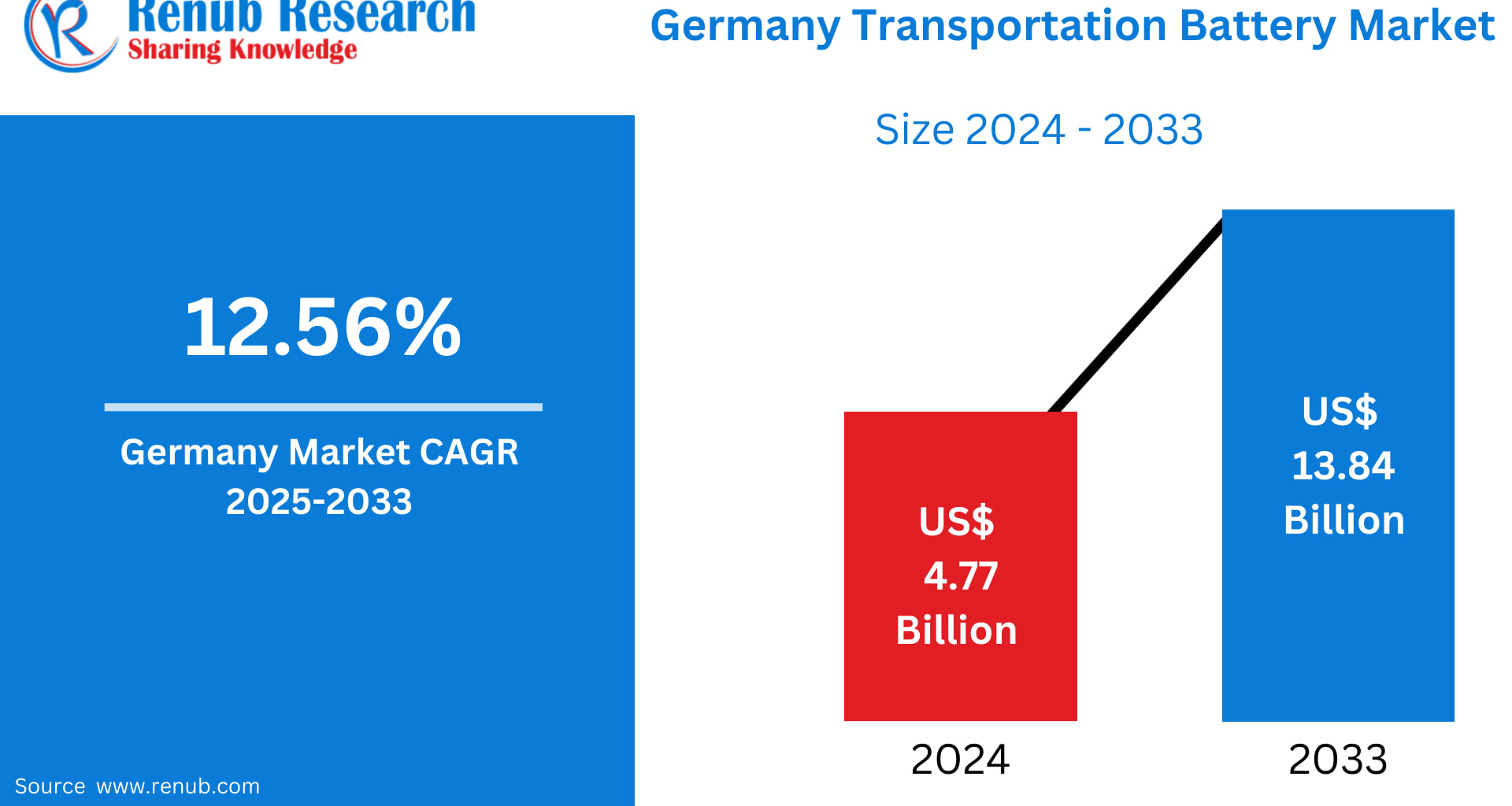

Germany’s transportation energy transformation is accelerating at a record pace, and at the heart of this shift lies the booming transportation battery market. According to Renub Research, the Germany Transportation Battery Market is expected to reach US$ 13.84 billion by 2033, rising from US$ 4.77 billion in 2024, representing a strong CAGR of 12.56% from 2025–2033. This remarkable momentum is driven by electrification, government decarbonization mandates, and major investments from German automotive giants.

More than just a technological shift, the battery revolution is redefining Germany’s economic, environmental, and industrial identity. As Europe pushes toward a fossil-free future, Germany stands at the center—engineers, policymakers, startups, and manufacturers collectively building a world-leading energy storage ecosystem.

Germany Transportation Battery Industry Overview

Germany’s transportation battery industry is experiencing an era of transformational growth, powered by innovation and a national commitment to sustainable mobility. As the country moves rapidly toward energy independence and decarbonization, transportation batteries have become the backbone of its mobility transformation.

Lithium-ion batteries currently dominate the market due to their high energy density, performance efficiency, and suitability for electric vehicles (EVs), plug-in hybrids, and public transportation fleets. At the same time, Germany is investing aggressively in next-generation solid-state batteries—seen by many as the “future of EVs” thanks to their enhanced safety, faster charging, and longer life cycles.

Government regulations remain the strongest catalyst for growth. National incentives, EU-level emissions targets, and subsidies for EV adoption and battery manufacturing have stimulated both supply and demand. As German automakers like Volkswagen, BMW, and Mercedes-Benz expand EV production, they are also building or partnering in new gigafactories to secure domestic battery supply.

Academic institutions and technology firms have also emerged as essential contributors, enabling the rapid advancement of battery chemistry, safety systems, and recycling technologies. Collaborative innovation is creating a value chain robust enough to meet rising domestic demand and position Germany as a global exporter of advanced battery solutions.

Yet, the road ahead is not without challenges. High production costs, raw material dependencies, and recycling gaps continue to threaten large-scale adoption. Despite these obstacles, Germany’s transportation battery market is poised for sustained long-term growth, powered by policy support, rapid electrification, and technological evolution.

Key Drivers of the Germany Transportation Battery Market Growth

1. Government Regulations & Rewards

One of the most significant forces behind Germany’s rapid battery market expansion is its supportive regulatory framework.

Policies include:

Subsidies for purchasing electric vehicles

Tax incentives for battery and EV manufacturers

Large-scale investments in EV charging infrastructure

EU-wide emissions reduction mandates

Funding programs for R&D in battery technology

Germany’s push for carbon neutrality—aligned with the European Green Deal—has accelerated the shift toward electrification across consumer, commercial, and industrial transportation. Importantly, these policies support both demand-side adoption and supply-side manufacturing, creating a balanced and self-sustaining ecosystem.

2. Strength of the German Automotive Industry

Germany’s reputation as the world’s automotive engineering powerhouse gives it a decisive competitive advantage.

Leading manufacturers—including Volkswagen, BMW, Mercedes-Benz, Bosch, Continental, and ZF—are investing billions in EV development and battery production. Their efforts are backed by:

Skilled labor

Mature supply chains

Strategic partnerships

Advanced engineering capabilities

These companies are setting up new battery plants, forming alliances with global cell manufacturers, and developing proprietary solid-state technologies. The industry’s strong foundation ensures rapid commercialization of new battery innovations and sustained market expansion.

3. Breakthroughs in Battery Technology

Continuous innovation is driving Germany’s market forward. Key advancements include:

Higher energy density lithium-ion cells

Commercialization pathways for solid-state batteries

AI-enhanced Battery Management Systems (BMS)

IoT-enabled predictive maintenance

Advanced recycling systems

Raw material recovery technologies

The push toward circular battery economy is particularly important as Europe aims to reduce supply chain risks and environmental impact. Germany’s R&D ecosystem—spanning universities, startups, research institutes, and automakers—ensures that the country remains at the forefront of global energy storage innovation.

Challenges Impacting the Germany Transportation Battery Market

1. High Production Costs & Infrastructure Gaps

Battery production remains capital-intensive, and Germany’s high energy and labor costs add further challenges. Gigafactories require billions in investment, often increasing EV prices and slowing mass-market adoption.

Charging infrastructure also remains uneven—urban areas are rapidly electrifying, while rural regions lag behind, reducing accessibility.

Solving these issues will require:

Public–private partnerships

Targeted rural charging deployments

Affordable energy pricing for manufacturers

Streamlined regulatory processes

Without cost-effective production and equitable infrastructure expansion, the pace of EV transition may slow.

2. Battery Recycling & End-of-Life Management

Growing EV adoption means Germany will soon face a high volume of end-of-life batteries. Current recycling capacity, however, is insufficient to meet future demand.

Challenges include:

Energy-intensive recycling processes

High operational costs

Limited recovery efficiency of key minerals

Environmental concerns from improper disposal

Germany is investing in advanced recycling plants and circular economy initiatives, but scaling these solutions remains a critical priority.

Germany Transportation Battery Market Overview by Leading States

Germany’s regional dynamics play a major role in shaping the market’s overall trajectory. Several federal states are emerging as key innovation and adoption hubs.

North Rhine-Westphalia (NRW)

North Rhine-Westphalia is one of Germany’s most industrially powerful states and a major contributor to the transportation battery market.

Key strengths include:

Strong automotive supply chain

Advanced research institutions

Leading battery recycling initiatives

High density of logistics firms adopting electric fleets

State-level incentives for electrification

NRW’s commitment to sustainability and its industrial heritage make it a central force in Germany’s battery transition.

Bavaria

Bavaria remains a cornerstone of Germany’s automotive engineering sector, home to major automakers and world-class technology clusters.

Its strengths include:

State-of-the-art EV and battery production facilities

R&D hubs focused on solid-state and high-efficiency batteries

Renewable energy integration

Strong government support for clean mobility

Bavaria’s industrial base ensures that it will continue to lead in the manufacturing and development of next-generation transportation batteries.

Berlin

Berlin has positioned itself as a thriving innovation hub for battery startups, sustainability tech firms, and EV mobility solutions.

Key advantages:

Startup-driven R&D environment

Focus on smart city mobility

High EV adoption rates

Government funding for digital and clean transport projects

As Europe’s startup capital, Berlin contributes significantly to the technological and strategic advancements in the transportation battery market.

Hamburg

Hamburg is emerging as a leader in sustainable logistics and maritime electrification.

Key strengths include:

Electrified public transport networks

Port operations shifting toward battery-powered systems

Investments in heavy-duty EV fleets

Strategic role as a logistics hub

Hamburg’s unique maritime focus makes it an essential part of Germany’s broader transportation battery strategy.

Recent Developments in the Market

At IAA Transportation 2024 in Hannover, Octillion Power Systems announced the launch of high-density lithium-ion battery systems customized for European electric vehicles. The move highlights growing global interest in Germany’s EV and battery landscape.

Market Segmentations

Battery Type

Lead-Acid

Lithium-Ion

Other Types

Vehicle Type

Passenger Cars

Commercial Vehicles

Drive Type

Internal Combustion Engine (ICE)

Electric Vehicles (EVs)

States Covered

North Rhine-Westphalia

Bavaria

Baden-Württemberg

Lower Saxony

Hesse

Berlin

Rhineland-Palatinate

Saxony

Hamburg

Rest of Germany

Key Players Covered

Below are brief editorial-style profiles for quick inclusion in Vocal articles.

1. Panasonic Corporation

Overview: Global leader in battery manufacturing, heavily invested in EV battery solutions.

Key Person: Yuki Kusumi, CEO

Recent Developments: Expanding European partnerships for sustainable lithium-ion supply.

SWOT:

Strength: Advanced battery tech

Weakness: High dependence on supply chain partners

Opportunity: European EV boom

Threat: Rising competition from Korean and Chinese manufacturers

Revenue Note: Strong growth from automotive battery segment.

2. Exide Industries

Overview: Major battery producer with expanding presence in advanced lithium technology.

Key Person: Gautam Chatterjee, MD & CEO

Recent Developments: Investments in next-gen lithium-ion production lines.

SWOT:

Strength: Wide product portfolio

Weakness: Transitioning from lead-acid dominance

Opportunity: EV battery expansion

Threat: Cost pressures

Revenue Note: Solid revenue from industrial and transportation batteries.

3. VARTA AG

Overview: German battery manufacturer known for premium energy storage systems.

Key Person: Markus Hackstein, CEO

Recent Developments: Strengthening R&D for high-density battery cells.

SWOT: Engineering strength; vulnerability to import costs; strong EV growth prospects; high market competition.

Revenue Note: Rising earnings from microbattery and energy storage divisions.

4. Hitachi Group Ltd

Overview: Diversified tech conglomerate active in EV component manufacturing.

Key Person: Keiji Kojima, CEO

Recent Developments: Advancements in smart BMS technologies.

SWOT: Strong electronics base; lower EV market presence; growing IoT battery opportunities; geopolitical risks.

5. Robert Bosch GmbH

Overview: Germany’s engineering giant with major EV battery innovation programs.

Key Person: Stefan Hartung, CEO

Recent Developments: AI-based BMS development and solid-state research.

SWOT: Strong engineering; dependency on auto cycle; huge EV opportunities; stiff global competition.

6. Samsung SDI Co. Ltd

Overview: Global leader in lithium-ion EV batteries and solid-state research.

Key Person: Yoonho Choi, President & CEO

Recent Developments: Launching high-nickel battery innovations for longer ranges.

SWOT: Tech leadership; costly R&D; expanding European partnerships; raw material risks.

7. LG Chem / LG Energy Solution

Overview: One of the world’s largest EV battery manufacturers.

Key Person: Hak Cheol Shin, Vice Chairman & CEO

Recent Developments: Expanding EV battery production capacity in Europe.

SWOT: Massive capacity; high competition; EV surge opportunity; raw material volatility.

Final Thoughts

Germany’s transportation battery market is entering a defining decade—one characterized by innovation, sustainability, and industrial transformation. With its strong automotive heritage, strategic policy backing, cutting-edge research ecosystem, and growing investments in clean mobility, Germany is not just adapting to the global EV revolution but shaping its future trajectory.

As battery technologies become safer, cheaper, and more efficient, Germany’s transition to electric mobility will accelerate even further. The result will be a greener transport sector, stronger industrial competitiveness, and a resilient energy future supported by homegrown battery innovation.