Europe Nuclear Medicine Market Size

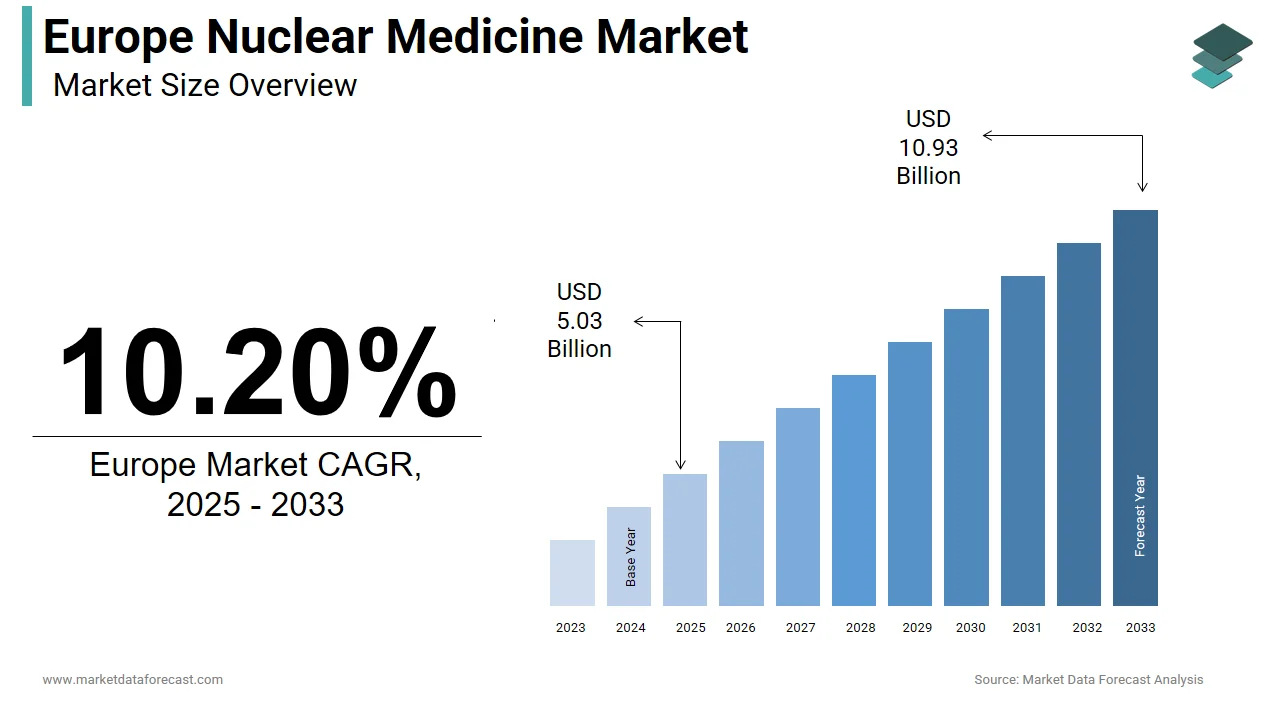

The Europe nuclear medicine market was valued at USD 4.56 billion in 2024, is estimated to reach USD 5.03 billion in 2025, and is projected to reach USD 10.93 billion by 2033, growing at a CAGR of 10.20% from 2025 to 2033.

Nuclear medicine is a diagnostic and therapeutic procedures that utilize radiopharmaceuticals to visualize biological function and target diseased tissue at the molecular level. Unlike conventional imaging modalities that depict anatomical structures, nuclear medicine provides functional insights, enabling early detection and precise management of diseases such as cancer, cardiovascular disorders, and neurological conditions. The region hosts more than 1,500 dedicated nuclear medicine departments with significant concentrations in Germany, France, and the United Kingdom. Europe maintains a robust regulatory framework under the European Medicines Agency and the Euratom Treaty, which governs the safe production, transport, and disposal of radioactive materials. The clinical integration of positron emission tomography and single photon emission computed tomography continues to deepen across tertiary care centers.

MARKET DRIVERS Rising Prevalence of Oncological and Neurodegenerative Disorders Fuels Diagnostic Demand

The growing burden of cancer and neurodegenerative diseases for nuclear medicine utilization, which is a primary factor propelling the growth of the Europe nuclear medicine market. The International Agency for Research on Cancer states that an estimated 4.4 million new cancer cases were diagnosed across Europe in 2022, with prostate, breast, and lung cancers representing the most frequent types. These malignancies increasingly rely on molecular imaging for staging, treatment planning, and response assessment. For instance, prostate-specific membrane antigen positron emission tomography has become standard in high-risk prostate cancer evaluation across several European nations. Concurrently, neurodegenerative conditions such as Alzheimer’s disease afflict over 9 million people in the European Union alone, as reported by Alzheimer Europe. Amyloid and tau imaging using fluorine-18-labeled tracers enables early differentiation of dementia subtypes, directly influencing therapeutic decisions and clinical trial enrollment. National healthcare systems in countries like Sweden and the Netherlands have integrated these protocols into national guidelines, boosting procedural volumes.

Expansion of Cardiac Imaging Protocols Drives Procedural Uptake

Cardiovascular diseases remain the second leading cause of death in Europe, prompting greater adoption of nuclear cardiology for non-invasive risk stratification. The expansion of cardiac imaging protocols is another significant factor boosting the growth of the Europe nuclear medicine market. The European Society of Cardiology indicates that ischemic heart disease accounts for nearly 1.8 million deaths annually in the WHO European region. In response, myocardial perfusion imaging has become integral to evaluating coronary artery disease in patients with intermediate pre-test probability or inconclusive stress electrocardiograms. Technetium-99m-based agents such as sestamibi and tetrofosmin are widely used due to their favorable imaging characteristics and established reimbursement pathways. Moreover, the 2023 European Guidelines on Chronic Coronary Syndromes explicitly endorse functional imaging over anatomical assessment in select patient cohorts, institutionalizing nuclear medicine’s role. National health authorities increasingly recognize nuclear cardiology’s cost-effectiveness in avoiding unnecessary invasive angiographies, which is further embedding it within cardiology workflows across the region.

MARKET RESTRAINTS Supply Chain Vulnerabilities for Molybdenum-99 and Technetium-99m Limit Procedural Capacity

The reliance on a fragile and aging global supply network for molybdenum-99, which is the parent isotope of technetium-99m that is limiting the growth of the Europe nuclear medicine market. Technetium-99m is used in approximately 80% of all nuclear medicine diagnostic procedures in Europe, with its production dependent on just five research reactors worldwide, none of which are located within the European Union. The Organisation for Economic Co-operation and Development Nuclear Energy Agency confirms that over 95% of Europe’s molybdenum-99 imports originate from reactors in Canada, the Netherlands, Belgium, and South Africa, all operating beyond their originally intended lifespans. Unplanned outages, such as the 2022 temporary shutdown of the BR2 reactor in Belgium, have triggered regional shortages that forced hospitals to reschedule or cancel thousands of procedures. The European Commission’s 2023 Strategic Agenda for Medical Isotopes acknowledges that the continent lacks sufficient domestic production capacity to ensure supply resilience. The short 66-hour half-life of molybdenum-99 necessitates rapid air transport and precise just-in-time delivery, leaving little room for error. Consequently, diagnostic departments in peripheral countries like Greece and Romania frequently experience inconsistent isotope availability, exacerbating regional healthcare disparities and constraining market scalability despite strong clinical demand.

Stringent Regulatory and Radiological Safety Requirements Impede Facility Expansion

The deployment and operation of nuclear medicine infrastructure in Europe are governed by an intricate web of regulatory controls under the Euratom Basic Safety Standards Directive and national radiation protection authorities. The stringent regulatory and radiological safety requirements are hindering the growth of the Europe nuclear medicine market. These regulations mandate extensive licensing procedures, facility shielding assessments, staff training protocols, and waste disposal plans that can delay new department establishment by 18 to 24 months. The European Basic Safety Standards require that every nuclear medicine site undergo a site-specific risk assessment approved by national regulators, a process that varies significantly between member states. These perceptions often trigger local zoning challenges or require additional environmental impact studies. Hospitals seeking to install new gamma cameras or PET scanners must also recruit certified radiation protection officers and medical physicists, yet a 2022 workforce analysis by the European Federation of Organisations for Medical Physics revealed a shortage of over 1,200 qualified professionals across the EU.

MARKET OPPORTUNITIES Theranostics Emergence Opens New Avenues for Targeted Radionuclide Therapy

The integration of diagnostic imaging and targeted radionuclide therapy under the theranostics paradigm is expected to bolster the growth of Europe’s nuclear medicine market. This approach leverages matched radiopharmaceutical pairs, such as gallium-68 for imaging and lutetium-177 for treatment, to deliver personalized cancer care. The landmark VISION trial published in the New England Journal of Medicine demonstrated that lutetium-177-PSMA-617 extended median overall survival by 4 months in metastatic castration-resistant prostate cancer patients, which led to its 2022 approval by the European Medicines Agency. The European Association of Nuclear Medicine estimates that more than 15,000 patients received lutetium-based therapies in Europe in 2024. Europe’s strong academic research base, including institutions like the University Hospital Heidelberg and the Institute Curie that accelerates translational innovation. Additionally, the European Union’s Horizon Europe program has allocated over 80 million euros to radiopharmaceutical development since 2021, fostering public-private partnerships.

Investment in Cyclotron and Radiopharmacy Infrastructure Enhances Isotope Self-Sufficiency

Undergoing a strategic shift toward decentralized and non-reactor-based radiopharmaceutical production by creating substantial infrastructure development will additionally escalate the growth of the Europe nuclear medicine market. As per the Joint Research Centre of the European Commission, the number of medical cyclotrons in the EU increased from 192 in 2018 to 267 in 2024, with Germany, France, and Italy accounting for nearly half of all installations. These compact accelerators enable the same-day production of short-lived positron emitters by reducing dependency on imported molybdenum-99 and supporting novel PET tracer development. Similarly, the UK’s National Health Service has funded 18 new radiopharmacies under its 2022 Molecular Imaging Strategy. Modular clean-room facilities compliant with Good Manufacturing Practice standards now allow local compounding of patient-specific doses, improving turnaround and reducing waste. Moreover, the European Directorate for the Quality of Medicines has streamlined certification for cyclotron-produced radiopharmaceuticals, facilitating cross-border distribution. This infrastructure build-out not only bolsters supply chain resilience but also enables clinical trials of next-generation tracers, positioning Europe at the forefront of molecular imaging innovation and creating new revenue streams for diagnostic networks and specialty pharmacies.

MARKET CHALLENGES Short Half-Life of Key Radiopharmaceuticals Constrains Geographic Accessibility

The intrinsic physical properties of commonly used radiopharmaceuticals with a fundamental logistical barrier to equitable service delivery are a new challenge for the growth of the Europe nuclear medicine market. Technetium-99m with a six-hour half-life and fluorine-18 with a 110-minute half-life decay rapidly within a narrow time window and proximity to imaging facilities. According to a 2024 analysis by the European Institute of Radiopharmacy, more than 60% of European regions classified as rural or remote lack access to on-site radiopharmaceutical preparation, which is forcing patients to travel over 100 kilometers for scans. This is especially acute in Eastern Europe, where countries like Bulgaria and Latvia operate fewer than five centralized radiopharmacies for their entire populations. The decay dynamic also results in significant material wastage. The European Commission estimates that up to 30% of technetium-99m doses are discarded due to scheduling mismatches or transportation delays. While generator-based systems offer some buffer, their elution efficiency declines after 24 hours, further limiting utility in low-volume centers. Attempts to establish regional distribution hubs have been hampered by aviation restrictions on radioactive shipments and inconsistent road transport regulations across Schengen and non-Schengen states. Consequently, diagnostic delays are common for time-sensitive indications like myocardial viability or seizure focus localization.

High Capital and Operational Costs Restrict Technology Adoption in Smaller Healthcare Settings

The deployment of advanced nuclear medicine technologies demands substantial financial and human capital that many European healthcare institutions cannot sustain. Beyond acquisition, annual operational expenses, including radiopharmaceuticals, maintenance, radiation safety compliance, and specialized staffing, can exceed 400,000 euros per facility. These figures are prohibitive for district hospitals and private clinics in Southern and Eastern Europe, where healthcare budgets are constrained. As a result, nuclear medicine remains concentrated in university hospitals and metropolitan centers by limiting penetration into secondary care. For instance, Germany’s G-DRG system reimburses PET scans for only a subset of oncology indications, discouraging investment in broader applications. Additionally, the need for dedicated radiochemistry labs and shielded hot labs further escalates facility modification costs.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

Segments Covered

By Type, Application, and County.

Various Analyses Covered

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Countries Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe.

Market Leaders Profiled

Cardinal Health, Curium Pharma, GE Healthcare, Novartis AG (Advanced Accelerator Applications), Siemens Healthineers, and Others.

SEGMENTAL ANALYSIS By Diagnostics Insights

The single photon emission computed tomography segment was the largest by accounting for 62.3% of the Europe nuclear medicine diagnostics market share in 2024, with its widespread clinical adoption, lower cost of equipment, and compatibility with technetium 99m based radiopharmaceuticals, which remain the most commonly used isotopes across Europe. The affordability of SPECT gamma cameras, typically priced between 300,000 and 600,000 euros compared to over 1 million euros for PET systems that makes them accessible to district hospitals and smaller clinics, particularly in Southern and Eastern Europe. National reimbursement schemes in countries like Italy and Spain prioritize SPECT myocardial perfusion imaging due to its strong evidence base and cost-effectiveness in ruling out coronary artery disease. Additionally, the European Society of Cardiology continues to endorse SPECT in its chronic coronary syndrome guidelines as a first-line functional imaging modality for intermediate-risk patients.

The positron emission tomography segment is lucratively growing with an expected CAGR of 8.4% from 2025 to 2033, with the rapid integration of PET into oncology pathways following regulatory approvals for novel tracers and theranostic applications. The European Medicines Agency’s 2022 authorization of gallium 68 PSMA 11 and 2023 approval of fluorine 18 DOPA have expanded PET indications beyond traditional fluorodeoxyglucose-based imaging. Germany alone added 42 new PET centers between 2020 and 2024, bringing its national total to 189, according to the sources. Furthermore, national cancer strategies in France and the UK now mandate PET CT for staging high-grade lymphomas, non-small cell lung cancer, and recurrent prostate cancer. The rise of hybrid PET MRI systems, now been installed in 68 academic hospitals across Europe.

By Therapeutics Insights

The Beta-emitting radiopharmaceuticals segment held a significant share of the Europe nuclear medicine therapeutics market in 2024, with the long-standing use of iodine 131 for thyroid ablation and yttrium 90 or lutetium 177 for neuroendocrine tumors and prostate cancer. Lutetium 177 PSMA therapy alone accounted for over 12,000 patient treatments in Europe in 2023. Beta emitters offer an optimal balance of tissue penetration, typically 1 to 10 millimeters, and manageable radiation safety profiles suitable for outpatient settings. National health systems have responded by establishing dedicated theranostics reimbursement codes, with Germany’s G BA approving full coverage for lutetium 177 DOTATATE in 2021. The production infrastructure for beta emitters is also more mature, with over 80% of European radiopharmacies capable of handling lutetium 177 compounding compared to fewer than 15 facilities qualified for alpha emitters.

The alpha-emitting radiopharmaceuticals segment is expected to grow with an expected CAGR of 14.2% throughout the forecast period, with the unique biological advantages of alpha particles, which deliver high linear energy transfer over extremely short distances, typically 50 to 100 micrometers, by enabling precise tumor cell killing while sparing surrounding healthy tissue. Actinium 225 and lead 212 are at the forefront with over 30 clinical trials active across Europe, including phase II studies at the University Hospital Heidelberg and Gustave Roussy Institute. Infrastructure development is accelerating with Germany and France investing in targeted alpha therapy production units under Horizon Europe funding. Regulatory momentum is also building as the EMA granted orphan drug designation to thorium-227-based conjugates for ovarian cancer in early 2024.

By Application Insights

The oncology segment was the largest and held 48.2% of the Europe nuclear medicine market share in 2024, with the expanding role of molecular imaging and targeted radionuclide therapy across the cancer care continuum. The integration of PSMA PET into prostate cancer guidelines by the European Association of Urology in 2023 has dramatically increased procedural volumes, with an estimated 220,000 PSMA scans conducted across the EU in 2024. Additionally, the EMA’s approval of multiple radioligand therapies has established theranostics as a standard of care in metastatic disease.

The neurology segment is deemed to witness the fastest CAGR of 9.1% from 2025 to 2033, with the urgent need for early and differential diagnosis of neurodegenerative diseases amid a rapidly aging population. Over 9 million Europeans live with dementia, and a timely distinction between Alzheimer’s dementia with Lewy bodies and frontotemporal lobar degeneration is now possible through amyloid PET and dopamine transporter imaging. Furthermore, the 2023 revision of the European Academy of Neurology guidelines recommends dopamine transporter SPECT for suspected Parkinsonian syndromes, reducing misdiagnosis rates by up to 30%.

COUNTRY LEVEL ANALYSIS Germany Nuclear Medicine Market Analysis

Germany was the top performer of the Europe nuclear medicine market by holding 24.3% of share in 2024. The country operates over 400 nuclear medicine departments and 189 PET centers, making it the most densely equipped nation in Europe. Germany’s leadership stems from its robust statutory health insurance system, which provides comprehensive reimbursement for both diagnostic and therapeutic nuclear medicine procedures, including lutetium 177 PSMA therapy, since 2022. The nation also hosts Europe’s most advanced radiopharmaceutical production ecosystem with over 30 Good Manufacturing Practice-certified radiopharmacies and major manufacturers like Curium and ITM Isotope Technologies Munich. Academic institutions, including the Technical University of Munich and University Hospital Heidelberg, drive innovation through clinical trials in theranostics and alpha therapy. Furthermore, Germany’s Federal Ministry of Education and Research has committed 150 million euros to the 2023 2027 National Strategy for Molecular Imaging, ensuring sustained infrastructure investment.

France Nuclear Medicine Market Analysis

France was ranked second by capturing 18.4% of the Europe nuclear medicine market share in 2024. The country’s strength lies in its centralized healthcare planning and strong public investment in nuclear medicine infrastructure. France operates 210 nuclear medicine departments, including 98 PET centers, and maintains domestic production of molybdenum 99 through the CEA’s Osiris reactor replacement program. Reimbursement policies are highly supportive with full coverage for PSMA PET and lutetium 177 therapies under the national health insurance scheme. France also leads in clinical adoption of novel tracers with over 15,000 patients enrolled in theranostics programs in 2024, according to the French Society of Nuclear Medicine. The integration of nuclear medicine into national cancer and neurodegenerative disease strategies further cements its role.

United Kingdom Nuclear Medicine Market Analysis

The United Kingdom nuclear medicine market growth is prompting significant opportunities in next coming years. Despite post-Brexit regulatory adjustments, the NHS has maintained strong support for nuclear medicine through its Molecular Pathology and Imaging Strategy launched in 2022. The UK operates 112 nuclear medicine departments and 76 PET centers with concentrated capacity in England’s Academic Health Science Networks. A key driver is the NHS Long Term Plan, which explicitly prioritizes precision oncology and allocated 85 million pounds to scale up PSMA PET and lutetium 177 therapy by 2025. The UK also benefits from research leadership with institutions like the Institute of Cancer Research and University College London pioneering next-generation radiopharmaceuticals.

Italy Nuclear Medicine Market Analysis

Italy nuclear medicine market growth is anticipated to grow with high procedural volumes, particularly in cardiology and oncology, with over 800,000 nuclear medicine exams performed annually. Italy operates 190 nuclear medicine units, with SPECT remaining dominant due to cost considerations in its regionally managed healthcare system. However, PET adoption is accelerating, driven by national health technology assessment recommendations that now favor fluorodeoxyglucose PET for lymphoma and lung cancer staging. The 2024 National Recovery and Resilience Plan includes 50 million euros for upgrading imaging infrastructure in southern regions to reduce geographic disparities.

Spain Nuclear Medicine Market Analysis

Spain nuclear medicine market growth is likely to grow with a network of 140 nuclear medicine departments, with significant concentration in Madrid, Catalonia, and Andalusia. A major growth catalyst is the 2023 National Strategy for Radiopharmaceutical Innovation, which commits 40 million euros to modernize cyclotrons, establish centralized radiopharmacies, and harmonize reimbursement across autonomous communities. PET access has expanded rapidly, with 58 operational PET centers as of 2024 compared to just 32 in 2018, per the Spanish Society of Medical Radiology.

COMPETITIVE LANDSCAPE

The Europe nuclear medicine market features intense yet specialized competition characterized by a blend of radiopharmaceutical manufacturers, imaging system providers, and integrated theranostics developers. Unlike commoditized sectors, competition here revolves around isotope reliability, clinical validation, regulatory alignment, and healthcare system integration. Established players compete not only on product portfolios but on their ability to ensure uninterrupted supply chain continuity for short-lived isotopes and to co-develop clinical protocols with leading academic centers. The entry of large pharmaceutical companies through acquisitions has intensified focus on targeted radionuclide therapies, particularly in oncology. Simultaneously, imaging technology firms differentiate through software-enabled quantification and workflow efficiency. National regulatory heterogeneity adds complexity as companies must navigate varying approval and reimbursement landscapes across member states. Collaboration rather than pure rivalry often defines the ecosystem, with public-private partnerships driving infrastructure modernization and workforce development. This nuanced competitive dynamic underscores the market’s high technical barriers and clinical integration demands.

KEY MARKET PLAYERS

Some of the companies that are playing a dominating role in the Europe nuclear medicine market include

Cardinal Health Curium Pharma GE Healthcare Novartis AG (Advanced Accelerator Applications) Siemens Healthineers AG TOP PLAYERS IN THE MARKET Curium is a leading global radiopharmaceutical company with deep roots in Europe through its operations in France, the Netherlands, and Germany. The company specializes in diagnostic and therapeutic nuclear medicine solutions, including the production of molybdenum-99 technetium-99m generators and lutetium 177. Curium has strengthened its position by investing in the PALLAS reactor project in the Netherlands, aimed at securing long-term isotope supply. It also expanded its theranostics portfolio through regulatory submissions for novel prostate cancer agents and enhanced Good Manufacturing Practice-compliant manufacturing capacity across its Petten and Saclay facilities to meet rising European demand. Advanced Accelerator Applications, a Novartis company, is a pioneer in molecular nuclear medicine headquartered in France. It gained prominence with the development and commercialization of Lutathera and Pluvicto, which are approved across Europe for neuroendocrine tumors and prostate cancer, respectively. The company has reinforced its footprint by establishing dedicated theranostics centers in collaboration with major European hospitals and investing in automated radiopharmaceutical dispensing systems. It also partners with academic institutions to advance clinical research and recently expanded its Saint Genis Pouilly facility to increase lutetium 177 production capacity for the European market. GE HealthCare plays a critical role in the Europe nuclear medicine ecosystem through its advanced imaging systems and radiopharmaceutical distribution network. The company supplies SPECT, PET, and PET CT scanners to over 500 hospitals across Europe and integrates artificial intelligence for image reconstruction and quantification. GE HealthCare has recently launched digital radiopharmacy solutions and partnered with European isotope producers to ensure seamless delivery of fluorine 18 and gallium 68. It also collaborates with national health systems to implement precision oncology pathways and has upgraded its European service infrastructure to support rapid deployment and maintenance of nuclear medicine equipment. TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the Europe nuclear medicine market primarily focus on strategic infrastructure investments to secure radiopharmaceutical supply chains, especially for critical isotopes like molybdenum 99 and lutetium 177. Companies are expanding Good Manufacturing Practice-compliant production facilities and backing next-generation reactor projects such as PALLAS. Another core strategy involves deepening theranostics integration through partnerships with academic hospitals and national health systems to embed targeted radionuclide therapy into standard care pathways. Firms also prioritize regulatory engagement to accelerate approvals of novel tracers and therapies across European jurisdictions. The digital transformation, including AI-enhanced imaging platforms, automated dose dispensing, and remote service capabilities, is leveraged to improve operational efficiency and diagnostic accuracy across the care continuum.

MARKET SEGMENTATION

This research report on the Europe nuclear medicine market has been segmented and sub-segmented into the following categories.

By Diagnostics

Single Photon Emission Computed Tomography (SPECT) Positron Emission Tomography (PET)

By Therapeutics

Alpha Emitters Beta Emitters Brachytherapy

By Application

Cardiology Neurology Oncology Other Applications

By Country

United Kingdom France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Rest of Europe