사진 확대

사진 확대 Amid a slowdown in global ship orders, liquefied natural gas (LNG) carriers are emerging as key drivers to lead K shipbuilding’s performance. LNG carriers, which are high value-added shipbuilders, are areas where domestic shipbuilders have a competitive advantage due to high technical barriers.

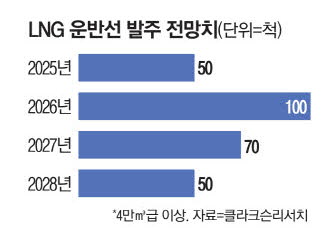

According to Clarkson Research, a British shipbuilding and shipping market analysis agency on the 18th, a total of 50 LNG carriers with 40,000㎥ or higher were ordered this year, but they are expected to reach 100 next year. Approximately 70 orders are expected in 2027. Currently, it is understood that domestic shipbuilders are rapidly increasing their inquiries to find out the terms of the order.

The sentiment of orders felt at the site is also rapidly improving. According to foreign media, Georgios Flebrakis, head of Hanwha Ocean’s European business development, said at the World LNG Summit & Awards in Turkiye, “Interest in building new LNG ships has increased over the past three to four months,” adding, “The delivery slot in 2029 will close quite quickly.” Three Korean shipbuilders, including Hanwha Ocean, HD Korea Shipbuilding & Marine Engineering, and Samsung Heavy Industries, are reportedly completing sales of remaining slots in 2028. It has secured three years’ worth of work, and it is highly likely to lead to securing four to five years’ worth of work.

사진 확대

사진 확대 The surge in demand for LNG carriers is attributed to demand for replacement of old ships and expectations for ultra-large LNG production projects from the United States. Kim Yong-min, a researcher at Yuanta Securities, predicted, “The momentum for ordering LNG carriers that will occur in the U.S., Qatar, and Mozambique in 2026 will be the driving force behind the recovery of the business.”

This year, the shipbuilding industry has continued to perform well thanks to a selection order strategy centered on high-value-added ship types despite sluggish global orders. HD Korea Shipbuilding & Marine Engineering has won a total of 117 ships and $15.62 billion so far this year, meeting 91.5 percent of its annual target ($18.05 billion). Recently, it is known to be pushing for a letter of intent to build eight 174,000㎥ LNG carriers with Japan First, raising expectations for additional orders exceeding $2 billion.

Hanwha Ocean, which does not disclose its order target, achieved 89.8% of last year’s total order of $8.86 billion with 43 ships and $7.96 billion. While Samsung Heavy Industries has secured $6.9 billion (70.4% of its target of $9.8 billion) this year, attention is being paid to winning orders for floating LNG production facilities worth 3 trillion won per unit.

[Reporter Park Seungjoo]

This article has been translated by GripLabs Mingo AI.