TechnipFMC (FTI) has posted a solid stretch recently, delivering a year-to-date return near 45% and climbing almost 23% over the past 3 months. Many investors are taking a closer look at what has fueled this momentum.

See our latest analysis for TechnipFMC.

Momentum for TechnipFMC has really picked up, with a nearly 45% year-to-date share price return and recent total shareholder returns showing multi-year strength. The latest price surge suggests renewed investor optimism around the company’s growth prospects and risk profile.

If TechnipFMC’s run has you rethinking your strategy, now is the perfect time to broaden your scope and discover fast growing stocks with high insider ownership

With shares up sharply and trading within a few percent of analyst targets, the key question for investors now is whether TechnipFMC’s impressive gains signal further upside or if the market is already factoring in future growth.

Most Popular Narrative: 4.7% Undervalued

TechnipFMC is trading at $42.85, while the most followed narrative values the stock higher at $44.95. This suggests that despite the recent rally, there may be more room to run. The discount rate used in the calculation is 7.53%, positioning the current price just below consensus fair value.

Expansion and recurring tail of Subsea services revenues, driven by a growing installed base and long-duration contracts (20, 35 years), provide predictable, high-margin income streams that underpin long-term earnings stability and net margin improvement.

The fair value isn’t just a number. It is anchored in bold profitability forecasts and ambitious assumptions about where cash flows are headed. Want to know what powerful catalysts and margin trajectories make analysts confident that pricing power will persist? Get the full story and judge for yourself.

Result: Fair Value of $44.95 (UNDERVALUED)

Have a read of the narrative in full and understand what’s behind the forecasts.

However, ongoing macroeconomic uncertainty and reliance on oil and gas markets remain potential challenges. These factors could disrupt TechnipFMC’s bullish trajectory.

Find out about the key risks to this TechnipFMC narrative.

Another View: Multiples Raise Valuation Questions

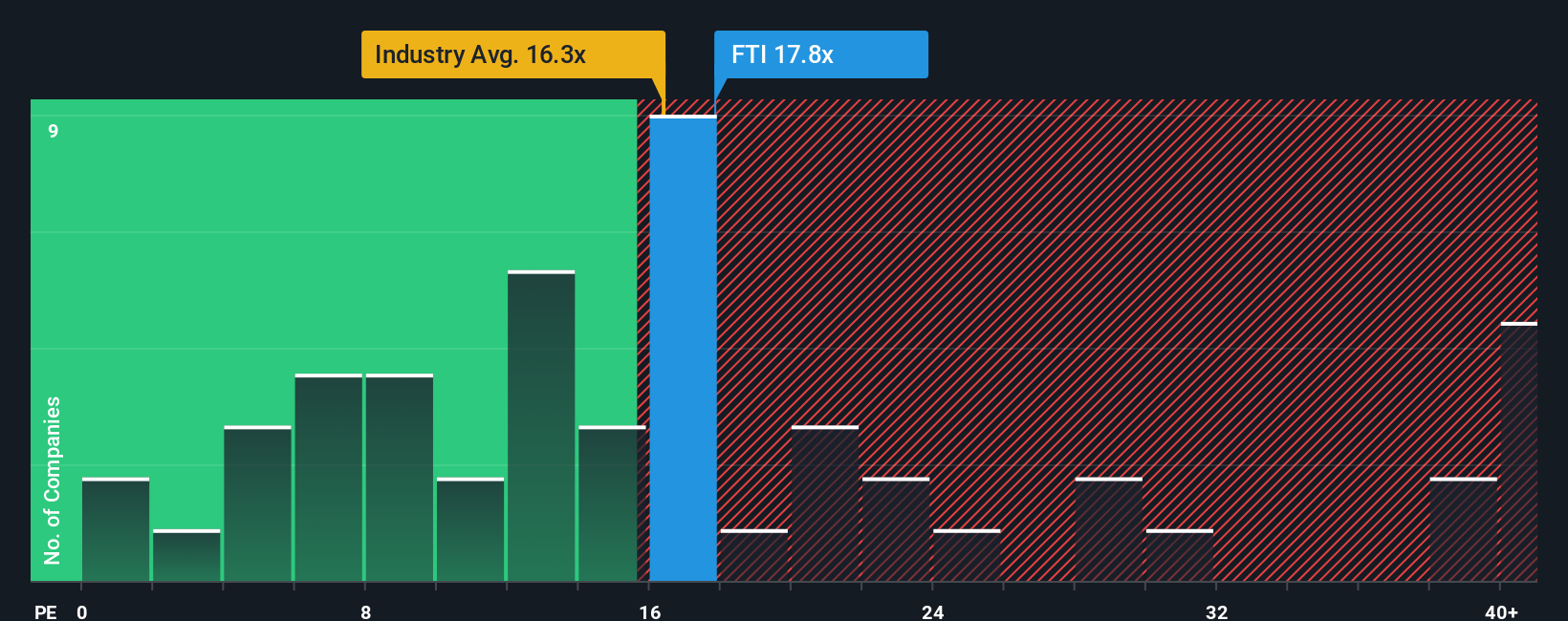

While discounted cash flow points to shares being undervalued, a quick look at the price-to-earnings ratio offers caution. TechnipFMC trades at 17.8 times earnings, which is notably above both the industry average of 16.3 and the peer average of 15.9. The fair ratio stands at 16.8. This gap means if market sentiment shifts or growth expectations falter, the shares could be at risk of re-rating. Is current optimism already built into the price?

See what the numbers say about this price — find out in our valuation breakdown.

NYSE:FTI PE Ratio as at Nov 2025 Build Your Own TechnipFMC Narrative

NYSE:FTI PE Ratio as at Nov 2025 Build Your Own TechnipFMC Narrative

If you’d like to dig into the data yourself or view things from a different angle, it’s quick and easy to create your own perspective in just a few minutes. Do it your way

A great starting point for your TechnipFMC research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t miss your chance to uncover stocks that could transform your portfolio. Simply Wall Street’s powerful screeners unlock fresh opportunities beyond TechnipFMC.

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if TechnipFMC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com