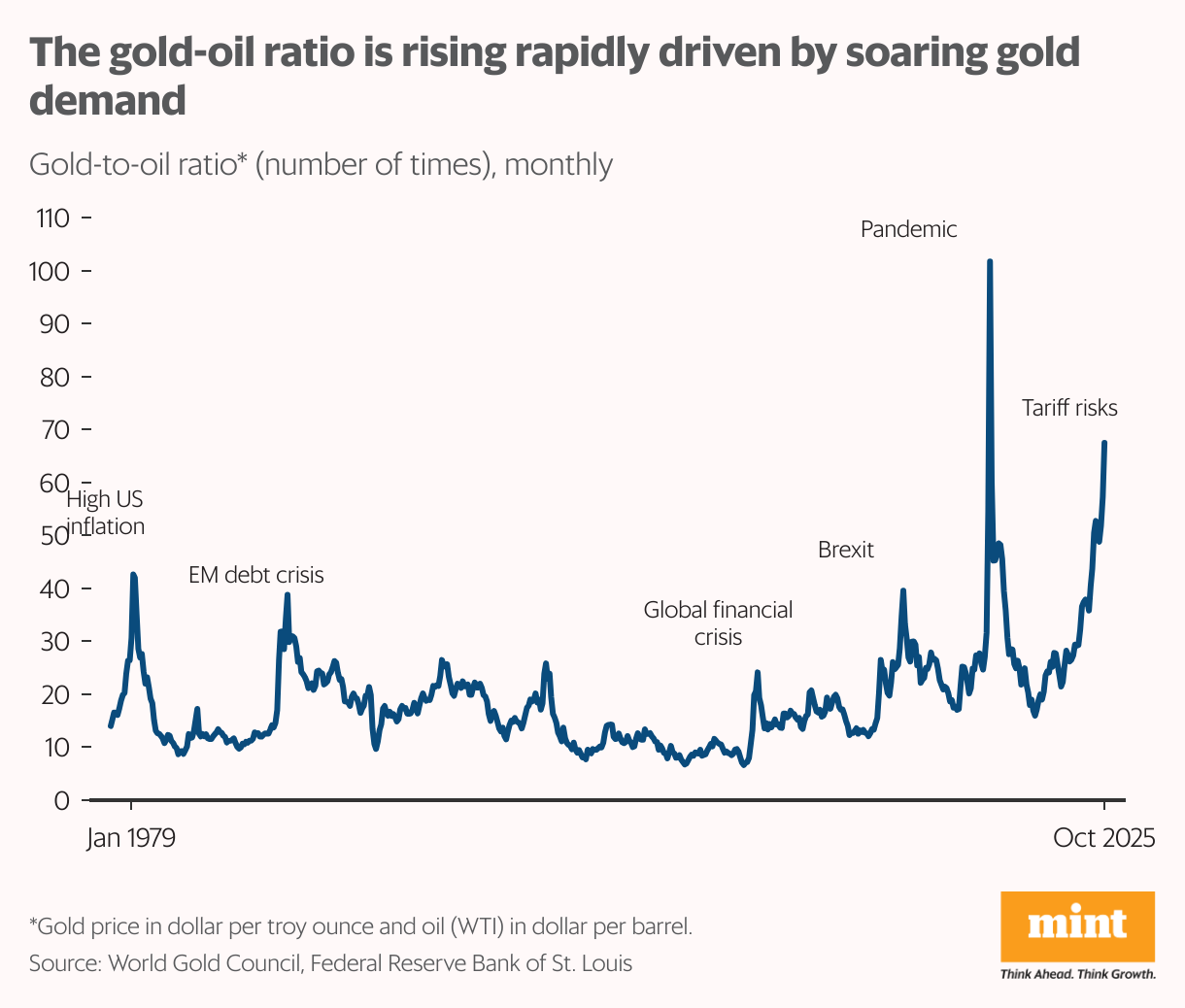

The gold-oil ratio is the ratio of the price of gold to the price of oil; both are measured in US dollars. When uncertainty is high and global growth is at risk, gold price shoots up and oil price falls; so, the gold-oil ratio rises.

This happened during the pandemic: the ratio reached an all-time high as global shutdowns sharply reduced oil demand and price, and uncertainty increased the demand for gold.

Currently, the ratio is about 68, which implies that markets value an ounce of gold to be equivalent to 68 barrels of oil. This is a huge jump from June 2022, when the ratio was 15.9.

Since then, gold price has more than doubled, and the cost of oil has halved; so the gold-oil ratio has quadrupled. The soaring ratio reflects unusually high uncertainty stemming from persistent geopolitical risk as well as concerns about global growth. The up-cycle shows no sign of ending, which says much about the shift to gold as a hedge against uncertainty.

Back to average?

The gold-oil ratio is viewed as a crisis predictor—with each up-cycle being associated with periods of economic and/or political uncertainty.

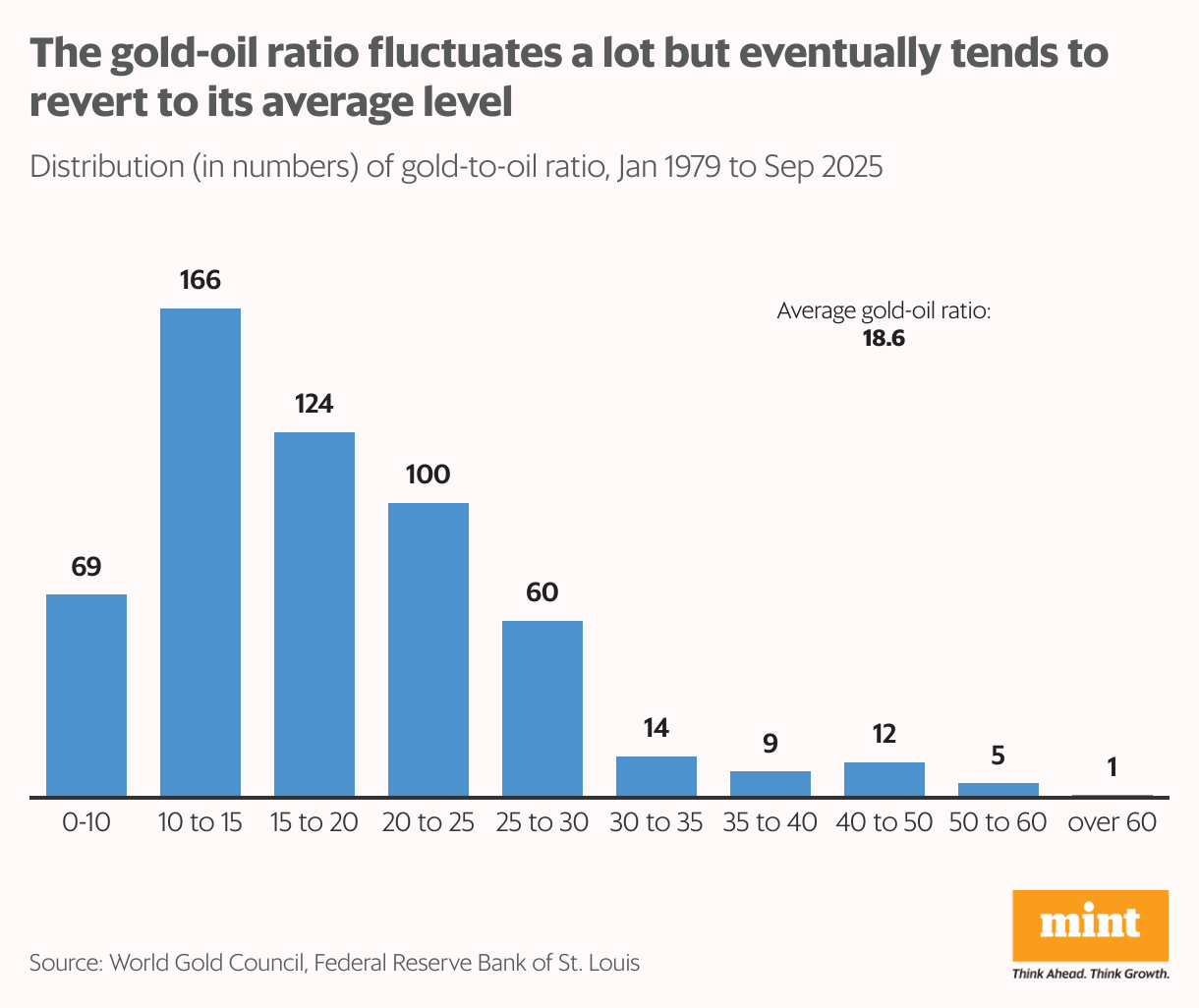

Data spanning nearly half a century (1978–2025) suggest that though the gold-oil ratio fluctuates a lot, it tends to revert towards its long-term average (mean). In fact, 40% of the observations lie between 16 and 25, around the average (mean) of 18.6.

Based on past trends, then, can it be concluded that the current ratio will eventually decline to more normal levels?

For the gold-oil ratio to decline, we need a fall in gold price, an increase in oil price, or some combination of the two. Gold prices could ease if, say, the US and China negotiate a mutually acceptable trade agreement on tariffs. But oil prices may not go up as much, even with easing trade uncertainty. This is because the link between oil price and uncertainty has become weaker.

Oil demand dynamics

Oil markets are going through a transformation. Between 2015 and 2024, 90% of the increase in oil supply came from the US shale boom, and 60% of the rise in oil demand came from China, per the International Energy Agency. The two giant economies complemented each other perfectly.

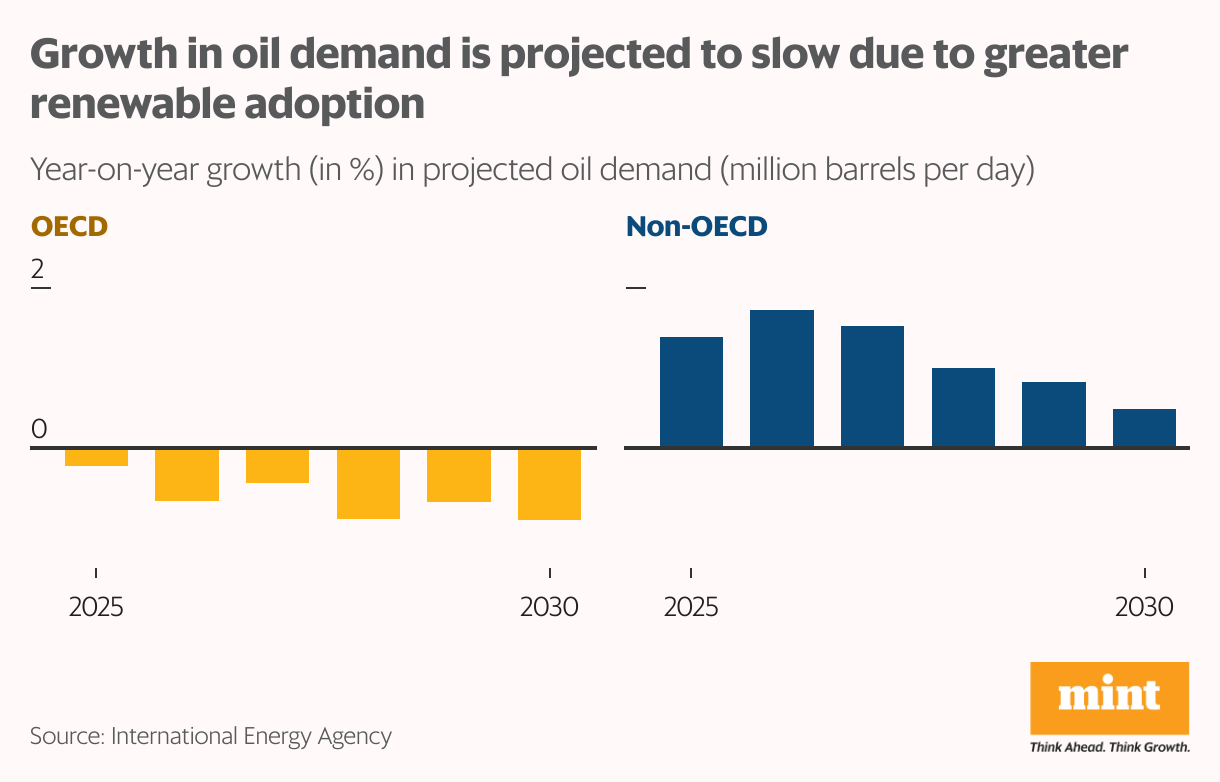

But China’s thrust on electric vehicles means that it has become less reliant on oil. At the same time, the rate of investment in new US shale capacity is slowing. Thus, future demand-supply dynamics will be very different.

Global oil demand is expected to plateau in response to slower growth and the replacement of oil with renewable energy. Emerging market demand will remain robust, but demand from developed countries in North America and Europe is expected to contract well before 2030.

The traditional link between GDP growth and oil demand also appears to be breaking down: from 2027, global growth is not expected to contribute as much to oil demand as it is increasingly substituted away by other fuels.

Gold beats black gold

In its heyday in the seventies, oil was known as black gold for its vital role in fuelling economic activity. While oil remains an important energy source, its influence has diminished. In 2024, the share of oil in total energy demand fell below 30%, from a peak of 46% fifty years ago.

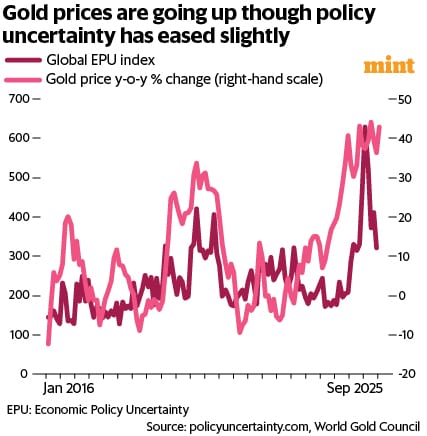

Meanwhile, gold has become the go-to asset for investors, not just as a hedge against inflation and geopolitical risk but also as an alternative to fiat currency debased by debt and deficits. Thus, although most indices of economic policy uncertainty have receded slightly from their April peaks, gold prices continue to rise.

View Full Image

.

The shift to gold is broad-based. Retail investors are buying gold exchange traded funds, central banks are purchasing gold, and institutions are advising clients to take exposure to gold. Besides, the recent escalation of US-China trade tensions has added to gold’s appeal.

As legendary investor Warren Buffett said, by buying gold, investors are “going long on fear”.

The author is an independent writer in economics and finance.