US President Donald Trump’s second term has marked the full transformation of American governance into a marketplace for influence. Whether it’s pardons, tariffs, artificial intelligence chips, or national security stakes-everything now has a price.What began in his first term as symbolic hotel stays and eyebrow-raising donor dinners has evolved into a sweeping system of transactional politics, where personal enrichment, family business ventures, and public policymaking are inseparably entangled.In an article, the Economist has called it the Black Friday presidency, defined by reduced enforcement and fresh forms of pay-to-play. The message from the Oval Office? The door’s open-if your check clears.

Corruption in Washington is nothing new. What’s different is the bluntness and scale. President Trump has discarded even the illusion of separation between personal gain and public duty.Take just a few examples:

“It’s the Mount Everest of corruption,” said Sen. Jeff Merkley (D-Ore.). And yet, unlike past presidents, Trump doesn’t even pretend. His governing philosophy is openly transactional.

As per the Economist, the result is what scholars call “insider capitalism”: a system where access to power, rather than innovation or merit, determines economic success.Three key trends define this moment:

As the AP reported, Trump’s crypto ventures “sidestep the rules of traditional political fundraising” and effectively allow him to mint loyalty-literally.

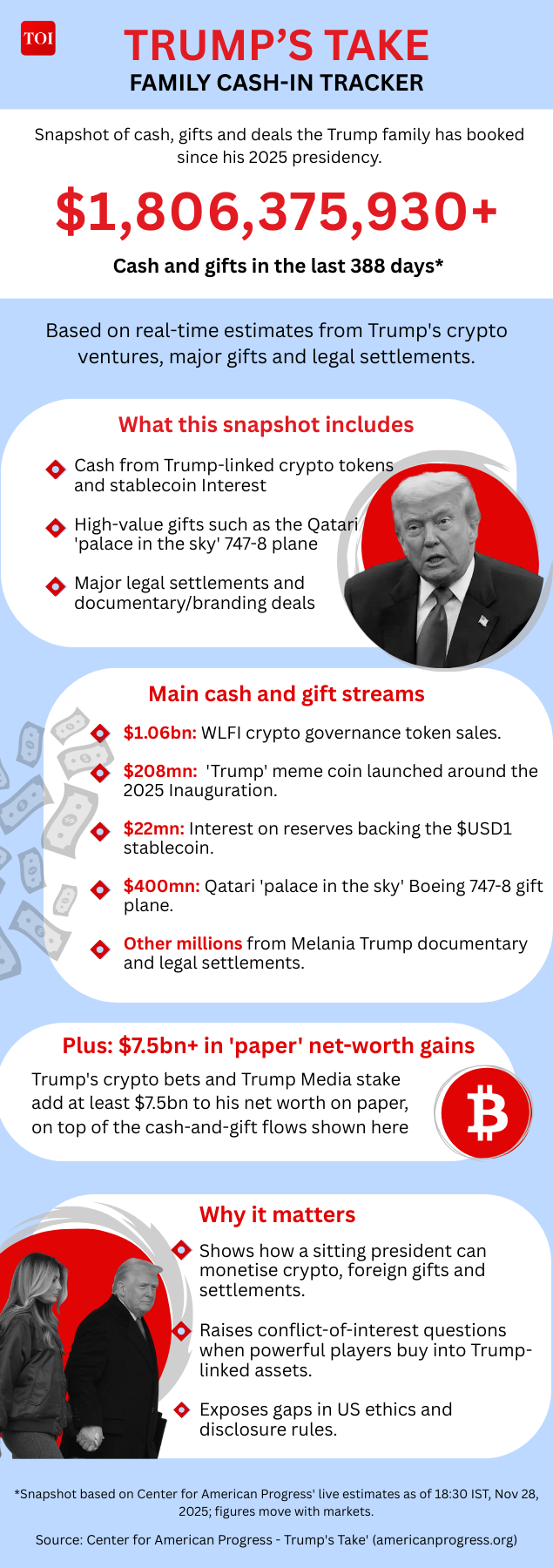

The coin economyTrump’s signature memecoin soared to over $70 before crashing to $10. But for insiders-including the Trump family-this volatility is irrelevant. They get paid on trades and token sales, not coin value.

Binance founder Changpeng Zhao, who pleaded guilty to money-laundering-related charges, reportedly played a role in building the WLFI stablecoin. Trump pardoned him months later.He’s not alone. Lobbyists now pitch pardons to white-collar convicts as “fast track” products, with success fees in the seven-figure range. Clemency consultant Sam Mangel told the Economist he’s been retained by 28 clients this year-up from one during Joe Biden’s entire term.Trump isn’t the first to receive extravagant foreign gifts. But his openness about their return on investment is new. The *Economist* reports that donors to Trump’s library, ballroom, or campaign have scored:

Regulation guttedThe Department of Justice’s anti-corruption unit has been decimated. According to the Economist, the Trump administration has dropped investigations into allies like Eric Adams and border czar Tom Homan, while pardoning 10 convicted politicians.“Shut up or suck up” has become the new survival strategy for corporate America, per Economist. Executives now operate on the assumption that silence buys safety-and praise is dangerous.Even Wall Street titans who once distanced themselves from Trump are now in line.“I try not to bring him my problems,” said one healthcare CEO about Trump. “I bring him solutions he’ll like that solve my problem.”Ballrooms, coins, and corporate stakes now serve as entry fees into policymaking. Donations buy attention. Crypto buys leverage. Access buys outcomes.

Washington is not only influencing markets. It is entering them. As the New York Times reported, the Trump administration has committed over $10 billion in equity stakes or future options across at least nine companies in minerals, steel, nuclear energy, and semiconductors.Some deals aim to counter China’s dominance in critical industries. Others have arrived with little explanation. Many were assembled within weeks. Former Commerce official William Reinsch told the Times that the Trump team invests by “whim.” Brookings scholar Darrell West said several deals show “almost no serious review.”The government’s first major purchase was a “golden share” in US Steel, giving the administration veto power over certain decisions. It followed that with a $400 million stake in MP Materials and a move to become Intel’s largest shareholder. Shortly afterward, Trump personally bought up to $5 million in Intel corporate debt.With Trumpism firmly entrenched in Washington-and with watchdogs weakened or gone-the marketplace for presidential favors is expanding.Expect more of this:

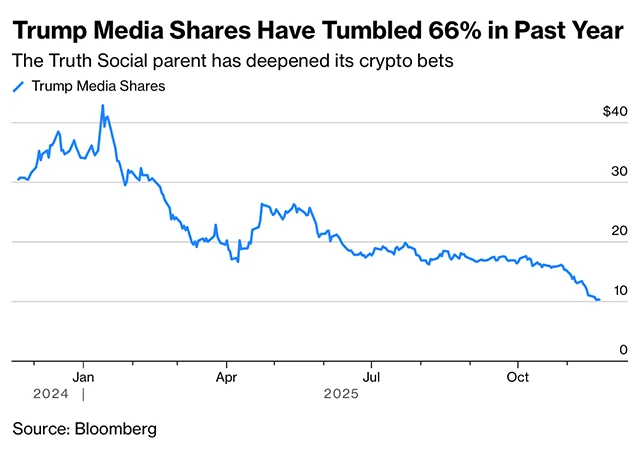

And now, as Bloomberg reports, the crypto crash is exposing risks. The Trump family’s fortune has dropped from $7.7 billion to $6.7 billion, largely due to declining token values.Yet, even in loss, they win: they still earn cuts from trades, fees, and locked token sales. The Bloomberg Billionaires Index estimates that even as prices drop, the Trump family unlocked an additional $220m worth of tokens this fall.The bottom lineThis isn’t politics-it’s business. And business is booming.As per the Economist, President Trump’s second term has delivered a working model for insider capitalism in the 21st century: deregulated, digitized, and dressed up in populist rhetoric.It’s no longer about appearances. “Nobody gives a shit,” a top DC lobbyist told Economist about Trump family conflicts. In a system where power can be traded, ethical lines aren’t crossed-they’re erased.Call it what it is: a Black Friday presidency, where the price tags are clear, the incentives are understood, and the only limit is how much you’re willing to pay.(With inputs from agencies)