Europe Bathroom Vanities Market Size

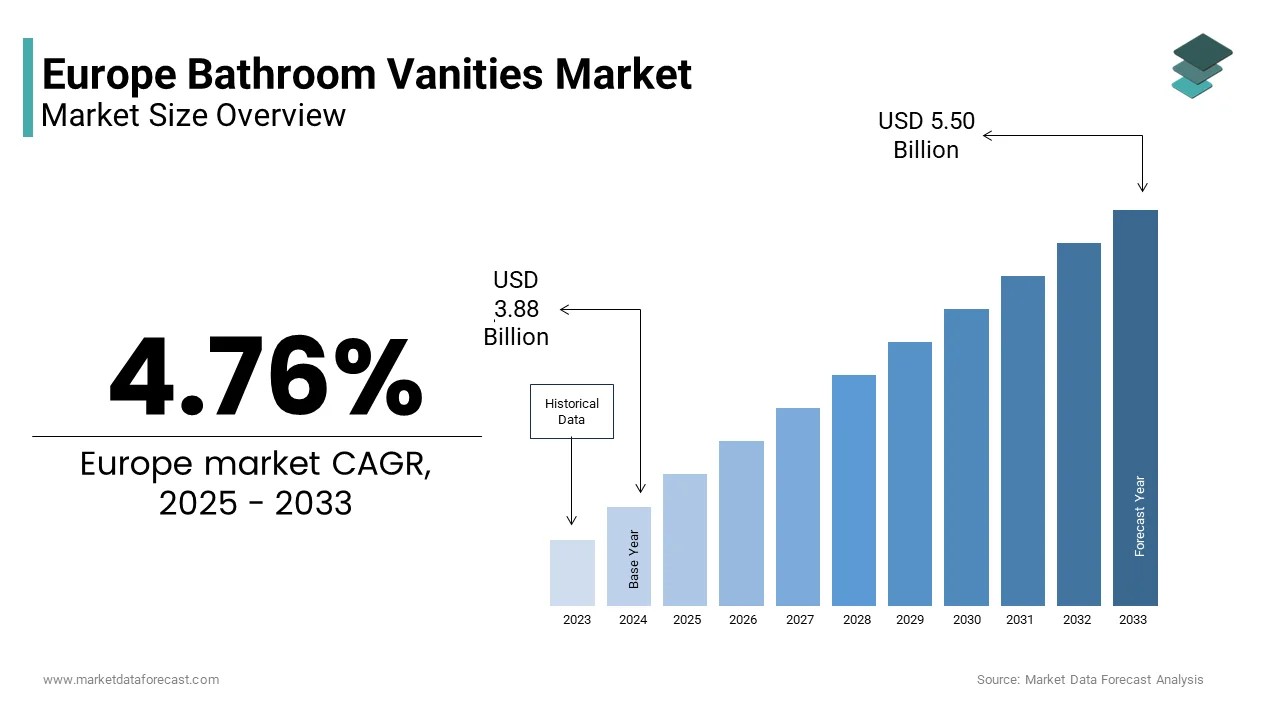

The Europe bathroom vanities market size was valued at USD 3.71 billion in 2024 and is anticipated to reach USD 3.88 billion in 2025 to USD 5.50 billion by 2033, growing at a CAGR of 4.76% during the forecast period from 2025 to 2033.

Introduction to the Europe Bathroom Vanities Market

Bathroom vanities are integrated units combining washbasins cabinetry and often mirrors or lighting, designed for residential and commercial washrooms with an emphasis on space optimization aesthetics and functionality. According to Eurostat, over 68% of European households undertook home improvement activities between 2020 and 2023 with bathroom renovations ranking among the top three projects across Germany France and Italy. The European Commission’s 2023 Energy Performance of Buildings Directive further incentivizes bathroom upgrades by linking water and energy efficient fixtures, including low flow faucets and LED integrated vanities to building energy ratings. Additionally, the average European household consumes 150 liters of water per person daily with bathroom fixtures accounting for nearly 70% of indoor usage driving demand for vanities with water saving integrations, as per recent survey. These socio regulatory and spatial dynamics position bathroom vanities not merely as furniture but as strategic elements in sustainable and human centric living environments across Europe.

MARKET DRIVERS Rising Home Renovation Activity Driven by Aging Housing Stock

Europe’s extensive aging housing inventory for sustained demand in bathroom vanities, as homeowners prioritize modernization for comfort efficiency and property value, which is driving the growth of Europe bathroom vanities market. According to Eurostat, nearly 35% of the EU’s residential buildings were constructed before 1970 with outdated plumbing inadequate storage and non-compliant fixtures necessitating comprehensive bathroom overhauls. France’s National Housing Agency noted that over 1.2 million bathroom renovation permits were issued in 2023 alone with integrated vanities featuring concealed cisterns and wall mounted designs favored for space savings in urban apartments. Similarly, Italy’s Superbonus 110 tax incentive which covered up to 110% of renovation costs until 2023 spurred more than 850000 bathroom upgrades including vanity replacements as confirmed by the Italian Ministry of Economy. These renovations are not cosmetic but functional responses to deteriorating infrastructure water conservation mandates and demographic shifts toward aging in place all converging to make vanity replacement a high priority in Europe’s residential retrofit wave.

Growing Demand for Compact and Multifunctional Urban Bathrooms

The intensification of urban living has elevated the need for space efficient bathroom solutions with integrated vanities at the core of this transformation, which is additionally levelling up the growth of Europe bathroom vanities market. According to Eurostat, many new residential constructions in the EU between 2020 and 2023 were apartments under 80 square meters reflecting policy driven densification in cities like Paris Amsterdam and Barcelona. In response, manufacturers are designing wall hung vanities with shallow depths under 40 centimeters built in lighting and mirrored cabinets that double as storage features, now standard of new vanity models sold in urban markets, as per the research. Similarly, Sweden’s National Board of Housing Building and Planning enforces minimum bathroom dimensions that prioritize fixture integration over separation pushing developers toward modular vanity systems. This urban spatial constraint coupled with rising expectations for aesthetic cohesion and smart functionality ensures that bathroom vanities are no longer afterthoughts but engineered solutions for high density living.

MARKET RESTRAINTS High Material and Labor Costs Constraining Mid Market Accessibility

The significant headwinds from escalating raw material and skilled labor expenses, which limit affordability is restricting the growth of Europe bathroom vanities market. According to the European Construction Sector Observatory, the cost of engineered wood panels a core material for vanity cabinetry rose by 28% between 2021 and 2023 due to supply chain disruptions and energy intensive manufacturing. Installation labor remains another bottleneck, where in Germany the Federal Employment Agency noted a shortage of over 45,000 certified bathroom fitters in 2023 with average installation fees exceeding 800 euros per unit. These cost pressures disproportionately affect middle income households who constitute over 60% of renovation demand as per Eurostat yet find premium integrated vanities financially out of reach. This cost accessibility gap risks segmenting the market into low quality imports and luxury domestic brands leaving a void in the sustainable mid-tier crucial for broad based adoption.

Fragmented Regulatory Standards Across EU Member States

The absence of harmonized technical and safety standards for bathroom vanities that creates compliance complexity and delays for manufacturers seeking pan European distribution. The fragmented regulatory standards across EU member states is limiting the growth of Europe bathroom vanities market. Unlike electrical or plumbing fixtures, which fall under CE marking directives vanity units are classified as furniture and thus subject to varying national building codes material emission limits and moisture resistance requirements. According to the European Committee for Standardization, only eight EU countries have adopted EN 14749 for bathroom furniture testing as of 2024 with others imposing unique mandates, such as France’s VOC emission limits under A+ labeling or Germany’s Blue Angel certification for formaldehyde free wood. This regulatory patchwork forces companies to maintain multiple product variants increasing design validation costs, as documented by the European Furniture Manufacturers Federation. In Scandinavia additional frost resistance and humidity durability tests are required for cabinetry due to climate conditions further complicating standardization. The lack of a unified EU framework not only inflates time to market but also stifles innovation as resources shift from design to compliance.

MARKET OPPORTUNITIES Integration of Smart and Wellness Oriented Features

The incorporation of smart technology and wellness enhancing functions aligned with rising consumer interest in health conscious living is creating new opportunities for the growth of Europe bathroom vanities market. According to the European Consumer Health Monitor, 67% of adults in Germany, France, and the Netherlands, now consider their bathroom a personal wellness space driving demand for vanities with integrated LED lighting anti fog mirrors UV sanitizers and touchless faucets. IKEA’s 2023 Smart Bathroom Collection launched across 18 European countries includes vanities with wireless charging shelves and ambient lighting controlled via app selling over 3,00,000 units in the first six months as per the company’s sustainability report. Similarly, Kohler’s Verdera Voice Lighted Mirror vanity line in the UK and Italy enables voice activated controls for lighting and temperature reflecting convergence with smart home ecosystems. The European Commission’s 2023 Circular Economy Action Plan also encourages “product as a service” models, which companies like Villeroy & Boch are testing through vanity leasing programs with embedded maintenance and upgrade options. These innovations transform the vanity from passive furniture to an interactive health interface creating premium value and recurring customer engagement in an otherwise mature category.

Expansion of Circular and Eco Designed Vanity Offerings

The shift toward circular economy principles presents a high growth opportunity for manufacturers developing bathroom vanities from recycled or rapidly renewable materials with modular repairable designs. The expansion of circular and eco designed vanity offerings is additionally to leverage the growth of Europe bathroom vanities market. According to the European Environment Agency, 12 million tonnes of furniture waste are generated annually in the EU with bathroom units contributing significantly due to moisture damage and style obsolescence. In response, brands like Kvik in Denmark and Mobalpa in France, now offer vanities made from FSC certified wood recycled glass countertops and water based finishes achieving Cradle to Cradle Gold certification, as verified by the European Sustainable Furniture Network. The Netherlands’ Circular Economy Hotspot initiative reported that 24 European vanity manufacturers adopted “design for disassembly” principles in 2023 enabling easy replacement of basins or doors without discarding the entire unit.

Shortage of Skilled Installation and After Sales Service Networks

The acute shortage of qualified tradespeople capable of installing complex integrated units particularly those with smart features or wall hung configurations is a significant challenge for the growth of Europe bathroom vanities market. In Spain, the National Confederation of Construction reported that average wait times for bathroom installation, now exceed 14 weeks up from 6 weeks in 2021 due to workforce aging and insufficient vocational training. Poor installation further leads to leaks structural damage and warranty disputes undermining consumer confidence in premium products. While DIY options exist they are unsuitable for wall mounted or smart vanities requiring precise plumbing and electrical integration.

Volatility in Timber and Composite Panel Supply Chains

The highly vulnerable to fluctuations in wood-based panel availability and pricing due to its dependence on engineered wood for cabinetry construction, which is additionally to hamper the growth of Europe bathroom vanities market. According to the European Panel Federation, hardwood plywood and MFC panel prices surged by 32% in 2022 and remained 18% above pre pandemic levels in 2023 due to reduced Russian timber imports energy cost spikes and sawmill closures in Central Europe. This volatility forces manufacturers to either absorb costs squeezing margins or pass them to consumers reducing competitiveness against low-cost Asian imports. Moreover, sustainability certifications like FSC and PEFC, now require full chain of custody documentation increasing administrative burden, as noted by the European Timber Trade Federation. Attempts to shift to alternative materials like bamboo or recycled polymers face scalability and aesthetic acceptance hurdles.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

4.76%

Segments Covered

By Distribution Channel, Application, Material, And By Country

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, & Rest of Europe

Market Leaders Profiled

Masco Corporation, Fuao Sanitaryware Private Ltd, Alya Bathroom Supply LLC, Native Trails, Virtu USA, Baden Haus S.p.A, Silkroad Exclusive, Inc, American Woodmark Corporation, Strasser Woodenworks, Bertch Cabinet, LLC

SEGMENTAL ANALYSIS By Distribution Channel Insights

The offline channels segment was accounted in holding a dominant share of the Europe bathroom vanities market in 2024 with the high involvement nature of bathroom renovations, which require tactile evaluation spatial planning and professional installation advice that physical showrooms uniquely provide. Large format retailers like Leroy Merlin Bauhaus and B&Q operate immersive bathroom studios, where customers can visualize full layouts with lighting and plumbing integrated experiences that drive conversion rates 3.5 times higher than online browsing, according to the Federation of European Home Improvement Retailers. Additionally, independent bathroom showrooms in Germany and Italy offer bespoke design services including 3D room scanning and custom vanity fabrication of high-end sales. The necessity for coordinated delivery with plumbing and tiling contractors further anchors purchases in physical networks where logistics and after sales support are seamlessly bundled.

The online distribution channel segment is projected to expand at a CAGR of 12.4% from 2025 to 2033 with the digital transformation in home improvement retail advanced visualization tools and rising comfort with high value online purchases among younger demographics. The UK’s Victorian Plumbing achieved 98% customer satisfaction by integrating live chat with certified bathroom advisors during online checkout, a service now adopted by 12 major EU retailers, according to the survey. Enhanced logistics including room of choice delivery and packaging recovery programs have further mitigated traditional e commerce barriers.

By Application Insights

The household and residential application segment was the largest by holding a significant share of the Europe bathroom vanities market in 2024 with the centrality of private bathrooms in European living standards with over 96% of EU households possessing at least one private washroom, as verified by the European Environment Agency. Renovation cycles are a primary driver, where the average European bathroom is updated every 12 to 15 years with vanity replacement being the most common intervention due to water damage style fatigue or accessibility needs. In Germany, the Federal Institute for Research on Building Urban Affairs and Spatial Development reported that 5.2 million households undertook bathroom upgrades between 2021 and 2023 with integrated vanities featuring water saving faucets and anti-slip surfaces prioritized for aging in place. Furthermore, urbanization trends, now live in apartments that favor compact wall hung vanities that maximize space in small dwellings. Residential demand thus remains the structural core of the market driven by demographic housing policy and lifestyle evolution.

The commercial application segment is projected to grow at a fastest CAGR of 8.7% throughout the forecast period with the stringent hygiene mandates rising standards in public facilities and the proliferation of high-end short stay accommodations. The EU’s 2023 Public Health Infrastructure Directive requires all newly constructed or renovated public buildings, including schools hospitals and transport hubs to install touchless fixtures and non-porous vanity surfaces to reduce pathogen transmission. In response, airports like Amsterdam Schiphol and Frankfurt have replaced all restroom vanities with seamless solid surface units featuring integrated basins and antimicrobial coatings, as confirmed by their 2023 facility reports. Additionally, luxury hotel chains like Accor and NH Hotel Group, now mandate designer vanities with LED mirrors and concealed storage in all refurbishments.

COUNTRY ANALYSIS Germany Bathroom Vanities Market Analysis

Germany was the top performer of the Europe bathroom vanities market by capturing by holding 23.3% of share in 2024 from its high homeownership rate robust renovation culture and demand for precision engineered fixtures. Over 42% of German households renovated their bathrooms between 2021 and 2023, as documented by the Federal Institute for Research on Building Urban Affairs and Spatial Development with wall hung vanities featuring soft close mechanisms and integrated LED lighting preferred for modern aesthetics and accessibility. Germany, also enforces strict DIN standards for bathroom furniture moisture resistance and load capacity ensuring premium quality. The “Aging in Place” initiative has further driven demand for height adjustable and grab bar compatible vanities with over 1.2 million units installed in senior residences in 2023, as reported by the Federal Ministry of Family Affairs.

Italy Bathroom Vanities Market Analysis

Italy bathroom vanities market held second position with 18.4% of share in 2024. Its strength lies in world renowned design heritage high renovation activity and government backed incentives that directly stimulated vanity replacements. Italian manufacturers emphasize artisanal craftsmanship marble inlays and custom sizing attributes highly valued in both domestic and export markets. Additionally, Italy has Europe’s highest density of bathroom showrooms with over 12,000 specialized retail points offering bespoke design services. Urban renewal projects in Milan and Rome have also mandated bathroom modernization in historic apartment blocks further sustaining demand. Italy’s fusion of policy support design excellence and consumer preference for permanent high-quality installations ensures its enduring influence in the marketplace.

United Kingdom Bathroom Vanities Market Analysis

The United Kingdom bathroom vanities market growth is likely to grow with the UK maintains strong vanity demand driven by its dynamic housing market active DIY culture and growing short term rental sector. In 2023, the Office for National Statistics reported that 1.4 million home improvement projects included bathroom upgrades with vanity replacement being the most common element due to water damage and style updates. Retailers like Victorian Plumbing and B&Q have leveraged online configurators and next day delivery to capture both trade and consumer segments. London’s new build regulations also require water efficient fixtures in all residential units pushing developers toward integrated vanity systems with low flow taps.

France Bathroom Vanities Market Analysis

France bathroom vanities market growth is likely to grow with the aggressive public policy promoting energy and water efficiency coupled with strong urban renovation programs. The MaPrimeRénov scheme provided over 2.1 billion euros in 2023 for bathroom upgrades with vanity units featuring dual flush systems and thermostatic faucets qualifying for the highest subsidy tiers, as confirmed by the French Environment and Energy Management Agency. Paris’s municipal renovation mandate requires all rental properties to install modern vanities with anti-slip surfaces and adequate storage by 2026. French consumers also prioritize compact designs, where 78% of new vanity sales in urban areas are wall hung models under 80 centimeters wide according to a Leroy Merlin consumer trends report. Leading domestic brands like Jacob Delafon emphasize minimalist aesthetics and ceramic innovation aligning with national design sensibilities. These regulatory and cultural drivers ensure France remains a high-volume high compliance market for bathroom vanities.

Spain Bathroom Vanities Market Analysis

Spain bathroom vanities market is fueled by a post pandemic tourism boom extensive second home ownership and coastal property renovations. The Costa del Sol and Balearic Islands alone saw more than 2,20,000 bathroom upgrades in 2023, primarily featuring moisture resistant vanities with marine grade finishes as documented by the Spanish Tourism Board. Additionally, government incentives like the Plan Renhata allocated 300 million euros in 2023 for home improvements with vanity replacements among the most claimed items. Spanish consumers favor bright white lacquered cabinets and integrated ceramic basins reflecting Mediterranean design preferences.

COMPETITIVE LANDSCAPE

Competition in the Europe bathroom vanities market is characterized by a three-tier structure comprising global premium brands regional specialists and value oriented private label suppliers. Leading players like Duravit Villeroy & Boch and Ideal Standard compete on design heritage technological integration and sustainability credentials rather than price alone. Mid-tier manufacturers in Italy, Spain, and Poland focus on customized solutions for local renovation trends and hospitality demands often leveraging craftsmanship and shorter lead times. At the lower end, large home improvement retailers offer private label vanities emphasizing affordability and basic functionality. Differentiation increasingly hinges on circular design smart features and seamless omnichannel experiences. While premium brands dominate aspirational segments value and mid-tier players capture volume through localized distribution and renovation subsidy programs creating a dynamic and multi layered competitive environment across Europe.

KEY MARKET PLAYERS

A few of the market players dominating the Europe bathroom vanities market

Masco Corporation Duravit AG Villeroy & Boch AG Ideal Standard International Fuao Sanitaryware Private Ltd. Alya Bathroom Supply LLC Native Trails Virtu USA Baden Haus S.p.A Silkroad Exclusive, Inc. American Woodmark Corporation Strasser Woodenworks Bertch Cabinet, LLC Top Players In The Market Duravit AG is a German premium bathroom solutions manufacturer renowned for its design driven and technologically advanced bathroom vanities that combine ceramic basins with precision engineered cabinetry. The company supplies products across Europe and exports to over 130 countries reinforcing Germany’s reputation for high quality bathroom fixtures globally. Duravit launched its “Architect Collection” featuring modular vanities with sustainable surface materials and integrated smart lighting tailored for European urban apartments. It also expanded its factory in Hornberg Germany to increase production of water efficient vanity units compliant with EU Ecodesign regulations. Villeroy & Boch AG is a Luxembourg headquartered but Germany rooted leader in ceramic and bathroom furniture manufacturing with a strong footprint, across European retail and commercial channels. The company integrates its heritage in ceramic craftsmanship with modern vanity designs featuring antimicrobial surfaces and water saving technologies. Villeroy & Boch introduced its “Wellness Bathroom” concept offering vanities with embedded ambient lighting anti fog mirrors and modular storage systems designed for aging populations. It also launched a circularity program in France and the Netherlands by enabling customers to return old vanities for material recovery and remanufacturing. By aligning product innovation with EU sustainability mandates and demographic trends the company strengthens its position as a holistic bathroom solutions provider in both mature and emerging European markets. Ideal Standard International SA is a pan European bathroom brand with manufacturing hubs in Belgium the UK and Italy serving residential and commercial clients across the continent. Known for its balance of design functionality and affordability the company offers a wide range of vanity solutions from compact urban units to high end hospitality collections. In 2023 Ideal Standard rolled out its “AquaSave” vanity line featuring integrated low flow faucets and recycled composite cabinets certified under the EU Ecolabel. The company also enhanced its digital showroom platform allowing retailers in Spain and Poland to configure and visualize vanity installations in real time. Through localized design adaptations strong trade partnerships and sustainability focused product development Ideal Standard maintains a resilient presence across diverse European markets while expanding its influence in sustainable bathroom infrastructure globally. Top Strategies Used By The Key Market Participants

Key players in the Europe bathroom vanities market focus on product innovation by integrating water saving fixtures smart lighting and antimicrobial surfaces to meet evolving hygiene and sustainability expectations. They invest in modular and space efficient designs tailored for urban apartments and aging populations aligning with EU building regulations and demographic shifts. Companies actively pursue circular economy initiatives including take back schemes material recycling and use of certified sustainable wood or composites. Strategic collaborations with architects interior designers and hospitality groups enhance brand visibility in high value commercial projects. Additionally, firms are expanding digital capabilities through augmented reality showrooms online configurators and virtual design consultations to bridge the gap between offline experience and online convenience while strengthening retailer and consumer engagement.

MARKET SEGMENTATION

This research report on the Europe bathroom vanities market is segmented and sub-segmented into the following categories.

By Distribution Channel

By Application

Household & Residential Commercial

By Material

Ceramic Wood Stone Plastic Others

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe