Brussels -Italy is slowing down. The European Commission dismisses triumphalist tones and government rhetoric: the Italian economy is suffering the most, and it will be second to last in terms of growth rates in 2026, with the lowest growth rate in 2027. The autumn economic forecasts reveal a country heavily dependent on the National Recovery and Resiliency Plan (NRRP), the primary driver of investments and productivity. For the rest, international uncertainties, falling exports, and past choices, including that of the Superbonus, will continue to weigh on public accounts.

Growth halved: from 0.7 percent to 0.4 percent in 2025

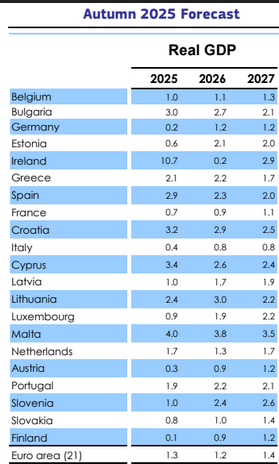

Compared to the May economic forecasts, the EU executive has again reduced the growth estimates for the Italian economy. The Gross Domestic Product (GDP) for 2025 is now projected to expand by 0.4 percent, down from the previously expected 0.7 percent. For 2026, the growth rate has been adjusted downwards by 0.1 percentage points, with growth now expected at 0.8 percent instead of 0.9 percent. For 2027, growth is still expected at 0.8 percent.

In terms of growth rates, Italy is one of the weakest and most struggling economies in the entire eurozone. If, at the end of this year, the black jersey will be for Finland (0.1 percent) and the country will be able to boast growth rates higher than those of Germany, Giorgia Meloni’s government in 2026 will have to surrender the title of penultimate economy in the euro area (behind only Ireland), and then slip to last place for growth rates in 2027, when Italy will be the only member country to have a GDP still below the 1 percent expansion threshold.

Practically everyone will experience a rebound that Italy will not. It will be a headache for the parties of the ruling coalition, who will have their hands full trying to prove that things are going well and that the country is running smoothly, because that is not the case. After all, “labour productivity is set to continue declining this year,” the EU executive said. With labour demand forecast to slow, productivity is expected to start recovering in 2026-27, benefitting from recent investments.” The unemployment rate is forecast to decrease steadily to 5.9% in 2027.

Export collapses and households do not spend, the hurdle of public accounts

The export crisis is weighing on Italy. Brussels forecasters predict that, as a result of the duties imposed and the general uncertainties, “goods exports are projected to contract by 0.6 percent, while services exports are set to increase. Conversely, imports of both goods and services are expected to rise considerably, leading net exports to subtract from GDP growth.” This implies a net indebtedness of the country, which is called upon to reduce the trajectory of its liabilities, but is instead expected to increase. At the end of 2025, the debt-to-GDP ratio is projected to be 136.4 percent, rising to 137.9 percent in 2026, and then falling to 137.2 percent in 2027.

Regarding the evolution of public accounts, the Commission highlights at least two factors: on the one hand, the impact of interest on the debt, which has increased and thus represents an additional burden. On the other hand, “large stock-flow adjustments related to the housing renovation tax credits” continue to have an adverse impact, a reference to the Superbonus introduced by the second Conte government.

The bet on domestic consumption

In this framework of uncertainties and constraints, the real key for Italy is domestic consumption. Households currently tend to save, the Brussels technicians point out, and this implies less stimulus for domestic demand. However, “in 2027, household consumption will become the main driver of growth, due to the slowdown in investment due to the end of the Recovery Fund.”

According to estimates, an increase in purchasing power linked to higher payrolls should contribute to higher consumption. Wages are anticipated to “grow strongly again this year and moderately thereafter,” reflecting the most recent price developments as reflected in the renewal of collective agreements.

Commissioner for the Economy Valdis Dombrovskis (photo: Valentine Zeler/European Commission)

Commissioner for the Economy Valdis Dombrovskis (photo: Valentine Zeler/European Commission)

In any case, according to the Commissioner for the Economy, Valdis Dombrovskis, there is a need for “a decisive action to unlock domestic growth.” A new and clear call to reform, after making wise use of the resources made available with the Recovery Fund.

Furthermore, “solid public budgets and reforms are prerequisites for growth,” he emphasized, calling for a careful monitoring of budgets, both in terms of spending and spending patterns. “Member states will need to adopt prudent approaches,” the commissioner stressed, and this is especially true for Italy.

Deficit, back within parameters

The only real good news for the government is the return below the 3 percent threshold in the deficit-to-GDP ratio, as set by the treaties and the Stability Pact as the benchmark for public accounts. Unlike debt, the trajectory here is downward: 3 percent in 2025, 2.8 percent in 2026, and 2.6 percent in 2027. The numbers, on the one hand, confirm that Italy is doing the homework Brussels assigned, and on the other hand, allow the European Commission to close the excessive deficit procedure that weighs on Italy, but not immediately.

In order to be able to recommend officially closing the excessive deficit procedure against Italy, “we need to see the data verified by Eurostat, which will be available in April,” Dombrovskis explained. To be able to flaunt this result, the government will therefore have to wait until the spring.

English version by the Translation Service of Withub