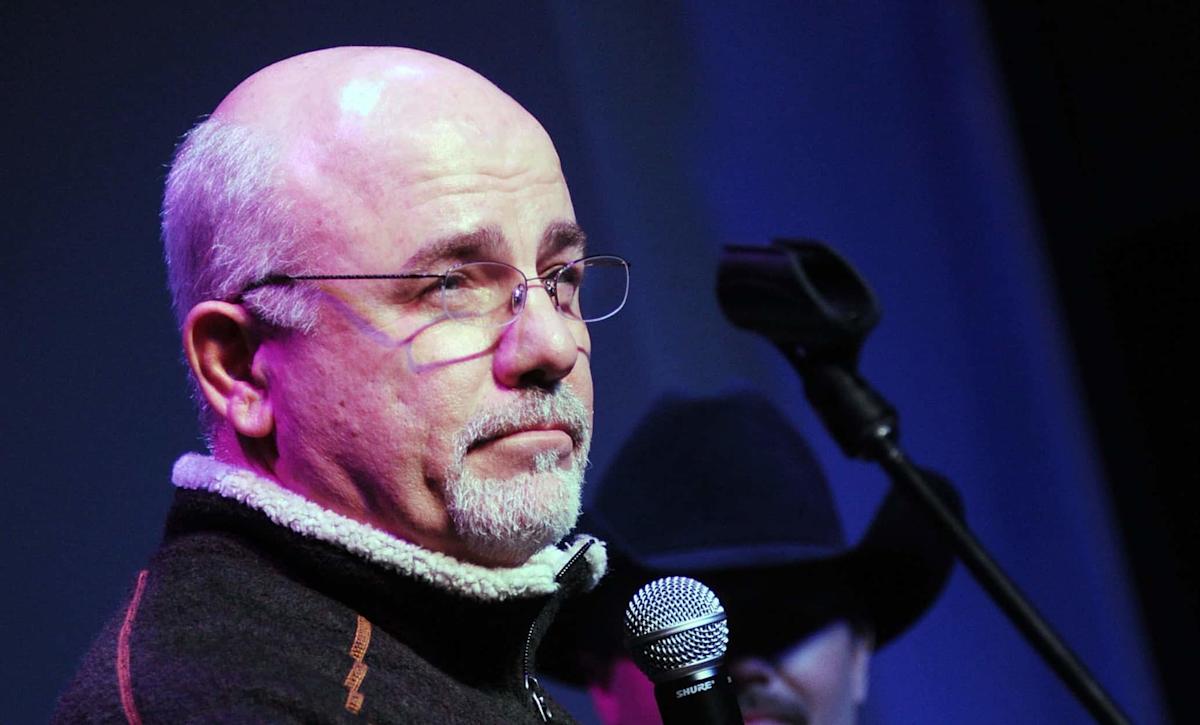

Rick Diamond/Getty Images)

Many people already believe that Dave Ramsey’s 8% rule is an excellent plan for retirement.

The challenge is that Dave’s rule leaves almost no room for error when it comes to investing heavily in the stock market.

Instead of depending on an 8% annual withdrawal rate in retirement, consider exploring other, more sustainable strategies.

A recent study identified one single habit that doubled Americans’ retirement savings and moved retirement from dream, to reality. Read more here.

If you’re a fan of personal finance guru Dave Ramsey, it shouldn’t surprise you that there are some differing opinions from other financial personalities. On the one hand, you want advice from people like Suze Orman, Jim Cramer and the like to help you understand all of the different roads that are open to you for investing, saving, budgeting and more.

On the other hand, if you solely want to live in the Ramsey world, that’s fine — millions of people look to Ramsey for advice on how to retire early and retire well. That said, Dave’s 8% retirement rule is definitely a controversial one, as it advocates taking a big risk and hoping for even bigger returns.

A highly controversial strategy, the 8% rule can be summed up as Ramsey recommending that retirees allocate 100% of their assets to equities. From there, these soon-to-be-retirees or retirees would then withdraw 8% per year of the portfolio’s starting value, with each year’s withdrawal adjusted based on inflation.

Dave’s advice is based on the idea that the market should see an average annual return of around 12%, which is great news if you are 100% invested. That being said, there is no question that the rule is heavily dependent on the market achieving double-digit returns every year, regardless of the actual likelihood in any given year. That’s not even mentioning that the strategy is risk-on, meaning there’s little-to-no balance and safety between equities and fixed income (e.g., debt securities like CDs, Treasurys, municipal or corporate bonds).

Let’s say that in your first year of retirement, you have a portfolio that’s 100% invested in equities with of principal of $500,000. If you pull out money based on the 8% rule, you would start with $40,000. Now, if you factor in 3% inflation, you are moving to pull $41,200 in year two, $42,436 in year three, etc., with the hope that you are earning more than you are spending.

Photo by Anna Webber/Getty Images for SiriusXM

This advice has been hotly debated in recent years due to its reliance on double-digit returns, especially if the market declines early in retirement, as retirees withdraw funds. In such cases, there is less money available for growth, and it takes longer to recover the lost funds. This is known as a sequence risk, and it could cripple your ability to live out Ramsey’s rule even if you see larger averages down the road.

Story Continues