Hello Reddit

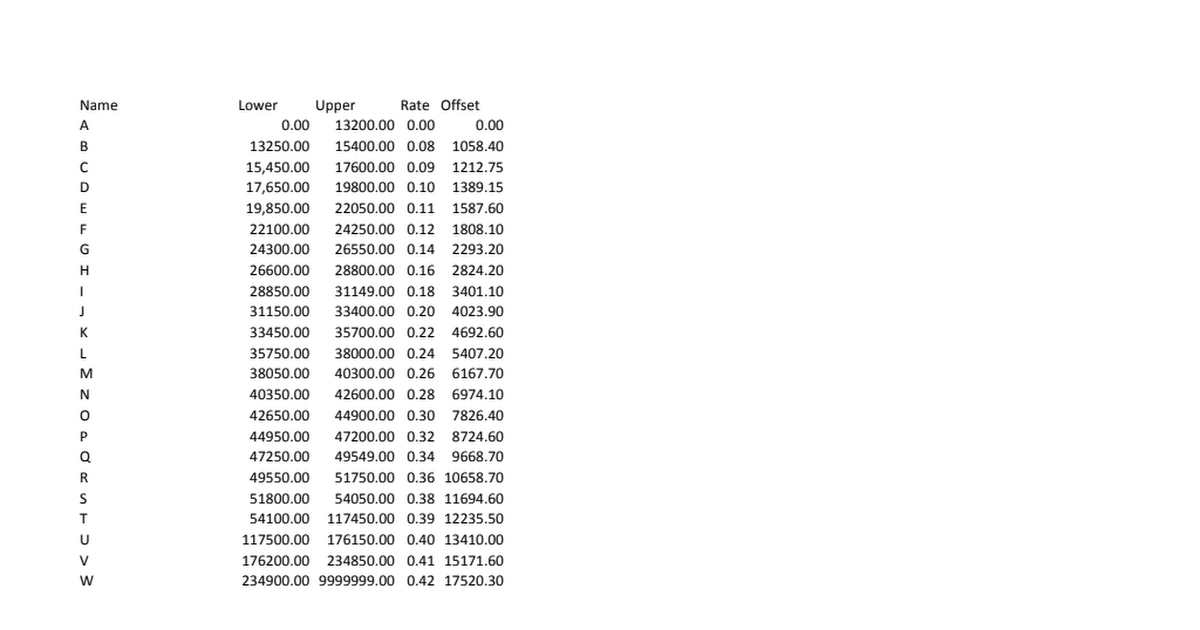

I've quit my company some time ago and considering founding a SARL-S and work like that. Assuming I have 155K income over a year; I did some simulations:

When I calculated taxes on this, considering now I have to pay full social contributions myself, and also to pay Communal Business Tax (I believe? not sure on this); it turns out that I've to pay like 79K as taxes and social contributions (SCs), and take 75K as net income.

However, it turns out there is something called SARL-S in Luxembourg; and if I found one of those; and register myself as a Salaried worker there; the net income raises to 83K; thanks to companies' flat tax rate and me paying SCs on my gross (which is lower than total gross) and company paying a bit less SCs (they don't pay Dependence Contribution (DP)). But it gets even better:

Since now I'm sole partner of this said company, and since I can set my payment as anything; if I set it as 38K, and pay the rest as 'dividend' to myself (yeah, this make is a bit more complicated due to tax withholding etc but not that complicated, really); I can raise the net income to about 105K! about 98K!*

Of course, going SARL-S way makes things more complicated but considering the difference; it's mind blowing! Am I missing something here?

Up to 23K less tax and contributions in a year is definitely a good reason to complicate things, don't you think?

*EDIT: Social contributions are still paid on dividends for owners in full, unlike taxes so fixed the calculations.

** Latest version of the Excel: https://docs.google.com/spreadsheets/d/10hmBQp5Rk2lZR5Wu5wes4BgVIlBk62-c/edit?usp=sharing&ouid=108465901171289666780&rtpof=true&sd=true

by Tzimitsce

10 comments

The only good reason to set up a company is to have a clear distinction between your assets/liabilities and those of your business.

On the tax side, it’s probably not going to be much more advantageous (unless you optimise the hell out of the tax code).

If you pay yourself less, then the company makes a profit subject to corporate tax, municipal tax, etc. Dividend would likely trigger tax withholding and you’d still have to declare said dividend on your personal tax returns

Fyi my dad made a good living setting up these structures. There are many people doing it. Just don’t be one of the people “optimizing your taxes” while blaming poor people for the states problems.

The 0 to 100k climb is punishing here… things only become feasible and self sustainable at ~300k but many don’t reach that with the administrative/fiscal pressure that gets multiplied with the inevitable first hire dilemma

I suggest doing 0 to 100 (300) in Dubai and return to Luxembourg then, but it depends on personal circumstances too

I am working on this for a family member. The key is gaining flexibility in marketing, juggling multiple small contracts, having the business able to hire with state benefits if needed. Note that if you have contracts at the size you are talking about here you will need to put a % profits in reserve for converting to a SARL when you reach EUR 12,000 in the reserve.

The main point is the ease and speed of entering into commercial activity. Otherwise the SARL-S is not different from other corporate forms.

This will be changed, if you are the owner and work for this company, you will have to pay the CCSS by yourself.

The saving you modelled looks driven mostly by the avoidance of social security on the dividends flow. CCSS seems to suggest on their website that you need to aggregate the salary with the profits of the company for social security purposes. If that’s indeed the case, the saving would probably disappear or become way less material

Useless

Why not create a sole proprietorship if you don’t need to issue convertible bonds or raise money? You’ll be only taxed as a natural person, and it won’t be a fuss like you show it currently

Hey, thanks for this- its super insightful.

I’m also freelancing at the moment , being a consultant, but from 2026 my income will increase quite a bit, so I’m starting to look into how to structure things in the most efficient way too.

If you end up finding a solid tax accountant who understands SARL-S setups and can actually take over all the administrative/tax optimisation parts, I’d really appreciate it if you could share their contact or any personal recommendations.

Thanks again for putting all this together, extremely helpful!

Personally, i opted for a regular sarl. Sarl-s has some stigma attached to it.

Comments are closed.