Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

Baker Hughes Investment Narrative Recap

Owning shares of Baker Hughes often comes down to believing in the company’s ability to capitalize on global energy infrastructure trends, particularly growth in gas technologies and LNG, while managing the volatility of upstream oil and gas markets. The recent Aramco contract in Saudi Arabia further strengthens a near-term catalyst, Baker Hughes’ expanding backlog in its Industrial & Energy Technology segment, though it does little to reduce immediate risks around price pressure and exposure to unpredictable energy demand.

One related announcement to watch is the company’s October 2025 contract win to supply liquefaction equipment for Sempra’s Port Arthur LNG project, underscoring the importance of large-scale LNG contracts as a growth catalyst. This aligns with Baker Hughes’ push to build recurring gas technology revenue and strengthen resilience amid sector cycles.

By contrast, persistent inflation and supply chain cost pressure could still reshape future profitability, details investors should be aware of…

Read the full narrative on Baker Hughes (it’s free!)

Baker Hughes’ narrative projects $29.1 billion in revenue and $2.9 billion in earnings by 2028. This requires 1.8% yearly revenue growth and an earnings decrease of $0.1 billion from current earnings of $3.0 billion.

Uncover how Baker Hughes’ forecasts yield a $51.75 fair value, a 9% upside to its current price.

Exploring Other Perspectives BKR Community Fair Values as at Oct 2025

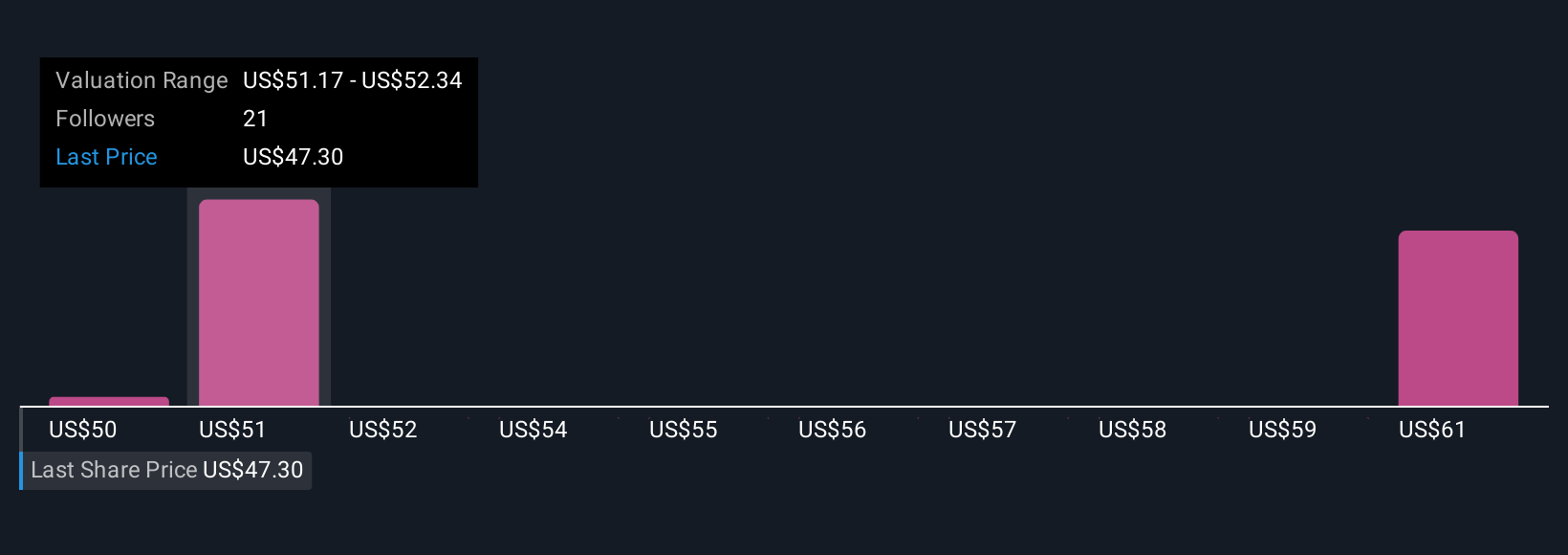

BKR Community Fair Values as at Oct 2025

Four fair value estimates from the Simply Wall St Community range from US$50 to US$61.72 per share. While many see growth from LNG and gas tech driving future results, opinions differ widely on risks tied to input costs and evolving energy markets.

Explore 4 other fair value estimates on Baker Hughes – why the stock might be worth just $50.00!

Build Your Own Baker Hughes Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

A great starting point for your Baker Hughes research is our analysis highlighting 3 key rewards that could impact your investment decision.Our free Baker Hughes research report provides a comprehensive fundamental analysis summarized in a single visual – the Snowflake – making it easy to evaluate Baker Hughes’ overall financial health at a glance.Searching For A Fresh Perspective?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Baker Hughes might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com