A new report from Mordor Intelligence on the “Norway’s Oil and Gas Upstream Market Size” provides an in-depth analysis of current trends, key growth factors, and upcoming opportunities.

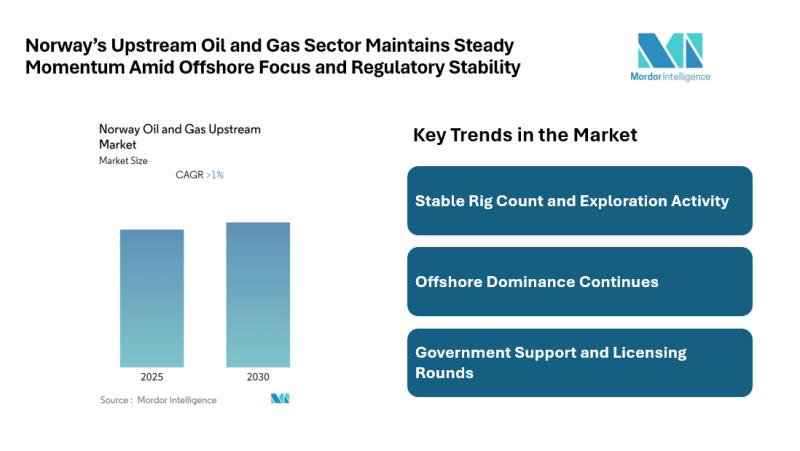

Norway’s oil and gas upstream market remains a cornerstone of the country’s energy sector, with a projected market value of USD 22.95 billion by 2030, growing at a modest CAGR of 1.00% between 2025 and 2030. Despite global shifts toward renewables, Norway continues to maintain a balanced approach, leveraging its mature offshore infrastructure and regulatory stability to support upstream exploration and production.

The upstream segment, which includes exploration, drilling, and production activities, is primarily concentrated in offshore regions such as the North Sea and the Norwegian Sea. With a low market concentration, the sector is characterized by a mix of international oil majors and domestic players, each contributing to Norway’s position as a reliable energy exporter.

Browse Report – Explore the report’s contents, sections, and key insights by browsing through its detailed information: https://www.mordorintelligence.com/industry-reports/united-states-oil-and-gas-downstream-market?utm_source=openpr

Key Trends in Norway’s Upstream Oil and Gas Sector

Offshore Dominance Continues

Norway’s upstream market is heavily skewed toward offshore operations. The country’s continental shelf remains one of the most active regions in Europe for oil and gas exploration. Offshore fields such as Johan Sverdrup and Troll continue to yield high output, supported by advanced subsea infrastructure and long-term investment commitments.

Stable Rig Count and Exploration Activity

The number of active rigs in Norway has remained relatively stable, reflecting consistent exploration and development efforts. While the pace of new discoveries has slowed compared to earlier decades, companies are focusing on maximizing recovery from existing fields and extending the life of mature assets.

Government Support and Licensing Rounds

Norway’s Ministry of Petroleum and Energy continues to offer annual licensing rounds, encouraging exploration in both mature and frontier areas. These rounds are critical for maintaining upstream momentum, especially as global competition for capital intensifies. The predictable regulatory framework and transparent bidding process make Norway an attractive destination for upstream investment.

Decommissioning and Late-Life Asset Management

As several fields approach the end of their productive life, decommissioning activities are gaining traction. This trend is reshaping upstream strategies, with operators investing in enhanced oil recovery techniques and planning for responsible field closures. The rise in decommissioning also opens opportunities for service providers specializing in plug-and-abandonment and subsea infrastructure removal.

Explore in-depth insights and regional perspectives, including localized editions like the Japanese market version: https://www.mordorintelligence.com/ja/industry-reports/united-states-oil-and-gas-downstream-market?utm_source=openpr

Market Segmentation: Norway Oil and Gas Upstream Breakdown

The Norway upstream oil and gas market can be segmented based on location and activity type:

By Location:

Offshore: Dominates the market with major fields in the North Sea, Norwegian Sea, and Barents Sea.

Onshore: Minimal activity, primarily focused on support services and logistics.

By Activity Type:

Exploration: Includes seismic surveys, licensing, and wildcat drilling.

Development and Production: Covers drilling, well completion, and hydrocarbon extraction.

Decommissioning: Involves field closure, infrastructure dismantling, and environmental restoration.

Key Observations:

Offshore fields account for the bulk of upstream spending and production volumes.

Exploration activity is concentrated in frontier areas like the Barents Sea.

Decommissioning is expected to grow steadily, especially post-2027.

Explore Competitive Landscape Details: https://www.mordorintelligence.com/industry-reports/norway-oil-and-gas-upstream-market/companies?utm_source=openpr

Key Players in Norway’s Upstream Oil and Gas Market

The upstream landscape in Norway is shaped by a mix of global energy firms and regional operators. These companies play a vital role in sustaining production levels and investing in future capacity.

Equinor ASA: Norway’s state-backed energy company leads the upstream segment with operations across major offshore fields. It continues to invest in enhanced recovery and field extensions.

Aker BP ASA: A key player in the Norwegian Continental Shelf, Aker BP focuses on efficient field development and has a strong portfolio of producing assets.

ConocoPhillips: The U.S.-based firm maintains a significant presence in Norway, particularly in the Greater Ekofisk Area, contributing to stable output.

TotalEnergies SA: Active in exploration and production, TotalEnergies is involved in several joint ventures and continues to participate in licensing rounds.

Royal Dutch Shell PLC: Shell’s upstream operations in Norway are focused on mature field management and infrastructure optimization.

Vår Energi AS: A growing force in the Norwegian upstream market, Vår Energi is expanding its footprint through acquisitions and development projects.

These companies benefit from Norway’s transparent regulatory environment and access to skilled labor, which supports efficient project execution and long-term planning.

Conclusion: Navigating Norway’s Upstream Energy Future

Norway’s oil and gas upstream market is set to maintain its strategic importance through 2030, supported by stable offshore production, government-backed licensing initiatives, and a clear regulatory framework. While the global energy landscape is shifting, Norway’s upstream sector continues to offer value through its mature infrastructure, experienced operators, and commitment to responsible resource management.

Explore Related Reports:

Oil and Gas Downstream Market: The market is segmented by type into refineries and petrochemical plants. By product type, it includes refined petroleum products, petrochemicals, and lubricants. Distribution channels are categorized as direct sales or wholesale, distributors or commercial, and retail. Geographically, the market spans North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. Market sizes and forecasts are provided in terms of USD value.

Get Full Details: https://www.mordorintelligence.com/industry-reports/oil-and-gas-downstream-market?utm_source=openpr

United States Oil and Gas Downstream Market: The report segments the market by type into refineries and petrochemical plants, by product into refined petroleum products, petrochemicals, and lubricants, and by distribution channel into direct sales/wholesale, distributors/commercial, and retail. Market size and forecasts are given in USD.

Get Full Details: https://www.mordorintelligence.com/industry-reports/united-states-oil-and-gas-downstream-market?utm_source=openpr

For any inquiries, please contact:

media@mordorintelligence.com

https://www.mordorintelligence.com/contact-us

About Mordor Intelligence

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals. With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

This release was published on openPR.