Find companies with promising cash flow potential yet trading below their fair value.

Eos Energy Enterprises Investment Narrative Recap

Eos Energy Enterprises is centered on the view that accelerating demand for long-duration energy storage and favorable U.S. policy will drive substantial business growth. The recent large equity and convertible note financings could prove meaningful to the company’s ability to meet near-term obligations and fund operations, though risks around persistent losses and ongoing dilution have not disappeared and remain top of mind for shareholders.

Of the latest developments, Eos’s decision to use the capital raised to repurchase some of its existing higher-interest convertible notes directly addresses a key near-term risk to its liquidity profile. This move could temporarily ease pressure from upcoming debt maturities, but the core challenges around cash burn and underlying profitability persist, leaving the short-term equity story largely unchanged.

However, while this funding round shores up liquidity, investors should be aware that continued capital raises in the face of ongoing losses can still…

Read the full narrative on Eos Energy Enterprises (it’s free!)

Eos Energy Enterprises is forecast to reach $1.4 billion in revenue and $275.2 million in earnings by 2028. This projection is based on a 247.7% annual revenue growth rate and an earnings increase of approximately $1.28 billion from current earnings of -$1.0 billion.

Uncover how Eos Energy Enterprises’ forecasts yield a $15.21 fair value, a 23% upside to its current price.

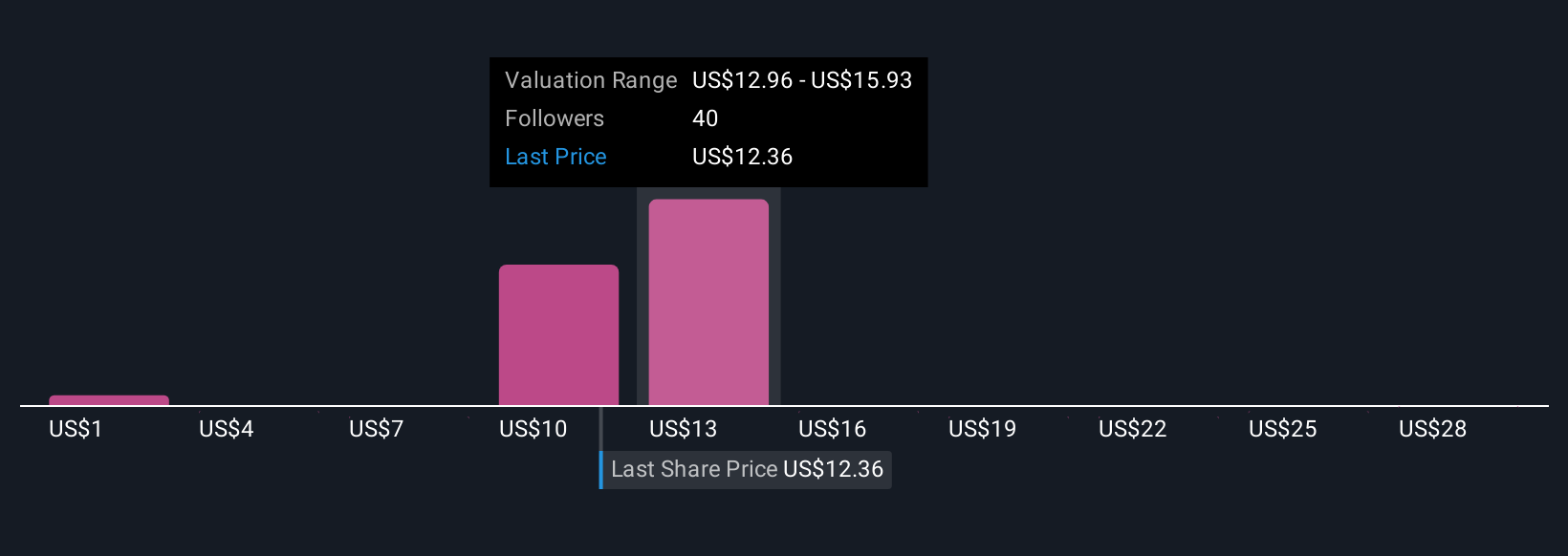

Exploring Other Perspectives EOSE Community Fair Values as at Nov 2025

EOSE Community Fair Values as at Nov 2025

The Simply Wall St Community produced 12 fair value estimates for Eos Energy, ranging from US$1.08 to US$30.78 per share. Amid these varied outlooks, persistent net losses and dilution remain crucial risks to consider as you explore further opinions on the company’s prospects.

Explore 12 other fair value estimates on Eos Energy Enterprises – why the stock might be worth over 2x more than the current price!

Build Your Own Eos Energy Enterprises Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Want Some Alternatives?

Opportunities like this don’t last. These are today’s most promising picks. Check them out now:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Eos Energy Enterprises might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com