Europe Paint Protection Film Market Size

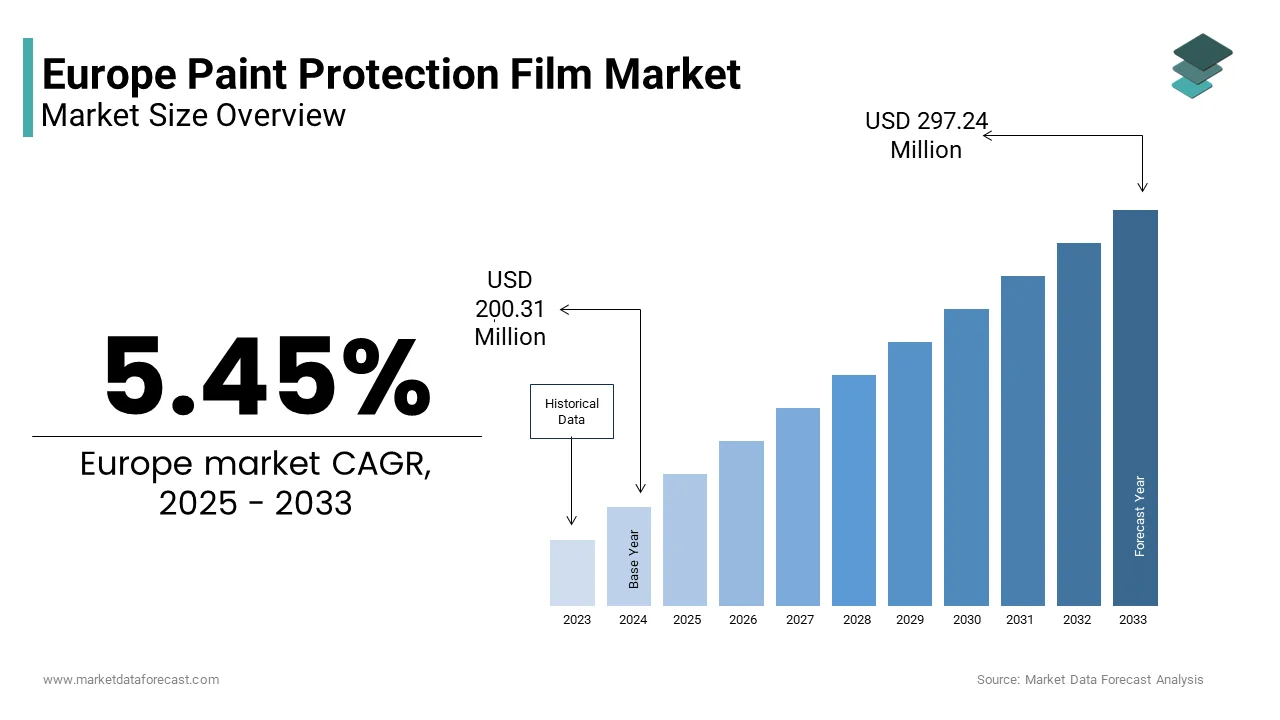

The Europe Paint Protection Film Market size was valued at USD 189.92 million in 2024 and is anticipated to reach USD 200.31 million in 2025 to USD 297.24 million by 2033, growing at a CAGR of 5.45% during the forecast period from 2025 to 2033.

Paint protection film (PPF) is a thermoplastic urethane-based transparent layer applied to vehicle exteriors to shield paint surfaces from stone chips, scratches, chemical etching, and environmental contaminants. In Europe, the market has evolved from a niche luxury accessory to a mainstream automotive care solution, driven by rising vehicle ownership, aesthetic consciousness, and the growing prevalence of high gloss and soft paint finishes that are more prone to damage. The technology now incorporates self-healing topcoats, hydrophobic properties, and UV resistance to prevent yellowing, critical in regions with intense sunlight like Southern Europe. Passenger car production is a significant activity within Europe’s automotive sector. The premium and electric vehicle segments increasingly incorporate paint protection film (PPF) as an additional service. Significant quantities of road salt are used across Northern and Central Europe. This road salt usage may contribute to corrosion and surface degradation on vehicles that lack protective measures. These environmental and automotive trends, though not direct market metrics, create a behavioral and operational foundation where paint preservation is no longer optional but integral to vehicle lifecycle management, resale value retention, and brand image in Europe’s discerning automotive culture.

MARKET DRIVERS Premium and Electric Vehicle Proliferation Drives Professional PPF Adoption

The rapid expansion of premium and electric vehicle segments across Europe is a primary driver of the Europe paint protection film market. These vehicles feature delicate paint systems and high residual values that justify protective investment. Registrations of premium brands have increased in Western Europe. Electric vehicles, in particular, often use softer water-based paints to reduce volatile organic compound emissions during manufacturing, making them more susceptible to marring and chemical staining. Electric vehicle (EV) paint systems may exhibit lower scratch resistance compared to conventional finishes. Consequently, dealerships in several European countries are now offering paint protection film (PPF) as a standard or optional add-on for new EV deliveries. Additionally, luxury automakers have collaborated with PPF manufacturers to develop approved films. This alignment between vehicle technology, consumer expectations, and dealer monetization strategies has institutionalized PPF as a critical post-purchase service in Europe’s evolving automotive ecosystem.

Rising Emphasis on Vehicle Resale Value and Aesthetic Maintenance

European consumers are increasingly viewing PPF as a long-term investment in vehicle preservation and residual value, which in turn accelerates the expansion of the Europe paint protection film market. This is particularly the case in markets with high used car transaction volumes and stringent appearance standards. The average age of passenger cars is increasing in some regions, reflecting extended ownership cycles. The surface condition of a vehicle can impact its trade-in or resale value. Vehicles with professionally installed protective film may show differences in market valuation compared to those without such protection, potentially depending on mileage and model characteristics. This trend is especially pronounced in Germany and Switzerland, where meticulous vehicle upkeep is culturally ingrained and certified PPF installation is often verified during pre-purchase inspections. Furthermore, the rise of online vehicle evaluations, where high-definition photos determine perceived condition, amplifies the importance of flawless paint. As a result, PPF has shifted from cosmetic enhancement to a financial safeguard, embedding itself in the lifecycle economics of vehicle ownership across affluent European markets.

MARKET RESTRAINTS High Installation Cost and Limited Skilled Application Network

High upfront cost of professional installation and the scarcity of certified applicators capable of delivering seamless and bubble-free coverage, especially on complex modern vehicle geometries, restrain the growth of the Europe paint protection film market. The cost associated with a complete vehicle PPF application tends to vary across Western Europe. This particular price range presents a barrier to widespread consumer adoption, despite increasing public interest. A limited number of repair centers across the EU hold credentials for PPF installation. A significant majority of these certified locations are situated in a few specific countries within the region. This geographic imbalance leaves Southern and Eastern European consumers with limited access to qualified services, forcing reliance on untrained installers whose poor workmanship, such as edge lifting or improper trimming, can damage paint and void film warranties. The market is constrained by a lack of human capital, specifically due to the absence of scalable training programs and standardized certification processes, which limits volume growth and reinforces the idea of PPF as an exclusive service rather than an accessible one.

Lack of Harmonized Performance Standards and Durability Claims

Lack of unified regulatory or industry-wide standards for performance validation obstructs the expansion of the Europe paint protection film market. This leads to inconsistent product claims and consumer confusion regarding longevity, self-healing capability, and chemical resistance. While ISO 20566 outlines test methods for automotive clear films, it is not mandatory, and manufacturers often use proprietary benchmarks that are not independently verified. Consumer agencies have noted an increase in complaints regarding paint protection films (PPF) that fail prematurely, such as yellowing or delaminating, despite being marketed with long-term guarantees. The absence of a CE marking requirement for PPF—since it is classified as an accessory rather than a safety component—further exacerbates the lack of oversight. Durability testing standards are applied in the United States to assess the quality of these products. European consumers thus face a fragmented landscape where advertised benefits. The market’s vulnerability to greenwashing and inconsistent quality, which erodes consumer confidence and impedes widespread adoption, will persist until the European Committee for Standardization implements mandatory performance disclosure protocols.

MARKET OPPORTUNITIES Integration with Sustainable and Circular Automotive Practices

The emergence of eco-conscious PPF formulations offers a significant opportunity for the Europe market to align with the EU’s circular economy and chemical safety mandates, which is driving the growth of the Europe paint protection film market. Leading manufacturers have developed films using bio-based polyurethane resins derived from castor oil and non-halogenated topcoats that eliminate perfluorinated compounds, substances restricted under REACH due to environmental persistence. The amount of material sourced from biological origins within high-performance films is increasing. Besides, several European PPF brands now offer take-back programs where removed films are collected, cleaned, and repurposed into acoustic insulation for automotive interiors, reducing landfill burden. A recent industry collaboration demonstrated promising rates for recovering used film materials. Sustainable PPF will become a compliance essential rather than a unique selling point once the EU mandates digital product passports and material traceability for vehicles. This opens up lucrative opportunities in European corporate fleets, EV OEMs, and eco-certified dealerships.

Expansion into Commercial and Fleet Vehicle Applications

The adoption of paint protection film in commercial and fleet vehicle segments, beyond just passenger cars, where appearance and maintenance costs directly impact efficiency and brand perception, creates fresh prospects for the expansion of the Europe paint protection film market. Delivery vans, luxury taxi fleets, and rental car companies are increasingly applying PPF to high-wear zones such as front bumpers, hoods, and door edges to reduce repainting expenses and downtime. Premium rental car fleets in some European markets are adopting partial paint protection film (PPF) coverage. This adoption of PPF coverage contributes to a reduction in refurbishment costs per vehicle. Similarly, logistics firms have trialed PPF on electric delivery vans in urban centers to protect against curb rash and graffiti, which are common in dense city environments. Lifecycle analyses suggest that fleet PPF installations generally achieve a payback within a little over a year. So, the commercial segment offers a scalable, cost-justified avenue for PPF penetration beyond individual car owners.

MARKET CHALLENGES Counterfeit and Gray Market Film Infiltration

A growing influx of counterfeit and unauthorized gray market products that mimic premium brands but lack performance integrity damages consumer trust and installer reputations, thereby challenging the growth of the Europe paint protection film market. These films often use low-grade thermoplastic polyolefin instead of aliphatic polyurethane, resulting in rapid yellowing, poor adhesion, and irreversible paint damage upon removal. Online marketplaces amplify the problem. Installers bear the brunt of warranty claims, while consumers face costly paint corrections. Adopting unified enforcement and brand authentication (e.g., QR holograms) is crucial for Europe’s PPF sector to prevent quality decline and attract investment.

Technological Limitations in Extreme Climate Performance

Current PPFs exhibit performance limitations in the continent’s diverse climatic extremes, which constrain reliability and consumer satisfaction in key regions, and thereby hinder the expansion of the Europe paint protection film market. In Northern Europe, prolonged exposure to sub-zero temperatures and road salt causes film embrittlement and edge lifting, particularly on vehicles parked outdoors. Some vehicle protection film (PPF) applications have shown signs of wear or failure following exposure to winter conditions. Conversely, in Southern Europe, intense UV radiation and ambient temperatures accelerate oxidative degradation, leading to yellowing and loss of gloss, issues especially prevalent on white and silver vehicles. A number of tested, commercially available PPFs may experience discoloration or degradation relatively quickly when exposed to accelerated weathering simulations. Additionally, modern ceramic and matte finish paints, popular on premium SUVs, require specialized adhesion promoters that many films lack, which risks delamination during removal. Geographic performance variance will persist until formulations achieve true all-climate resilience, limiting adoption and raising service liabilities across Europe’s diverse automotive markets.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

5.45%

Segments Covered

By Material, End-User, And By Country

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic & Rest of Europe

Market Leaders Profiled

Eastman Chemical Company (U.S.), 3M (U.S.), Hexis S.A.S, XPEL, Inc. (U.S.), AVERY DENNISON CORPORATION (U.S.), Kangde Xin Optical Film Materials (Shanghai) Co., Ltd (China), Renolit SE (Germany), SWM, Inc. (U.S.), Guangdong Mr Film Plastic Industrial Co., Ltd (China), Sunvase (China)

SEGMENTAL ANALYSIS By Material Insights

The Thermoplastic polyurethane (TPU) segment dominated the Europe paint protection film market and captured a substantial share in 2024. The leading position of the TPU segment is credited to superior mechanical and optical properties that align with European consumer expectations for long-term vehicle preservation. Thermoplastic polyurethane (TPU) provides notable elasticity, allowing it to stretch and absorb impacts effectively without cracking, and conform smoothly to intricate automotive shapes. A significant portion of premium paint protection films (PPF) utilize aliphatic TPU because it resists yellowing when exposed to sunlight. Current TPU films feature integrated topcoats that can repair minor surface scratches and swirls at typical temperatures. The material’s compatibility with hydrophobic and anti-contaminant coatings further enhances maintenance ease, reducing washing frequency and chemical exposure. The extended lifespan of modern vehicles increases the need for tough, low-maintenance protection solutions, which firmly positions TPU as the material of choice for everyone from car owners to professional detailers.

The thermoplastic polyurethane is also the fastest-growing segment in the Europe paint protection film market and is projected to expand at a CAGR of 8.43% from 2025 to 2033. The rapid acceleration of the TPU is driven by continuous innovation in bio-based and recyclable TPU formulations that align with EU chemical and circular economy regulations. Leading manufacturers in Europe have introduced paint protection films containing a notable percentage of content derived from bio-based sources like castor oil, which helps reduce dependence on fossil feedstocks while maintaining performance characteristics such as clarity and impact resistance. The production of bio-based polyurethane in Europe is growing, which is establishing scalable raw material channels for sustainable paint protection films. Furthermore, TPU’s thermoplastic nature enables post-use recovery. A pilot program has demonstrated that used paint protection film could potentially be processed and repurposed into other materials, such as acoustic insulation for automotive interiors, showing a significant material recovery potential. Forthcoming mandates requiring material traceability for certain products are expected to further encourage the use of certified sustainable films. The increasing availability of factory-installed PPF on high-end vehicles like those from Porsche and Volvo ensures that eco-compliant TPU, as a superior alternative to legacy materials, will strengthen its position as the industry standard and a primary catalyst for growth.

By End-Use Industry Insights

The automotive segment held the majority share of the Europe paint protection film market. The supremacy of the automotive segment is propelled by the intrinsic link between PPF and vehicle aesthetics, resale value, and paint system vulnerability in modern automobiles. Passenger vehicles are increasingly manufactured with paints susceptible to damage, particularly in the premium and electric vehicle segments. Dealerships in certain regions now routinely offer paint protection film (PPF) as a service, and vehicles with PPF tend to hold greater resale value. Additionally, the cultural emphasis on vehicle upkeep in countries where annual inspections assess paint condition further entrenches PPF as a lifecycle necessity. The automotive sector endures as the definitive heart of Europe’s Paint Protection Film (PPF) industry, driven by high transaction volumes in the used car market and lengthy ownership cycles.

The electronics segment is expected to exhibit a noteworthy CAGR of 9.17% from 2025 to 2033. The swift expansion of the electronics segment is fueled by the rising demand for protective films on high-value consumer devices such as smartphones, tablets, and premium laptops, where screen and chassis scratch resistance directly impacts user satisfaction and brand perception. Many users notice minor scratches on their smartphone screens shortly after purchase, leading manufacturers to investigate the application of protective films during production. Luxury technology companies are incorporating clear protective films on various surfaces, such as speaker grilles and metal casings, to maintain the appearance of their products. Additionally, the growth of smart home devices, such as touch screen thermostats and security panels, creates new demand for anti-fingerprint and UV-stable films that maintain gloss in sunlit interiors. The use of protective films during the assembly and handling stages appears to reduce the number of items rejected due to cosmetic damage. Growth in Europe’s premium electronics market, where design is now a key differentiator, offers high-margin, tech-focused opportunities in this niche segment, independent of the automotive industry.

COUNTRY-LEVEL ANALYSIS Germany Paint Protection Film Market Analysis

Germany dominated the Europe paint protection film market and accounted for a significant share in 2024. The domination of the German market is driven by its concentration of premium and electric vehicle manufacturers and a culture of meticulous vehicle maintenance. Home to BMW, Mercedes-Benz, and Porsche, the country’s automotive ecosystem drives demand for OEM-approved and dealer-installed PPF that meets stringent optical and durability standards. Germany also hosts the highest density of certified PPF installers in Europe, with numerous workshops accredited by major film manufacturers, ensuring consistent application quality. The Federal Motor Transport Authority’s rigorous pre-registration inspections further reinforce the importance of flawless paint. Additionally, Germany’s leadership in sustainable chemistry supports the adoption of eco-friendly TPU films. This blend of industrial scale, technical rigor, and consumer expectation solidifies Germany’s position as Europe’s PPF benchmark.

United Kingdom Paint Protection Film Market Analysis

The United Kingdom was the second-largest country in the Europe paint protection films market and captured a share of 17.7% in 2024. The growth of the UK market is propelled by strong consumer emphasis on vehicle residual value and growing adoption in corporate and rental fleets. Many individuals purchasing pre-owned automobiles consider the quality and condition of the vehicle’s exterior finish to be a major determinant in their decision. The practice of applying paint protection film (PPF) is seen as a means to maintain a vehicle’s value. Vehicle owners are keeping their cars for longer periods, which makes investing in the preservation of the exterior condition a sound economic choice. Luxury car rental providers have started using protective films on parts of their fleets to help keep the vehicles looking new throughout their operational lifecycles. Using these protective measures can help reduce expenses associated with vehicle reconditioning and upkeep. London’s congestion charge and ultra-low emission zone have also spurred uptake among high-mileage urban drivers seeking to protect investment in costly compliance vehicles. With a mature used car market and data-transparent pricing platforms, the UK treats PPF not as a luxury but as a calculated asset management tool.

France Paint Protection Film Market Analysis

France is another key region in the Europe paint protection film market due to urban vehicle density, aesthetic sensibilities, and alignment with luxury automotive and lifestyle brands. In Paris and Lyon, where narrow streets and tight parking increase curb rash risk, PPF adoption among private owners and chauffeur services is notably high. France’s luxury goods heritage extends to automotive care. Brands have partnered with French detailers to offer bespoke PPF services that include hand-finished edges and custom pattern cutting for rare models. Besides, the government’s incentives for EV adoption have increased fleet registrations of high gloss white and silver vehicles, colors particularly prone to visible marring, amplifying protective film demand. This cultural and regulatory confluence positions France as a style-driven yet technically demanding PPF market.

Italy Paint Protection Film Market Analysis

Italy is steadily growing in the Europe paint protection film market because of a deep appreciation for automotive design and rapid adoption of advanced film technologies. Italian consumers prioritize the preservation of unique paint finishes, driving demand for optically neutral, non-yellowing TPU films. Italy also hosts a vibrant network of artisanal installers in Milan and Bologna who specialize in hand-tailored applications for complex carbon fiber and sculpted bodywork, setting regional benchmarks for craftsmanship. The country’s vulnerability to coastal salt and Alpine Road grit further justifies protective investment, particularly in seasonal vehicle usage patterns. Moreover, Italian film converters have pioneered UV-stable topcoats specifically formulated for Mediterranean sunlight intensity, enhancing product differentiation. With design integrity as a core value, Italy treats PPF as an extension of automotive artistry rather than mere protection.

Switzerland Paint Protection Film Market Analysis

Switzerland is likely to grow in the Europe paint protection film market from 2025 to 2033, owing to its exacting standards in vehicle upkeep and exceptionally long ownership cycles. Swiss consumers view PPF as a lifetime investment, often reinstalling films during repaints or reselling vehicles with certification of professional application. Luxury brands include PPF in their Swiss delivery packages as standard, reflecting dealer recognition of local expectations. Additionally, the country’s strict environmental regulations favor TPU films that are free of halogenated solvents and compatible with recycling streams, aligning with national sustainability goals. Certified installers undergo rigorous training in pattern accuracy and edge sealing, ensuring flawless results that meet Swiss precision norms. Switzerland is a prime example of a premium, quality-focused Paint Protection Film (PPF) market, where a population with high disposable income, an inclination to keep vehicles long-term, and a cultural aversion to cosmetic damage mean performance and durability are valued more highly than initial cost.

COMPETITIVE LANDSCAPE

Competition in the Europe paint protection film market is characterized by a blend of global material science leaders and regionally focused innovators vying for premium positioning rather than price. Differentiation hinges on optical clarity, durability under extreme climates, and compatibility with modern automotive paint systems, including soft water-based and matte finishes. Leading firms such as XPEL, 3M, and Hexis compete through proprietary formulations, digital pattern accuracy, and installer certification ecosystems that ensure flawless application. The absence of harmonized EU performance standards creates both opportunity and risk as brands make unverified claims about longevity and self-healing capabilities. Consumer trust is further challenged by counterfeit films and unqualified installers, particularly in Southern and Eastern Europe. As sustainability regulations tighten and vehicle electrification accelerates, demand for protective solutions competition increasingly centers on innovation, transparency, and integration with OEM value chains rather than volume alone.

KEY MARKET PLAYERS

A major market player for a long time

Eastman Chemical Company (U.S.) 3M (U.S.) Hexis S.A.S XPEL, Inc. (U.S.) AVERY DENNISON CORPORATION (U.S.) Kangde Xin Optical Film Materials (Shanghai) Co., Ltd (China) Renolit SE (Germany) SWM, Inc. (U.S.) Guangdong Mr Film Plastic Industrial Co., Ltd (China) Sunvase (China) Top Players In The Market XPEL Technologies Corp is a global leader in automotive surface protection with a strong foothold in the Europe paint protection film market. The company supplies advanced thermoplastic polyurethane films featuring self-healing topcoats and hydrophobic technology tailored for European vehicle models and climate conditions. XPEL’s proprietary Design Access Program provides pre-cut patterns for most Europeanmakess,,s, including Pors BMWvo,,o ensuring precise fitment and reduced installation time. These initiatives reinforce XPEL’s global reputation for innovation while aligning with EU sustainability directives and premium automotive trends. 3M Company is a multinational science and technology enterprise with a long-standing presence in the Europe paint protection film market through its Scotchgard brand. The company leverages its materials science expertise to develop high clarity aliphatic polyurethane films that resist yellowing and maintain gloss under intense UV exposure common in Mediterranean regions. 3M’s global R&D infrastructure enables rapid adaptation to new automotive paint systems, including ceramic and matte finishes. The company also launched a digital training platform for installers to standardize application quality across diverse markets. These actions strengthen 3M’s role as a trusted supplier in both OEM and aftermarket channels. HexisS.A.S..S.. is a French specialty film manufacturer that has emerged as a key European player in the paint protection film segment through localized innovation and vertical integration. The company produces high-performance PPF at its ISO certified facility in France using proprietary polyurethane formulations designed for Europe’s climatic and regulatory environment. Hexis emphasizes sustainability by eliminating halogenated solvents and developing recyclable film structures compliant with REACH. The company also expanded partnerships with European luxury car dealers and fleet operators to offer factory-aligned protection programs. These initiatives position Hexis as a regionally rooted yet globally competitive PPF provider. Top Strategies Used By The Key Market Participants

Key players in the Europe paint protection film market iibio-basanhalogen-freeee film formulations to comply with EU chemical regulations and circular economy goals. They develop extensive digital pattern libraries for pre-cut filming across diverse European vehicle models. Companies expand certified installer networks and offer standardized technical training to ensure consistent application quality and brand integrity. Strategic partnerships with premium automotive dealers and fleet operators embed PPF into factory or delivery packages. Additionally, firms enhance transparency through QR-code authentication and digital product passports to combat counterfeiting and support upcoming EU traceability mandates. These strategies collectively reinforce regulatory alignment,nt bra tr,usttrustnd service differentiation across Europe’s premium automotive care landscape.

MARKET SEGMENTATION

This research report on the Europe paint protection film market is segmented and sub-segmented into the following categories.

By Material

Thermoplastic Polyurethane Polyvinyl Chloride Others

By End-use Industry

Automotive Electronics Others

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe