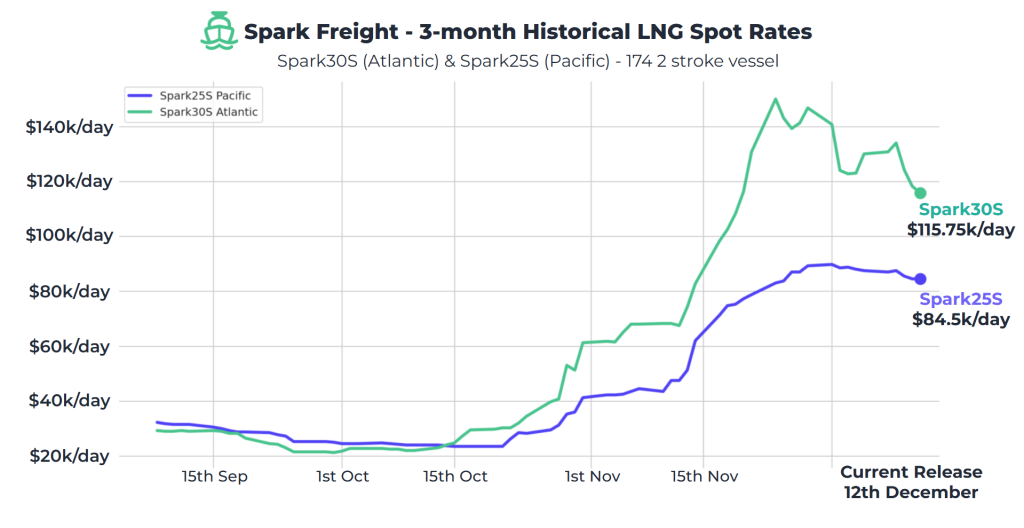

Spark’s data lead, Qasim Afghan, told LNG Prime on Friday that Spark30S (Atlantic) LNG freight rates decreased by $14,250 to $115,750 per day.

Similarly, Spark25S (Pacific) rates dropped by $3,000 to $84,500 per day, he said.

“Activity in the Atlantic remains robust with fresh cargo sales and new requirements emerging almost daily,” Fearnley LNG said in its weekly LNG report.

The Oslo-based advisory and brokering firm said that prompt tonnage “continues to be tight, keeping December laycan rates firmly in six-figure territory.”

“Further forward, more ships are appearing and some players are showing greater openness to subletting, though limited concluded fixtures means benchmark rates for the second half of January remains unclear,” Fearnley LNG said.

“High production levels and steady FOB sales continue to underpin the basin’s overall strength,” it said.

“In contrast, the Pacific has been notably subdued, with prompt demand quiet and rates largely moving sideways. Only distant requirements in second-half January are under consideration,” Fearnley LNG said.

“The Middle East, however, remains hot, pulling tonnage into the basin, and some owners are considering ballasting even further to West Africa to capture Atlantic-premium earnings,” Fearnley LNG said.

European prices drop

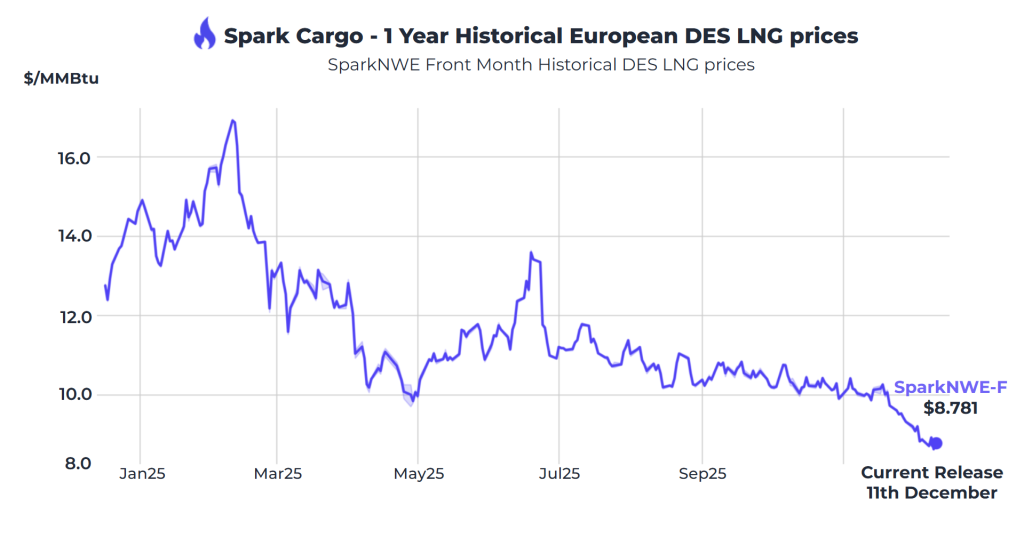

In Europe, the SparkNWE DES LNG decreased compared to last week.

“The SparkNWE DES LNG front-month price for January decreased by $0.046 to $8.781/MMBtu this week, the lowest front-month DES LNG price for NW-Europe since April 2024. The basis to the TTF is assessed at -$0.455/MMBtu,” Afghan said.

“The US front-month arb (via COGH) has widened $0.217 week-on-week, currently pricing in at -$0.305/MMBtu and now more strongly pointing towards Europe. The US front-month arb (via Panama) has narrowed to breakeven levels,” Afghan said.

“Earlier this week, US LNG was closest to shut-in levels for over four years, as the TTF-Henry Hub spread has tightened significantly and Atlantic freight rates rallied over the last two months. Currently, Spark’s Max US Netbacks assessment shows that US LNG exports are valued at only a $2.582/MMBtu premium to the Henry Hub x 115 percent, which is the typical variable cost in long-term contracts, down from a premium of $4.13/MMBtu a month ago,” he said.

Image: Spark

Image: Spark

Data by Gas Infrastructure Europe (GIE) shows that volumes in gas storages in the EU dropped from last week and were 71.29 percent full on December 10, 2025.

Gas storages were 73.85 percent full on December 3, 2025, and 80.89 percent full on December 10, 2024.

JKM

In Asia, JKM, the price for LNG cargoes delivered to Northeast Asia in January 2025 settled at $10.745/MMBtu on Thursday.

Last week, JKM for January settled at 10.880/MMBtu on Friday, December 5.

Front-month JKM dropped to 10.865/MMBtu on Monday, 10.850/MMBtu on Tuesday, and 10.775/MMBtu on Wednesday.

State-run Japan Organization for Metals and Energy Security (Jogmec) said in a report earlier this week that JKM for last week “fell to low-$10s/MMBtu on December 5 from high-$0s/MMBtu the previous weekend.”

“In Northeast Asia, JKM fell for five consecutive days throughout the week due to strong supply driven by increasing US exports. Spot LNG demand in China remained weak due to steady domestic production and pipeline imports. The inventories in South Korea also stayed stable,” Jogmec said.