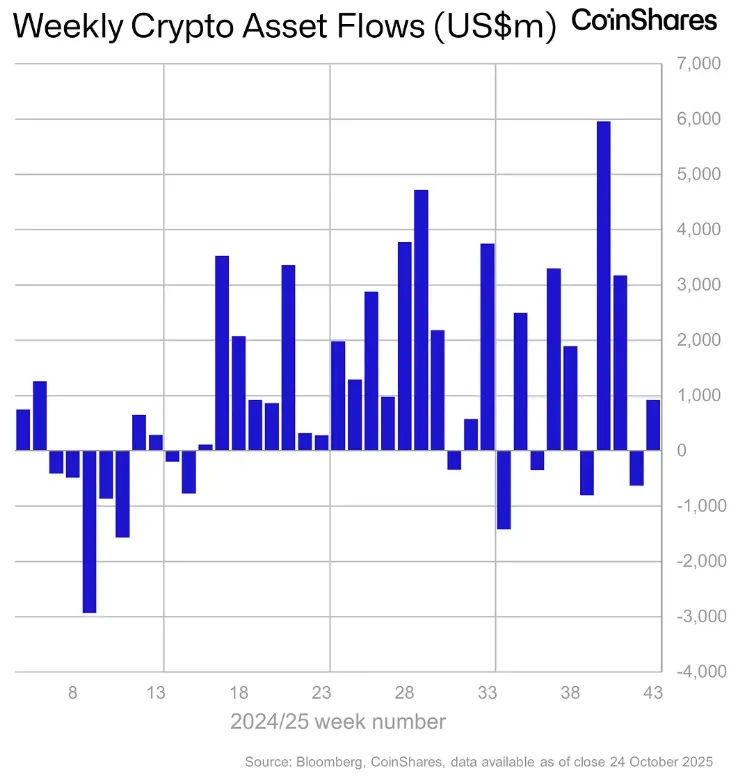

Between October 17 and 24, inflows into cryptocurrency investment products reached $921 million. This positive trend was supported by U.S. inflation data, which came in below analysts’ expectations, according to a report by CoinShares.

Weekly inflow dynamics into crypto funds. Source: CoinShares.

Weekly inflow dynamics into crypto funds. Source: CoinShares.

Trading volumes for exchange-traded products (ETP) remained high at $39 billion, significantly above the year-to-date average of $28 billion.

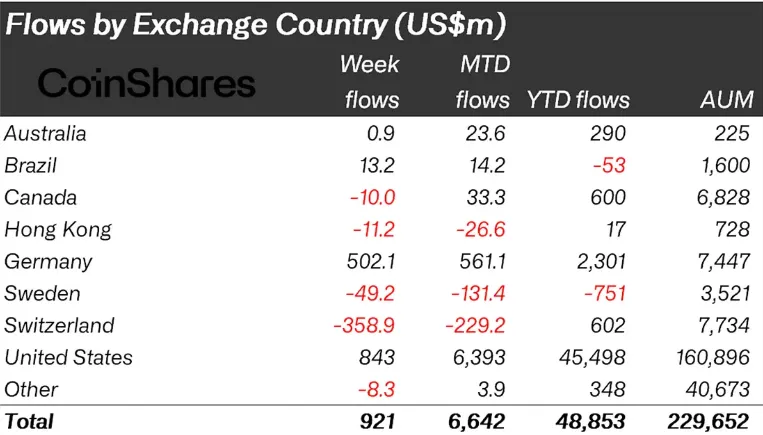

The United States led in capital inflow with $843 million. Germany recorded one of its largest weekly results in history at $502 million.

Weekly capital inflow distribution by region. Source: CoinShares.

Weekly capital inflow distribution by region. Source: CoinShares.

Meanwhile, $359 million was withdrawn from Swiss funds. Analysts attributed this to asset transfers between providers rather than seller pressure.

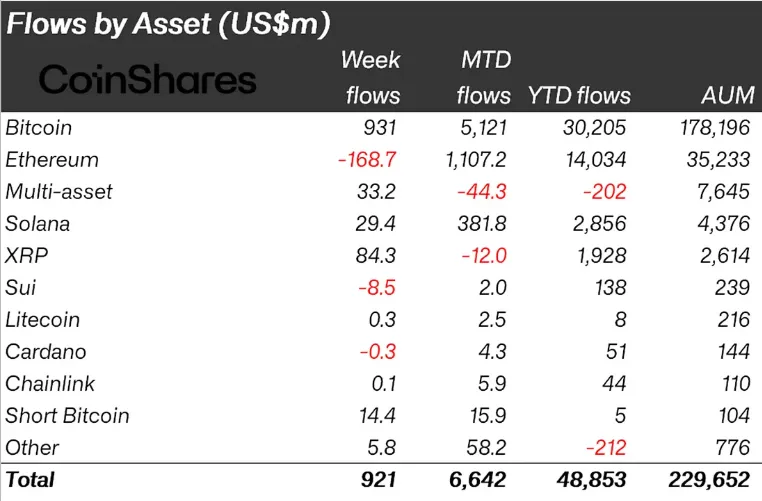

Bitcoin funds were the primary contributors to the inflow, attracting $931 million. Since the beginning of the year, total investments in these funds have reached $30.2 billion.

Weekly capital inflow distribution by asset. Source: CoinShares.

Weekly capital inflow distribution by asset. Source: CoinShares.

Investment products based on Ethereum recorded an outflow of $169 million for the first time in five weeks. However, ETPs with double leverage on this asset remain in demand.

Inflows into funds based on Solana and XRP slowed in anticipation of the launch of ETFs in the U.S. Over the week, they amounted to $29.4 million and $84.3 million, respectively.

Earlier, from October 10 to 17, outflows from cryptocurrency investment products amounted to $513 million.

Нашли ошибку в тексте? Выделите ее и нажмите CTRL+ENTER

Рассылки ForkLog: держите руку на пульсе биткоин-индустрии!