Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

State Street Investment Narrative Recap

To be a shareholder in State Street, one likely needs confidence in the company’s ability to maintain market leadership in global custodial services, asset management, and ETF offerings while managing industry-wide challenges such as margin pressure and emerging competition. The latest fixed-income offering and robust third-quarter earnings do not materially alter the most important near-term catalyst, broad inflows into passive and ETF products, nor do they fully address the main risk of continued fee compression impacting long-term profitability.

Among the latest developments, the launch of the SPDR Portfolio Ultra Short T-Bill ETF (SPTU) stands out. This product addresses growing demand for low-cost, cash-like investment options, which supports the ongoing shift toward passive investing, the same trend underpinning State Street’s key growth catalyst in ETF asset inflows and recurring fee revenue.

On the other hand, investors should be aware that even as new products expand the ETF suite, pressure from industry-wide fee reductions could ultimately…

Read the full narrative on State Street (it’s free!)

State Street’s narrative projects $14.7 billion in revenue and $3.5 billion in earnings by 2028. This requires 3.3% yearly revenue growth and an $0.9 billion earnings increase from the current $2.6 billion.

Uncover how State Street’s forecasts yield a $127.30 fair value, a 11% upside to its current price.

Exploring Other Perspectives STT Community Fair Values as at Oct 2025

STT Community Fair Values as at Oct 2025

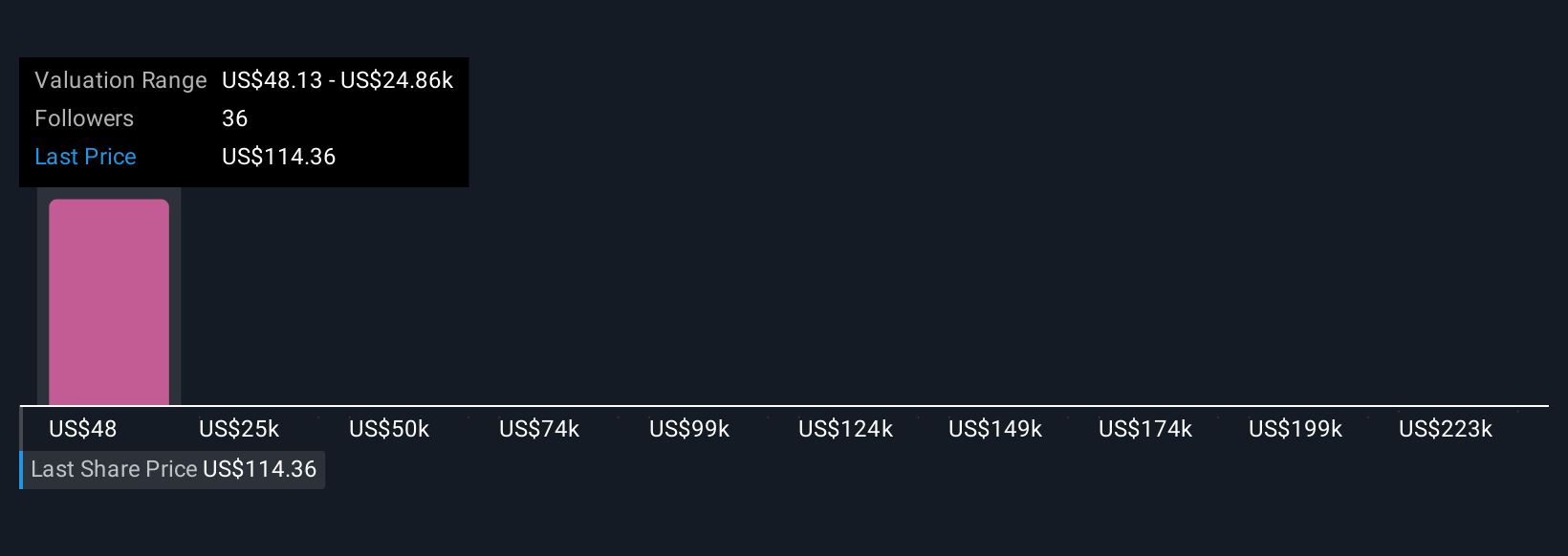

Six fair value estimates from the Simply Wall St Community range from US$48.13 to over US$248,000, underlining far-reaching conclusions. While ETF-driven growth remains a central catalyst, opinions differ widely on how product expansion might shape State Street’s future.

Explore 6 other fair value estimates on State Street – why the stock might be worth less than half the current price!

Build Your Own State Street Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Seeking Other Investments?

Markets shift fast. These stocks won’t stay hidden for long. Get the list while it matters:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com