One of the justifications the Liberal and National parties have made for abandoning the target of net zero by 2050 is that the policy will cost too much.

For example, the Nationals leader, David Littleproud, erroneously said: “The cost of net zero by 2050 will be $9tn … That will put things like Medicare and NDIS at risk.”

On Wednesday, the Liberal senator Leah Blyth said: “I don’t think that we can be stewards of the environment if we can’t afford it.”

However, looking only at the cost of the transition to net zero emissions by 2050 ignores how much it will cost the Australian economy if we – and the world – don’t make the changes required to meaningfully address climate change.

That is to say, how does the cost of net zero compare to the cost of a scenario where we don’t take any more action on climate change, or delay the net zero transition?

Various groups have conducted modelling to answer this question, and at least three recent analyses have found that it is far cheaper for Australia, and the world, to make a well-coordinated effort to reach net zero by 2050:

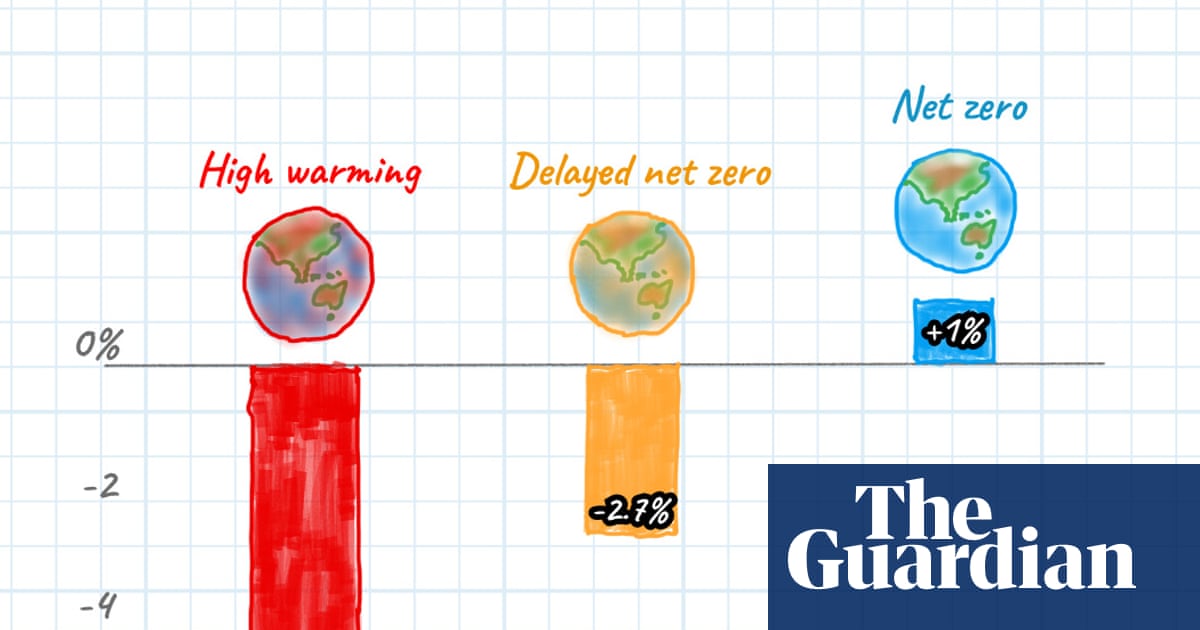

The chart above shows the results of modelling by Ortec Finance. They found that if climate change is not sufficiently addressed, Australia’s GDP would be 9% lower than it would otherwise be in 2050. This would amount to a difference of several hundred billion dollars.

Even a delayed net zero response, where global governments are slower on implementing policies but then take swift action on emissions to meet the 2050 deadline, will cost more than the alternative – an orderly transition to net zero.

The Ortec Finance report is not an outlier, either.

A Treasury report in September analysed three different net zero scenarios, and concluded that “clear and credible climate action will lead to more jobs, higher wages and better living standards for Australians” and “a disorderly transition would mean fewer jobs, less business investment, lower wages, lower living standards and higher power prices in a smaller economy”.

Elsewhere, modelling from the Investor Group on Climate Change found that global policies as at 2024, which would result in 3C of warming, would mean a $656bn hit to Australia’s GDP by 2050. In an alternative scenario, in which Australia and other countries make an orderly transition to net zero, Australia’s economy would be $590bn better off than the 3C warming scenario.

Here are the definitions of the scenarios modelled by Ortec Finance:

Net zero

This is an orderly version of Ortec Finance’s most ambitious transition scenario in their 2025 update. It does not anticipate the world reaching net zero until the mid-2050s and shows a global temperature rise of 1.6°C by 2100. It is an orderly and rapid low-carbon policy and technology transition, with comparatively lower physical risks due to lower global temperatures, and assumes adaptation takes place.

Delayed net zero

This scenario assesses the effects of a sudden step-up in policy action in 2030 that triggers a shock in financial market sentiment. It assumes limited additional policy action until that point, when a highly ambitious set of low-carbon policies is introduced. In response, markets rapidly price in both transition and physical climate risks, leading to the emergence of stranded assets and widespread financial disruption.

High warming

This failed transition scenario simulates the outcomes of current global climate policies and incorporates the 0.2C temperature jump observed last year. It anticipates a global temperature rise of 3.7C by 2100, where the transition to a low-carbon economy occurs only on economic grounds, without the introduction of any new climate policies.

The scenario is designed to evaluate the implications of a future with no additional policy action to limit climate change. It assumes the triggering of multiple climate tipping points, leading to very severe chronic and acute physical risks. Financial markets begin to price in climate-related risks during two distinct periods as the magnitude of these risks becomes more widely acknowledged and understood.

Thank you for your feedback.