Adams Diversified Equity Fund (NYSE:ADX) just reported a 16% total return on net asset value for the first nine months of 2025, outpacing the S&P 500 Index and Morningstar U.S. Large Blend category. This kind of update gives investors plenty to discuss.

See our latest analysis for Adams Diversified Equity Fund.

ADX’s latest results come on the back of steady momentum in the share price this year. The stock is now trading at $22.5, marking an 11.1% price return since January. The longer-term numbers are notable as well, with total shareholder return reaching 20.9% over the past year and a significant 135% over five years. This highlights the fund’s consistent ability to reward patient investors as market confidence in its active approach grows.

If you’re scouting for other funds or stocks with strong ownership and growth traits, it’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

With such strong recent gains and a share price still trading below net asset value, investors may wonder whether there is still untapped value in Adams Diversified Equity Fund or if the market has already taken its future growth into account.

Price-to-Earnings of 7.7x: Is it justified?

Adams Diversified Equity Fund is currently trading at a price-to-earnings (P/E) ratio of 7.7x, which is significantly lower than both its industry and peer averages. With the last close price at $22.5, this level suggests the market values its earnings well below what is typical for similar capital market firms.

The P/E ratio reflects how much investors are willing to pay for each dollar of earnings. In capital markets, where earnings stability and growth often command higher multiples, a low P/E can mean skepticism about future profitability or undiscovered value for patient investors. For ADX, this raises the question of whether the pessimism is warranted or if the market underestimates its earnings potential.

Right now, ADX’s price-to-earnings ratio stands well below both the US Capital Markets industry average of 25.9x and its peer average of 18.3x. These compelling discounts may point to overlooked strengths or nuances in the fund’s business profile that the broader market has yet to factor in.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 7.7x (UNDERVALUED)

However, sustained weakness in short-term returns or an unexpected shift in earnings stability could present challenges to the ongoing optimism surrounding Adams Diversified Equity Fund’s valuation.

Find out about the key risks to this Adams Diversified Equity Fund narrative.

Another View: SWS DCF Model Puts Valuation in Perspective

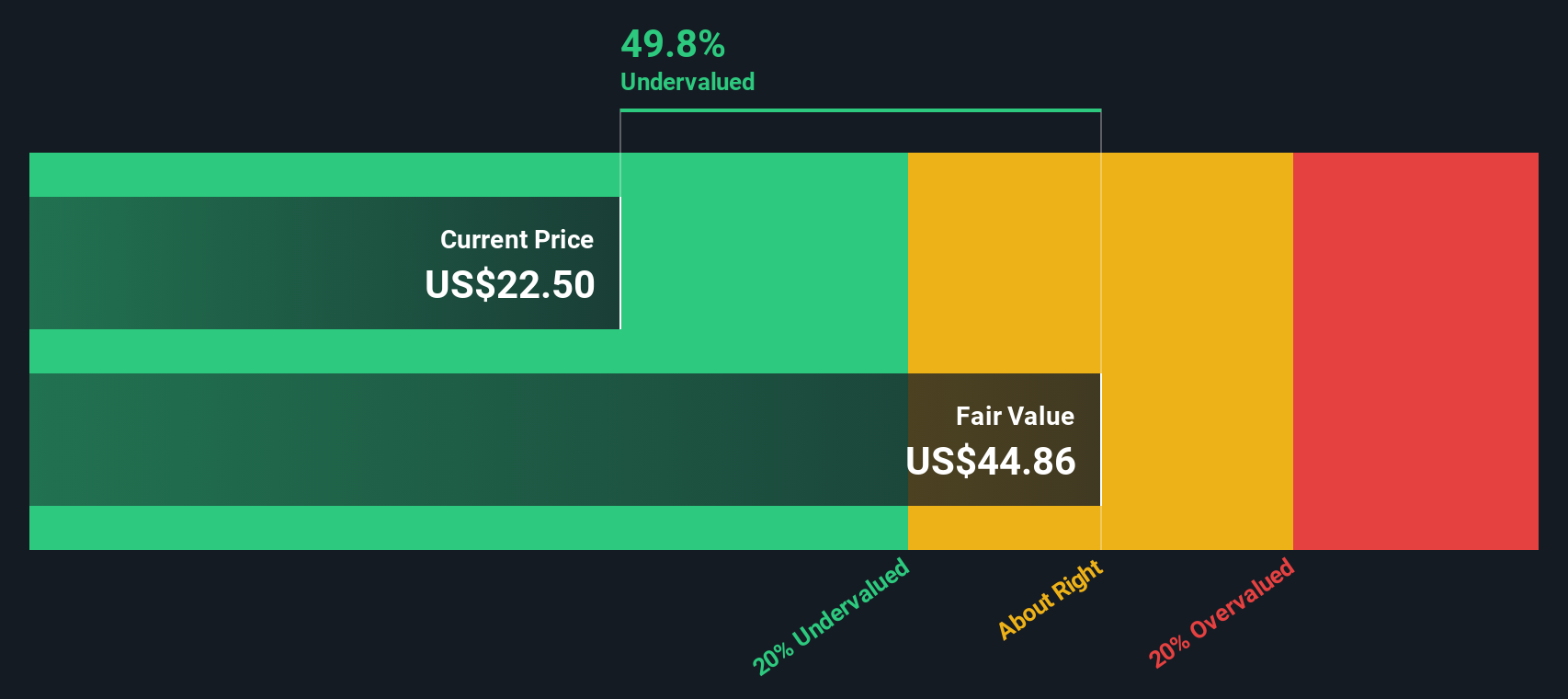

Looking at things through the lens of our SWS DCF model paints a different picture. On this basis, ADX is trading at a 49.8% discount to our estimate of its fair value, suggesting the shares might be even more undervalued than standard earnings multiples imply. However, can this model’s assumptions about future growth and cash flows stand up to scrutiny?

Look into how the SWS DCF model arrives at its fair value.

ADX Discounted Cash Flow as at Oct 2025

ADX Discounted Cash Flow as at Oct 2025

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Adams Diversified Equity Fund for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match – so you never miss a potential opportunity.

Build Your Own Adams Diversified Equity Fund Narrative

If our analysis sparks questions or you’d rather put your own research skills to work, you can shape your perspective in just a few minutes with Do it your way.

A great starting point for your Adams Diversified Equity Fund research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Staying ahead of the market means acting on the right ideas at the right time. The Simply Wall Street Screener is your toolkit for finding compelling stocks and timely opportunities others might miss.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com