These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

Cheniere Energy Investment Narrative Recap

To be a Cheniere Energy shareholder, you need confidence in resilient global LNG demand and the company’s ability to grow through long-term contracts and brownfield expansions despite increasing competition and evolving energy policy. The latest results, an earnings beat, rising dividend, and ongoing buybacks, do not materially change the most important short-term catalyst, which remains the company’s ability to sign new long-term offtake agreements, while the risk from potential LNG market oversupply and pressure on contract pricing persists.

Among the recent announcements, the new long-term sale and purchase agreement with JERA stands out. This contract, covering deliveries from 2029 to 2050, is directly relevant to Cheniere’s focus on expanding its contracted backlog, supporting its strategy to mitigate market volatility and provide cash flow stability as new capacity comes online.

By contrast, investors should be mindful of the increasing risk from the global surge in new LNG supply capacity, as an oversupplied market could…

Read the full narrative on Cheniere Energy (it’s free!)

Cheniere Energy’s outlook projects $24.1 billion in revenue and $3.1 billion in earnings by 2028. This reflects a 9.8% annual revenue growth but a $0.7 billion earnings decrease from today’s $3.8 billion.

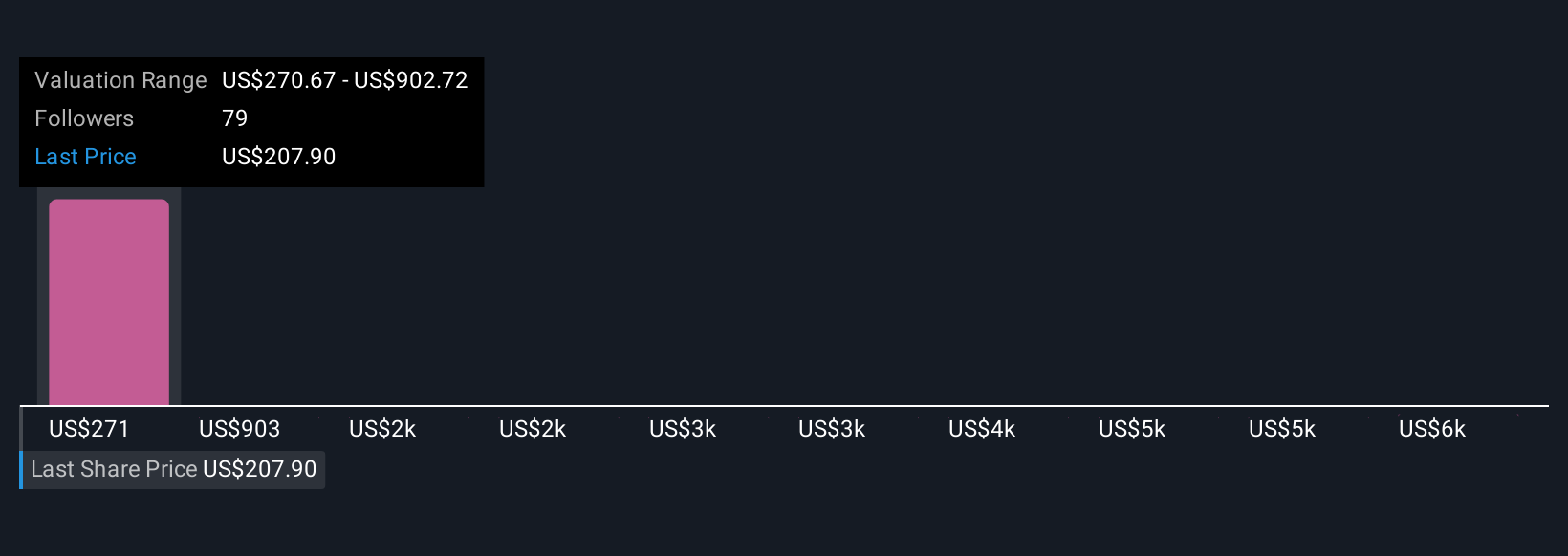

Uncover how Cheniere Energy’s forecasts yield a $270.67 fair value, a 30% upside to its current price.

Exploring Other Perspectives LNG Community Fair Values as at Nov 2025

LNG Community Fair Values as at Nov 2025

Five private investor fair value estimates in the Simply Wall St Community ranged from US$270.67 to US$6,591.19. While many see strong growth drivers in new LNG contracts, your view on global LNG oversupply risk may reshape expectations for Cheniere’s future.

Explore 5 other fair value estimates on Cheniere Energy – why the stock might be a potential multi-bagger!

Build Your Own Cheniere Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com