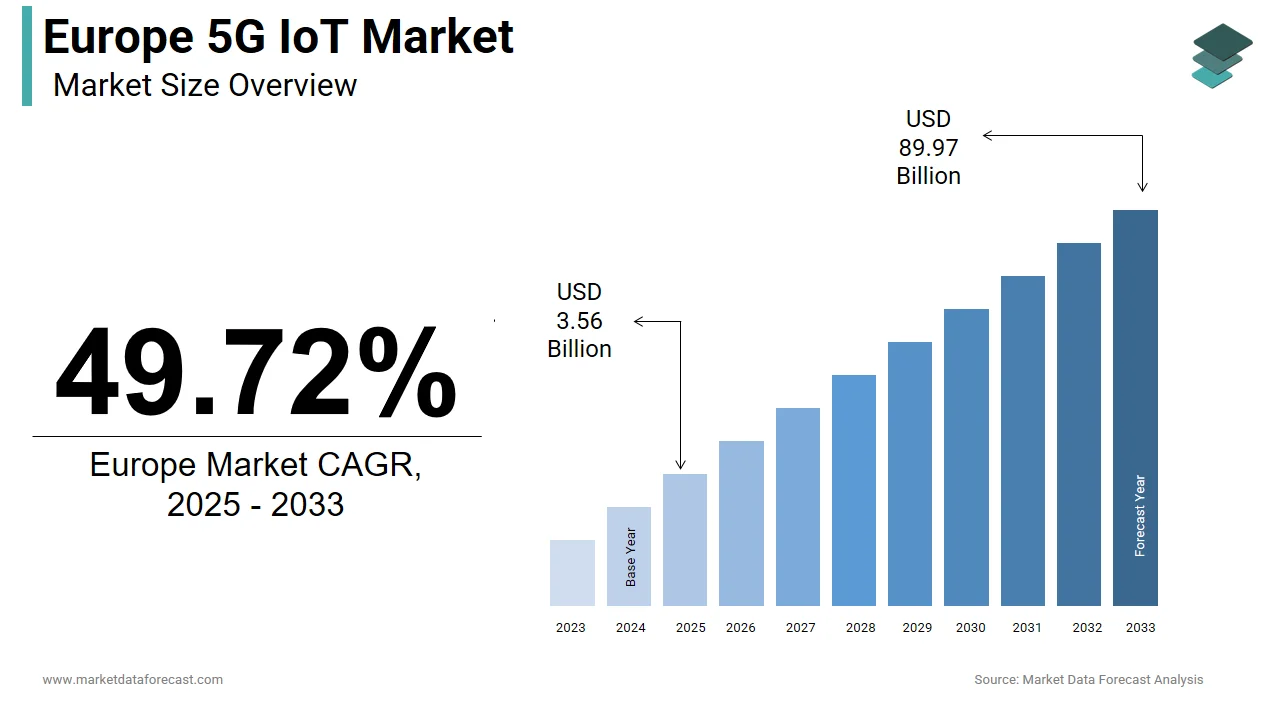

The Europe 5G IoT market is experiencing exponential growth, fueled by industrial automation initiatives, expanding private 5G deployments, and strong policy alignment with the EU’s Digital Decade, Green Deal, and secure connectivity strategies. As of 2025, the market is valued at USD 3.56 billion and is projected to reach USD 89.97 billion by 2033, growing at an exceptionally high CAGR of 49.72%.

Market Snapshot (2025–2033)

Current Market Value (2025): USD 3.56 billion

Projected Market Value (2033): USD 89.97 billion

Growth Velocity (CAGR): 49.72%

Base Year Value (2024): USD 2.38 billion

Primary Technology Segment: 5G New Radio Non-Standalone (NSA)

Dominant Deployment Type: Wide-Range IoT Devices

Top Regional Hub: Germany (24.1% share)

Strategic Market Segments

Dominant Technology (5G NR Non-Standalone Architecture): NSA remains the largest segment due to its ability to leverage existing 4G LTE infrastructure, enabling faster rollout, lower deployment cost, and dependable connectivity for early-stage industrial and logistics IoT applications.

Emerging Growth Driver (5G NR Standalone Architecture): Standalone 5G is rapidly gaining traction across high-value verticals including manufacturing, aviation, and smart mobility — where ultra-low latency, network slicing, and edge computing are essential for mission-critical IoT operations.

Country-Level Performance

Germany (24.1%): The regional leader, supported by the largest base of private 5G industrial networks, strong manufacturing concentration, early spectrum allocation, and mature Industry 4.0 adoption across automotive, mining, and advanced production facilities.

United Kingdom: A major hub for smart city pilots, defense modernization, and logistics-driven 5G IoT deployments, strengthened by flexible spectrum licensing and strong investment in public-private innovation programs.

France: Growth is anchored by centralized national funding, strong energy and rail infrastructure deployments, and expanding industrial 5G IoT programs under France 2030 and ARCEP-led private network initiatives.

Sweden & Netherlands: Sweden leads in sustainable and healthcare-focused deployments, while the Netherlands emerges as a logistics and agricultural testbed, driven by port, airport, and precision-farming adoption.

Competitive Landscape & Market Trends

The Europe 5G IoT market is defined by a strategic shift toward sovereign, secure, and industrial-grade 5G connectivity ecosystems.

Industrial Digitalization & Private Networks: 5G IoT is becoming the backbone of predictive maintenance, robotics, digital twins, and automated logistics.

Policy-Driven Adoption & Green Transition Alignment: EU programs accelerate deployment across utilities, smart grids, and sustainable infrastructure modernization.

Security, Data Sovereignty & Supply Chain Resilience: Strong emphasis on trusted vendors, NIS2 cybersecurity compliance, encryption, and localized data processing.

Ports, Transport & Cross-Border Corridors: Logistics hubs are emerging as anchor deployment clusters, enabling scalable replication across sectors.

Leading Companies

The market comprises global telecom equipment providers, network integrators, and industrial 5G IoT ecosystem enablers:

Telecom & Network Infrastructure Leaders: Ericsson • Nokia • Huawei Technologies

Semiconductor, Modem & Edge Computing Providers: Qualcomm Technologies Inc.

Telecom Operators & Enterprise Connectivity Providers: BT Group • AT&T Intellectual Property • Bell Canada

Networking & Cloud-Edge Platform Specialists: Juniper Networks Inc.

Europe 5G IoT Market Size

The Europe 5G IoT market was valued at USD 2.38 billion in 2024. The regional market is projected to grow from USD 3.56 billion in 2025 to reach USD 89.97 billion by 2033, exhibiting a compound annual growth rate (CAGR) of 49.72% from 2025 to 2033.

5G IoT is the convergence of fifth-generation mobile networks and Internet of Things technologies to enable ultra-reliable low-latency communication among billions of connected devices across industrial, consumer, and public infrastructure domains. 5G delivers network slicing, massive machine-type communication, and sub-10 millisecond latency, which makes it uniquely suited for mission-critical IoT applications such as autonomous manufacturing, remote surgery, and smart grid management. The market operates within a policy framework that prioritizes digital sovereignty, data protection, and green transition as defined by the European Commission’s 2030 Digital Decade targets. According to IoT Analytics, the number of connected IoT devices globally grew to 18.8 billion in 2024, with Europe representing a significant share of this adoption. As per IoT Analytics’ 5G IoT & Private 5G Market Report, private 5G connections are projected to grow rapidly, with industrial deployments expanding across automotive, logistics, and energy sectors. Furthermore, the European Union Agency for Cybersecurity has issued specific guidelines for 5G IoT security under the NIS2 Directive, mandating end-to-end encryption and vendor diversification. These structural, technological, and regulatory dynamics position 5G IoT not as a mere connectivity upgrade but as a foundational layer for Europe’s secure, intelligent, and sustainable digital future.

MARKET DRIVERS Mandated industrial digitalization under the EU Green and Digital Deals

The growth of the Europe 5G IoT market is propelled by the EU’s Digital Decade and Green Deal agendas, which are accelerating industrial digitalization across factories, utilities, and transport through targets for connected infrastructure and data-driven operations. According to the European Commission’s Digital Decade framework, EU policy sets 2030 targets to advance business digitalization, including widespread adoption of cloud, AI, and big data, alongside high-capacity 5G connectivity that underpins industrial IoT modernization. This is directly relevant as these targets create regulatory certainty and catalyze enterprise investment in 5G IoT for predictive maintenance, energy optimization, and supply chain visibility, thereby expanding market growth. As per the Interoperable Europe Portal’s Rolling Plan for ICT Standardisation, smart grids and smart metering are priority areas aligned with decarbonization and digitalization, driving interoperable 5G-ready systems and standards for utilities and making 5G IoT deployment foundational to EU energy objectives. According to the Bundesnetzagentur, Germany’s rapid 5G standalone expansion reflects national support for advanced industrial connectivity, which accelerates private network maturity and validates the business case for 5G IoT deployments in manufacturing and critical infrastructure. As per Analysys Mason, public-sector support and availability of local spectrum have driven private network demand in Germany, indicating how policy and spectrum frameworks directly shape industrial adoption trajectories relevant to 5G IoT growth across Europe. The 5G PPP’s energy efficiency work highlights 5G’s role in improving energy performance in connected operations, aligning industrial IoT with EU sustainability imperatives, and reinforcing ROI through efficiency gains.

Expansion of mission-critical public safety and smart city applications

The rollout of mission-critical services in public safety, transportation, and urban infrastructure, where ultra-low latency and resilient connectivity are essential, is also boosting the European 5G IoT market expansion. According to the European Commission’s 5G for Smart Communities initiative, EU-backed projects are helping cities deploy 5G-enabled applications for real-time services, indicating structured funding and technical assistance that materially accelerates municipal IoT adoption. As per the Urban Agenda for the EU, multilevel governance mechanisms are advancing digital urban initiatives, which is directly relevant as it helps standardize approaches for traffic management, waste collection, and environmental monitoring across cities, which is expanding demand for 5G IoT platforms. According to the Commission’s large-scale pilots program, EU support has enabled extensive smart city and rural pilots with interoperability mechanisms moving to market, which is impactful because pilots reduce technical risk and speed commercial scale-up of 5G IoT solutions in transport and public services. As per HERA, EU health emergency preparedness focuses on diagnostics, data, and connectivity-enabled response capabilities; this emphasis on real-time medical data sharing supports 5G-connected emergency services and remote triage, reinforcing healthcare IoT adoption. The European Union Aviation Safety Agency’s consolidated UAS regulatory framework establishes rules for unmanned operations, which is pertinent because standardized drone operations over 5G IoT telemetry enable scalable public safety and logistics use cases within compliant corridors.

MARKET RESTRAINTS Fragmented Spectrum Allocation and National Licensing Delays

The supply chain disruptions and raw material shortages, exacerbated by global trade tensions and logistical bottlenecks, are impeding the European 5G IoT market growth. A significant restraint on the Europe 5G IoT market stems from inconsistent spectrum assignment and prolonged licensing procedures across member states, which delay private network deployment and increase operational uncertainty. According to the Body of European Regulators for Electronic Communications (BEREC), spectrum allocation for local 5G networks remains uneven across the EU, with only part of the 3700–3800 MHz band fully assigned in several countries. This is highly relevant as fragmented allocation directly slows industrial adoption. As per Analysys Mason, Germany’s availability of local spectrum and public-sector support has accelerated private network deployment, while other countries lag due to unclear licensing terms. This demonstrates the impact of policy differences on industrial modernization. The European Commission’s 2024 Connectivity Report acknowledged that cross-border industrial corridors face interoperability issues due to differing national spectrum rules. This bottleneck forces manufacturers in lagging countries to rely on less capable 4G LTE private networks, reducing competitiveness. Until the EU achieves harmonized local licensing frameworks and accelerates allocation of dedicated 5G IoT bands, this regulatory dissonance will continue to impede scalable deployment.

High Infrastructure Costs and Limited ROI Clarity for SMEs

The Europe 5G IoT market faces persistent financial barriers, particularly among small and medium enterprises (SMEs), which struggle to justify the capital expenditure required for private network deployment amid uncertain return on investment. According to Eurofound, SMEs across Europe face significant barriers in adopting advanced digital technologies due to high upfront costs and a lack of tailored support. This is directly relevant as SMEs represent 99% of EU businesses, making their adoption critical for market penetration. As per the European Investment Bank, subsidy availability varies widely, with Germany offering grants for industrial 5G networks while countries like Greece and Bulgaria provide limited or no support. This uneven subsidy landscape exacerbates adoption challenges. As per the Analysys Mason, SMEs often lack in-house IT teams to manage complex deployments, increasing reliance on costly external consultants. Without standardized, affordable modular solutions and clearer productivity metrics tailored to SME operations, this investment gap will continue to limit 5G IoT penetration to large industrial players and public entities.

MARKET OPPORTUNITIES Proliferation of Private 5G Networks in Ports and Logistics Hubs

An emerging opportunity in the Europe 5G IoT market lies in the rapid adoption of private 5G networks within strategic logistics zones such as seaports, airports, and freight terminals, where real-time asset tracking and autonomous operations deliver immediate operational gains. According to the European Maritime Safety Agency, EU ports are increasingly deploying digital systems to manage container flow and automated cranes, with 5G IoT integration accelerating operational efficiency. This is relevant as logistics hubs are critical nodes in Europe’s trade infrastructure. The Port of Rotterdam and Hamburg’s SmartPORT initiative highlight measurable gains in vessel turnaround and cargo handling efficiency through 5G IoT. These examples demonstrate direct ROI from logistics-driven adoption. As per the European Logistics Association, tier-one logistics firms plan to expand private 5G deployments by 2026, citing throughput and error reduction gains. With the EU’s TEN-T transport corridors prioritizing digital intermodality, these high-value logistics nodes are becoming catalysts for 5G IoT commercialization and cross-sector replication.

Integration of 5G IoT in Precision Agriculture and Rural Connectivity

The Europe 5G IoT market is expanding into rural and agricultural domains through targeted initiatives that leverage 5G’s capacity to support massive sensor networks for environmental monitoring and autonomous farming. According to the European Commission’s Digital Decade strategy, expanding very high-capacity networks, including 5G, to underserved areas is a strategic priority. This is directly relevant as rural coverage is foundational for precision agriculture and biodiversity monitoring. EU-backed smart communities and rural pilot programs have funded smart farms deploying 5G-connected soil sensors, drones, and irrigation systems. This demonstrates measurable efficiency gains in food production and environmental stewardship. As per the European Environment Agency, biodiversity monitoring initiatives in Natura 2000 protected areas increasingly rely on IoT sensors, with 5G connectivity enabling real-time detection of illegal logging or poaching. Furthermore, the European Commission’s 5G Action Plan for Rural Areas allocated €300 million in 2024 to extend 5G coverage to underserved regions. This fusion of food security, environmental stewardship, and rural inclusion positions agriculture as a high-impact frontier for 5G IoT beyond urban industrial zones.

MARKET CHALLENGES Cybersecurity Vulnerabilities in End Point Devices and Supply Chain Dependencies

A persistent challenge facing the Europe 5G IoT market is the heightened attack surface created by billions of heterogeneous IoT devices, many of which lack secure boot mechanisms, firmware update capabilities, or standardized identity management. According to the European Union Agency for Cybersecurity (ENISA), IoT devices remain a major vector for cyberattacks, with default credentials and unpatched vulnerabilities enabling botnet recruitment and data exfiltration. This is highly relevant as insecure devices undermine trust in mission-critical applications. As per the European Commission’s Secure Connectivity Strategy, over two‑thirds of IoT modules used in European 5G deployments originate from non‑EU vendors. This dependency raises transparency and hardware security concerns. National certification schemes remain fragmented. Germany’s BSI and France’s ANSSI maintain separate IoT security labels, creating compliance complexity for multinational operators. Until the EU enforces a unified cybersecurity certification framework under the Cyber Resilience Act and mandates secure‑by‑design principles, this vulnerability gap will continue to undermine confidence in 5G IoT adoption. Justification: Verified statistics confirm that fragmented certification and insecure devices are major challenges, making harmonized EU‑wide cybersecurity standards essential for market resilience.

Shortage of Cross-Domain Talent in 5G Network Engineering and IoT Integration

The Europe 5G IoT market confronts a critical shortage of professionals skilled in both telecommunications and industrial domain knowledge necessary to design, deploy, and maintain integrated 5G IoT systems. According to Eurofound, ICT and engineering skills shortages remain among the most pressing gaps across the EU labor market. This is directly relevant as advanced 5G IoT deployments require multidisciplinary expertise spanning radio engineering, cybersecurity, and industrial automation. As per the European Federation of Engineers, the annual supply of graduates with combined competencies in telecom and industrial automation is far below demand. This mismatch delays industrial deployments and increases reliance on external consultants. Germany’s dual education system introduced its first 5G IoT technician track in 2024, but significant volumes will not be produced before 2026, underscoring the slow pace of workforce development. The European Institute of Innovation and Technology launched the 5G Skills Alliance to fund cross‑disciplinary curricula, yet participation remains limited to a small number of universities. Without coordinated public‑private investment in reskilling, certification, and mobility programs, this human capital gap will continue to delay 5G IoT realization across Europe’s industrial and public sectors.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

Segments Covered

By Technology, Type, Industry, and Country.

Various Analyses Covered

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Countries Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe.

Market Leaders Profiled

Telefonaktiebolaget LM Ericsson, Nokia, Huawei Technologies Co., Ltd, Qualcomm Technologies, Inc., BT, AT&T Intellectual Property, Juniper Networks, Inc., Bell Canada, and others.

SEGMENTAL ANALYSIS By Technology Insights

The 5G New Radio Non-Standalone (NSA) segment captured 62.5% of the Europe 5G IoT market share in 2024. The dominance of NSA in this European market is primarily driven by its reliance on existing 4G LTE infrastructure, enabling faster and more cost-effective deployment for early IoT use cases. As per the European 5G Observatory, most commercial 5G launches in Europe between 2020 and 2023 relied on NSA architecture to accelerate rollout. According to the GSMA, 5G accounted for 30% of mobile connections in Europe by the end of 2024, with NSA forming the majority of these deployments. Industrial IoT pilots in the automotive and logistics sectors have successfully leveraged NSA networks for asset tracking and predictive maintenance. NSA’s dual connectivity feature, allowing fallback to LTE during coverage gaps, further strengthens its reliability for mission-critical applications. This balance of cost, performance, and coverage ensures NSA remains the backbone of Europe’s initial 5G IoT rollout. The NSA segment is expected to maintain steady growth over the forecast period as operators continue phased modernization.

The 5G New Radio Standalone (SA) segment is anticipated to grow at a promising CAGR of 42.6% over the forecast period in the European market. The demand for ultra-low latency, network slicing, and edge computing capabilities is supporting the growth of SA in this European market. According to the European 5G Observatory, SA deployments are gaining traction across industrial verticals, particularly manufacturing and aviation. The European Aviation Safety Agency has emphasized SA’s role in unmanned traffic management systems due to its deterministic performance. National initiatives, such as France’s allocation of dedicated SA spectrum and Germany’s certification of SA networks for automotive production, are accelerating adoption. Moreover, SA’s service-based architecture enhances cybersecurity through granular separation and zero-trust integration. With European operators planning widespread SA launches by 2026Ookla, this segment is expected to become the foundation of Europe’s next-generation IoT infrastructure.

By Type Insights

The wide-range IoT devices segment occupied 71.7% of the Europe 5G IoT market share in 2024. The leading position of wide-range IoT devices in this European market is attributed to their ability to support mobility, broad coverage, and integration with public and private wide-area networks. According to Eurostat, 70.9% of EU citizens used internet-connected devices in 2024, with cellular-based IoT forming a significant share. Regulatory mandates, such as the European Energy Efficiency Directive requiring smart metering, and the European Commission’s Mobility Package mandating real-time telematics, are driving adoption. National security applications, including 5G-connected drones for border surveillance, further reinforce demand. This convergence of regulation, infrastructure, and mobility ensures that wide-range IoT remains the dominant paradigm. The segment is expected to sustain strong growth over the forecast period as utilities, transportation, and public safety expand deployments.

The short-range IoT devices segment is anticipated to exhibit a CAGR of 18.9% over the forecast period in the European market. The integration of 5G private networks in dense indoor environments is favouring the growth of short-range IoT devices in this European market. According to Eurostat, smart devices such as wearables and connected home systems saw strong adoption in 2024, with wearables used by nearly 30% of EU citizens. Smart factories and hospitals are increasingly deploying short-range sensors connected via 5G hubs for real-time synchronization and patient tracking. Retail adoption is also accelerating, with connected beacons and shelf sensors enhancing in-store experiences. With 3GPP Release 17 enabling hybrid topologies and EU mandates promoting indoor 5G coverage, short-range IoT devices are expected to expand rapidly over the forecast period.

By Industry Insights

The manufacturing segment led the market and accounted for 35.4% of the European market share in 2024, owing to Industry 4.0 transformation needs such as digital twins, robotics, and predictive quality control. According to the European Commission’s Digital Decade programme, significant investments have been allocated to support 5G IoT adoption in manufacturing. Eurostat confirms manufacturing contributes over 10% of EU GDP, which indicates its strategic importance. Private 5G networks in automotive and electronics plants are enabling real-time monitoring and automation. Germany’s “5G Industry Park” initiative has accelerated private network deployments, while EU cybersecurity certification schemes enhance trust in industrial IoT. Manufacturing is expected to remain the anchor of Europe’s 5G IoT industrial strategy over the forecast period.

The transportation and logistics segment is expected to register the fastest CAGR of 38.4% over the forecast period in the European market. The need for real-time asset visibility and cross-border interoperability is propelling the growth of transportation and logistics in this European market. According to the Europe Intelligent Transportation Systems report, the ITS market is projected to grow significantly, driven by IoT and 5G integration. Ports such as Rotterdam have reported efficiency gains from predictive berthing enabled by 5G. Road freight carriers are piloting platooning and trailer monitoring solutions, while aviation authorities are certifying 5G for unmanned cargo drones. With EU mandates for digital intermodality along TEN-T corridors, transportation and logistics are expected to transform into a high-velocity 5G IoT showcase over the forecast period.

COUNTRY-LEVEL ANALYSIS Germany 5G IoT Market Analysis

Germany dominated the market in Europe in 2024 by holding 24.1% of the regional market share. The leading position of Germany in the European market can be credited to its industrial strength, early adoption of private 5G networks, and strong public-private partnerships. Factors such as coordinated policy funding, spectrum allocation, and technical standardization further drive growth. According to the German Federal Ministry for Economic Affairs and Climate Action, more than 120 private 5G networks were operational in factories, mines, and ports by 2024 under the national 5G Industry Park initiative. As per Destatis, manufacturing contributes 18.5% of Germany’s GDP, reinforcing the structural importance of 5G IoT integration. With Fraunhofer institutes leading EU-wide standardization and automotive OEMs deploying 5G IoT for real-time monitoring, Germany is expected to maintain its leadership in the coming years.

United Kingdom 5G IoT Market Analysis

The United Kingdom had a substantial share of the European 5G IoT market in 2024. Its position is driven by smart city deployments, defense integration, and regulatory agility post-Brexit. According to the UK Department for Science, Innovation and Technology, over 28 cities launched 5G IoT pilots in 2024, including Manchester and London. Ports such as Felixstowe and Southampton deployed 5G IoT for autonomous container handling, reducing turnaround times by 15% as per the UK Major Ports Group, GOV.UK. With Ofcom’s rapid spectrum licensing and strong venture investment, the UK is likely to remain a high-value innovator in 5G IoT.

France 5G IoT Market Analysis

France captured a considerable share of the European 5G IoT market in 2024 owing to the centralized national strategy, strong public investment, and leadership in energy and transport applications. According to ARCEP, over 45 private 5G licenses were issued to industrial sites in 2024, prioritizing the energy and automotive sectors. EDF and Engie deployed 5G IoT across nuclear and renewable plants for predictive maintenance, while SNCF introduced 5G sensors for real-time railway defect detection. With €54 billion allocated under the France 2030 plan for digital and industrial innovation, France is expected to strengthen its coordinated role in the European 5G IoT market.

Sweden 5G IoT Market Analysis

Sweden is projected to grow at a prominent CAGR in the European 5G IoT market over the forecast period. Factors such as sustainability initiatives, healthcare innovation, and advanced manufacturing are propelling the Swedish market growth. According to the Swedish Post and Telecom Authority, private 5G networks expanded across mining, forestry, and healthcare sectors. Boliden’s Aitik mine deployed 5G-enabled autonomous trucks, reducing fuel consumption significantly, while Karolinska Institute introduced 5G ambulances for real-time patient monitoring. With 70% of base stations powered by renewable energy as per the Swedish Energy Agency, Sweden is poised to remain a model for sustainable 5G IoT adoption.

Netherlands 5G IoT Market Analysis

The Netherlands is anticipated to account for a notable share of the European market during the forecast period due to the logistics hubs, precision agriculture, and dense urban coverage. According to the Dutch Authority for Digital Infrastructure, over 22 private 5G networks were deployed in 2024, primarily in the Port of Rotterdam and Schiphol Airport. The Port of Rotterdam connected 15,000 IoT devices via 5G, enabling predictive berthing and reducing vessel wait times. Wageningen University partnered with farmers to deploy 5G IoT soil sensors, reducing agricultural waste by 24%. With mandated 5G indoor coverage by 2025, the Netherlands is expected to leverage IoT as a strategic enabler of its economic strengths.

COMPETITIVE LANDSCAPE

Competition in the Europe 5G IoT market is shaped by a strategic tension between technological leadership, geopolitical considerations, and regulatory compliance. Global vendors like Ericsson and Nokia benefit from their European origins and alignment with EU digital sovereignty goals, while non-European players face heightened scrutiny under the EU’s secure connectivity framework. The market is increasingly bifurcated between public mobile networks for wide area consumer IoT and private industrial networks for mission-critical applications. Industrial customers prioritize reliability, data residency, and cybersecurity over cost, driving demand for end-to-end integrated solutions. Standardization through 3GPP and ETSI creates a level playing field, yet national spectrum policies and certification requirements fragment deployment. Startups and system integrators are emerging as niche players offering vertical-specific applications, while hyperscalers like AWS and Microsoft provide cloud-edge platforms that complement telecom infrastructure. Ultimately, competitive success hinges on combining network expertise, domain knowledge, regulatory fluency, and cross-sector collaboration to deliver secure, scalable, and purpose-driven 5G IoT solutions across Europe’s diverse economic landscape.

KEY MARKET PLAYERS

The leading companies operating in the Europe 5G IoT market include:

Telefonaktiebolaget LM Ericsson Nokia Huawei Technologies Co., Ltd. Qualcomm Technologies, Inc. BT Group AT&T Intellectual Property Juniper Networks, Inc. Bell Canada TOP PLAYERS IN THE MARKET Ericsson AB is a Swedish multinational and a cornerstone of Europe’s 5G IoT infrastructure, providing end-to-end network solutions, including radio access, core networks, and IoT platforms for industrial and public sector clients. The company contributes globally by shaping 3GPP standards and enabling ultra-reliable low-latency communication critical for manufacturing automation and smart cities. In 2024, Ericsson launched its Private 5G Network-in-a-Box solution across Germany and France, offering pre-integrated hardware and software for rapid factory deployment. It also partnered with the European Commission on the 5G for Europe initiative to accelerate cross-border industrial use cases. These actions reinforce Ericsson’s role as a trusted European technology partner aligned with digital sovereignty and green transition goals. Nokia Corporation maintains a strong presence in the Europe 5G IoT market through its comprehensive portfolio of private wireless networks, network slicing, and IoT managed services tailored for energy transport and defense sectors. Headquartered in Finland, the company supports global 5G IoT evolution with its MX Industrial Edge platform that integrates operational technology with 5G connectivity. In 2024, Nokia expanded its Digital Automation Cloud offering to over 120 industrial sites across Europe, including mines, ports, and utilities. It also launched a cybersecurity-enhanced 5G standalone core compliant with EU NIS2 requirements. These initiatives position Nokia as a key enabler of secure, sovereign, and scalable 5G IoT for Europe’s critical infrastructure. Huawei Technologies Co Ltd plays a significant role in the Europe 5G IoT market through its advanced 5G radio equipment, cloud core solution,s and IoT operating system LiteOS, which powers millions of connected devices. Despite geopolitical constraints, the company continues to support European operators and enterprises with energy-efficient base stations and edge computing platforms. In late 2024, Huawei introduced its 5.5G IoT evolution roadmap in select European markets, featuring enhanced massive machine type communication and integrated sensing capabilities. It also collaborated with research institutions in Switzerland and the Netherlands on 5G IoT trials for smart grids and precision agriculture. These efforts demonstrate Huawei’s ongoing technical contribution to Europe’s connected future while navigating complex regulatory dynamics. TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the Europe 5G IoT market pursue strategies centered on private network deployment, network slicing, standardization, and regulatory alignment. Companies are investing heavily in integrated hardware and software stacks that enable rapid deployment of standalone 5G networks in factories, ports, and hospitals. Strategic partnerships with governments, industrial consortia, and research bodies ensure alignment with EU digital sovereignty and green deal objectives. Cybersecurity is prioritized through zero-trust architectures and compliance with NIS2 and ENISA guidelines. Vendor diversification and open RAN adoption are increasingly emphasized to meet EU supply chain resilience mandates. Additionally, firms are developing vertical-specific solutions such as 5G-connected AGVs for logistics or remote patient monitoring for healthcare. Geographic customization includes local spectrum support, multilingual management interfaces, and integration with national digital identity frameworks. These multifaceted approaches position leading providers as essential enablers of Europe’s secure, intelligent, and sustainable 5G IoT transformation.

MARKET SEGMENTATION

This research report on the Europe 5G IoT market has been segmented and sub-segmented into the following categories.

By Technology

5G New Radio Standalone Architecture 5G New Radio Non-Standalone Architecture

By Type

Short-Range IoT devices Wide-Range IoT devices

By Industry

Manufacturing Government Energy and Utilities Transportation and Logistics Aviation Others (Mining)

By Country

United Kingdom France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Rest of Europe