Key insights on the natural gas market provided by NGI’s price and data analysts

Expand

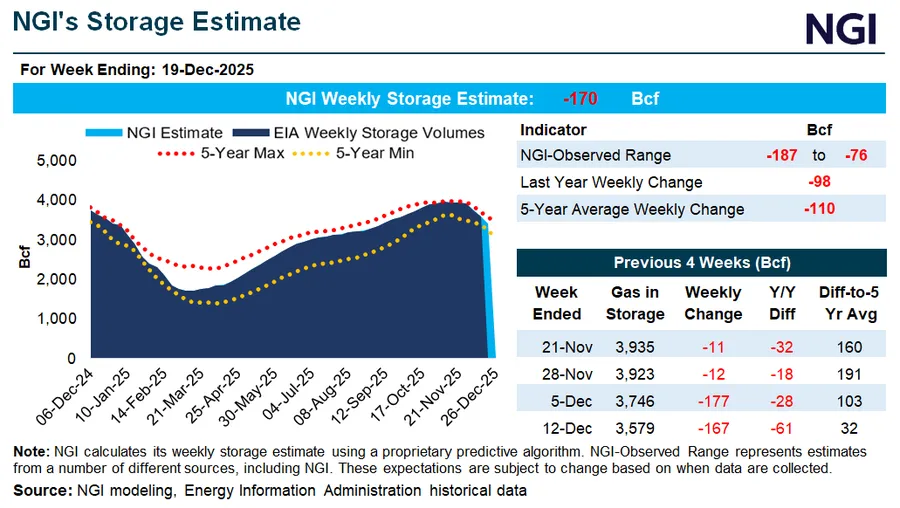

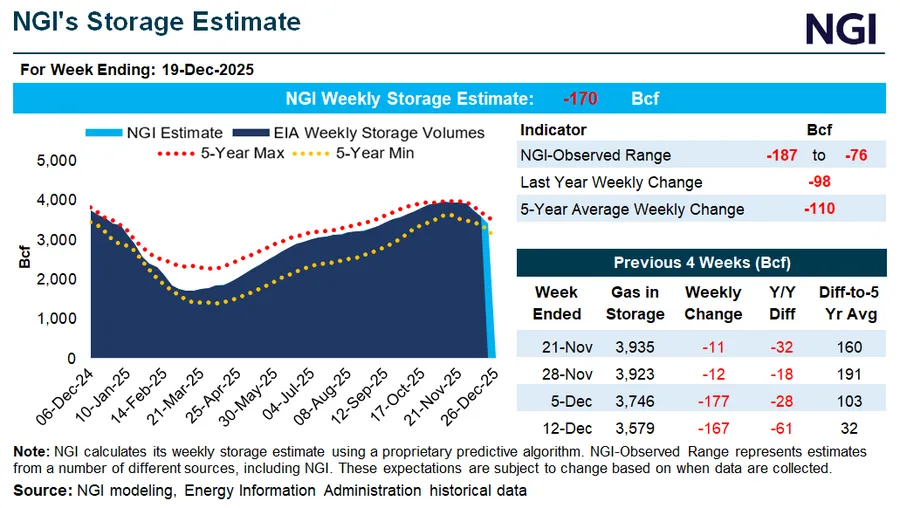

NGI is projecting the latest Lower 48 U.S. Energy Information Administration (EIA) Weekly Natural Gas Storage Report through the week ended Dec. 19 to show a withdrawal of 170 Bcf. Although in line with the previous storage report showing a 167 Bcf pull, 170 Bcf would be significantly higher than the 98 Bcf withdrawal from one year ago. That would increase the storage deficit to last year to minus 133 Bcf from minus 61 Bcf.It’s a similar story versus the previous five-year average, which showed a withdrawal of 110 Bcf. Pulling 170 Bcf out of storage this week would handily wipe out the surplus to last year. That excess currently stands at 32 Bcf but would fall to a deficit of 28 Bcf should NGI’s estimate be exact.A small increase in withdrawals week/week would be in line with the slight 0.8 increase in Lower 48 heating degree days for the week. That helped push gas demand for power generation up 2% week/week, despite a 7% increase in renewable output for the period. Hydroelectric power output was also up 10% for the week.According to Wood Mackenzie data, Lower 48 dry gas production averaged 109.4 Bcf/d last week, down 0.4 Bcf/d from the week prior. Drilling rigs and hydraulic fracturing (frack) spreads across the continental U.S. fell by six and eight respectively, per Baker Hughes Co. and Primary Vision figures, but that type of downturn is not out of the ordinary for this time of year. NGI’s pipeline scrapes showed feed gas deliveries to Lower 48 LNG liquefaction facilities averaged 17.6 Bcf/d, down 0.6 Bcf/d week/week.Because Christmas falls on a Thursday, the next EIA storage report is set to be published on Monday (Dec. 29) at noon ET. New Year’s Day also falls on a Thursday, but the report through Dec. 26 is scheduled to be released on New Year’s Eve.