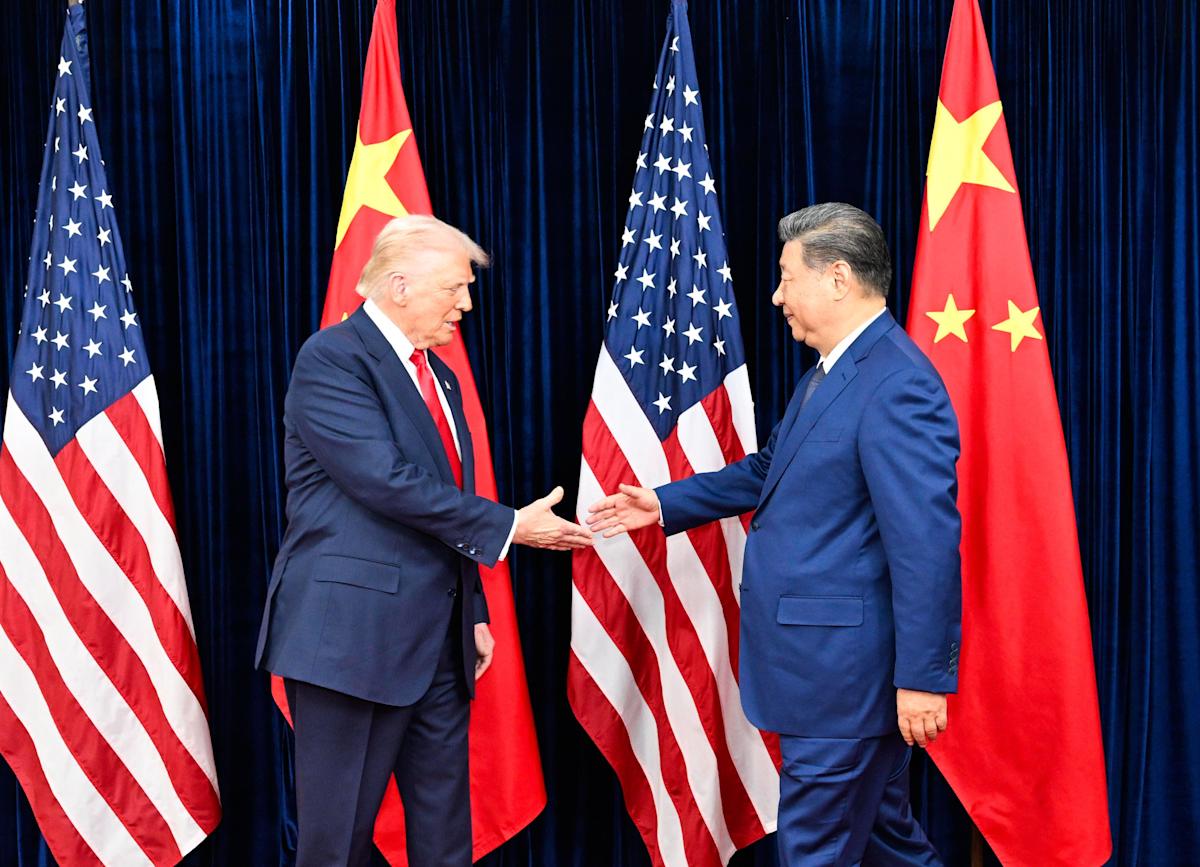

The FTSE 100 (^FTSE) and European stocks were mostly lower on Thursday as traders digested the new trade deal between US president Donald Trump and his Chinese counterpart Xi Jinping.

The two world leaders met in Busan in South Korea this morning, with Trump agreeing to reduce tariffs on China from 57% to 47% in a one-year deal. This was in exchange for Beijing resuming purchases of US soybeans, the continuation of rare earth exports and a crackdown on the trade of fentanyl.

Trump characterized his discussions with Xi as “fantastic,” emphasizing a “great relationship” between the two leaders, while premier Xi noted that both parties had achieved “a basic consensus” despite ongoing differences.

Furthermore, the leaders agreed to collaborate on issues concerning Ukraine and stated their intention to eliminate shipping tariffs and fees.

Today marked the first face-to-face meeting between the two since Trump returned to the White House in January, with Trump stating that he will visit Beijing in April.

“On a scale of one to 10, the meeting with Xi was 12,” he told reporters on route back to the US.

Elsewhere, investors will also be focused on the European Central Bank (ECB) policy decision this afternoon, where rates are widely expected to remain on hold at 2%.

President Christine Lagarde is likely to reiterate that policy remains “in a good place.” Deutsche Bank’s European economists said they expect the tone to stay unchanged, though dovish risks include trade uncertainty, energy inflation, and credit transmission concerns.

London’s benchmark index (^FTSE) was around 0.4% lower in early trade

Germany’s DAX (^GDAXI) rose 0.3% and the CAC (^FCHI) in Paris was hovering around the flatline

The pan-European STOXX 600 (^STOXX) was down 0.1%

Wall Street is set for a negative start as S&P 500 futures (ES=F), Dow futures (YM=F) and Nasdaq futures (NQ=F) were all in the red after a mixed performance yesterday.

The pound was 0.1% up against the US dollar (GBPUSD=X) at 1.3204

Follow along for live updates throughout the day:

LIVE 7 updates

Download the Yahoo Finance app, available for Apple and Android.