Europe Edible Insects Market Size

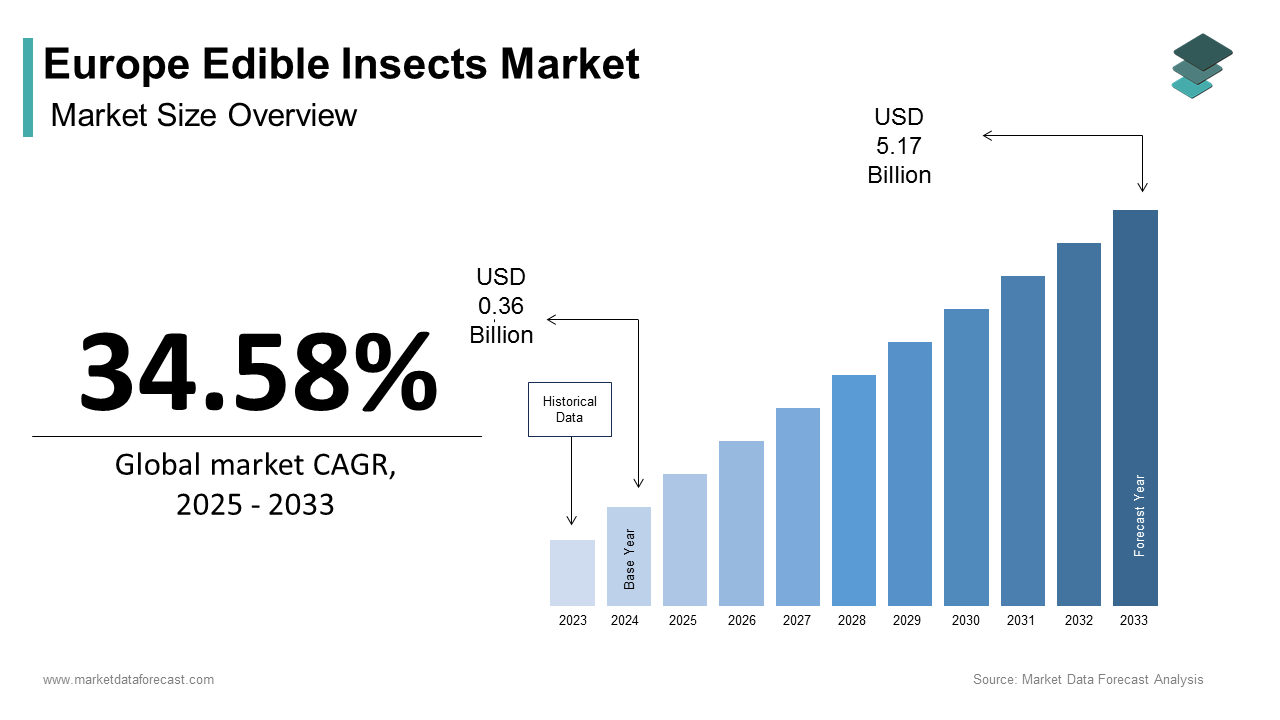

The Europe edible insects market size was calculated to be USD 0.36 billion in 2024 and is anticipated to be worth USD 5.17 billion by 2033, growing from USD 0.48 billion in 2025 at a CAGR of 34.58% during the forecast period.

Edible insects are the farming, processing, and commercialization of insect species approved for human consumption under European Union novel food regulations. These include primarily mealworms, crickets, and grasshoppers, which are offered whole, dried, powdered, or as ingredients in protein bars, snacks, pasta, and baked goods. The market exists at the intersection of food security, sustainability, and alternative protein innovation driven by mounting environmental pressures on conventional livestock systems. According to the European Food Safety Authority, more than 35 novel food applications for edible insects have been authorized since 2021, with yellow mealworm and migratory locust among the first approved species. As per Eurostat, livestock production accounts for approximately 17% of the EU’s agricultural greenhouse gas emissions, which indicates the ecological impetus for low-impact protein sources. The European Commission’s “Farm to Fork” strategy explicitly identifies insect protein as a key enabler of sustainable food systems, encouraging research and market development. Furthermore, as per the Joint Research Centre, insect farming requires up to 95% less land and 90% less water than beef production per kilogram of protein. These environmental and regulatory dynamics position edible insects not as a fringe novelty but as a scientifically endorsed component of Europe’s future food landscape.

MARKET DRIVERS Environmental Imperatives and the Push for Sustainable Protein Sources

The urgent need to decarbonize food systems in alignment with the European Green Deal and Farm to Fork Strategy is one of the major factors driving the growth of the European Europe edible insects market. According to the Joint Research Centre, insect farming generates significantly fewer greenhouse gas emissions and uses far less water compared to conventional poultry production per kilogram of protein output. This efficiency is critical as the European Environment Agency reported that agriculture contributes over 10% of the EU’s total emissions, with livestock as the dominant source. Policy frameworks actively incentivize alternatives. The European Commission allocated €85 million in 2024 through its Horizon Europe program to scale insect protein production for human consumption, including automated rearing and processing technologies. National governments are also acting. For instance, France’s Ministry of Agriculture launched the “Protéines du Futur” initiative in 2024, providing grants to insect farms to achieve industrial scale while meeting organic certification criteria. Consumer awareness is rising. According to Eurobarometer, over 40% of Europeans aged 18 to 35 now consider environmental impact when choosing protein sources. Startups like Ÿnsect and Protix are leveraging this shift by supplying defatted insect flour to food manufacturers for use in pasta, cereals, and meat analogs. Climate policy, efficiency gains, and shifting consumer values are aligning to create a strong demand base for edible insects in Europe.

Regulatory Authorization and Scientific Endorsement by EU Food Safety Bodies

The formal approval of specific insect species under the EU Novel Food Regulation has provided a critical foundation for market legitimacy and commercial scaling, which is further boosting the edible insects market expansion in Europe. According to the European Food Safety Authority, the authorization of dried yellow mealworm in January 2021 marked the first time an insect was deemed safe for human consumption in the EU, establishing a scientific and legal precedent. Since then, the European Commission has approved multiple insect species, including house cricket and lesser mealworm, following rigorous assessments covering allergenicity, microbiological safety, and nutritional composition. This regulatory clarity enables product innovation and retail placement. As per the European Commission’s Novel Food Catalogue, over 120 insect‑based food products were legally marketed across EU member states in 2024, ranging from protein powders to ready‑to‑eat snacks. Retail adoption follows suit as Carrefour and Edeka launched dedicated insect protein shelves in 2024 with clear labeling and nutritional information complying with EFSA guidelines. According to the European Food Information Council, nearly 60% of consumers trust food safety authorities more than brands when evaluating novel foods, reinforcing EFSA’s role. Certification pathways also facilitate export, as Swiss and Dutch insect producers now supply authorized ingredients to manufacturers in non‑EU countries using EU approval as a global benchmark. Regulatory endorsement and EFSA’s credibility are transforming edible insects into a safe, mainstream food category with global export potential.

MARKET RESTRAINTS Persistent Consumer Aversion and Cultural Resistance to Insect Consumption

A significant restraint on the Europe edible insects market stems from deep‑seated cultural aversion and psychological barriers that associate insects with contamination or poverty rather than nutrition. According to a 2024 Eurobarometer survey, only 17% of EU citizens reported willingness to eat whole insects, while nearly 40% remained open to processed forms like flour, which indicates a preference for ingredient integration over visible consumption. This resistance is particularly pronounced among older demographics and in Southern Europe. As per the European Consumer Organisation, over two‑thirds of consumers aged 55+ consider insects unappetizing or unsuitable for human food. Marketing missteps have exacerbated skepticism as Germany’s Federal Office of Consumer Protection documented complaints in 2024 regarding misleading “natural protein” claims that omitted insect origin on packaging. Retailer hesitation further limits exposure as Tesco and Auchan discontinued insect snack lines in 2024 due to low repeat purchase rates despite initial trial interest. Unlike in Asia or Africa, where entomophagy has historical roots, Europe lacks culinary traditions normalizing insect use. Cultural resistance and consumer skepticism remain strong, requiring product innovation in familiar formats and transparent communication to broaden acceptance.

Limited Production Scale and High Retail Pricing

The Europe edible insects market faces structural constraints due to underdeveloped farming infrastructure and high production costs that result in premium pricing inaccessible to mainstream consumers. According to the European Alternative Proteins Association, the average retail price for insect protein powder in 2024 was €28 per kilogram compared to €12 for pea protein and €8 for whey. This disparity stems from small‑scale rearing facilities with limited automation. Only a handful of insect farms in the EU operate at capacities exceeding 1,000 metric tons annually, as per data from the European Commission’s Directorate‑General for Agriculture. Most producers remain pilot scale with manual harvesting and inconsistent yields. Energy costs further inflate expenses. According to the Joint Research Centre, climate‑controlled rearing environments account for over 60% of total production costs due to Europe’s temperate climate. Consequently, startups struggle to achieve economies of scale. Ynsect’s 2024 sustainability report noted that even with its automated vertical farm in France, production costs remain significantly above break‑even without public subsidies. Retailers reflect this in pricing. For instance, a 40‑gram cricket protein bar sells for €3.50 in Germany, making it uncompetitive with conventional snacks. Limited scale, high energy costs, and premium pricing are keeping edible insects niche, and automation and renewable energy integration are key to mainstream adoption.

MARKET OPPORTUNITIES Integration into Mainstream Food Products as Invisible Ingredients

A major opportunity in the Europe edible insects market lies in using defatted insect flour as a functional ingredient in familiar food formats where taste, texture, and appearance mask insect origin while delivering nutritional and environmental benefits. This “invisible integration” strategy bypasses cultural resistance by embedding insect protein into everyday items like bread, pasta, snacks, and meat analogs. According to the European Food Information Council, over 80 new product launches in 2024 incorporated insect flour at levels between 5% and 15% to boost protein and micronutrient content without altering sensory profiles. French bakery chain Paul trialed mealworm‑enriched baguettes in 2024, achieving protein levels comparable to legume breads with no detectable flavor difference, as confirmed by sensory panels at AgroParisTech. Similarly, Dutch startup Bugsolutely supplies cricket flour to Italian pasta makers producing high‑iron, high‑protein spaghetti now sold in over 200 Eataly stores. Regulatory support enables this shift. The European Commission’s updated nutrient profiling model includes insect protein as a positive criterion for health claims. As per a 2024 European Consumer Organisation study, 63% of European consumers are willing to try insect‑based foods if they resemble conventional products. Invisible integration into familiar foods offers the most practical route to mainstream adoption, which is combining regulatory support with consumer openness.

Expansion into Pet Food and Aquaculture Feed Creating Cross‑Market Synergies

While direct human consumption remains limited, the Europe edible insects market benefits from rapid adoption in adjacent sectors, which is creating economies of scale that indirectly support human food applications. According to the European Pet Food Industry Federation, over 280 insect‑based pet food products were authorized in the EU in 2024, with sales growing by 44% year on year. Aquaculture is an even larger driver. For instance, as per the European Aquaculture Association, 17% of farmed fish feed in the EU now contains insect meal, which is replacing unsustainable fishmeal. Companies like Protix and Entocube operate integrated biorefineries producing both animal feed and human‑grade flour from the same rearing stream. As per the European Alternative Proteins Association, cross‑segment revenue reduces break‑even thresholds by 35%. Regulatory alignment accelerates adoption. For instance, the European Commission authorized insect meal in poultry and pig feed in 2021 and in aquaculture feed in 2017, which is establishing safety precedents that ease human food approvals. Moreover, a 2024 YouGov survey found that 52% of pet owners expressed greater openness to human insect foods after feeding them to animals. Cross‑market synergies in pet food and aquaculture are driving scale, lowering costs, and improving consumer familiarity, strengthening the edible insect ecosystem.

MARKET CHALLENGES Inconsistent Allergen Labeling and Cross‑Contamination Risks

A persistent challenge facing the Europe edible insects market is the lack of harmonized allergen disclosure protocols and documented risks of cross‑reactivity with crustacean and dust mite allergies. According to the European Food Safety Authority, yellow mealworm and cricket proteins share structural similarities with shellfish allergens, which is prompting mandatory “may contain crustaceans” warnings on all insect food labels. However, implementation remains inconsistent. The European Commission’s Rapid Alert System for Food and Feed documented 14 non‑compliance cases in 2024 where insect products lacked required allergen statements or used ambiguous phrasing like “natural protein source.” This creates consumer confusion and legal risk. For instance, France’s Directorate General for Competition banned three insect snack brands in early 2025 for inadequate allergy warnings. Scientific understanding is also evolving. According to the Charité University Hospital in Berlin, 11% of shellfish‑allergic patients showed IgE reactivity to mealworm extract in clinical tests in 2024. Yet diagnostic tools are not standardized across EU clinics, limiting accurate prevalence data. Without harmonized allergen labeling and validated testing, consumer trust will remain fragile, slowing retail confidence and broader adoption.

Fragmented Novel Food Approval Process Across Member States

Despite EU‑level authorization, the edible insects market in Europe faces operational complexity due to divergent national interpretations of novel food regulations and additional local restrictions that delay product rollout and increase compliance costs. According to the European Commission’s Food Safety Portal, while EFSA grants Union‑wide approval, national food agencies retain authority over labeling language, packaging design, and retail placement. In 2024, Italy’s Ministry of Health required all insect products to carry a skull‑and‑crossbones symbol during a temporary review, causing six‑month delays for market entry. Similarly, Poland’s Chief Sanitary Inspectorate mandated separate facility certification for insect processing not required in Germany or the Netherlands. According to the European Alternative Proteins Association, startups spend an average of nine months and €120,000 navigating country‑specific requirements before pan‑European distribution. Retailers exacerbate fragmentation—Carrefour stocks insect pasta in France but not in Spain due to differing internal risk assessments. Fragmented national rules undermine the EU’s single market principle, which is creating costly delays and disadvantaging smaller producers; harmonization is essential for sector growth.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

34.58%

Segments Covered

By Product, Application, And Region

Various Analyses Covered

Global, Regional & Country Level Analysis; Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis; Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, and the Czech Republic

Market Leaders Profiled

Protix, Ÿnsect, InnovaFeed, Entomo Farms, AgriProtein, Beta Hatch, Hexafly, NextProtein, Jimini’s, Bugfoundation, Micronutris, Aspire Food Group, Nutrition Technologies, Protifarm, Entocube

SEGMENTAL ANALYSIS By Product Insights

The cricket segment led the market by occupying 48.4% of the Europe edible insects market share in 2024. The leading position of crickets in this European market is attributed to their neutral flavor profile, high protein density, and early regulatory approval under the EU Novel Food framework. According to the European Food Safety Authority, cricket powder contains 65–70% protein by dry weight along with all nine essential amino acids, vitamin B12, iron, and calcium. The European Commission authorized dried house cricket for human consumption in December 2021 by providing regulatory clarity that accelerated product development. As per Deep Market Insights, crickets accounted for the largest insect type market size in Europe in 2024. The European Alternative Proteins Association reported that over 70% of insect-based food startups in Europe in 2024 selected cricket as their primary species due to established farming protocols and higher consumer acceptance compared to beetles or caterpillars. Retailers such as Edeka and Carrefour also noted that cricket-based snacks generated significantly higher repeat purchases than mealworm products. This combination of nutritional superiority, regulatory precedence, and market validation solidifies cricket’s leadership. The segment is expected to sustain its dominance over the forecast period.

The beetles segment is anticipated to grow at a CAGR of 29.5% over the forecast period, owing to its status as the first insect authorized for human consumption in the EU and its functional properties in baking and extrusion. According to the European Commission, dried yellow mealworm received novel food approval in January 2021. As per the Joint Research Centre, mealworm flour exhibits superior binding and emulsifying properties compared to cricket, which is enabling its use in bread, pasta, and ready meals. French bakery chain Paul launched mealworm-enriched baguettes in 2024 to achieve higher protein content while maintaining traditional sensory qualities. Ÿnsect’s automated vertical farm in France produces over 20,000 metric tons of mealworm annually, making it Europe’s largest insect protein facility. According to the European Food Information Council, 54% of consumers perceive mealworm as “less insect-like” than crickets, which is aiding acceptance. With EU innovation funds backing and growing B2B demand, mealworm is rapidly transitioning into a mainstream protein source. The segment is expected to expand significantly over the forecast period.

By Application Insights

The powder segment dominated the market by accounting for 63.5% of the Europe edible insects market share in 2024. The dominance of powder in this European market is attributed to its versatility and ability to integrate into a wide range of food formats while bypassing consumer aversion to whole insects. According to the European Food Safety Authority, defatted insect powder retains high protein content and micronutrients while eliminating fat that can cause rancidity. For instance, insect powders are a major product type in Europe’s edible insect market. Startups such as Jimini’s and Protifarm supplied cricket and mealworm powder to over 120 European food brands in 2024. As per the retail data from Edeka, 78% of insect-based SKUs in 2024 used powder as the primary format, with pasta and bread leading sales. Powder simplifies regulatory compliance since one novel food authorization per species covers multiple end products. This ingredient-first approach aligns with Europe’s preference for familiar foods enhanced with sustainable nutrition. The segment is expected to maintain its leadership over the forecast period.

The protein bars segment is expected to register the fastest CAGR of 30.5% over the forecast period in the European edible insects market. Fitness culture, clean-label trends, and precise dosing capabilities are propelling growth in this segment. According to the European Health and Fitness Association, over 42 million Europeans engaged in regular strength or endurance training in 2024. Brands such as Bugfoundation and Entomo Farms launched cricket-based bars in Germany and the Netherlands in 2024, achieving protein levels of 20 grams per serving. Carrefour introduced a “Future Protein” shelf in 2024 featuring six insect bar brands, with sales growing by 47% in the first six months. As per the European Food Information Council, framing insect bars as “sustainable protein” increased trial likelihood by 33%. With strong alignment to wellness trends and scalable production, protein bars are expected to expand rapidly over the forecast period.

REGIONAL ANALYSIS France Edible Insects Market Analysis

France dominated the European edible insects market in 2024 by holding 22.7% of the regional share. The leading position of France in the European market can be credited to proactive government support, agritech innovation, and early adoption in culinary and retail channels. According to the French Ministry of Agriculture, the “Protéines du Futur” initiative allocated €45 million in 2024 to scale insect farming, with grants awarded to 12 facilities. Ÿnsect’s vertical insect farm near Amiens produces over 20,000 metric tons of mealworm annually, supplying both human and pet food markets. Carrefour launched Europe’s first mainstream insect protein aisle in 2024, while the French Federation of Chefs documented that 18% of Parisian bistros offered insect-based dishes. With regulatory alignment, scientific validation, and consumer education, France exemplifies a coordinated national strategy. France is expected to maintain its leadership in edible insect adoption and innovation.

Netherlands Edible Insects Market Analysis

The Netherlands held a substantial share of the European edible insects market in 2024. The growth ofthe Netherlands in the European market is driven by agri-food technology, logistics, and sustainable protein innovation. According to the Dutch Ministry of Agriculture, over 28 insect protein companies operate in the Netherlands, including Protix. Wageningen University validated insect flour in gluten-free bread, achieving 25% higher protein content. The Port of Rotterdam facilitates exports, while Albert Heijn and Jumbo launched insect-based products in 2024 with sales exceeding projections by 34%. The Dutch Nutrition Centre included insects in its 2024 dietary guidelines as a sustainable protein option. The Netherlands is expected to remain Europe’s hub for insect protein innovation and distribution.

Germany Edible Insects Market Analysis

Germany accounted for a substantial share of the European edible insects market in 2024, owing to the health-conscious consumers, organic food culture, and strict safety standards. According to the German Federal Institute for Risk Assessment, over 90% of authorized insect products carry detailed nutritional labeling and allergen declarations. Retailers like Edeka introduced insect protein bars with QR codes linking to EFSA dossiers. The University of Hohenheim found that 41% of Germans aged 25–40 are willing to try insect foods if backed by scientific institutions. The Federal Environment Agency reported that insect farms produce 94% fewer emissions than beef per kilogram of protein. Germany is expected to sustain its high-value segment through evidence-based and eco-conscious practices.

United Kingdom Edible Insects Market Analysis

The United Kingdom is expected to hold a prominent share of the European market over the forecast period due to the fitness culture, startups, and openness to alternative proteins. According to DEFRA, over 35 insect-based food products were authorized under the UK Novel Foods regime in 2024. UK Active reported that 28 million Britons engaged in regular fitness activities, fueling demand for insect protein bars. Brands like Eat Grub achieved distribution in over 500 gyms and health food stores. Waitrose introduced “Future Protein” meal kits in 2024 with trial rates 2.1 times higher than plant-based alternatives. The University of Leeds documented that combining insect flour with herbs and spices eliminates off-notes in baked goods. The UK is expected to remain a dynamic growth corridor for insect protein innovation.

Switzerland Edible Insects Market Analysis

Switzerland is predicted to witness a healthy CAGR during the forecast period in the European edible insects market. The premium positioning and sustainability values are fuelling the market growth in Switzerland. According to the Swiss Federal Office of Food Safety, 22 insect-based products were authorized in 2024 with emphasis on organic certification. Gault&Millau reported that over 30% of Zurich and Geneva fine dining establishments featured insect dishes. The Swiss Federal Statistical Office found that 52% of residents view insects as a credible, sustainable protein source, the highest in Europe. The Swiss Green Economy Platform recognized insect farming as a “resource-efficient innovation” in 2024, granting tax incentives to producers. Switzerland is expected to expand its premium niche in edible insect adoption.

COMPETITION OVERVIEW

Competition in the Europe edible insects market is defined by a dynamic interplay between agritech scale players prem, premium culinary brands, and ingredient specialists navigating a complex landscape of regulation constraints, consumer perception, and sustainability mandates. The market features a dual trajectory where large vertically integrated farms like Ÿnsect focus on industrial scale and B2B ingredient supply while niche brands such as Essento cultivate cultural acceptance through gastronomy and retail premiumization. Regulatory harmonization under the EU Novel Food framework provides a common foundation yenationalal differences in labeling, allergen communication, and retail risk tolerance create fragmentation. Innovation centers on masking insect origin through powder formats and functional food integration to overcome cultural aversion. Competition is not primarily price price-basedeputation driven with, trust anchored in scientific validation tra, transparency,y and environmental credentials. Startups face high entry barriers due to capital intensity regulations, regulatory costs, and consumer skepticism, and benefit from EU innovation funding and growing B2B demand from health food and fitness sectors. Ultimately, success hinges on balancing scalability senso,ry neutrality, and storytelling to position insects as both sustainable and socially acceptable.

KEY MARKET PLAYERS

A few major players of the Europe edible insects market include

Protix Ÿnsect InnovaFeed Entomo Farms AgriProtein Beta Hatch Hexafly NextProtein Jimini’s Bugfoundation Micronutris Aspire Food Group Nutrition Technologies Protifarm Entocube Top Strategies Used by the Key Market Participants

Key players in the Europe edible insects market pursue strategies centred on regulatory compliance, scientific validation, product visibility, and premium differentiation. Companies prioritize securing Novel Food authorization from the European Food Safety Authority as a foundation for legitimacy and retail access. They invest in third-party verified environmental and nutritional data to build trust with health-conscious consumers and B2B partners. Product development focuses on defatted powders and flours that integrate seamlessly into familiar foods like bread, pasta, and bars, thereby bypassing psychological resistance to whole insects. Strategic collaborations with retailers, chefs, and fitness brands enhance trial and normalize consumption. Sustainability storytelling is emphasized through lifecycle assessments, renewable energy-powered farms, and circular feed systems using pre-consumer waste. Geographic specialization allows firms to align with national values, whether France’s agritech policy, Germany’s health rigor, or Switzerland’s premium ethics. These approaches collectively transform edible insects from a novelty into a credible pillar of Europe’s future food system.

Leading Players in the Europe Edible Insects Market Ÿnsect SA is a French pioneer in vertical insect farming specializing in yellow mealworm production for human food and pet nutrition. The company contributes to the global alternative protein movement through its fully automated high-rise insect farm near Amiens, which sets benchmarks for yield efficiency and environmental performance. In 2024, Ÿnsect secured European Novel Food approval for its defatted mealworm protein and launched a B2B ingredient line targeting bakery and pasta manufacturers. It also partnered with major retailers to develop private labelinsect-enrichedd products while publishing third-party verified lifecycle assessments demonstrating 98% lower carbon emissions than beef. These actions position Ÿnsect as a science-driven, scalable leader advancing edible insects from niche to norm. Protix B.V. is aNetherlands-basedd innovator in insect bioconversion using black soldier fly and mealworm to produce protein for human food, animal feed, and horticulture. The company plays a pivotal role in the global circular economy by transforming food waste intohigh-qualityy nutrition. In 2024, Protix expanded its human food division by introducing cricket and mealworm powder compliant with EFSA safety standards and began supplying ingredient solutions to European food brands developing high-protein snacks and cereals. It also integrated blockchain traceability into its supply chain, allowing customers to verify farm origin and processing conditions. These initiatives reinforce Protix’s commitment to transparency sustainabilit, andcross-sectorall protein innovation. Essento AG is a Swiss company focused on premium edible insect products for retail and gastronomy across Europe. The company elevates entomophagy through culinary refinement, branding, and consumer education,n positioning insects as a gourmet,t sustainable protein. In late 2024, Essento launched a range of ready-to-cook insect pasta and baking flour in organic supermarkets across Germany, Switzerland,d and Austria. It also collaborated with Michelin-starred chefs to create seasonal insect-based menus and published a comprehensive allergen and nutrition transparency dossier aligned with European Food Safety Authority guidelines. By merging gastronomic excellence with scientific rigor, Essento advances cultural acceptance and premium market development for edible insects in discerning European markets. MARKET SEGMENTATION

This research report on the Europe edible insects market has been segmented and sub-segmented based on product, application, and region.

By Product

Beetles Caterpillar Cricket

By Application

By Region

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe