The 2025 investing year is on the books!

This was another good year for Wall Street. The market shook off some trade-related jitters from this April to put in another solid performance. We even made several new all-time highs. Once again, the expected recession never arrived. After a long pause, the Federal Reserve resumed cutting interest rates again.

I’m pleased to say that the 2026 Buy List performed well, although we didn’t do as well as the overall market. Much of this can explained by our conservative approach. In 2025, safe and secure stocks were not the most sought after on Wall Street.

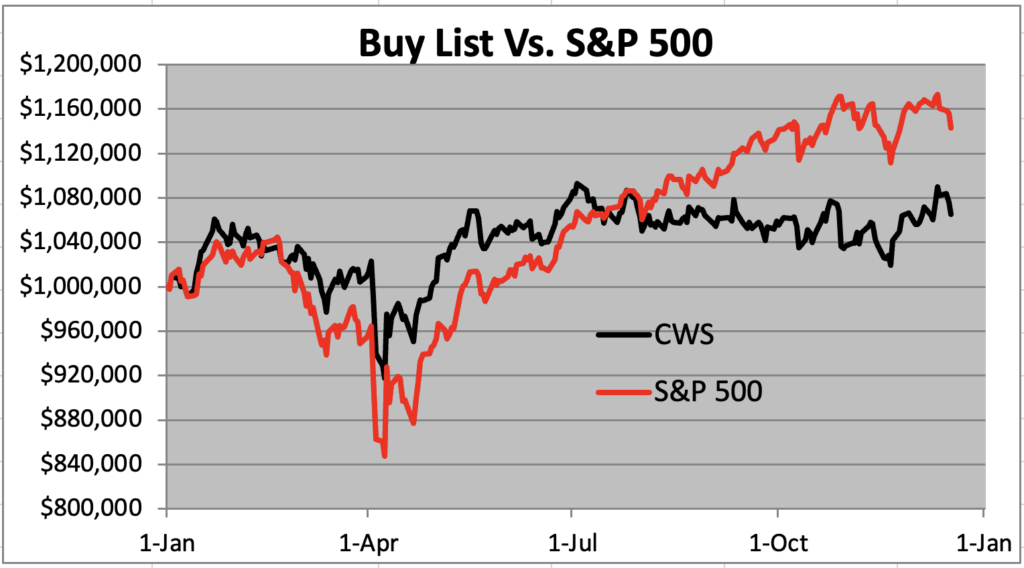

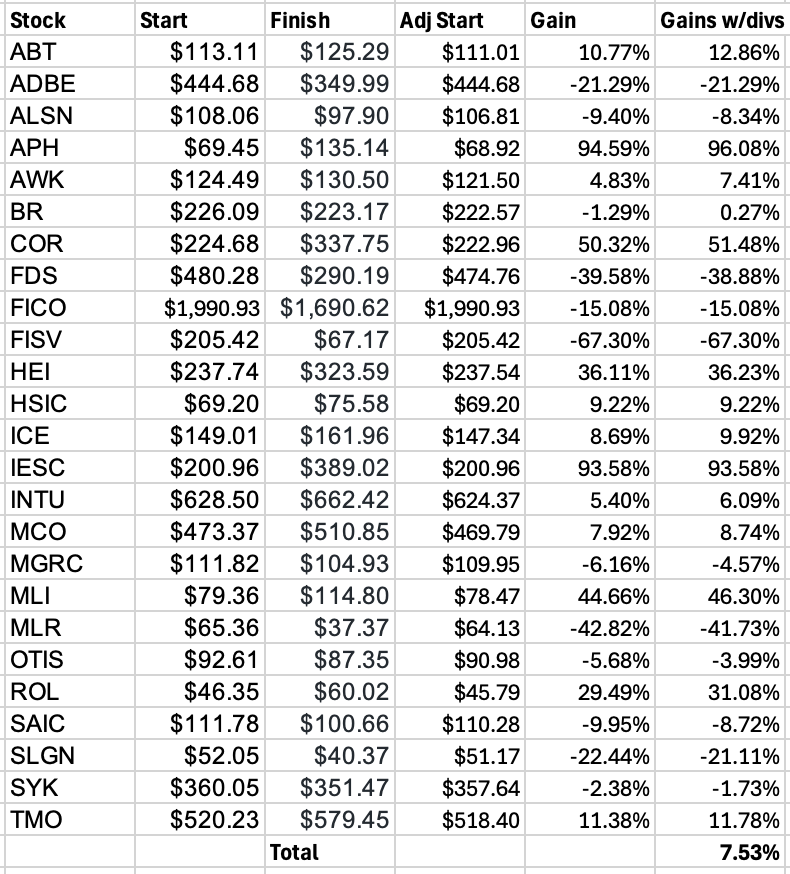

For the year, the S&P 500 gained 16.39%, and with dividends, it was up 17.88%. Our Buy List was up 6.54% for the year, and with dividends, the gain was 7.53%. Most of our underperformance came when the market sharply turned around in April, May and June.

In 2025, the Buy List had a “beta” of 0.7105. That’s unusually low for us. I think this shows us how much risk the rest of the market was absorbing.

For the 20 years of the Buy List, the S&P 500 with dividends is up 706.20%, while our Buy List is up 713.84%.

Here’s a look at our Buy List versus the S&P 500 throughout the year (this doesn’t include dividends).

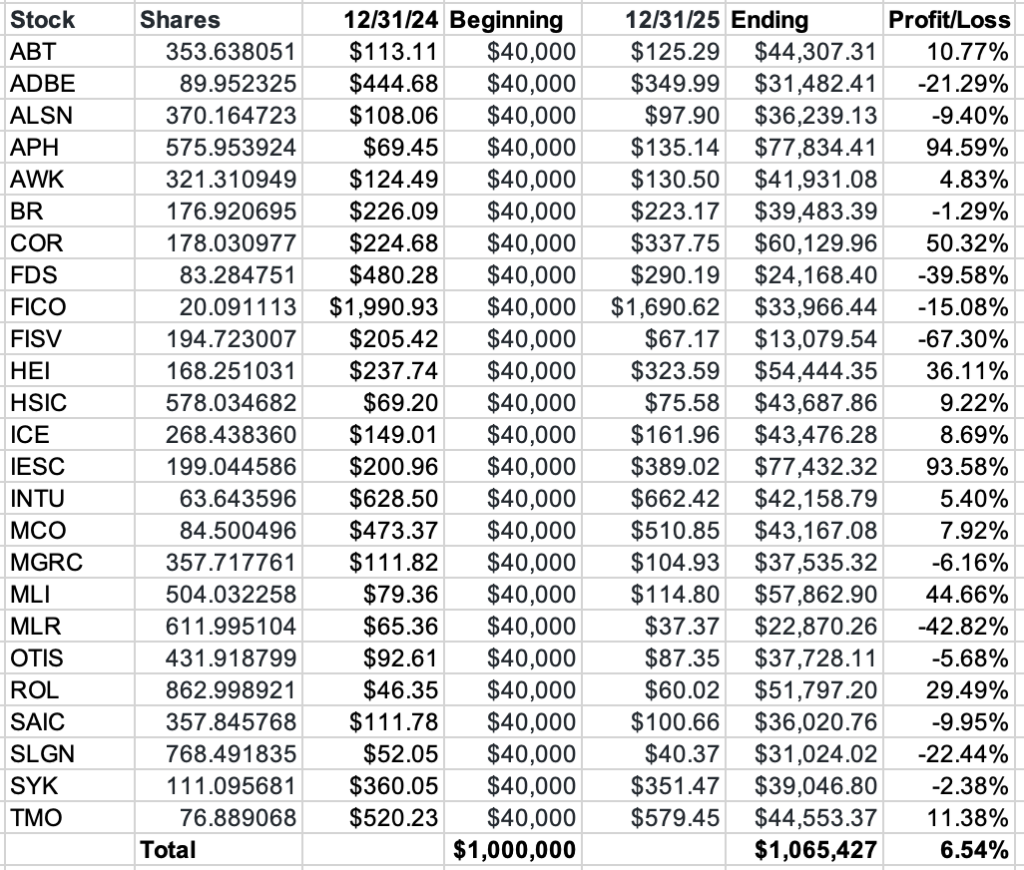

I always strive to be as transparent as possible when discussing our track record. Here’s a breakdown of how our Buy List performed in 2025. For tracking purposes, I assume the Buy List is a $1 million portfolio and that all 25 stocks are equally weighted at the start of the year.

Amphenol was our biggest winner on the year with a gain of more than 94%. IES Holdings also did very well with a gain of over 93%. Cencora gained 50% for us. Fiserv was our biggest loser with a loss of 67%. FactSet and Miller Industries also had tough years. In 2024, Fiserv and Miller both gained 54%.

FICO had a very dramatic year in 2025. At one point in May, it lost nearly one-third of its value in one week. Later, the stock popped more than 40% off its August low in just a few weeks.

Note that during the year, Fiserv changed its symbol from FI to FISV.

Here’s the data behind the dividend-adjusted returns. I’ve listed each stock’s beginning price, ending price and dividend-adjusted starting price.

Posted by Eddy Elfenbein on December 31st, 2025 at 10:14 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.