Published on

December 17, 2025

By: Paramita Sarkar

Tropical North Queensland (TNQ) has set an impressive benchmark in the tourism sector, with international visitor spending soaring to a record $1.1 billion in the year ending September 2025. This remarkable achievement marks an 18.5% year-on-year increase, underscoring the region’s continued recovery and growth in the post-pandemic period. The success has been driven by robust marketing campaigns backed by the Australian Federal Government’s $15 million Tourism Recovery Program.

Tourism Tropical North Queensland (TTNQ) Chief Executive Officer Mark Olsen highlighted the phenomenal growth in international visitation, with a 14.6% increase to 595,000 international visitors compared to the previous year. Alongside the rise in visitor numbers, there was a notable boost in visitor spending, which reflects a shift towards higher-value tourism. The average spend per visitor increased by 3.4% to $1,910, and the average length of stay rose to 9.7 nights, up 0.4 nights from the previous year.

Key International Markets Driving Growth

Several international markets played a pivotal role in this growth, with the United States emerging as TNQ’s largest source of international visitors, followed by significant increases from China, New Zealand, and the United Kingdom. Below is a breakdown of key international markets and their performance for the year ending September 2025.

International Visitor Statistics by Source Market (Year Ending Sept 2025)Source MarketVisitors (YE Sept 2025)% Growth (YoY)Estimated Spend CharacteristicsUnited States94,000+9.2%Largest international source market for TNQChina43,000+62.6%Highest growth rate, aided by Cathay Pacific seasonal flightsNew Zealand40,000+48.3%Strong increase due to new direct Jetstar flights from ChristchurchUnited Kingdom79,000+5.9%Exceeded pre-pandemic (2019) levelsJapan91,000-8.2%Slight decline after being TNQ’s top marketCanada21,000+18.2%Contributed to growth in North America clusterNetherlands16,000+32.7%Significant growth within Continental EuropeGermany29,000-18.7%Decline compared to the previous yearFrance13,000-21.6%Decrease in visitation from France

Source: Tourism Research Australia (TRA), International Visitor Survey (IVS)

As shown in the table, the United States has become the dominant source market for TNQ, surpassing previous top markets like Japan, which experienced a slight decline. The growth from China, with a remarkable 62.6% increase, was fueled by the return of seasonal flights with Cathay Pacific, catering to the influx of travelers for the Chinese New Year period. Meanwhile, New Zealand saw the largest increase in visitor numbers among major markets, growing by 48.3%, thanks to new direct flights from Christchurch launched by Jetstar in April 2025.

Despite the challenges posed by fluctuating travel patterns, markets like the Netherlands showed strong performance with 32.7% growth, helping to offset declines from markets such as Germany and France, which both saw a decrease in visitation.

Regional Aggregates and Market Clusters

Government data also groups these countries into broader regional clusters to track investment effectiveness and tourism outcomes. The regions with the most notable growth are Asia, Continental Europe, and North America, reflecting global trends in tourism recovery. The performance of these clusters for the year ending September 2025 is as follows:Market ClusterVisitors (YE Sept 2025)% Growth (YoY)Asia194,000+17.7%Continental Europe130,000+8.2%North America115,000+10.7%

The Asian market, in particular, led the charge with a 17.7% increase in visitors, driven by China’s explosive growth. North America, bolstered by increased visitation from both the United States and Canada, grew by 10.7%, further cementing the importance of these markets to TNQ’s tourism economy.

Key Expenditure & Stay Metrics

The growth in international visitors also led to impressive increases in visitor spending. TNQ saw a total international spend of $1.1 billion, which is an 18.5% increase compared to the previous year. The region’s average spend per visitor was recorded at $1,910, reflecting the high-value nature of the visitors attracted to the region.

Here are the key expenditure and stay metrics for the region:MetricTNQ Result (YE Sept 2025)Growth / ComparisonTotal International Spend$1.1 Billion+18.5% increase YoYAverage Spend per Visitor$1,910+3.4% increase YoYTotal Visitor Nights5.8 Million+19.9% increase YoYAverage Length of Stay9.7 NightsIncreased by 0.4 nightsAvg. Daily Spend (Int’l)~$197 per nightCalculated based on total nights/spend

This table further emphasizes the high-value tourism that TNQ is attracting, with visitors staying longer and spending more per night. On average, visitors spent about $197 per day, significantly contributing to the local economy. This indicates that Tropical North Queensland has become a prime destination for longer-term, high-spending tourists, and highlights the success of the region’s marketing efforts.

Domestic Tourism Growth and Economic Impact

In addition to the international tourism boom, Tropical North Queensland has also seen strong growth in domestic tourism. According to recent government records from the Domestic Tourism Survey, TNQ has recorded a domestic expenditure of $2.4 billion, with $2.2 billion generated from overnight stays and $191.6 million from day trips. This makes TNQ a key player in Queensland’s tourism sector, with 8.7% of Queensland’s market share and 7% of the state’s overnight visitors.

The domestic tourism sector has contributed significantly to the local economy, with 1.39 million overnight visitors representing 7% of the state’s total visitors. The average length of stay for domestic visitors was recorded at 4.1 nights, above the Queensland and national averages of 3.6 and 3.4 nights, respectively. This indicates that both international and domestic tourists are attracted to the region for extended stays.

Here are the key domestic tourism figures:MetricTNQ ResultComparisonDomestic Spend per Visitor$1,657Queensland Avg: $1,082 / Australia Avg: $952Total Domestic Spend$2.4 BillionTotal Domestic Overnight Visitors1.39 MillionAverage Length of Stay (Domestic)4.1 NightsQueensland Avg: 3.6 / National Avg: 3.4

Government Investment and Marketing Campaigns

A major driver of this success has been the $15 million Federal Government Tourism Recovery Program, which funded 110 international campaigns in 2024-2025. These campaigns helped attract over 205,000 additional international visitors, contributing directly to the region’s record-breaking tourism performance. This funding also supported the creation of more than 1,500 additional jobs in local communities, strengthening the broader economy.

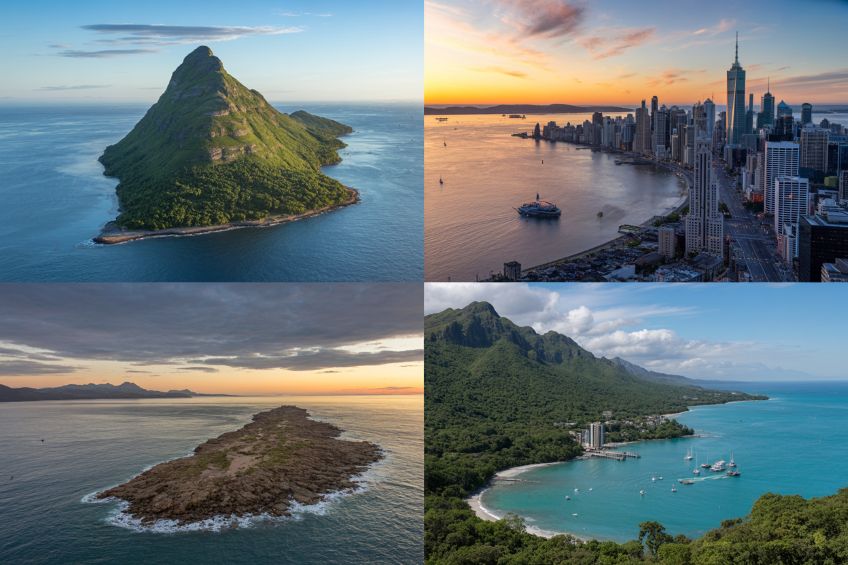

Through targeted international marketing and strategic partnerships with airlines, including the launch of Fiji Airways services, the region has successfully attracted key international markets. The campaigns were designed to highlight TNQ’s unique selling points, such as the Great Barrier Reef, Daintree Rainforest, and rich cultural offerings, appealing to a diverse range of travelers.

Looking Ahead: Sustaining the Growth

With the successful recovery in both international and domestic markets, Tropical North Queensland is poised for sustained growth. The region plans to continue building on these successes by further diversifying its tourism offerings and maintaining strong relationships with key markets, particularly those showing significant growth potential like China, New Zealand, and North America.

The future looks bright for Tropical North Queensland, with tourism continuing to be a critical driver of economic growth and job creation in the region. As the world recovers from the impacts of the pandemic, TNQ remains a key destination for travelers seeking adventure, natural beauty, and a high-quality tourism experience.