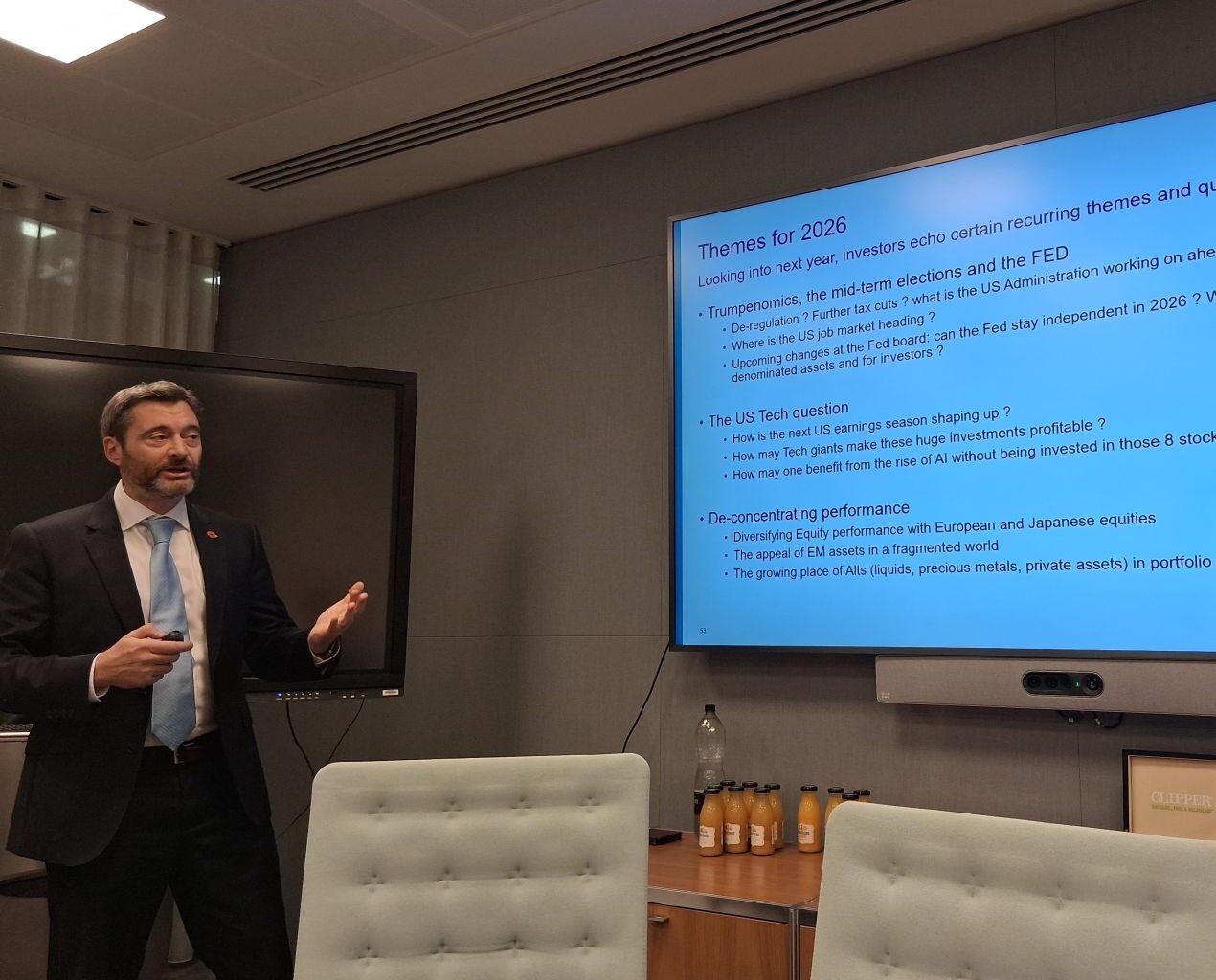

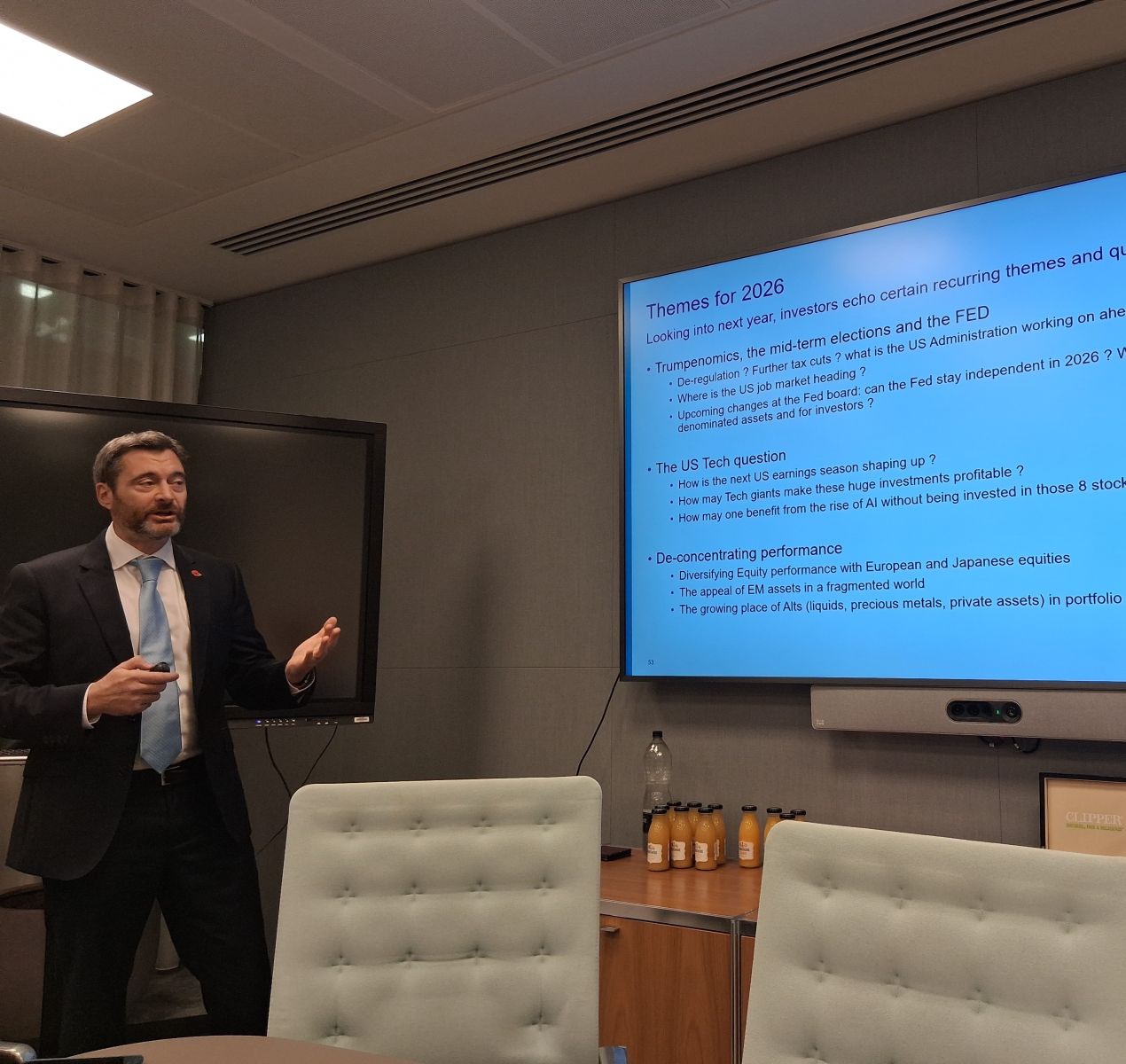

Paris-based Natixis Investment Managers, which delves into the 2026 market outlook, provides perspectives on both global and local trends, and insights into the investment landscape.

Amidst geopolitical uncertainty and increasing market volatility,

Julien Dauchez (pictured), head of client solutions group at

Natixis

Investment Managers, told attendees at a London media event

this week that investors are seeking re-assurance over their

portfolios.

“Clients are concerned about the artificial

intelligence bubble, as well as US inflation, the job market

and the US Federal Reserve losing its independence,” Dauchez

said.

Mabrouk Chetouane, head of global market strategy at Natixis IM,

also said at the event that the Trump leadership had not

achieved the results it wanted. “There has been a decline in US

economic growth, although the economy will not collapse. Growth

should recover in the second half of 2026. The impact of Trumps

import tariffs has also not been as bad as expected,” he said.

Dauchez emphasised the recent move towards European equities,

away from US equities, as well as towards emerging markets and

Japan. “Emerging market equities have been outperforming

developed ones since the start of the year. 2025 has also been

another year for bonds, with flexible global bonds being

appealing,” Dauchez said. “The weaker dollar also benefits

emerging market debt. Alternative investments, including precious

metals, are another big winner of 2025.”

“Looking into 2026, with questions raised over the Federal

Reserve losing its independence, investors are considering

reducing their exposure to US equities,” he said. Dauchez

highlighted the benefits of diversifying into European and

Japanese equities as well as the appeal of emerging market assets

in a fragmented world. “There is a growing place for alternatives

– liquids, precious metals and private assets – in portfolio

construction,” he added. “Many investors are also seeing how to

benefit from tech stocks, outside the US top 10, into

infrastructure, electrification, Chinese tech gems.”

“Clients are becoming wary of growth stocks and want to diversify

away from big US tech names,” he continued. “European equities

also pay good dividends and investors are trying to diversify

into dividend paying stocks. Europe is a prime market for this,”

Dauchez said. “Small tech firms can do well and the appetite for

small caps is more pronounced. Investors are also becoming more

interested in Japanese stocks.”

Their views have been echoed by a number of wealth managers who

favour diversifying out of US equities towards European ones

such as London-based Guinness Global Investors.

German asset manager DWS, for instance, also prefers European

equities over the US, due to the diversification aspect, cheaper

valuations, and the higher share of cyclical corporations in

Europe. See more

here and

here.

A number of wealth managers have also come out recently in favour

of emerging markets and Asia this year including, for instance,

Aberdeen Investments, Paris-based Amundi, Carmignac and Indosuez,

as well as GIB Asset Management and Franklin Templeton. See more

here commentary and here.