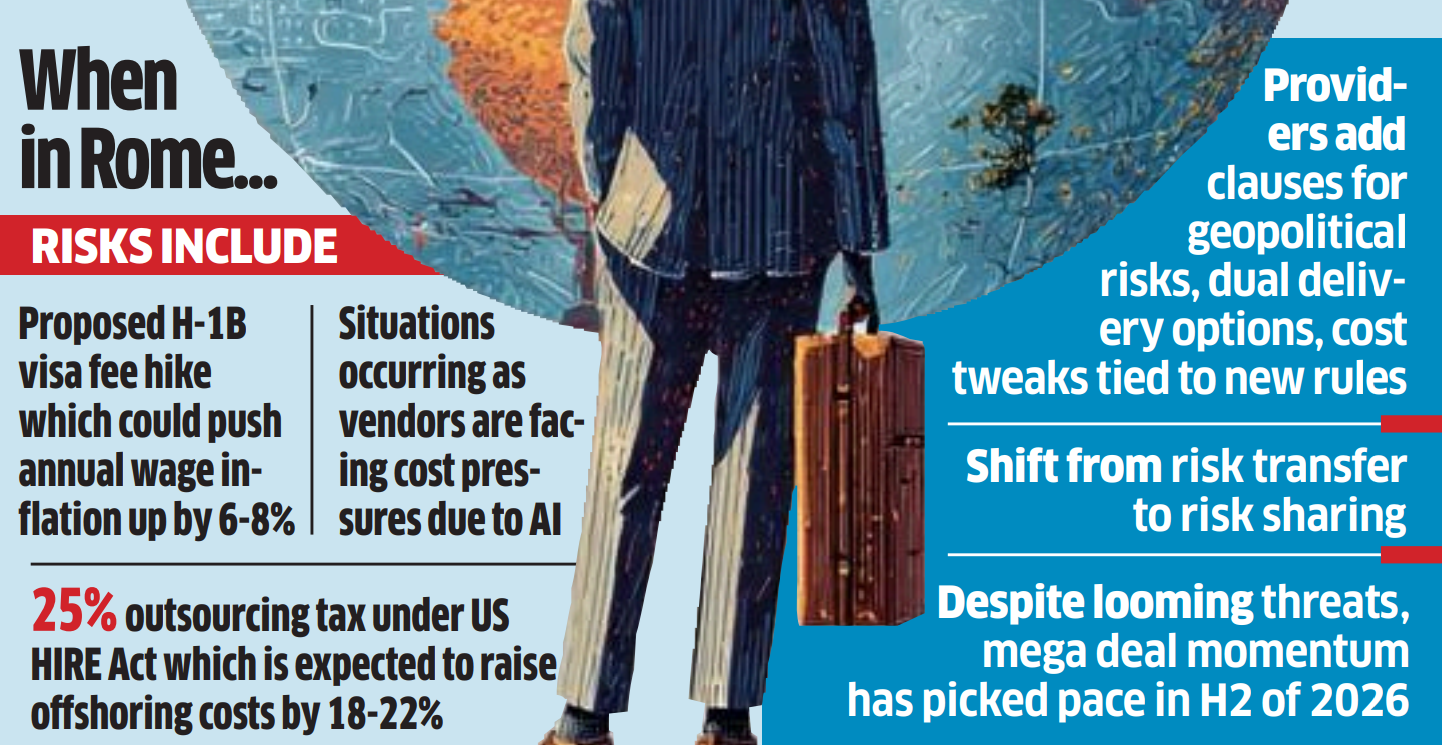

Existing geopolitical risks include the US administration’s moves to hike H-1B visa fee and impose a 25% outsourcing tax, while the India-Pakistan tensions earlier this year had led companies to a point of invoking force majeure clauses, industry experts said.

“100% of the client conversations we are having are wanting to prepare for these situations… In some situations, we have started calling it CAU – crisis as usual,” said Jimit Arora, CEO of research firm Everest Group.

These situations are occurring at a time when vendors are facing extreme cost pressures due to AI, he added. Companies are reassessing exposure and the theme of concentration risk has come back.

ETtech

ETtech“Conversations that once focused purely on cost, delivery and SLAs now include scenario planning for tariffs, labour mobility, and data residency,” said Phil Fersht, chief executive of HfS Research.

IT service providers “are adding clauses for geopolitical contingencies, dual delivery options, and cost adjustments tied to new regulations,” Fersht said. “The result is a move from risk transfer to risk sharing.”

Their clients, on the other hand, “are asking for automatic fee resets if laws change, and shorter pricing cycles instead of long 5-year blocks,” according to Rahul Hingmire, managing partner at Vis Legis Law Practice.

“Clients also want broader exit rights if geopolitical or tax changes suddenly make offshore work expensive. Some deals now require a full register of all AI-assisted processes,” Hingmire said.

He added that IT firms are spreading delivery across India, Mexico, Canada and Poland to de-risk policy shifts. According to Everest, a H-1B visa fee hike could push annual wage inflation up by 6-8% while a 25% outsourcing tax under the HIRE Act may increase offshoring costs by 18-22%.

To be sure, the HIRE Act, introduced by senator Bernie Moreno, is still at the proposal stage.

“Contracts are the new risk maps,” said Hardeep Sachdeva, senior partner at law firm AZB & Partners. “Force majeure now covers geopolitical disruptions, indemnities are tighter, and clients demand transparency on subcontractors and data flows.”