In recent weeks, the European market has shown resilience, with the pan-European STOXX Europe 600 Index ending slightly higher in a holiday-shortened week, reflecting positive sentiment about future earnings and economic conditions. Amid this backdrop, growth companies with high insider ownership can be particularly appealing to investors seeking alignment between management and shareholder interests, as insiders often have a vested interest in driving long-term value.

Name

Insider Ownership

Earnings Growth

Warimpex Finanz- und Beteiligungs (WBAG:WXF)

25.9%

100.6%

S.M.A.I.O (ENXTPA:ALSMA)

16.1%

72.8%

MilDef Group (OM:MILDEF)

13.7%

83%

Magnora (OB:MGN)

10.4%

75.1%

KebNi (OM:KEBNI B)

36.3%

61.2%

Guard Therapeutics International (OM:GUARD)

13.1%

103.3%

DNO (OB:DNO)

13.5%

97.5%

CTT Systems (OM:CTT)

17.5%

52%

Circus (XTRA:CA1)

24.1%

66.1%

Bonesupport Holding (OM:BONEX)

10.4%

49.7%

Let’s dive into some prime choices out of the screener.

Simply Wall St Growth Rating: ★★★★★☆

Overview: EnergyVision NV is a Belgian company offering solar energy and mobility-as-a-service solutions to both corporate and residential clients, with a market cap of €621.60 million.

Operations: EnergyVision NV generates revenue through its EPC Activity (€66.65 million), Asset-Based Energy (€18.88 million), Asset-Based Mobility (€6.11 million), and Non-Asset-Based Energy (€34.29 million) segments.

Insider Ownership: 10.1%

Revenue Growth Forecast: 20.9% p.a.

EnergyVision demonstrates strong growth potential with earnings forecasted to grow 43.2% annually, outpacing the Belgian market’s 15.3%. Revenue is expected to rise at a robust 20.9% per year, surpassing both the market and significant growth benchmarks. Despite high debt levels and a projected low return on equity of 12.8%, analysts anticipate a stock price increase of 32%. No recent insider trading activity has been reported within the past three months.

ENXTBR:ENRGY Earnings and Revenue Growth as at Dec 2025

Simply Wall St Growth Rating: ★★★★★☆

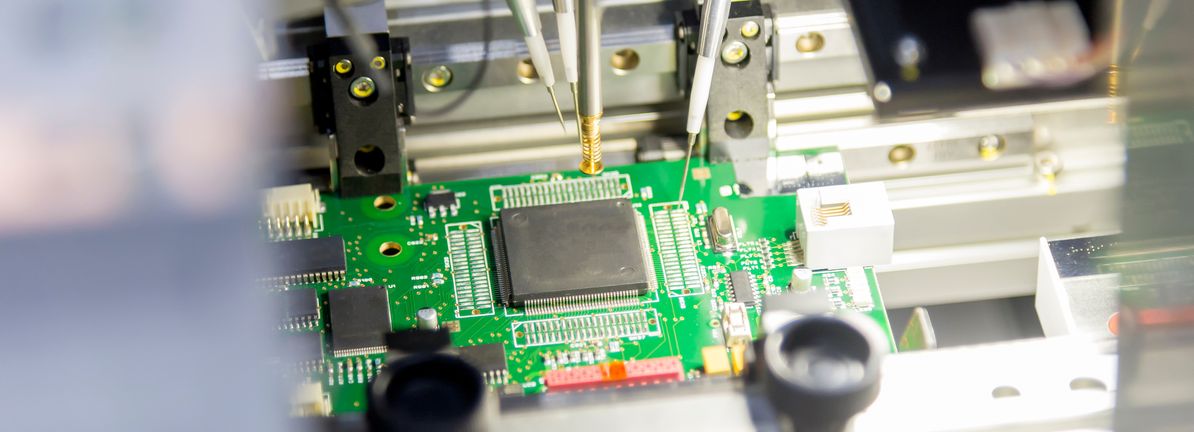

Overview: Canatu Oyj specializes in developing and selling carbon nanotubes (CNTs) for the semiconductor, automotive, and medical diagnostics industries across Finland, the United States, Japan, and Taiwan with a market cap of €284.45 million.