Source: Dealogic IPOs include any European Companies that IPOed U.S. stock exchanges.

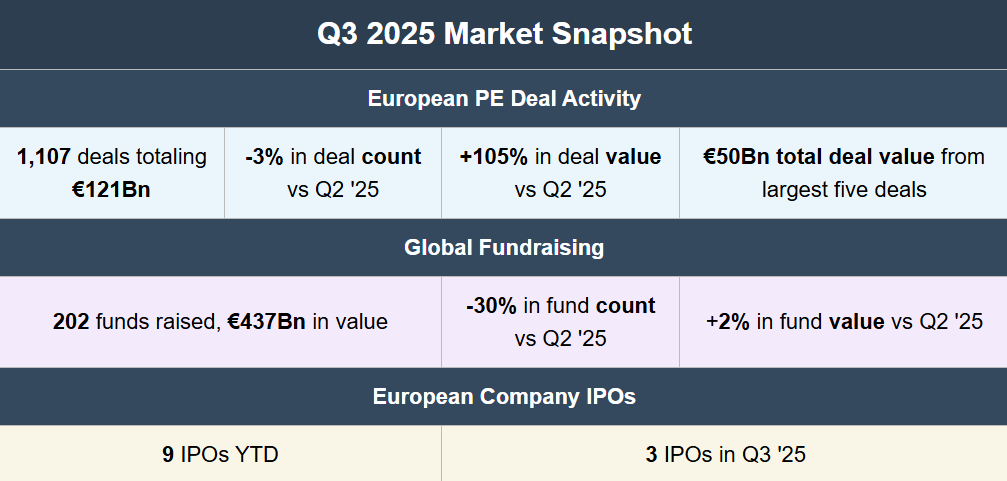

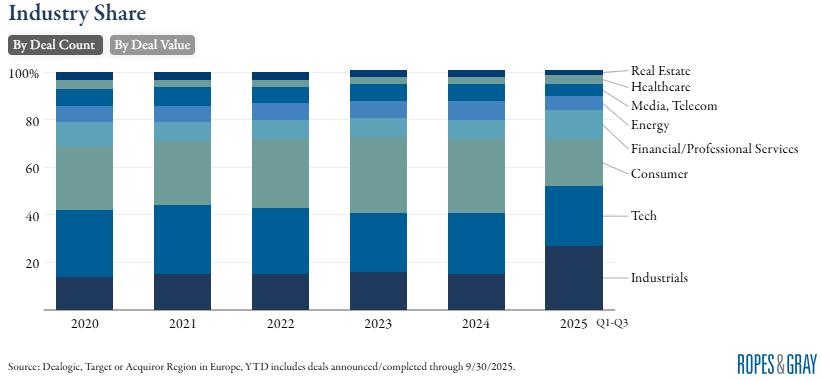

Deal Count: Europe showed resilient buyout activity in Q3, on pace to exceed 2024. The market is moving with improved sentiment into Q4 with global sponsors—especially U.S. firms—deploying capital actively.

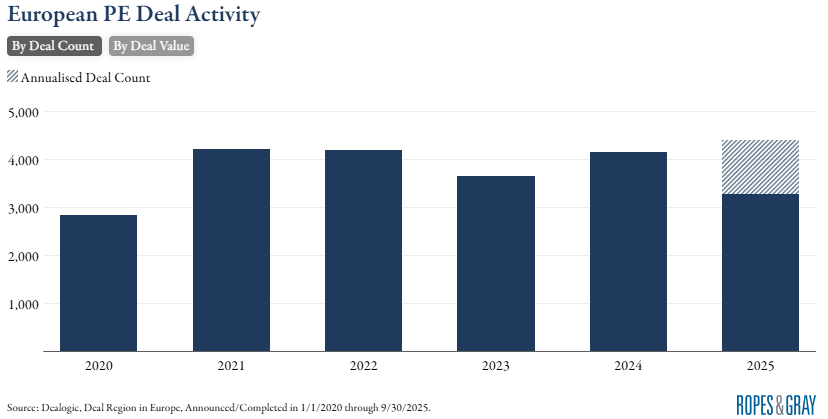

Deal size: Three quarter of deal size data show that they are getting larger, especially in the €1 billion to €5 billion range, showing that the market has responded positively to lower rates and more stable macroeconomic outlook. Large PE players such as Apollo, KKR, Advent, and Partners Group among others are driving large deal activity.

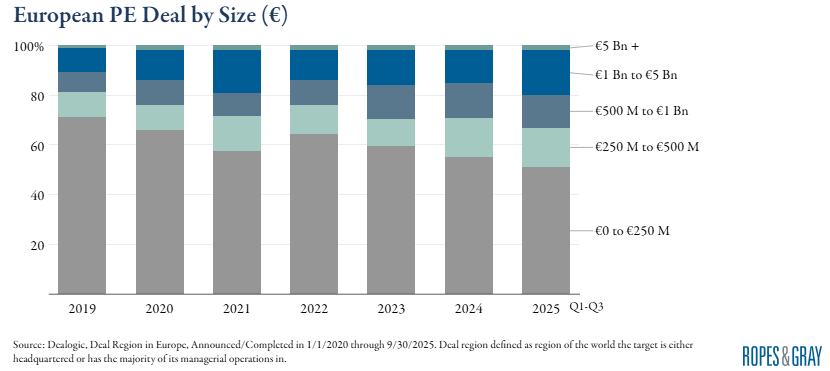

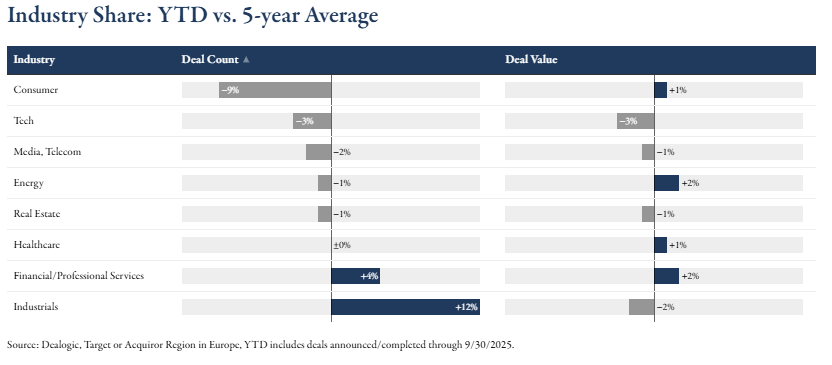

Year to date, Industrials is up 12% in deal count due to an influx of chemical-related deals.

Financial/Professional Services is above average for both deal count and value driven by Europe’s energy transition, especially surrounding technology, testing, and inspection.

Consumer deal count is down but the large Keurig deal kept deal value from deviating largely from the 5-year average.

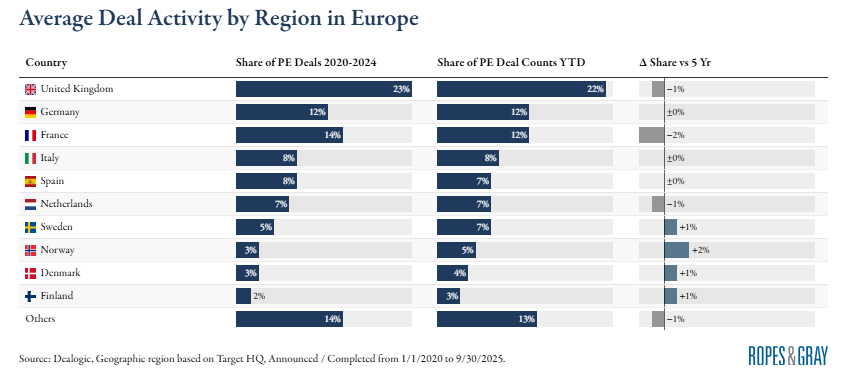

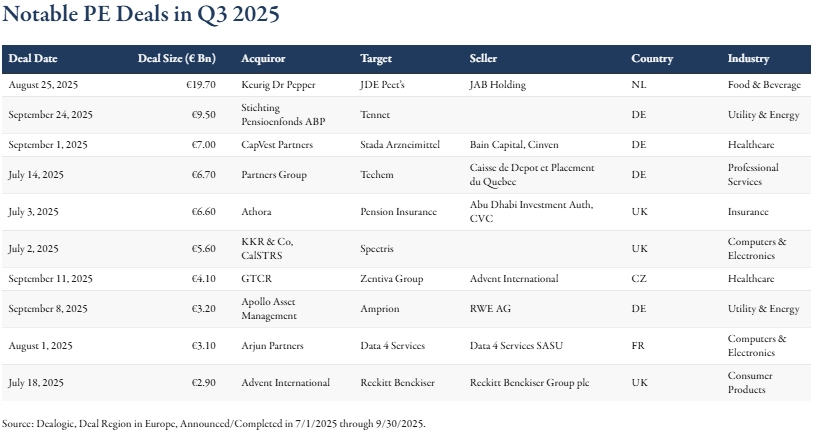

Q3 Highlights: Germany had a strong quarter, taking up 4 deals in the top 10 PE deals in terms of deal size. The Keurig deal gave the Netherlands a spotlight in Q3, though it didn’t affect deal count averages.

Q1 – Q3 Commentary: Sweden, Norway, Denmark, and Finland having above average deal activity while France has had a weaker year likely due to political turmoil. UK, France, and Germany continue to lead deal activity by number of deals in the region, making up 46% of the market.

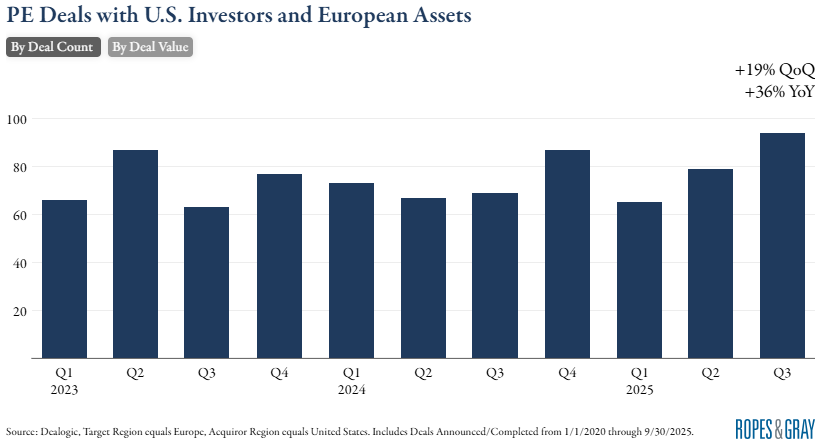

Cross-border activity with the U.S. spiked up in Q3 2025 in Europe, a recovery from low participation in the past three years. In Q3 alone, deal value increased 952% compared to last quarter, driven by large deals such as Keurig’s acquisition of JDE Peets at €19.7Bn.

Deal count has also been growing steadily, with Q3 2025 up 36% in deal count from the same period last year.

Uncertainty sowing in the U.S. due to regulatory uncertainty and the European governments’ commitments to investment in defense, technology, and infrastructure are main drivers of this renewal in cross-border activity from U.S. investors.

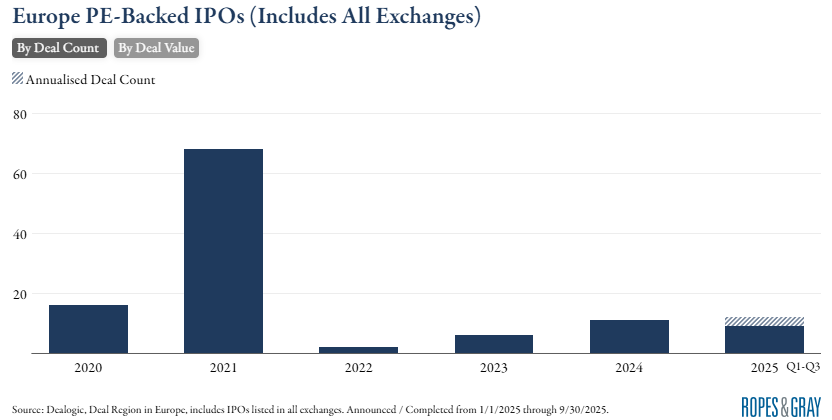

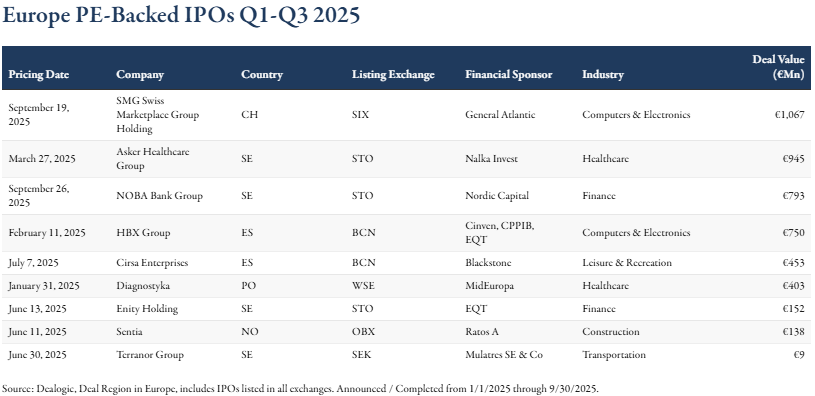

Uptick in IPOs: Q3 2025 was a strong quarter for IPOs, one more deal compared to Q3 2024 and 3 times the number in the same quarter 2023. If momentum continues into Q4, 2025 IPOs will exceed 2024.

The Stockholm exchange was the most frequent listing exchange followed by Barcelona.

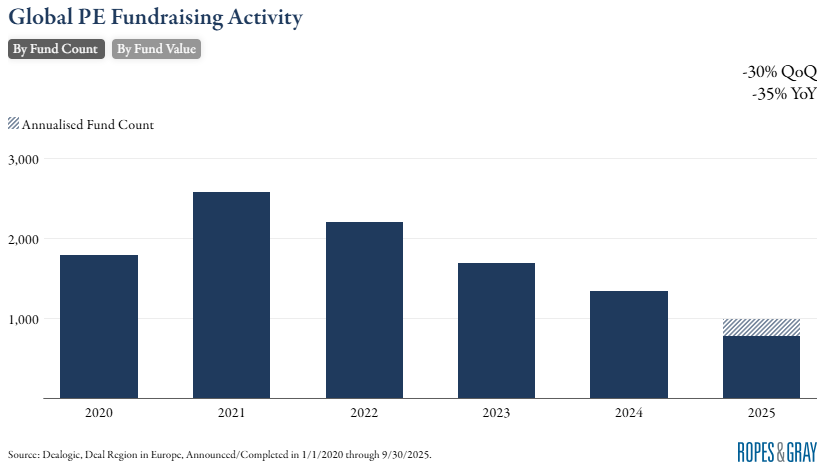

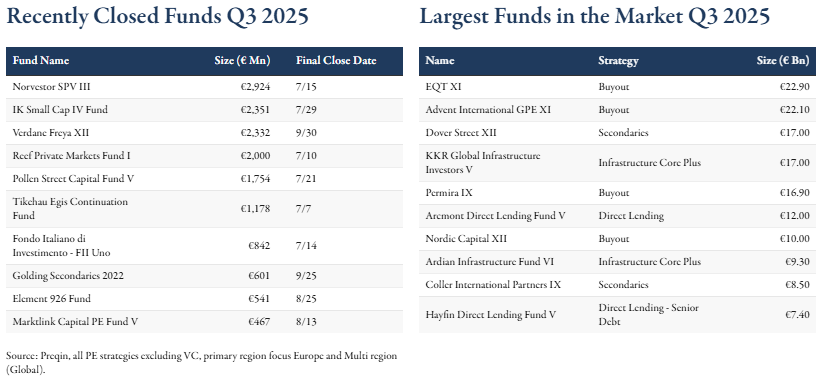

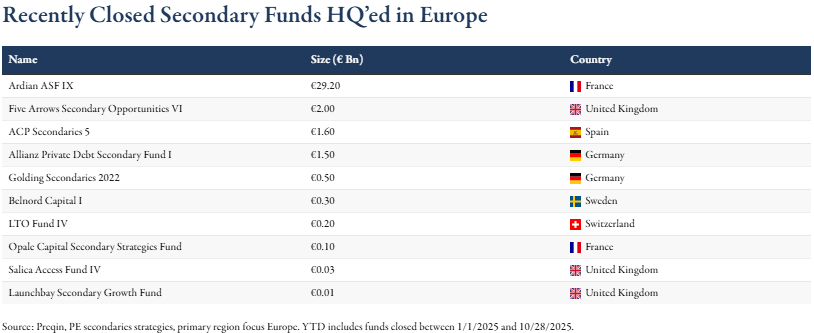

Fundraising: the number of global funds closed in Q3 has been the lowest in the past 4 years as the market works through volatility and uncertainty. However, the growth in values suggests that funds are getting larger and more concentrated in established PE players.

Funds in the Market: buyout, secondaries, infrastructure, and private credit dominate the top funds in the market, most of which are from well known and large global names such as EQT, Advent, and KKR.

Strong Growth in Global Secondaries with exposure to Europe: Deal value remains high as mega secondary funds or vehicles dedicated to secondaries headquartered in Europe experienced positive fundraising momentum. This is likely to continue as the market continues to seek liquidity. In the future, more specialized strategies such as real estate, infrastructure, or credit secondaries will proliferate as players seek for more diversification beyond traditional private equity secondaries.

A Look Ahead

Summary: European PE activity in Q3 2025 was anchored by steady private equity, a recovering IPO window, and strong secondaries fundraising. The market enters Q4 2025 with improving, but still selective, exit and IPO windows, supported by gradual macro stabilization, evolving EU/UK market-structure reforms, and deal themes anchored in energy transition, data infrastructure, and AI. The market should see a steady, fundamentals‑led recovery for the rest of the year, even into 2026, with regulatory upgrades in process that may expand the toolkit for liquidity. With valuations moderating and growth near trend, the market should see strong activity from sponsors that lean into sectoral tailwinds, operational value creation, and multi‑route exits.

Data Centers: Jefferies highlights data center build-outs as a principal demand engine for European energy and technical contracting, calling out Germany and the UK as near-term focus markets; it also notes robust H2 2026 pipelines across contractors. HSBC reports a recovery in fibre demand, accelerated by AI-led data center investments; global fibre volumes are projected to expand from about 50m km in 2024 to over 130m km by 2029 (approximately 21% CAGR), implying pull-through across European digital infrastructure supply chains. Furthermore, Société Générale notes European utilities are evaluating conversions of aging coal and gas plants into data centers to secure grid connections and cooling.

Sustainability and Industrials: CVC underscores decarbonization and digitalization as twin structural deal drivers, identifying Europe as the most active global hub for private infrastructure and highlighting mid-market assets as suitable for add-on, greenfield, and operational value creation. Jefferies points out that solar became the largest source of EU electricity in June 2025, and the EU is on track for a 54% emissions reduction by 2030, reinforcing continued capital deployment into industrial electrification. Furthermore, Enel, a diversified energy company domiciled in Italy, reports that distribution grids will be the backbone of Europe’s energy transition.

Cross-Border Trends: Dealogic and Mergermarket observe rising U.S. sponsor deployment and increased U.S. LP allocations to Euro-focused strategies, with managers explicitly reframing Europe as a priority deployment region in 2025. Mergermarket flags sustained sponsor appetite for specialist consulting and advisory platforms in Europe—particularly sustainability, health and safety, and AI/data consulting.

Liquidity: Secondaries and private‑wealth channels remain practical liquidity valves as private equity exit improves slowly. Existing relationships will have an advantage for private wealth but leadership transitions and intensifying competition for private wealth, as well as operating‑model streamlining, are the variables to watch into 2026.

Retail Expansion into Privates: The EQT Nexus PE ELTIF launched in Q3 2025 provides non-professional individual investors access to private markets with lower minimum investment thresholds compared to traditional private equity structures.

Regime Reform: Recently, Reuters reported that European Investment Bank President Nadia Calvino urged the European commission to pass this reform that will make it easier to raise money and invest across the EU by creating a simpler framework for financial, legal, and taxation rules. The proposal is due in January, but if the reform passes it will become another tailwind for Europe in the face of a volatile U.S.