Key Takeaways

The DOJ is seeking five-year prison sentences for Samourai Wallet founders Keonne Rodriguez and William Lonergan Hill.

After pleading guilty in July, Rodriguez and Hill are scheduled for sentencing this week.

This new prosecution mirrors the DOJ’s earlier charges against the developers of Tornado Cash.

When crypto investigator ZachXBT ranked Nigeria, India and three others as the world’s worst jurisdictions for crypto crime victims, it struck a nerve across the digital asset community.

His blunt verdict, that the U.K. and Canada are where crypto cases go to die, raises questions about the widening global gap between the scale of crypto fraud and the ability of law enforcement to respond.

Despite the rapid adoption of digital assets, many countries continue to lack the legal clarity and resources to pursue crypto-related crime, leaving fraud survivors in limbo.

ZachXBT Flags Worst Jurisdictions

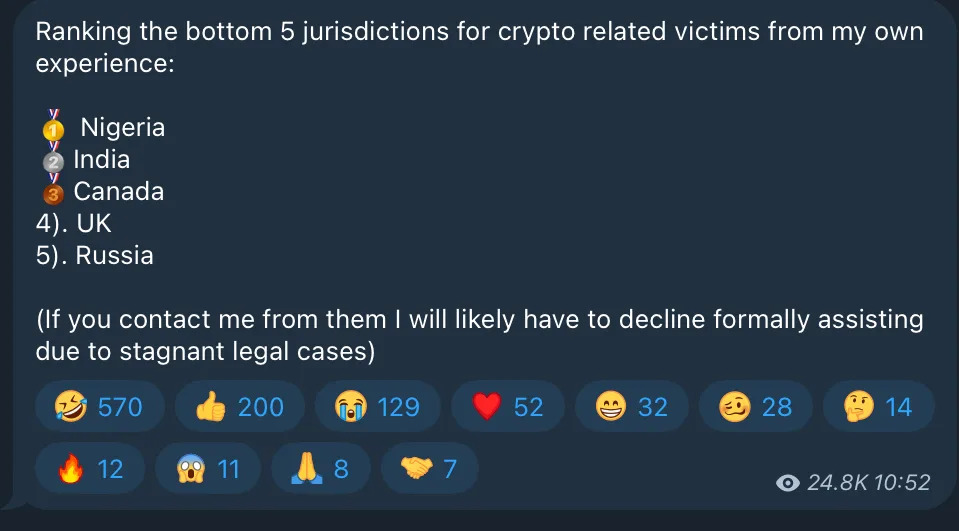

This week, ZachXBT called out the five worst countries for crypto-related crime victims seeking justice:

ZachXBT ranks the worst jurisdictions for crypto victims. | Source: Telegram

Sending out the information on his Telegram channel, he wrote: “If you contact me from them, I will likely have to decline formally assisting due to stagnant legal cases.”

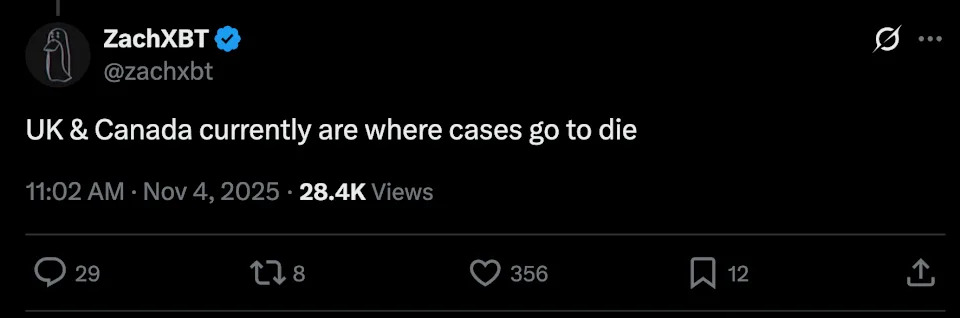

ZachXBT later added on X that the “U.K. and Canada currently are where cases go to die.”

He also listed his top jurisdictions where victims are most likely to see action from authorities:

The comments have highlighted the growing disparity between global crypto users as the industry continues to suffer significant attacks.

Crypto Crime Soaring

According to Chainalysis’ 2025 Crypto Crime Report, illicit crypto addresses received at least $40.9 billion in 2024.

That represents roughly 0.14% of total on-chain activity, down from 0.61% the previous year, though Chainalysis notes these numbers often rise as new data emerges.

Chainalysis reported a 21% year-over-year rise in stolen crypto funds to $2.2 billion, with North Korean hackers responsible for $1.34 billion, around 61% of the total.

In 2025, crypto crime has surged brutally.

According to a mid-year report from TRM Labs, hackers have stolen more than $2.1 billion from cryptocurrency platforms in the first six months of 2025, already surpassing the $1.8 billion lost in all of 2024.

The figure represents a 50% year-over-year increase and puts the industry on pace to shatter previous annual records.

The single largest event, the Bybit cold wallet exploit, accounted for over $1.5 billion of the total, roughly 70% of all stolen funds so far this year.

Why Victims Rarely See Justice

For all the technological advances in blockchain, justice for crypto crime victims still heavily depends on where they live.

In many jurisdictions, legal ambiguity and limited access to the correct resources have rendered the process of reporting digital theft ineffective.

While on-chain investigators can now follow stolen funds across blockchains in seconds, many victims never see those funds returned if there is no clear prosecution route in place.

Nigeria

Nigeria’s struggle with crypto-related crime is complicated by its long-standing reputation as a global hub for online fraud.

A 2024 academic assessment found that crypto fraud has become one of the most common forms of cyber-enabled crime prosecuted in Nigeria.

With only about 36% of Nigerian adults having access to formal banking, digital assets have become both an economic lifeline and a criminal opportunity.

One offender, Eze Harrison Arinze, was charged with defrauding victims in 13 countries, stealing $382,000 in Bitcoin, according to an EFCC press release.

Despite such prosecutions, systemic weaknesses continue to block justice for most victims.

Overlapping jurisdiction among the EFCC, Central Bank of Nigeria (CBN), and Securities and Exchange Commission (SEC) has created a procedural bottleneck.

Nigerian lawyer, Chukwudi Ofili, believes that Nigeria does not have a “unified legal and regulatory framework that is applicable across all relevant jurisdictions.”

India

India’s stance on crypto remains legally ambiguous.

Digital assets are neither fully legal nor outright banned, creating a murky regulatory environment where tax obligations exist without a coherent legal framework.

Since 2022, investors have been required to pay a 30% capital gains tax on crypto profits, yet there is no official recognition of crypto as an asset class.

This contradiction has left law enforcement and victims navigating a “legal no man’s land.”

“The ambiguity stems from a history of regulatory uncertainty, including a central bank circular restricting crypto services that was later struck down by the Supreme Court, leaving no comprehensive legislation in place,” crypto payment firm Lightspark wrote in a blog.

The Enforcement Directorate and Central Board of Direct Taxes regularly investigate crypto-related offenses, but prosecutions are slow and inconsistent.

Police also often freeze digital wallets and exchange accounts under suspicion of money laundering, yet restitution for victims is rare due to the lack of defined processes.

This vacuum has also enabled crypto exchanges to exploit jurisdictional loopholes.

One high-profile example is WazirX, once India’s largest trading platform.

After suffering a $230 million hack, the exchange came under intense scrutiny from the ED for alleged money-laundering violations.

However, its parent company had been incorporated in Singapore, effectively distancing the platform from Indian regulatory reach.

China

In China, justice for crypto crime victims is often indistinguishable from punishment for crypto users themselves.

The country’s sweeping ban on crypto trading and mining, first imposed in 2021, has created a black-market ecosystem where victims of fraud are unable to file legitimate complaints without exposing their own participation in illegal activity.

Last week, a provincial court sentenced five individuals for operating an underground crypto trading network.

The main orchestrator received four years and six months in prison and a 200,000 RMB ($28,000) fine.

In its ruling, the court said the sentences were necessary to deter “activities that undermine national financial stability.”

Despite Hong Kong’s gradual embrace of regulated digital assets, mainland China’s enforcement remains relentless.

Canada and the U.K.

In countries with strong legal frameworks, such as Canada and the U.K., it is expected that crypto crime victims will fare better.

Yet crypto sleuth ZachXBT slammed the two nations as “where cases go to die,” highlighting the legal issues that remain unresolved for years.

This is heavily due to both nations suffering from fragmented enforcement.

ZachXBT’s comment on the U.K. and Canada. | Source: X

In Britain, crypto investigations are divided among a range of agencies, including the National Crime Agency (NCA), Action Fraud, local police forces, and the Financial Conduct Authority (FCA), with no clear ownership.

Despite a variety of new measures, including the Crypto Wallet Freezing Order, the powers remain enforceable only when assets are held by U.K.-based exchanges or custodians.

Canada faces similar challenges, as the Royal Canadian Mounted Police (RCMP) and local cybercrime units share overlapping mandates.

Prosecution Growing, But Global Justice Remains Scarce

While scam victims in emerging markets are struggling to file a basic complaint, prosecutors in the West are attempting to aggressively target bad actors.

The U.S. Department of Justice recently sought five-year sentences for Samourai Wallet founders Keonne Rodriguez and William Lonergan Hill, accusing them of laundering over $237 million through their Bitcoin privacy app.

The case mirrors the earlier prosecution of Tornado Cash developers, whom U.S. authorities accused of facilitating more than $1 billion in illicit transfers.

When Dutch programmer Alexey Pertsev was arrested in 2022, protestors argued that the charges blurred the line between publishing open-source software and actively participating in criminal conduct.

Organizations such as the Ethereum Foundation voiced support for the developers’ legal defense.

Until global enforcement becomes more coordinated and regulations become more streamlined, crypto justice is likely to remain uneven.

The post Crypto Crime’s Dead Ends: Why Victims Rarely See Justice in Nigeria, India, and Beyond appeared first on ccn.com.