Amid expanding Danish investment across Greenland’s mining sector, the state-owned Export and Investment Fund of Denmark (EIFO) has approved a 5.2-million-euro ($5.6 million) loan for GreenRoc Strategic Materials Plc to advance redevelopment of the high-grade Amitsoq graphite mine in southern Greenland.

Positioned at the intersection of European energy transition goals and Arctic resource ambition, Greenland has become an emerging focal point in Western efforts to secure critical minerals.

Among these, graphite has grown increasingly vital as expanding clean energy production and subsequent Chinese export restrictions have reshaped global supply chains, positioning the battery material as critical to both energy security and resource independence.

As global supply chains recalibrated under clean-energy demand, European policy followed a trajectory similar to that of the United States – developing continent-wide frameworks to secure access to critical raw materials and reduce import dependence.

Following years of limited direct engagement in Greenland’s economic development, Danish attention has shifted back through new financial and institutional mechanisms that appear to reassert the kingdom’s role within the island’s growing resource sector.

Functioning as the state’s primary vehicle for international financing, the Export and Investment Fund of Denmark has become the principal instrument through which this renewed engagement is being executed, with a newly approved 5.2-million-euro loan to GreenRoc Strategic Materials to support redevelopment of the world-class Amitsoq graphite project in southern Greenland.

More EIFO funding

Already supporting Greenland’s mining sector through its 2019 entry into Amaroq Minerals Ltd. via the Danish-Greenlandic business initiative, EIFO broadened that involvement earlier this year with a 100 million Danish kroner ($15.5 million) investment in the company as it advances gold and critical mineral projects in the island’s south.

Extending its growing Greenlandic portfolio, the latest support falls under a loan facility – a flexible form of project financing designed to fund defined stages of mine advancement – providing capital for the next phase of development at Amitsoq, including bulk sampling, drilling, and commissioning of a pilot plant to convert graphite concentrate into active anode material for lithium-ion batteries within Europe’s emerging battery supply chain

“The project aligns very closely with EIFO’s strategic ambitions to support viable and impactful projects in Greenland, while also reinforcing business activities that contribute to the security of supply of critical minerals in Europe,” said Peter Boeskov, chief commercial officer of the Export and Investment Fund of Denmark. “We are equally committed to supporting the green transition, which is highly dependent on stable and secure value chains for critical raw materials like graphite.”

Intended to advance the Amitsoq graphite project as it enters its pre-development phase, the financing follows its June designation as a strategic project under the EU’s Critical Raw Materials Act, a classification that highlighted its importance to European supply security.

“We are delighted to have reached this agreement with EIFO. It provides GreenRoc with a viable financing route to develop our plans to establish European domestic production of high-tech, high-demand graphite materials,” said GreenRoc Strategic Materials Chairman George Frangeskides. “We also see it as due recognition of the inherent quality of our Amitsoq project and an endorsement of our ambitions to establish a full-scale processing plant in Europe for the production of active anode material for the EV sector.”

According to EIFO, the loan forms part of a wider Greenlandic commitment that now totals nearly 52 million euros (US$56 million) across roughly 25 companies operating in sectors ranging from mining to clean technology.

Recent initiatives include investment in Rock Flour Company, which is developing the use of glacial sediment for agricultural and carbon-capture applications, as well as joint ventures with Greenlandic partners through the Danish-Greenlandic Business Collaboration.

“Greenland is a strategic priority for EIFO. We are committed to supporting and strengthening its economic development, as well as promoting the advancement of supply chain resilience for critical minerals,” said Export and Investment Fund of Denmark CEO Peder Lundquist. “With GreenRoc, we are backing a company with the potential to play a pivotal role in securing graphite supply chains and creating jobs in Greenland. We are pleased to provide financing for this initiative, and we are actively looking to increase our Greenlandic commitment further.”

Greenland graphite

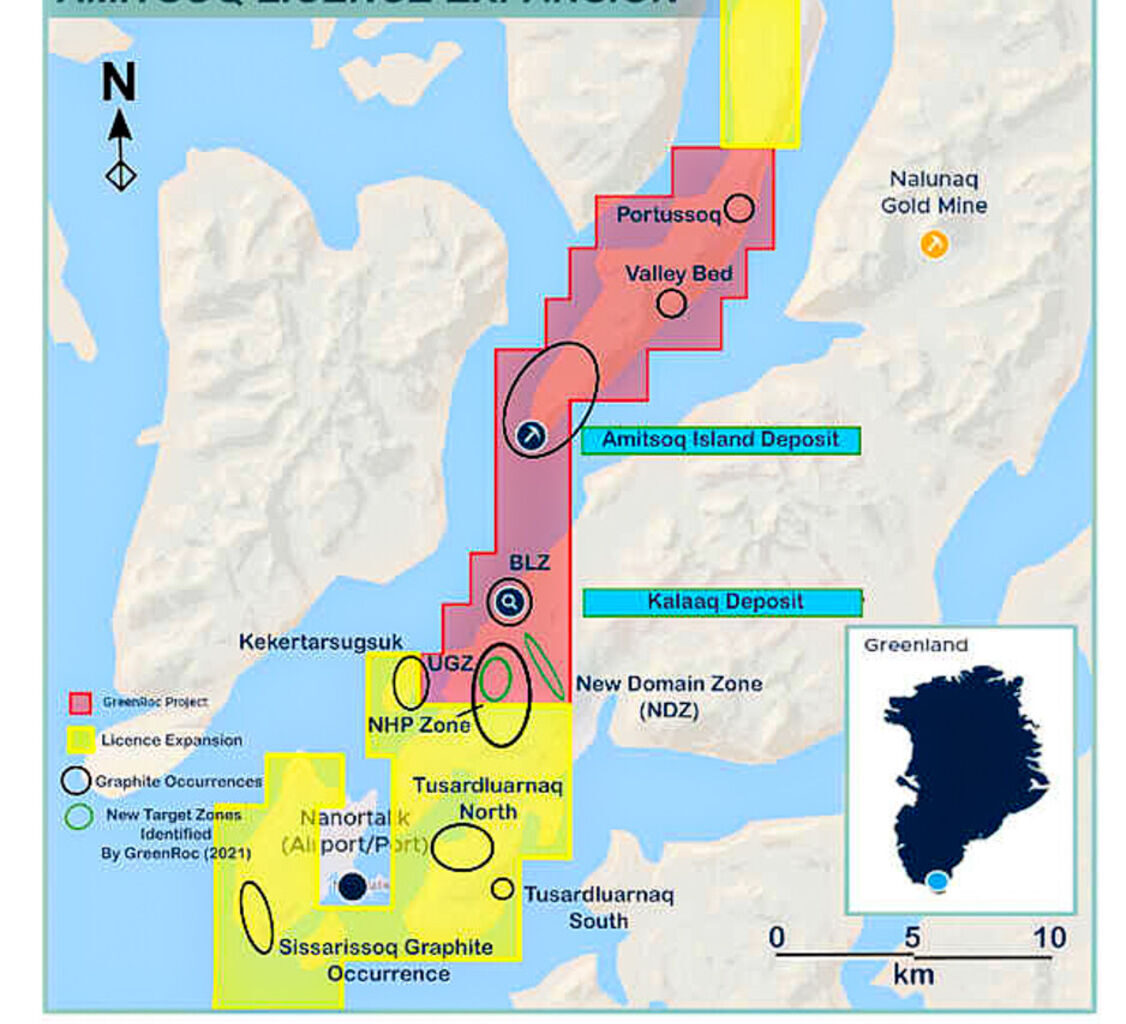

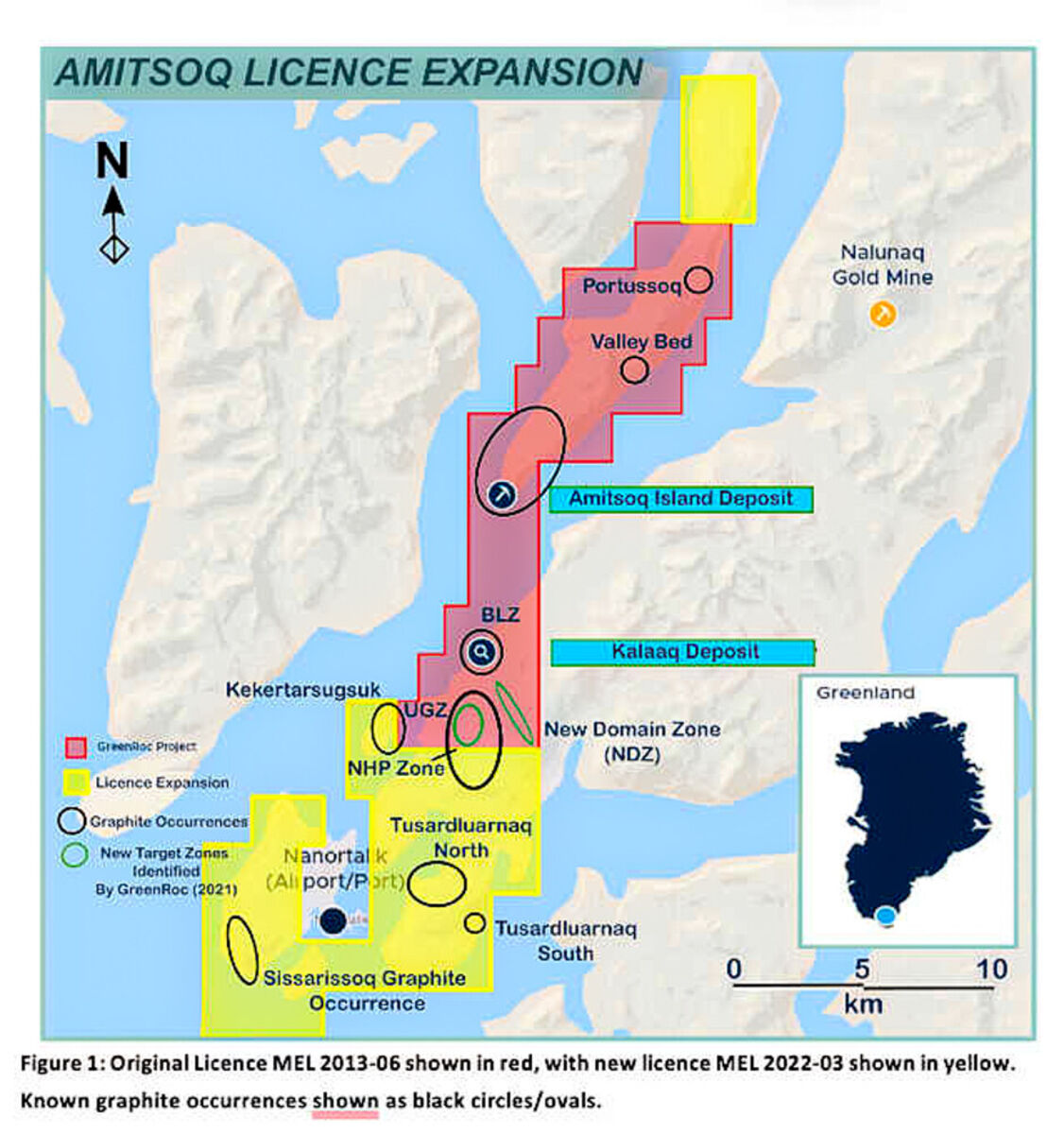

Located roughly 20 kilometers (12 miles) north-northeast of the town of Nanortalik in southern Greenland, Amitsoq is a historical underground graphite mine first operated between 1915 and 1922.

Though production during that early period was limited, the deposit was later recognized for its exceptionally high-grade flake graphite, exceeding 20% graphitic carbon – placing it among the richest known graphite resources worldwide.

Acquired by GreenRoc in 2021, the company has since advanced the project through successive exploration and engineering programs, beginning with systematic drilling and metallurgical testing that established a JORC-compliant resource estimate of 23.05 million metric tons of measured, indicated, and inferred resources averaging 20.41% graphitic carbon, or roughly 10.39 billion pounds of contained graphite.

Advancement of the project gained definition in 2023 with a preliminary economic assessment that mapped plans for an underground mine producing about 80,000 metric tons of graphite concentrate each year across a 22-year span.

That study placed development costs near $131 million and outlined a post-tax net present value of roughly $179 million, with an internal rate of return of about 26.7%.

Building on those results, a 2024 feasibility review expanded the scope to include a graphite anode materials plant capable of handling the same annual output, estimating total construction costs around $320 million and long-term returns approaching $545 million, with payback anticipated about four years after start-up.

Progress after these studies has since focused on preparing the project for pre-development, including environmental and social impact assessments required for an exploitation license application to Greenland’s government.

Current plans also call for a pilot-scale plant to refine Amitsoq graphite into anode-ready material for European battery manufacturing, aligning the operation with the region’s growing push for domestic supply chains.

Supported by testing that confirms the ore’s ability to produce high-purity spherical graphite exceeding 99.97% carbon content, the project is positioned to supply both energy storage and defense industries as demand for non-Chinese graphite sources accelerates.

Recognition under the EU’s Critical Raw Materials Act, along with ESG certification through Digbee’s independent assessment platform, further emphasize GreenRoc’s bid to advance Amitsoq as a model for responsible Arctic resource development.

As preparatory work continues, the newly approved financing from EIFO establishes the next step toward converting one of Greenland’s most promising graphite resources into an operational mine capable of supporting Europe’s long-term industrial independence.