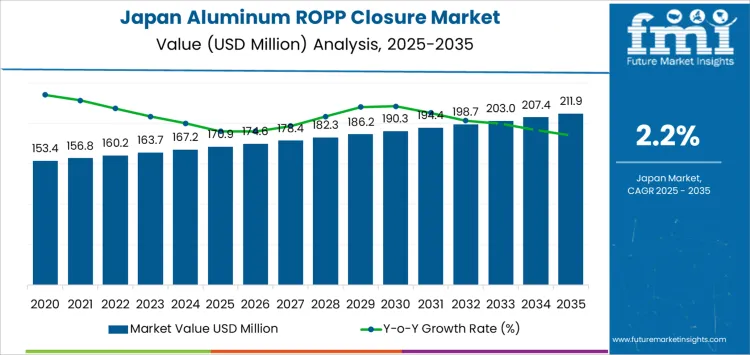

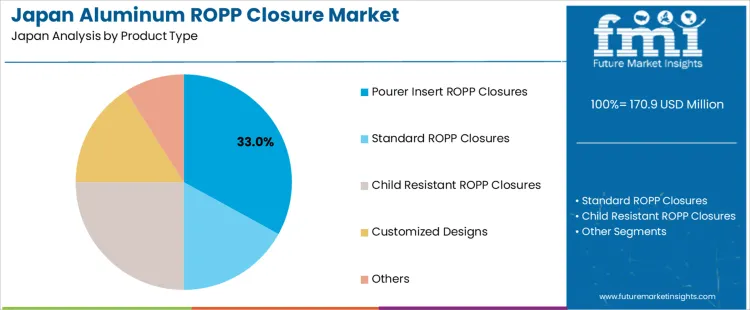

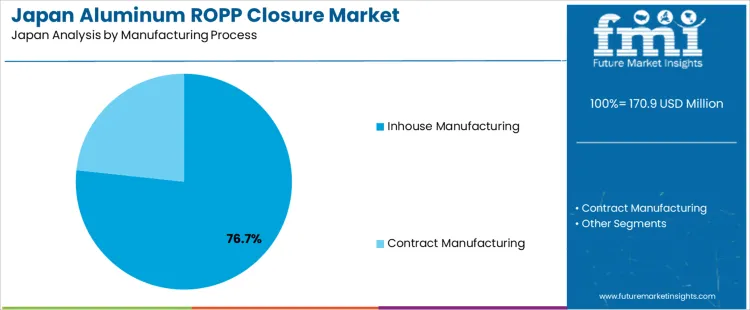

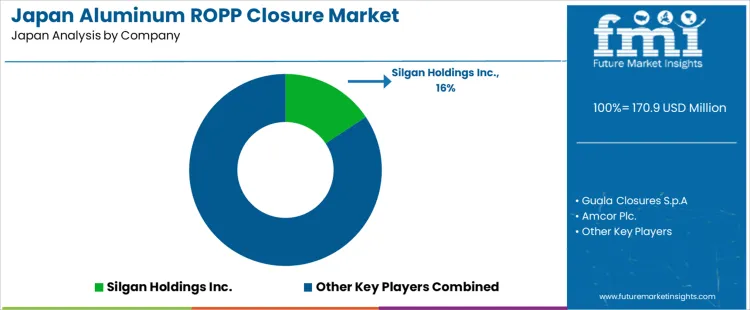

Demand for aluminum ROPP closure in Japan is valued at USD 170.9 million in 2025 and is projected to reach USD 211.9 million by 2035 at a CAGR of 2.2%. The industry is structured around beverage, pharmaceutical, food, and cosmetics packaging, with pharmaceuticals accounting for the largest end-use share at 38.0%, followed by food at 25.0% and non-alcoholic beverages at 15.0%. Pourer insert closures hold a 33% product share, while child resistant designs account for 25%, reflecting safety-driven packaging needs. Closures with 24 to 38 mm neck size dominate at 69.5%. Inhouse manufacturing remains prevalent at 76.7%. Key suppliers operating in Japan include Silgan Holdings, Guala Closures, Amcor Plc., Crown Holdings, and Herti JSC.

After 2030, growth in the aluminum ROPP closure industry in Japan is led by stable pharmaceutical production volumes, bottled health drinks, and premium beverage packaging rather than mass beverage expansion. Demand from alcoholic beverages remains controlled due to mature consumption patterns, while cosmetics and personal care contribute steady niche uptake through customized designs. Printed closures account for only 25%, indicating continued preference for functional branding over decorative finishes. Manufacturing remains concentrated around contract packaging hubs in Kanto and Chubu, serving domestic brand owners. Replacement demand from existing bottling lines and regulatory-driven shifts toward child resistant designs sustain baseline demand. Competitive positioning increasingly depends on threading precision, tamper evidence reliability, and compatibility with high-speed bottling lines rather than unit pricing advantages.

Quick Stats of the Demand for Aluminum ROPP Closure in Japan

Demand for Aluminum ROPP Closure in Japan Value (2025): USD 170.9 million

Demand for Aluminum ROPP Closure in Japan Forecast Value (2035): USD 211.9 million

Demand for Aluminum ROPP Closure in Japan Forecast CAGR (2025–2035): 2.2%

Leading Product Type in Japan (2025): Pourer Insert ROPP Closures (33%)

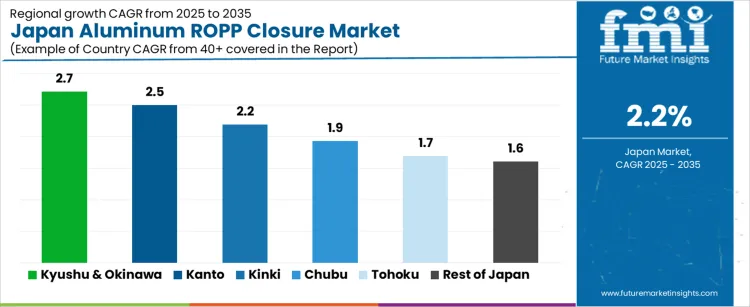

Key Growth Regions in Japan: Kyushu & Okinawa, Kanto, Kinki, Chubu

Top Players in Japan: Silgan Holdings, Guala Closures, Amcor Plc., Crown Holdings, Herti JSC

What is the Demand Forecast for Aluminum ROPP Closure in Japan through 2035?

The demand for aluminum ROPP closure in Japan is valued at USD 170.9 million in 2025 and rises to USD 186.2 million by 2030, reflecting a net addition of USD 15.3 million over the first half of the forecast period. The historical rise from USD 153.4 million in 2020 to USD 170.9 million in 2025 shows a consumption pattern anchored in bottled spirits, pharmaceuticals, edible oils, and functional beverages where tamper evidence and torque-controlled sealing are structurally required. The Japan aluminum ROPP closure industry is driven less by packaging novelty and more by stable filling line throughput across liquor distilleries, OTC medicine bottlers, and premium oil brands. Growth in this phase is rooted in SKU stability, export-grade packaging standards, and ongoing replacement of plastic closures in regulated liquid packaging.

From 2030 to 2035, demand expands from USD 186.2 million to USD 211.9 million, adding a further USD 25.7 million in incremental value. Annual additions gradually step up from roughly USD 4.1 million to over USD 4.5 million toward the end of the period, reflecting rising bottled beverage volumes and stronger premiumization in spirits, nutraceutical liquids, and infused health drinks. Wider adoption of ROPP closures in small-batch craft alcohol, export-driven beverage brands, and pharmaceutical syrup packaging strengthens downstream pull. The closure format also benefits from higher rejection of single-use plastics in premium liquid packaging. By 2035, demand for aluminum ROPP closure in Japan remains structurally tied to regulated liquid packaging, export packaging integrity, and premium bottle positioning rather than short-term shifts in consumer packaging design.

Aluminum ROPP Closure Industry in Japan Key Takeaways

Metric

Value

Industry Value (2025)

USD 170.9 million

Forecast Value (2035)

USD 211.9 million

Forecast CAGR (2025–2035)

2.2%

What Is Fueling the Demand for Aluminum ROPP Closure in Japan Beverage and Packaging Industry?

The demand for aluminum ROPP closure in Japan is closely tied to the structure of the local beverage, pharmaceutical, and premium personal care industries, where packaging precision and tamper evidence are strictly enforced. Historically, growth was supported by bottled spirits, functional drinks, and pharmaceutical syrups where controlled sealing and reclosure performance are essential. Japans strong culture of quality assurance and brand trust reinforced early adoption of ROPP closures over simpler caps. Demand also strengthened through export oriented beverage producers who require globally accepted closure formats for international logistics. The dominance of glass bottles in premium sake, health tonics, and specialty drinks further anchored aluminum ROPP usage across domestic production lines.

Future demand for aluminum ROPP closure in Japan will be shaped by premiumization trends, export focused beverage manufacturing, and rising expectations for tamper safety and recyclability. Functional beverages, nutraceutical liquids, and small batch spirits will continue to favor ROPP closures for their sealing reliability and upscale appearance. Pharmaceutical packaging will also support steady demand where regulatory compliance and batch integrity are tightly controlled. Barriers include rising aluminum cost volatility, competition from advanced plastic closures in mass volume beverages, and lightweight packaging initiatives that favor flexible formats. Long term demand will depend on how well aluminum ROPP closures align with Japans circular economy targets, export standards, and premium product positioning across beverages, healthcare, and personal care packaging.

What Is the Structural Breakdown of the Demand for Aluminum ROPP Closure in Japan by Product Type and Manufacturing Process?

The demand for aluminum ROPP closure in Japan is structured by product type and manufacturing process. By product type, demand is classified into pourer insert ROPP closures, standard ROPP closures, child resistant ROPP closures, customized designs, and others. By manufacturing process, production is divided into inhouse manufacturing and contract manufacturing. These segment divisions reflect how Japans beverage bottling standards, pharmaceutical packaging controls, and premium product branding practices influence closure design selection and production strategy. High automation levels inside Japanese bottling facilities favor tight dimensional tolerance and defect control. Regulatory supervision from food safety and pharmaceutical authority’s shapes both tooling design and material traceability. Long term OEM supply relationships dominate procurement instead of spot sourcing.

Why Do Pourer Insert ROPP Closures Lead the Demand for Aluminum ROPP Closure in Japan by Product Type?

Pourer insert ROPP closures account for 33% of the demand for aluminum ROPP closure in Japan, reflecting strong usage in spirits, premium beverages, edible oils, and pharmaceutical syrups. Consumption intensity is high because controlled flow dispensing is required for accuracy, waste reduction, and consumer convenience. Usage remains stable due to Japans high bottled liquor export volume and domestic ready to drink beverage production. Procurement is driven by long term supply agreements between beverage producers and closure manufacturers. Price sensitivity remains moderate because insert precision and sealing performance reduce leakage risk and brand liability. Specification control is strict due to tamper evidence standards, torque compliance, and liner compatibility. Import dependence remains visible for precision insert components. Switching tendency remains low because bottling line calibration is closely matched to specific pourer geometries.

What Is Driving Inhouse Manufacturing to Dominate the Demand for Aluminum ROPP Closure in Japan by Manufacturing Process?

Inhouse manufacturing represents 76.7% of the demand for aluminum ROPP closure in Japan, reflecting Japans preference for vertical integration, quality control, and production confidentiality. Large beverage, cosmetic, and pharmaceutical firms operate captive closure lines to ensure consistent torque output, decorative finish accuracy, and food contact compliance. Consumption per facility remains high due to continuous bottling schedules and minimal reliance on external suppliers. Capital investment in multi cavity tooling reduces long term unit cost despite high upfront expenditure. Price elasticity remains low because equipment uptime and defect prevention outweigh outsourced savings. Regulatory exposure is tightly managed through internal audit systems rather than third party certification. Inventory risk is controlled through synchronized closure and bottle production. Contract manufacturing remains limited to seasonal surges and specialty designs. This structure stabilizes domestic supply chains and reinforces production self sufficiency across Japans packaging ecosystem.

What Is Sustaining the Demand for Aluminum ROPP Closure in Japan Beverage and Pharmaceutical Packaging Systems?

Demand for aluminum ROPP closures in Japan is sustained by premium beverage bottling, pharmaceutical liquid packaging, and export-oriented branding standards. Sake, spirits, flavored water, and functional beverage producers rely on tamper-evident, torque-controlled closures to meet strict retail safety and traceability expectations. Pharmaceutical syrups and oral solutions also specify ROPP for secure sealing and dosing integrity. Japan focus on shelf presentation, packaging uniformity, and anti-counterfeiting supports continued use of aluminum rather than plastic alternatives. Demand is tied to quality assurance, export compliance, and brand trust rather than volume-driven beverage expansion.

How Is Premium Beverage Bottling Reinforcing ROPP Closure Adoption?

Japan premiumization of alcoholic and functional beverages directly supports aluminum ROPP demand. Sake brewers, whisky distillers, and craft spirits producers prioritize closures that deliver tamper evidence, consistent opening torque, and metallic presentation aligned with premium shelf positioning. Export-oriented bottles must comply with overseas safety norms, reinforcing reliance on standardized ROPP sealing formats. Limited-edition packaging, gift sets, and seasonal releases further reinforce aluminum closure use where visual quality and reseal performance matter. This demand is driven by branding discipline and export-readiness rather than by low-cost mass beverage packaging.

Why Are Pharmaceutical Liquids and Health Tonics Creating Structural Demand?

Japan large aging population sustains steady production of liquid medications, nutritional tonics, and OTC syrups that depend on secure, leak-proof closures. Aluminum ROPP closures are specified for their chemical resistance, tight sealing under temperature variation, and tamper-evident performance. Hospitals, clinics, and pharmacies demand packaging that maintains dosing reliability and resists accidental opening. Regulatory inspection regimes prioritize torque consistency and seal integrity over material substitution. This demand is structurally linked to long-cycle healthcare consumption rather than to retail beverage trends.

How Do Cost Pressures, Sustainability Shifts, and Automation Upgrades Restrain Expansion?

Demand for aluminum ROPP closure in Japan faces restraint from rising aluminum input costs and increasing use of lightweight plastic closures in low-margin beverages. Sustainability targets are also encouraging bottle-weight reduction and mono-material packaging in certain segments. High-speed bottling lines require continuous automation upgrades to maintain ROPP compatibility, which limits adoption in smaller regional filling operations. In addition, closure liner materials face periodic reformulation due to food-contact regulation updates. These factors moderate volume acceleration despite stable long-term structural demand.

What is the Demand for Aluminum ROPP Closure in Japan by Region?

Region

CAGR (%)

Kyushu & Okinawa

2.7%

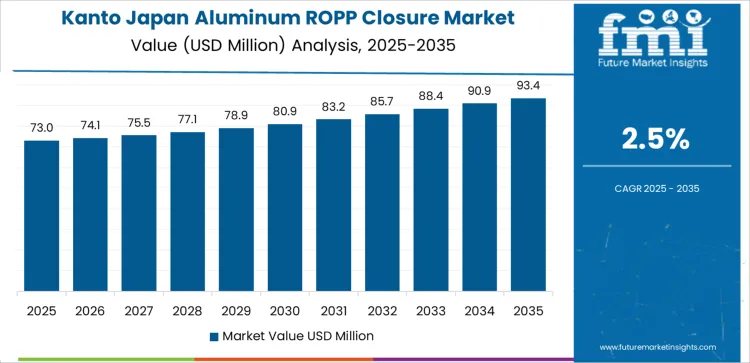

Kanto

2.5%

Kinki

2.2%

Chubu

1.9%

Tohoku

1.7%

Rest of Japan

1.6%

The demand for aluminum ROPP closures in Japan is expanding at a measured pace across all regions, led by Kyushu and Okinawa at a 2.7% CAGR. Growth in this region is supported by beverage bottling activity, pharmaceutical liquid packaging, and steady demand from export-oriented food products. Kanto follows at 2.5%, driven by its dense concentration of beverage manufacturers, contract packers, and pharmaceutical filling operations. Kinki records 2.2% growth, reflecting stable demand from edible oil, spirits, and processed beverage producers. Chubu at 1.9% shows moderate uptake linked to regional food processing and logistics. Tohoku and the Rest of Japan, at 1.7% and 1.6%, reflect slower growth shaped by lower packaging volumes, fewer high-speed bottling lines, and longer replacement cycles for closure systems.

How Is Beverage Bottling Activity in Kyushu and Okinawa Influencing Aluminum ROPP Closure Demand?

Growth in Kyushu and Okinawa is progressing at a CAGR of 2.7% through 2035 for aluminum ROPP closure demand, supported by rising local spirits bottling, functional beverage filling, and export oriented food processing activity. Breweries and distilleries in Fukuoka and Okinawa continue to expand premium glass packaging output for regional and tourist driven consumption. Compared with Tohoku, demand here is shaped more by brand driven packaging upgrades than essential food applications. Aluminum ROPP closures are primarily used for liquor bottles, flavored syrups, and nutraceutical liquids distributed through retail and duty free networks.

Distilleries and breweries anchor core closure usage

Premium glass packaging supports higher value demand

Export oriented bottling strengthens production stability

Beverage brands dominate procurement volumes

What Is Sustaining Aluminum ROPP Closure Consumption Across High Volume Bottling Lines in Kanto?

Expansion in Kanto reflects a CAGR of 2.5% through 2035 for aluminum ROPP closure usage, driven by dense concentration of beverage factories, pharmaceutical syrup plants, and contract bottling facilities. Tokyo and surrounding prefectures lead glass bottle packaging for spirits, functional drinks, and oral liquid medicines. Kanto differs from Kyushu and Okinawa through stronger reliance on automated bottling throughput rather than brand led premiumization. Aluminum ROPP closures are used at scale across tonic water, cough syrups, energy tonics, and flavor concentrate packaging.

High speed bottling lines sustain stable closure demand

Pharmaceutical liquids support regulated packaging usage

Contract bottlers dominate regional volume output

Automation cycles influence replacement timing

Why Is Regional Food and Liquor Production Supporting Moderate ROPP Closure Growth in Kinki?

Growth in Kinki is advancing at a CAGR of 2.2% through 2035 for aluminum ROPP closure demand, supported by sake brewing, regional beverage processing, and specialty food liquid packaging. Osaka and Kyoto remain key centers for traditional alcoholic drinks and premium condiment bottling. Kinki contrasts with Kanto through lower automation intensity and greater emphasis on craft production. Aluminum ROPP closures are applied across rice wine, flavored vinegars, herbal extracts, and cooking sauces targeted at domestic consumers and foodservice distributors.

Traditional sake brewing sustains baseline demand

Specialty condiments drive small batch closure usage

Craft beverage packaging shapes procurement patterns

Regional brands anchor steady purchasing cycles

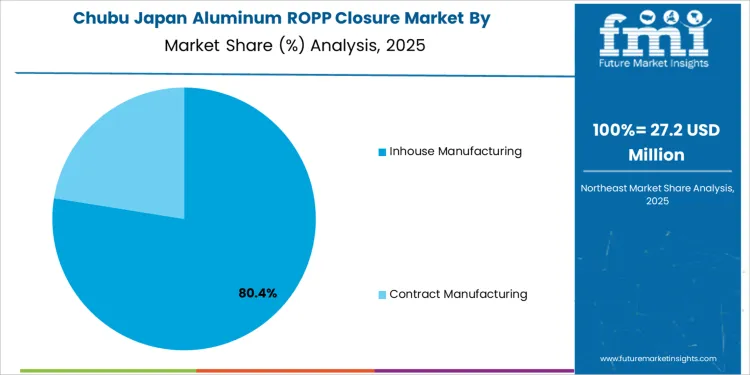

How Is Manufacturing and Beverage Supply Chain Development Shaping ROPP Closure Demand in Chubu?

Expansion in Chubu reflects a CAGR of 1.9% through 2035 for aluminum ROPP closure demand, supported by bottled water plants, energy drink filling, and regional pharmaceutical packaging. Nagoya and nearby industrial cities host multiple co packing operations supplying national beverage brands. Chubu differs from Kinki through stronger contract manufacturing orientation rather than brand owned bottling. Aluminum ROPP closures are deployed across mineral water, vitamin drinks, mouthwash, and oral syrups. Procurement remains volume focused with limited premium packaging exposure.

Bottled water plants anchor steady closure consumption

Energy drink filling supports recurring volume demand

Contract packers shape purchasing decisions

Cost focused sourcing guides supplier selection

What Is Sustaining Conservative Aluminum ROPP Closure Uptake Across Tohoku Bottling Operations?

Growth in Tohoku is moving at a CAGR of 1.7% through 2035 for aluminum ROPP closure demand, supported by dairy beverage processing, regional syrup manufacturing, and community level pharmaceutical packaging. Tohoku contrasts with Kanto and Chubu through lower production scale and limited export exposure. Aluminum ROPP closures are mainly used for flavored milk drinks, cough syrups, and regional health tonics. Lower throughput and fewer automated lines continue to restrain faster growth despite stable local consumption.

Dairy beverages support basic closure application

Regional syrups sustain essential liquid packaging

Limited automation slows large scale conversion

Local manufacturers dominate procurement activity

How Does Low Volume Packaging Infrastructure Influence ROPP Closure Demand in the Rest of Japan?

Growth in the Rest of Japan is advancing at a CAGR of 1.6% through 2035 for aluminum ROPP closure demand, shaped by small bottling operations, medicinal liquid packaging, and food ingredient filling in semi-rural areas. This region differs from Kanto and Kyushu and Okinawa through slower production turnover and longer equipment replacement cycles. Aluminum ROPP closures are primarily used for herbal extracts, food essences, locally distributed spirits, and institutional pharmaceutical liquids. Procurement remains tightly linked to annual production planning and distributor supply agreements.

Small bottling units drive low volume steady demand

Herbal and medicinal liquids anchor usage base

Long replacement cycles limit faster growth

Distributor networks guide regional sourcing

What Is Driving the Demand for Aluminum ROPP Closure in Japan and Which Firms Shape Supply Access

The demand for aluminum ROPP closures in Japan is tied to beverage production stability, growth in ready to drink alcoholic formats, and strict packaging integrity standards across food and pharmaceutical bottling. Toyo Seikan holds a central domestic position through deep integration with Japanese beverage brands and long term supply agreements covering spirits, functional drinks, and nutraceutical products. Daiwa Can Company supports demand through metal packaging systems aligned with sake, wine, and health drink bottlers. Silgan Holdings participates through imported closures and technology linked to global spirits brands bottled in Japan under license. Guala Closures supplies premium tamper evident systems used in imported wine and high value liquor segments.

Amcor supports demand through packaging system integration where closures are supplied as part of broader bottle and sealing programs for export oriented beverage producers. Crown Holdings participates through metal packaging infrastructure tied to multicategory beverage formats where closure standardization is required. Herti JSC serves selected private label spirits and imported wine bottlers through distributor led access. Procurement in Japan is guided by opening torque consistency, liner compatibility, recyclability rules, and audit requirements under food contact regulations. Buyer preference favors suppliers with domestic production, rapid tooling adjustment, and bilingual technical support. Demand patterns track alcoholic beverage output, private label spirits growth, and export packaging activity.

Key Players in the Aluminum ROPP Closure Industry in Japan

Silgan Holdings Inc.

Guala Closures S.p.A

Amcor Plc.

Crown Holdings Inc.

Herti JSC

Scope of the report

Items

Values

Quantitative Units (2025)

USD million

Product Type

Pourer Insert ROPP Closures, Standard ROPP Closures, Child Resistant ROPP Closures, Customized Designs, Others

Manufacturing Process

Inhouse Manufacturing, Contract Manufacturing

Neck Type

Up to 24 mm, 24 to 38 mm, Above 38 mm

Printing Type

Printed, Non Printed

End Use

Alcoholic Beverage, Non Alcoholic Beverage, Food, Pharmaceuticals, Cosmetics and Personal Care

Regions Covered

Kyushu & Okinawa, Kanto, Kansai, Chubu, Tohoku, Rest of Japan

Key Companies Profiled

Silgan Holdings Inc., Guala Closures S.p.A, Amcor Plc., Crown Holdings Inc., Herti JSC

Additional Attributes

Dollar by sales breakdown by region, product type, manufacturing process, neck size, printing type, and end use; growth projections through 2035; premiumization and export-driven beverage impact; regulatory-driven child resistant adoption; automated bottling line compatibility; replacement demand from existing bottling lines; supplier domestic presence and tooling flexibility; long-term supply agreements; aluminum price volatility impact; functional beverage and pharmaceutical syrup adoption trends

Aluminum ROPP Closure Industry in Japan Segmentation

Product Type:

Pourer Insert ROPP Closures

Standard ROPP Closures

Child Resistant ROPP Closures

Customized Designs

Others

Manufacturing Process:

Inhouse Manufacturing

Contract Manufacturing

Neck Type:

Up to 24 mm

24 to 38 mm

Above 38 mm

Printing Type:

End Use:

Alcoholic Beverage

Non Alcoholic Beverage

Food

Pharmaceuticals

Cosmetics and Personal Care

Region:

Kyushu & Okinawa

Kanto

Kansai

Chubu

Tohoku

Rest of Japan

The demand for aluminum ROPP closure in Japan is estimated to be valued at USD 170.9 million in 2025.

The market size for the aluminum ROPP closure in Japan is projected to reach USD 211.9 million by 2035.

The demand for aluminum ROPP closure in Japan is expected to grow at a 2.2% CAGR between 2025 and 2035.

The key product types in aluminum ROPP closure in Japan are pourer insert ROPP closures, standard ROPP closures, child resistant ROPP closures, customized designs and others.

In terms of manufacturing process, inhouse manufacturing segment is expected to command 76.7% share in the aluminum ROPP closure in Japan in 2025.