BNN Bloomberg is Canada’s definitive source for business news dedicated exclusively to helping Canadians invest and build their businesses.

Leave it to the U.S. administration to play the markets. The combination of the Federal Open Market Committee (FOMC) indicating the end of quantitative tightening (QT), the soft, but not yet bad employment picture, and likelihood of good earnings news out of Big Tech (US$27 trillion reporting this week from the five MAG stocks), and what looks like a path towards trade peace (for now) with China makes for a continued expansion of equity multiples.

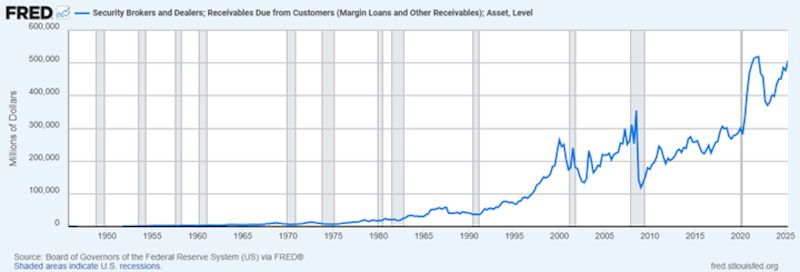

Make no mistake, this is not bullish. We are creating a significant speculative bubble with margin debt at all time highs. The only thing missing is the catalyst, the reason to sell. History reminds us that markets can stay irrational for far longer than we can stay solvent. In other words, do not short the bull.

Graph 1

Graph 1

One major reason we have advocated for buffer (upside participation with downside protection) style ETFs in recent years is the recognition that it can keep going. The AI tailwind is powerful. When you sprinkle on easier financial conditions, the only major thing that can kill it is the real economy performance. Core Inflation that is much higher than three per cent where the FOMC needs to raise rates or stop cutting. These are known, unknowns that simply take months or quarters to have clarity on. The market is seemingly ignoring all geopolitical concerns with U.S. President TACO true to form in recent weeks.

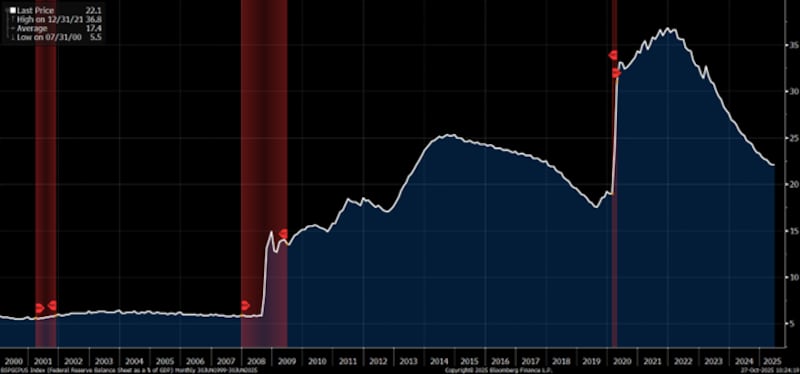

Graph 2

Graph 2

The end of quantitative tightening (shrinking the Fed’s balance sheet) can help the fiscal picture too and create easier financial conditions. This too can help equity markets by adding liquidity. Thus, leading to an overheating and higher than expected inflation. But this too is measured slowly in months and quarters and will matter when it does.

I’ve been asked a lot lately about the market valuation. What I can tell you in observing markets closely for almost 40 years, when markets are at all time highs and valuations are already extreme, there is no telling how far it can go. Greenspan gave his famous irrational exuberance speech in December 1996. The market doubled from that point. Once the market did peak in 2000, it did take until 2013 to make new highs.

Graph 3

Graph 3

BMO has a series of great buffer ETFs that can help. BMO US Equity Buffer Hedged to CAD ETF – April (ZAPR) and BMO US Equity Buffer Hedged to CAD ETF – October (ZOCT) demonstrate what kind of participation you can expect as seen in the ups and downs of 2025.

Graph 4

Graph 4

Follow Larry:

YouTube: LarryBermanOfficial

Twitter: @LarryBermanETF

LinkedIn: LarryBerman