MarketAxess Holdings (MKTX) has been on investors’ radar lately as its stock performance stands in contrast to broader market trends. The company’s shares are down over the past month, which has sparked questions about underlying value and future direction.

See our latest analysis for MarketAxess Holdings.

MarketAxess Holdings’ share price has steadily lost ground this year, with a year-to-date price return of -25.76%. The total shareholder return for the past 12 months is even weaker at -38.23%. While a short-term rally has lifted its share price by 4.5% over the last week, the longer-term momentum is still fading as investors remain cautious about growth prospects and risk appetite seems subdued.

If this shift in momentum has you curious about what else is changing in the market, it could be the perfect moment to uncover new ideas with fast growing stocks with high insider ownership

But with shares notably below analyst targets and the company still demonstrating growth in revenue and net income, the real question is whether this dip reveals a compelling value or if the market has already accounted for future gains.

Most Popular Narrative: 17.5% Undervalued

The most followed narrative places MarketAxess Holdings’ fair value well above its last close, framing the recent share weakness as an opportunity if future growth meets projections. With analysts and market-watchers focused on expansion into new markets, a critical catalyst stands out:

The company is rapidly expanding into new geographies and asset classes, particularly through its growth in emerging markets (EM) and Eurobonds. These segments saw more than 20% volume growth and double-digit commission revenue increases, suggesting the addressable market is broadening and could support higher long-term revenue and earnings.

Wondering what assumptions are behind this bold fair value? The answer lies in rapid revenue expansion, surging margins, and a future profit multiple that even skeptics question. What if one number flips the whole picture? Interested to find out which key ingredients drive this narrative’s optimism?

Result: Fair Value of $202.67 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, if large block trades continue to occur off-platform or if competition increases further, MarketAxess could experience pressure on both future revenue growth and margins.

Find out about the key risks to this MarketAxess Holdings narrative.

Another View: How Do MarketAxess Shares Stack Up on Valuation?

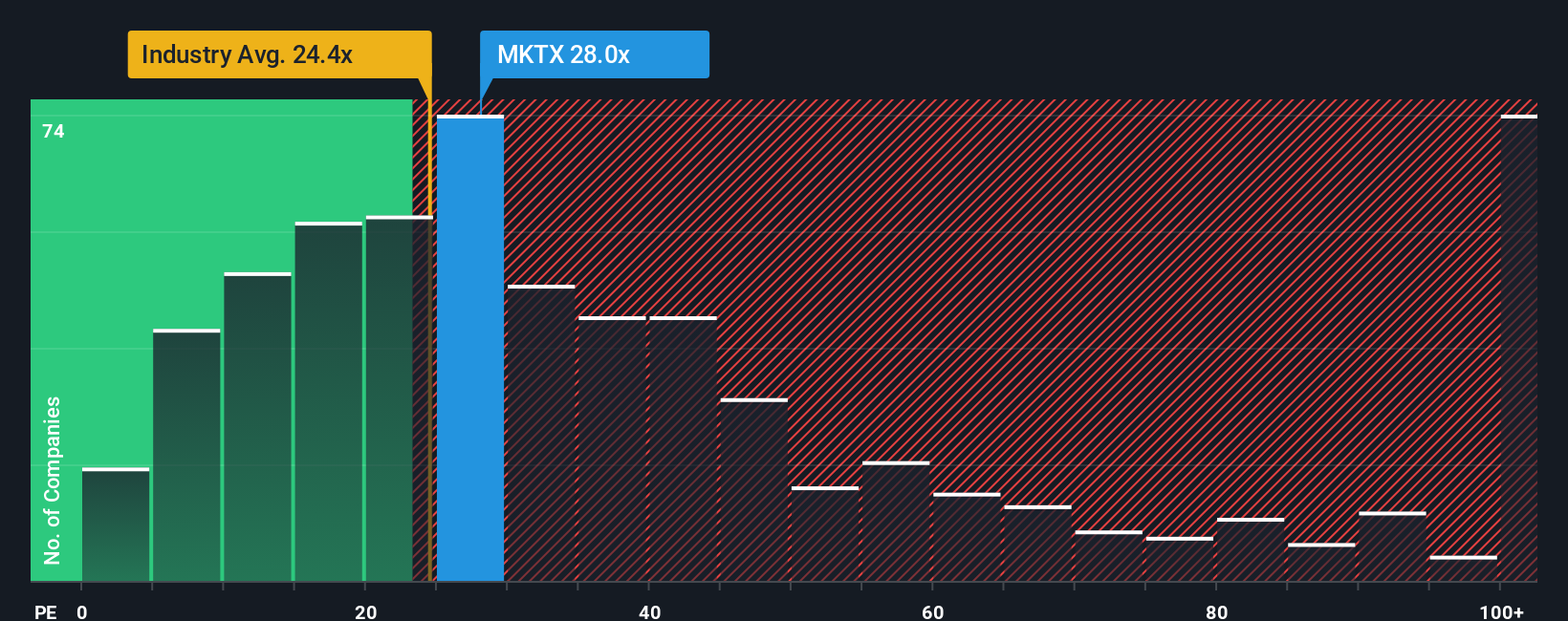

Taking a different approach, let’s look at MarketAxess Holdings using a commonly watched price-to-earnings ratio. At 28x, its ratio is notably higher than the industry average of 24.1x, the peer group’s 26.1x, and especially above the fair ratio of 14.6x. This suggests the market is attaching a premium to MarketAxess, but is that justified or does it present valuation risk if sentiment changes?

See what the numbers say about this price — find out in our valuation breakdown.

NasdaqGS:MKTX PE Ratio as at Nov 2025 Build Your Own MarketAxess Holdings Narrative

NasdaqGS:MKTX PE Ratio as at Nov 2025 Build Your Own MarketAxess Holdings Narrative

If you see things differently or want to dig deeper into the numbers, you can explore all the details and shape your own view in just a few minutes, Do it your way

A great starting point for your MarketAxess Holdings research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t wait for the next big stock to pass you by. Use the Simply Wall Street Screener now to open the door to truly unique market opportunities.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

We’ve created the ultimate portfolio companion for stock investors, and it’s free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com