Intraday Performance and Price Movements

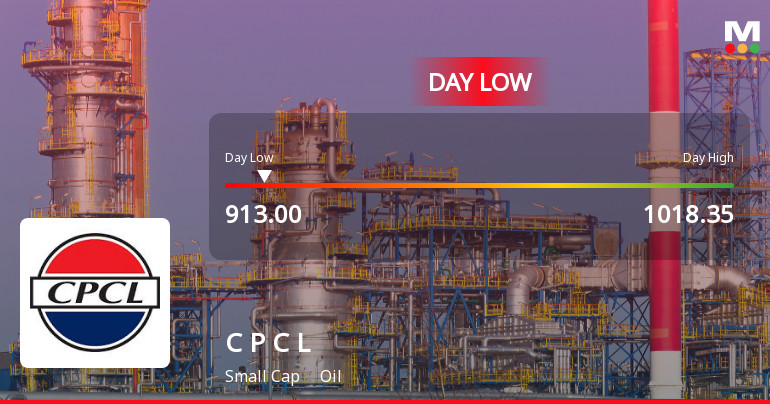

On the trading day, Chennai Petroleum Corporation’s share price declined by 7.32%, with the intraday low recorded at Rs 940.2, reflecting a 7.62% drop from the previous close. This movement contrasted sharply with the broader market, where the Sensex advanced by 0.99%, closing at 85,427.39 points. The stock’s performance lagged behind the oil sector, underperforming by 8.81% relative to its peers.

The stock exhibited high volatility, with an intraday volatility of 5.46% calculated from the weighted average price, indicating significant price fluctuations throughout the session. Notably, Chennai Petroleum Corporation’s price remained above its 50-day, 100-day, and 200-day moving averages, yet traded below its shorter-term 5-day and 20-day moving averages, suggesting recent downward momentum amid longer-term support levels.

Market Context and Sector Comparison

The broader market environment was characterised by a positive trend, with the Sensex recovering from a flat opening and gaining 923.95 points during the day. The index is currently trading close to its 52-week high, just 0.44% shy of the peak at 85,801.70. The Sensex’s 50-day moving average remains above its 200-day moving average, signalling a sustained bullish trend over recent months. Additionally, the Sensex has recorded gains over the past three consecutive weeks, accumulating a 2.66% rise.

Mid-cap stocks led the market rally, with the BSE Mid Cap index advancing by 1.12%. In contrast, Chennai Petroleum Corporation’s share price declined sharply, diverging from the positive momentum seen in the mid-cap segment and the broader market.

Short-Term and Long-Term Performance Metrics

Examining Chennai Petroleum Corporation’s recent performance reveals a mixed picture. Over the past day, the stock’s decline of 8.18% contrasts with the Sensex’s gain of 0.99%. The one-week period shows a further decline of 11.71% for the stock, while the Sensex recorded a modest 0.28% increase.

However, over longer durations, Chennai Petroleum Corporation’s stock has demonstrated substantial growth. The one-month performance stands at 20.97%, compared to the Sensex’s 1.44%. Over three months, the stock has risen by 44.51%, significantly outpacing the Sensex’s 5.74% gain. The one-year and year-to-date figures also show strong appreciation, with the stock up 53.19% and 49.13% respectively, compared to the Sensex’s 6.77% and 9.32% over the same periods.

Extending the horizon further, the stock’s three-year and five-year returns are 364.44% and 983.42%, respectively, markedly higher than the Sensex’s 37.13% and 93.00%. Even over a decade, Chennai Petroleum Corporation’s stock has recorded a 383.04% rise, compared to the Sensex’s 229.07%.

Factors Contributing to Intraday Price Pressure

The sharp intraday decline in Chennai Petroleum Corporation’s share price occurred despite a broadly positive market backdrop. The divergence from the Sensex and mid-cap rally suggests company-specific factors or sector-related pressures may have influenced investor sentiment during the session.

While the stock remains supported by its longer-term moving averages, the breach of shorter-term averages indicates immediate selling pressure. The heightened volatility further underscores the unsettled trading conditions for the stock on this day.

Summary of Market Sentiment and Outlook

In summary, Chennai Petroleum Corporation’s share price experienced a notable intraday low of Rs 940.2 on 26 Nov 2025, reflecting a decline of over 7% amid elevated volatility. This performance contrasts with the broader market’s upward trajectory, where the Sensex advanced close to its yearly highs and mid-cap stocks led gains.

The stock’s position above its longer-term moving averages suggests underlying support, yet the pressure below shorter-term averages highlights immediate challenges in price momentum. Investors observing the stock will note the divergence from sector and market trends during the session, signalling a period of adjustment or reassessment in valuation.

Overall, Chennai Petroleum Corporation’s recent trading activity underscores the dynamic nature of market forces impacting individual stocks, even within a generally positive market environment.

Get 1 year of Weekly Picks FREE when you subscribe to MojoOne. Offer ends soon. Start Saving Now →