Trump’s oil boom is here – pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is NextDecade’s Investment Narrative?

Owning NextDecade stock means believing in the buildout of US liquefied natural gas capacity at a time when the company remains unprofitable, has a limited cash runway, and is still reliant on regulatory milestones. The recent pre-filing with FERC for a sixth train at Rio Grande LNG is a meaningful development, potentially shifting the short-term catalyst toward regulatory progress instead of simply operational milestones on Trains 4 and 5. Given the company’s history of rising losses, high debt, and recent board and CFO changes, the upside from this expansion news is counterbalanced by persistent risks such as ongoing negative earnings, significant financing needs, and going concern flags noted by auditors. Short-term price moves after the announcement suggest investor optimism, but catalysts and risks have evolved to hinge more on regulatory timelines and access to fresh capital.

However, tightened financing terms and going concern issues remain essential risks to consider.

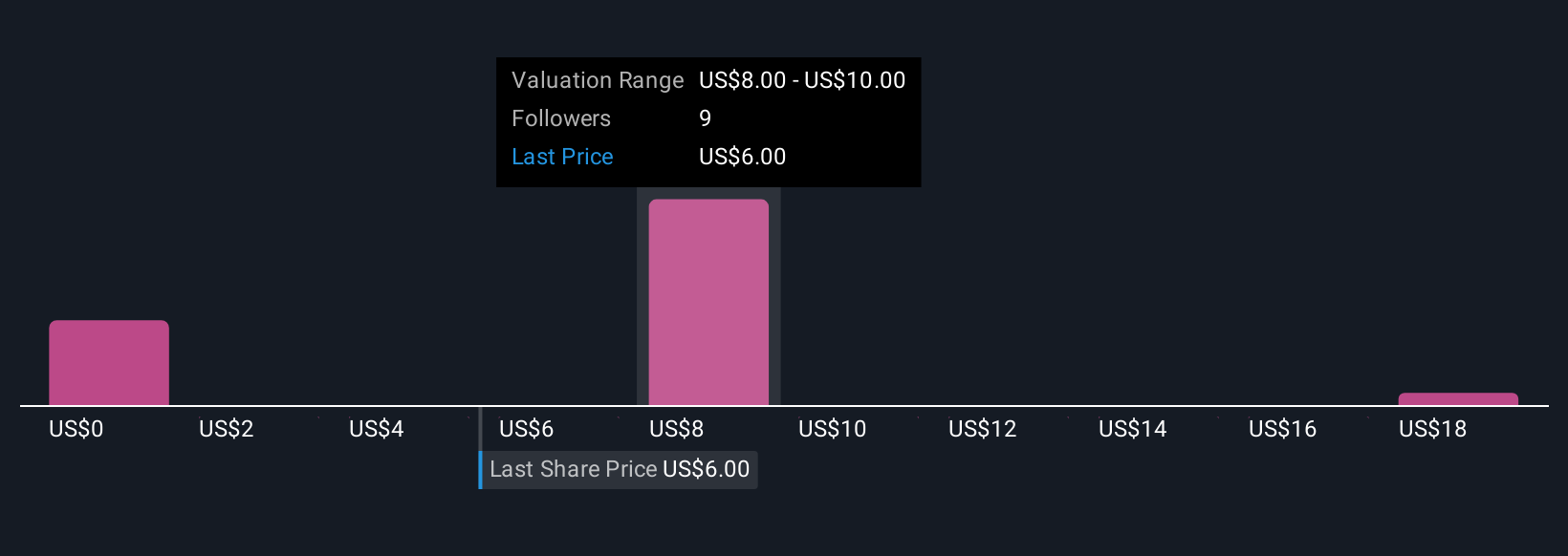

NextDecade’s shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives NEXT Community Fair Values as at Nov 2025 The Simply Wall St Community values for NextDecade range from US$2 to US$20 per share across four opinions, showing very wide conviction gaps. While some see significant upside, concerns over ongoing losses and regulatory hurdles weigh on others, underscoring how market participants assess both opportunity and risk very differently. Explore these diverse viewpoints to inform your perspective.

NEXT Community Fair Values as at Nov 2025 The Simply Wall St Community values for NextDecade range from US$2 to US$20 per share across four opinions, showing very wide conviction gaps. While some see significant upside, concerns over ongoing losses and regulatory hurdles weigh on others, underscoring how market participants assess both opportunity and risk very differently. Explore these diverse viewpoints to inform your perspective.

Explore 4 other fair value estimates on NextDecade – why the stock might be worth over 3x more than the current price!

Build Your Own NextDecade Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Ready To Venture Into Other Investment Styles?

Don’t miss your shot at the next 10-bagger. Our latest stock picks just dropped:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if NextDecade might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com