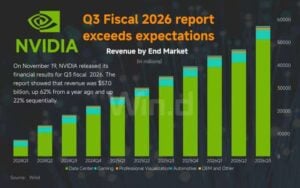

Nvidia reported strong results for the third quarter of its fiscal year ending October 26, 2025. The company posted $57 billion in revenue, which increased 22% from the previous quarter and 62% from the same period last year. The numbers show that demand for Nvidia’s chips and systems remains high, especially in artificial intelligence and data center markets.

Q3 Performance: High Revenue and Steady Profit Margins

The Data Center segment led the quarter again with $51.2 billion in revenue. This segment grew 25% from the previous quarter and 66% from a year earlier. Growth comes from ongoing orders by cloud companies, enterprise clients, and research institutions. They use Nvidia’s platforms to train and run AI models.

Profitability also stayed strong. Nvidia reported a 73.4% GAAP gross margin, up slightly from the previous quarter. Its non-GAAP gross margin was 73.6%. These margins show the company continues to benefit from strong pricing power and high demand for advanced AI hardware.

Net income reached $31.9 billion, rising 21% from the previous quarter and 65% from the year before. Diluted earnings per share (EPS) came in at $1.30 on both a GAAP and non-GAAP basis. Operating income also remained high at $36 billion, showing that Nvidia is managing its expenses while growing its revenue.

Cash generation continued to strengthen. Free cash flow was about $22.1 billion, which increased by 32% from last year. Nvidia also returned $37 billion to shareholders in the first nine months of fiscal 2026 through buybacks and dividends. The company still has more than $62 billion available under its current buyback authorization.

Overall, the financial results show that Nvidia is still growing at a fast pace, even as its growth rate begins to stabilize. The results also provide a strong base as the company expands into new areas, such as infrastructure and energy-efficient computing.

After the earnings release, Nvidia’s stock rose about 3% in after-hours trading. This came after stronger-than-expected revenue and earnings.

Q4 Forecast and Short-Term Trends

Nvidia expects another strong quarter ahead. For Q4 fiscal 2026, the company forecasts revenue of around $65 billion, plus or minus 2%. It also expects gross margins to improve slightly, reaching about 75% on a non-GAAP basis. Operating expenses are set to rise as the company invests in research and in new product development cycles.

The outlook suggests that Nvidia believes demand will remain strong in the near term. At the same time, the company faces new challenges. Growth is still high, but it is no longer rising at the extreme levels of earlier years.

Nvidia will focus more on expanding its infrastructure. They aim to boost efficiency and manage long-term costs. These trends set the stage for the company’s latest major initiative.

A Major Strategic Turn: The $100 Billion AI Deal with Brookfield

Nvidia just announced a big partnership with Brookfield Asset Management, a leading asset management company. They plan to create an AI infrastructure program worth up to $100 billion. This move marks a shift in Nvidia’s strategy.

The chipmaker will shift from just selling chips and systems. Now, it will help build a complete infrastructure for AI growth. The program will include investments in land, power, data centers, and advanced computing systems.

Jensen Huang, founder and CEO of Nvidia, stated:

“AI is transforming every industry, and like electricity, it will require every nation to build the infrastructure to power it. AI infrastructure demands land, power, and purpose-built supercomputers—and our partnership with Brookfield brings all of these elements together in a ready-to-deploy AI cloud.”

Brookfield brings experience in infrastructure, real estate, and energy. Nvidia brings the technology and the hardware that run modern AI models. Together, they aim to support global demand for AI computing, which continues to rise sharply.

This partnership shows that Nvidia is expanding beyond its traditional role as a chip designer. The company wants to be part of designing and building the physical foundations that AI depends on. This includes everything from cooling systems to energy supply.

The move could help Nvidia secure long-term revenue streams and reduce the bottlenecks that come from limited infrastructure capacity.

Powering AI Responsibly: Energy Use and Emissions

As Nvidia steps deeper into infrastructure, the environmental impact of AI computing becomes more important. Data centers and high-performance computing systems use large amounts of electricity. They also demand advanced cooling systems and steady grid capacity.

The company has acknowledged these challenges and increased its sustainability efforts across its operations, supply chain, and product designs.

A key part of Nvidia’s environmental strategy is its use of clean electricity. The company reports that it achieved 100% renewable electricity for its offices and data centers under its operational control. This shift reduces its Scope 1 and 2 emissions and lowers the carbon footprint of its own operations.

The GPU king has set science-based targets to reduce emissions. They want to limit global warming to 1.5°C. The goal is to cut Scope 1 and Scope 2 emissions by 50% by FY 2030, using FY 2023 as the baseline.

For its products, Nvidia aims to cut emissions intensity during customer use by 75% per petaflop of computing power by 2030. This target matters because most of Nvidia’s emissions come from how its products are used, not how they are manufactured.

A big part of Nvidia’s total emissions comes from its suppliers, also known as Scope 3 emissions. They occur during the production of components.

Nvidia is also engaging its supply chain. The company reports that it has engaged suppliers responsible for more than 80% of its upstream emissions. It encourages these suppliers to set their own science-based targets.

The Blackwell GPU and Beyond

Energy efficiency is another focus area. Nvidia’s newer systems deliver much better performance for every unit of power used. Some platforms show 50% to 99% lower energy use per unit of compute compared to older systems.

The Blackwell GPU platform is very energy-efficient. It’s built to manage large AI workloads and cut down on power use.

Despite these efforts, Nvidia still faces challenges. Its total emissions rose in recent years because demand for its products grew so quickly. Scope 3 emissions make up the biggest part of its footprint. Reducing them will require long-term efforts with suppliers and customers.

As Nvidia grows its infrastructure role, it must also create facilities that use clean electricity. Efficient cooling systems will help keep its environmental impact aligned with its goals.

Balancing Growth, Infrastructure, and Sustainability

Nvidia’s Q3 results show a company that remains strong financially and continues to grow at a fast pace. The new partnership with Brookfield shows that Nvidia is preparing for the next phase of AI growth by investing in global infrastructure.

At the same time, the company is working to reduce emissions, improve energy efficiency, and manage its environmental impact as its influence expands. The coming years will test how well Nvidia balances these goals.

Strong finances give the company momentum. Large-scale projects bring long timelines. Sustainability efforts will become more important as AI’s energy use grows worldwide. Nvidia’s long-term progress will depend on how effectively it brings the strategies together.