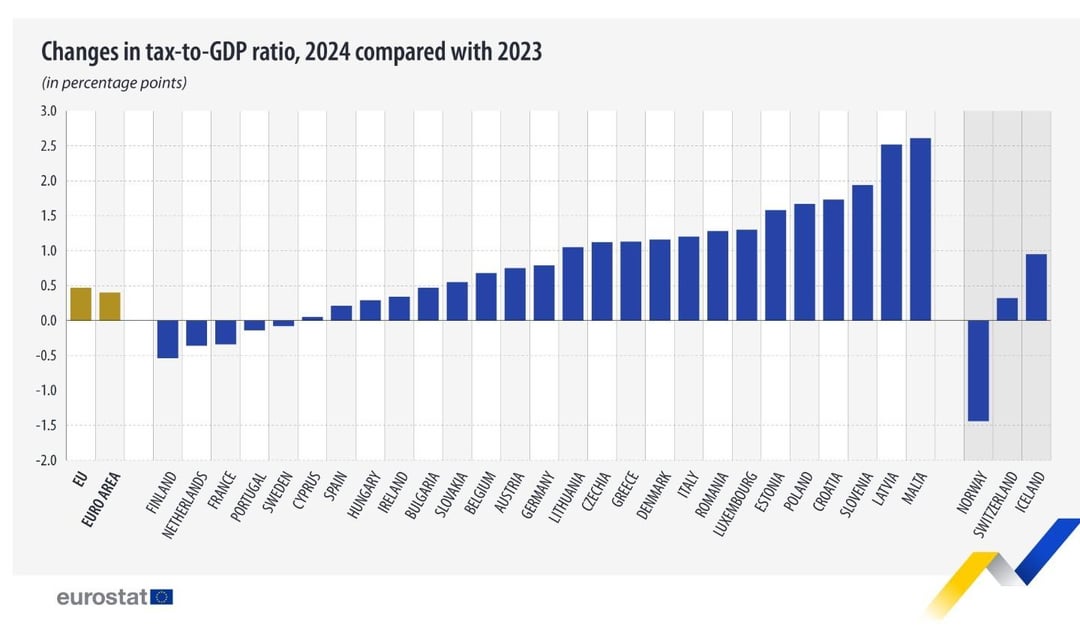

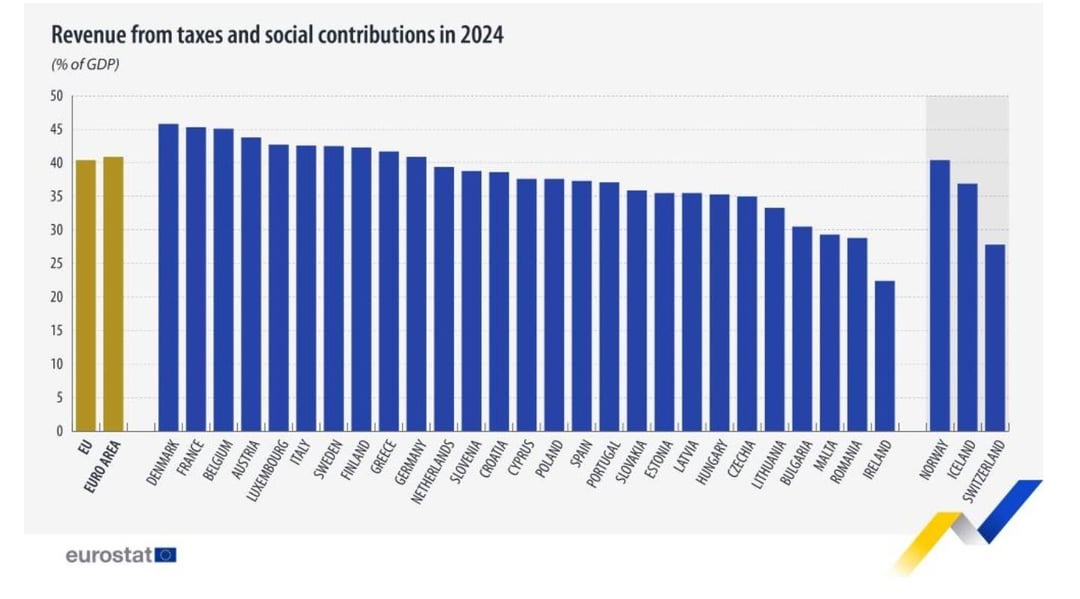

Finland lowers taxes more than any other EU country, the tax-to-GDP ratio being now slightly lower than in Sweden a new Eurostat survey finds

by Single_Share_2439

Finland lowers taxes more than any other EU country, the tax-to-GDP ratio being now slightly lower than in Sweden a new Eurostat survey finds

by Single_Share_2439

8 comments

Source: https://ec.europa.eu/eurostat/en/web/products-eurostat-news/w/ddn-20251031-2

https://preview.redd.it/85satiiyc67g1.jpeg?width=1000&format=pjpg&auto=webp&s=0cf5fc8aa101eb29417698d994b2911f47070946

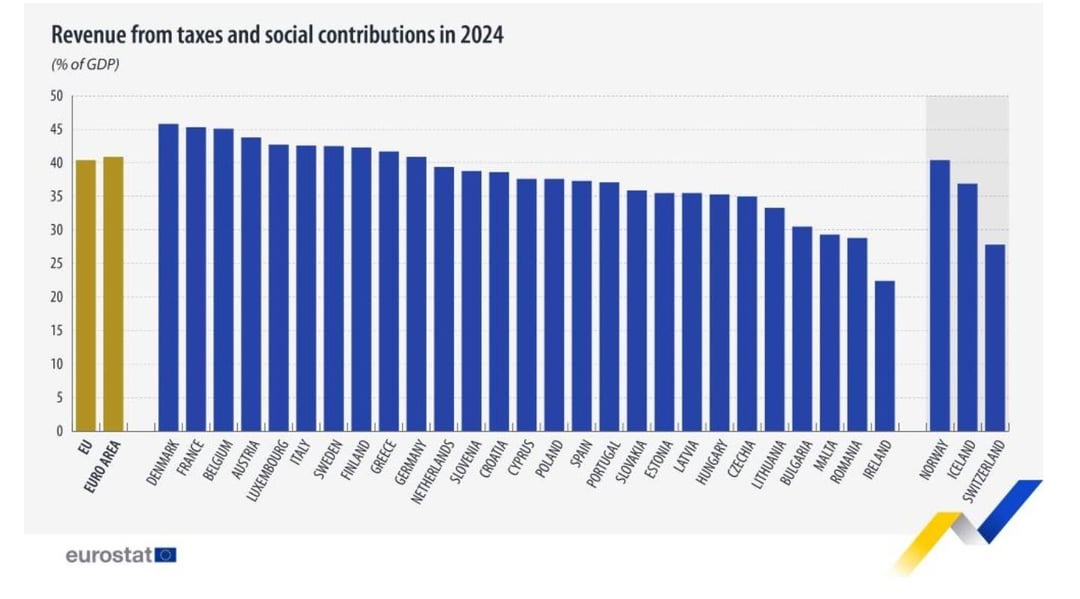

Tax-to-gdp ratio still well above the EU-average. Don’t agree with alot of the decisions made by the current government, but you can’t tax yourself out of a recession either.

Tax-to-GDP ratio lowering does not necessarily mean “Finland lowered taxes more than any other EU country”. It could be so that GDP increased faster than tax revenue.

How about public spending to GDP ratio? That’s the real problem. Out of every 1 EUR earned in Finland it takes 60 cents just to keep the system running? Why people are not rioting over this is beyond me. In Europe only Ukraine spends more in public spending!

Where does it say that taxes are lowered? I think tax contributions are just lower because companies are not making profit and people are unemployed.

keeping in mind that even with this taxes are still way high and public spending as a percentage of GDP is basically the highest in the EU. All this is saying is that the last government was insane and now this is a slight return toward reason.

As a restaurant owner, I’m happy that the tax for food is going down from 14 to 13,5 %. But omg those rounding errors it’s going to produce again as happened with the 25,5 general vat. 🤣

Sweden and Finland are close on the tax revenue to GDP ratio.

Finland’s problem is that 56% of the GDP is generated in the public sector. For Sweden, the same number is 48%. This means that relatively too much of our economy relies on tax revenue.

The percentage difference between Finland and Sweden equals 30b€. A rough estimate for how much Finland’s GDP has to grow without public sector growing is about 50b€ or about 17%. For scale, that equals all of the top 25 biggest Finnish companies doubling their sizes overnight.

Comments are closed.