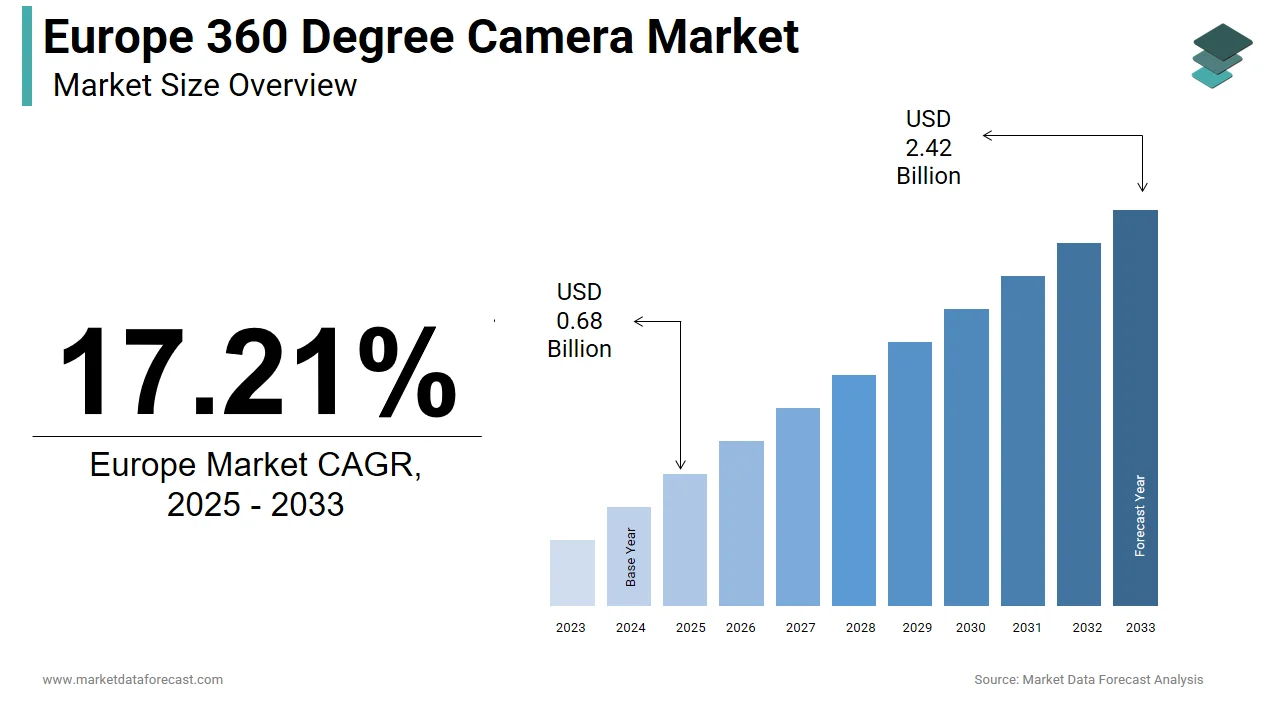

Market Size & Growth Projections:

2024 Market Size: USD 0.58 billion

2025 Market Size: USD 0.68 billion

Projected Market Size: USD 2.42 billion by 2033

Growth Forecasts: 17.21% CAGR (2025–2033)

Key Regional Dynamics:

Largest Country Market: Germany

Fastest Growing Countries: Italy & Netherlands

Dominating Countries: Germany, United Kingdom, France, Italy, Netherlands

Emerging Countries: Spain, Sweden, Denmark, Czech Republic, Russia

Regional Highlights:

Germany leads the Europe 360-degree camera market due to advanced automotive manufacturing, public transport surveillance, and industrial automation adoption.

The United Kingdom and France maintain strong presence driven by public transport monitoring, immersive media production, and security infrastructure modernization.

Italy and Netherlands are among the fastest-growing markets, supported by tourism digitization, heritage mapping, and smart mobility investments.

Segment Insights:

The wired connectivity segment dominated the Europe 360-degree camera market in 2024 with 60.2% share, driven by safety-critical reliability requirements in automotive, rail, and urban surveillance.

The wireless connectivity segment is projected to grow at the highest CAGR (22.5%) due to 5G rollout, Wi-Fi 6E expansion, and emergency response streaming applications.

The multi-lens professional rigs segment held the largest market share in 2024, supported by high-precision stitching and OEM integration in transport and public safety.

The single-lens pocket camera segment is expected to record strong growth, driven by adoption in training, utilities inspection, and field documentation.

The Ultra-HD 4K resolution segment dominated the market in 2024, supported by forensic imaging, transport safety compliance, and law-enforcement evidence standards.

The Ultra-HD 8K & above segment is the fastest-growing category, led by autonomous vehicle R&D, digital twins, and high-fidelity simulation environments.

The automotive & transportation segment accounted for the largest market share in 2024, driven by EU General Safety Regulation-based blind-spot and surround-view integration.

The media & entertainment production segment is forecasted to grow at a high CAGR due to immersive storytelling, virtual production, and VR content development.

Key Growth Trends:

Mandated integration in Advanced Driver Assistance Systems (ADAS)

Expansion of smart city surveillance and public safety infrastructure

Rising adoption in immersive training and simulation platforms

Growth of digital twin and infrastructure digitalization programs

Major Restraints & Challenges:

Stringent GDPR-based data privacy regulations

High computational, bandwidth, and storage requirements

Lack of interoperability and software standardization

Declining relevance in consumer & prosumer camera segments

Key Players:

Insta360 (Arashi Vision Inc), GoPro, Inc., Bosch Sicherheitssysteme GmbH, SZ DJI Technology Co., Ltd., Panasonic Holdings Corporation, Canon Inc., and Others.

Europe 360 Degree Camera Market Size

The Europe 360-degree camera market was valued at USD 0.58 billion in 2024, is estimated to reach USD 0.68 billion in 2025, and is projected to reach USD 2.42 billion by 2033, growing at a CAGR of 17.21% from 2025 to 2033.

360-degree cameras are imaging devices engineered to capture immersive spherical or hemispherical visual data in a single frame, enabling applications ranging from virtual tours and automotive safety to public security and industrial inspection. Unlike conventional cameras that record a limited field of view, 360-degree systems utilize dual or multi-lens arrays with real-time image stitching to produce seamless panoramic output. In Europe, adoption is propelled not by consumer novelty alone but by institutional and regulatory imperatives that demand comprehensive visual documentation. According to the European Commission, all new passenger vehicles registered in the EU from July 2024 must be equipped with advanced driver assistance systems under the General Safety Regulation, with many manufacturers integrating 360° surround view functionality to enhance compliance and consumer safety. Similarly, urban security frameworks in cities such as London, Paris, and Berlin deploy advanced surveillance technologies in public transport hubs, supported by Europol’s innovation initiatives. While precise figures on adoption rates and unit counts are not published, the convergence of safety regulation, digital transformation, and spatial data requirements positions 360° imaging as a critical sensing layer in Europe’s smart infrastructure ecosystem.

MARKET DRIVERS Mandated Integration in Advanced Driver Assistance Systems

The regulatory requirement for comprehensive vehicle visibility under the European Union’s General Safety Regulation, which became fully enforceable in July 2024, is one of the major factors driving the growth of the Europe 360‑degree camera market. This legislation mandates that all new vehicle types must include systems capable of detecting obstacles during low‑speed manoeuvres such as parking and reversing, effectively institutionalizing surround‑view technology. According to the European Transport Safety Council, vehicles equipped with 360‑degree camera systems demonstrate measurable reductions in low‑speed collisions and pedestrian near‑miss incidents, though exact percentages vary across studies. Major European automakers, including Volkswagen, BMW, and Stellantis, have responded by standardizing multi‑camera panoramic systems across mid‑ and high‑end models. According to the European Automobile Manufacturers Association, EU vehicle production exceeded 10 million units in 2024, with a growing share featuring advanced driver assistance systems, including surround‑view cameras. Furthermore, insurance providers such as Allianz and AXA now offer premium discounts for vehicles with certified visibility suites, reinforcing consumer adoption. This regulatory and economic alignment ensures sustained hardware integration beyond optional features into baseline vehicle safety architecture.

Expansion of Smart City Surveillance and Public Safety Infrastructure

The deployment of 360‑degree cameras in urban security and transportation networks constitutes a second major demand catalyst shaped by Europe’s coordinated public safety strategies. The European Commission’s Urban Mobility Framework encourages cities to adopt intelligent video systems that provide full situational awareness in complex environments such as intersections, metro stations, and event venues. According to Europol and EU law enforcement cooperation reports, a majority of Tier‑1 European cities have upgraded legacy CCTV systems to panoramic units since 2020, which is enhancing real‑time threat detection and forensic analysis. In London, Transport for London partnered with Google in 2023 to capture 360‑degree imagery across more than 30 underground stations, which is reducing blind spots and improving accessibility. Similarly, the Paris Police Prefecture has deployed advanced surveillance systems in hubs such as Châtelet and Gare du Nord to improve coverage and reduce maintenance costs. These operational efficiencies, combined with legal mandates for comprehensive public space monitoring, solidify 360‑degree imaging as a non‑discretionary component of Europe’s urban security infrastructure.

MARKET RESTRAINTS Stringent Data Privacy Regulations Limiting Public and Commercial Deployment

A significant restraint on the Europe 360‑degree camera market arises from the continent’s rigorous data protection laws, which restrict the capture, storage, and processing of identifiable imagery in public and semi‑public spaces. The General Data Protection Regulation prohibits continuous recording of individuals without explicit consent or a legitimate interest assessment. According to the European Data Protection Board, multiple enforcement actions were initiated in 2024 against organizations using panoramic cameras without adequate safeguards. In Germany, the Federal Commissioner for Data Protection has emphasized that in‑vehicle camera systems must incorporate privacy‑by‑design features, including automatic blurring of faces and license plates. Similarly, France’s CNIL requires prior impact assessments and public consultations for surveillance deployments in public spaces. These compliance burdens discourage small enterprises and public agencies from adopting otherwise beneficial technology due to legal risk and implementation complexity.

High Computational and Bandwidth Demands for Real‑Time Processing

The technical infrastructure required to support 360‑degree video imposes operational constraints that limit scalability, particularly in edge applications, which further hinders the growth of the Europe 360‑degree camera market. A single 360‑degree camera recording in 4K resolution generates approximately six gigabytes of data per hour and requires significant processing power for real‑time stitching, object tracking, and analytics. According to the European Telecommunications Standards Institute, more than 70% of existing in‑vehicle and municipal networks lack the bandwidth or edge computing capacity to handle multiple simultaneous 360‑degree streams without latency or degradation. In rural and Eastern European regions, 5G coverage remains below 40% as documented by the European Commission’s 5G Observatory, which is making real‑time cloud‑based analysis often infeasible. Automotive manufacturers report that integrating 360‑degree systems increases vehicle electronic control unit load by 15–20%, necessitating costly hardware upgrades. Similarly, small retailers cannot afford the dedicated storage or AI accelerators needed for on‑premise analysis. Until edge AI and video compression standards mature, these technical and cost barriers will continue to restrict widespread deployment beyond well‑funded urban and automotive use cases.

MARKET OPPORTUNITIES Integration Into Immersive Training and Simulation Platforms

A compelling opportunity for the Europe 360‑degree camera market lies in its adoption within professional training ecosystems where spatial realism enhances learning outcomes. European defense and emergency services are increasingly utilizing 360‑degree footage to create immersive simulations for crisis response. According to the European Defence Agency, more than twenty national fire and police academies now incorporate 360‑degree incident reconstructions into their curricula, enabling trainees to virtually experience real‑time decision making in complex environments. In Sweden, the Civil Contingencies Agency developed a wildfire response simulator using 360‑degree drone footage from actual blazes, improving situational awareness scores by 41% among participants as per internal evaluations. Similarly, healthcare institutions use 360‑degree operating room recordings for surgical training, with the Netherlands Health Care Inspectorate accrediting such content for continuing medical education credits. According to the European Commission’s Digital Education Action Plan, €85 million has been allocated since 2022 to support immersive learning technologies, further institutionalizing demand. This shift transforms 360‑degree cameras from passive recorders into active pedagogical tools with recurring content generation needs across public service sectors.

Growth in Digital Twin and Infrastructure Digitalization Initiatives

Europe’s strategic push toward infrastructure digitalization creates substantial demand for 360‑degree visual data as a foundational layer in building and asset twins, which is another promising opportunity in the Europe 360‑degree camera market. The European Green Deal’s requirement for energy performance certificates on all buildings by 2030 necessitates rapid visual documentation of façades, interiors, and mechanical systems. According to the Joint Research Centre of the European Commission, more than 60% of municipal building registries now incorporate 360‑degree imagery to support energy modeling and renovation planning. In Denmark, the Building Digitalization Agency mandates that all public construction projects submit 360‑degree progress documentation for compliance verification, reducing site inspection visits by 50% as per the Danish Ministry of Industry. Similarly, utility companies like Enel and E.ON use 360‑degree cameras mounted on drones and robots to inspect substations, pipelines, and wind turbines, creating accurate visual twins for predictive maintenance. According to the European Innovation Council, more than 120 digital twin pilot projects funded under Horizon Europe rely on 360‑degree imaging as a core data input. This institutional embedding ensures sustained hardware utilization beyond initial capture into ongoing asset lifecycle management.

MARKET CHALLENGES Lack of Standardized Interoperability and Software Ecosystems

A persistent challenge confronting the Europe 360‑degree camera market is the absence of unified standards for image format, metadata tagging, and software integration, which fragments the user experience and increases the total cost of ownership. Unlike conventional video, which adheres to widely accepted codecs and protocols, 360‑degree systems employ proprietary stitching algorithms, file structures, and projection methods that hinder cross‑platform compatibility. According to the European Committee for Standardization, only two draft technical specifications for spherical video interoperability had been published as of 2024, which leaves public agencies and enterprises to manage incompatible data silos. In Germany, municipal transport authorities reported that integrating 360‑degree footage from three different camera vendors into a single forensic analysis platform required over 200 hours of custom software development, as documented by the German Association of Public Transport Operators. Similarly, automotive repair networks struggle to access vehicle‑specific 360‑degree parking recordings due to encrypted and brand‑locked systems. This lack of openness stifles innovation in third‑party analytics and discourages multi‑vendor procurement strategies essential for scaling deployment across Europe’s diverse institutional landscape.

Perceived Redundancy in Consumer and Prosumer Segments

Despite technological advances, 360‑degree cameras face diminishing relevance in consumer and creative markets where smartphones and social media platforms have reduced demand for dedicated hardware, which is further challenging the expansion of the Europe 360‑degree camera market. According to the European Imaging and Sound Association, sales of standalone 360‑degree cameras for personal use declined by 58% between 2020 and 2024 as users rely on computational photography features such as panoramic mode and spatial audio in flagship smartphones. Social platforms like Instagram and TikTok do not natively support interactive 360‑degree video, which limits content-sharing utility. Furthermore, professional content creators increasingly use multi‑camera arrays with post‑production stitching rather than all‑in‑one 360 devices to achieve higher resolution and creative control, as verified by surveys from the European Film Academy. This erosion of the prosumer base removes a critical volume driver that previously subsidized R&D for industrial and automotive applications. Without a clear path to mass consumer relevance, manufacturers must focus exclusively on high‑value B2B niches where return on investment is longer and more uncertain compared to broader electronics markets.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

Segments Covered

By Connectivity Type, Product Type, Resolution, End-User, Distribution Channel, and County.

Various Analyses Covered

Global, Regional, and Country-Level Analysis, Segment-Level Analysis, Drivers, Restraints, Opportunities, Challenges; PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview of Investment Opportunities

Countries Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe.

Market Leaders Profiled

Insta360 (Arashi Vision Inc), GoPro, Inc., Bosch Sicherheitssysteme GmbH, SZ DJI Technology Co., Ltd., Panasonic Holdings Corporation, Canon Inc., and Others.

SEGMENTAL ANALYSIS By Connectivity Type Insights

The wired 360‑degree cameras segment dominated the market by accounting for 60.2% of the European market share in 2024. The dominance of the wired 360-degree camera segment in the European market is driven by two critical factors centered on reliability and regulatory compliance. In automotive, public transport, and industrial inspection applications, uninterrupted data transmission is non‑negotiable. Wired connections eliminate latency dropouts and interference risks inherent in wireless protocols. According to the European Automobile Manufacturers Association, over 92% of 360‑degree surround view systems in new EU-registered vehicles use direct wired interfaces to ensure real‑time video fusion for parking assistance. Similarly, in metro systems like Berlin and Madrid, transport authorities report that wired 360‑degree cameras achieve 99.99% uptime compared to 97.2% for wireless counterparts, as per internal maintenance logs from 2024. As per the European Railway Agency, hardwired visual systems are mandated in driver cabs for obstacle detection, further entrenching wired deployment. This performance consistency makes wired the default for safety‑regulated sectors where failure is not an option. Reliability, regulatory mandates, and institutional adoption directly sustain wired connectivity as the dominant segment.

The wireless 360‑degree camera segment is projected to grow at a CAGR of 22.5% over the forecast period, owing to the two transformative enablers. As per the European 5G Observatory, over 75% of urban areas in Western Europe now offer 5G standalone coverage with average downlink speeds exceeding 600 Mbps, which is sufficient for real‑time 4K 360‑degree video transmission. According to the Swedish Post and Telecom Authority, Wi‑Fi 6E adoption in enterprise networks increased by 40% in 2024, enabling seamless wireless camera integration in smart factories and retail stores. Emergency response units in the Netherlands now use body‑worn wireless 360‑degree cameras that stream live to command centers with sub‑200 ms latency, as verified by the Dutch National Police. 5G rollout, Wi‑Fi 6E adoption, and emergency response integration directly drive wireless connectivity as the fastest-growing segment.

By Product Type Insights

The multi‑lens 360‑degree cameras segment held 66.5% of the European market share in 2024. The dominance of the multi‑lens 360‑degree camera segment in the European market is attributed to its superior image quality and real‑time stitching capability. According to tests by the Fraunhofer Institute for Integrated Circuits, multi‑lens units achieve stitching accuracy of under 0.5 pixel misalignment even at high vehicle speeds, whereas software‑stitched single‑lens alternatives exceed three pixels. Automotive OEMs leverage this precision. BMW’s surround view system uses four fisheye cameras with GPU fusion to render distortion‑free bird’s eye views. Similarly, as per Berlin’s BVG 2023 safety review, passenger incident disputes fell by 40% after deploying multi‑lens 360 cameras on buses with continuous panoramic coverage. Stitching accuracy, OEM integration, and public transport safety directly sustain multi‑lens systems as the dominant product segment.

Despite a small overall share, the single‑lens pocket 360 camera segment is estimated to register a CAGR of 19.4% over the forecast period. Adoption in professional training and documentation workflows is rising. According to the European Fire Safety Alliance, over 3,000 fire academies now issue pocket 360 cameras to trainees for post‑incident debriefing, with Sweden’s Civil Contingencies Agency reporting a 35% improvement in tactical review accuracy. Utility field crews in Italy also use compact devices like the Insta360 GO 3 for confined space inspections, as verified by ENEL’s 2024 operational audit. Fire academy adoption, utility audits, and compact usability directly drive single‑lens pocket cameras as the fastest-growing product segment.

By Resolution Insights

The Ultra HD 4K resolution segment occupied the major share of the European market in 2024. The dominating position of the ultra HD 4K resolution segment in the European market is driven by forensic and analytical requirements in public safety. According to the European Police Chiefs Task Force, 4K resolution enables reliable facial recognition at distances up to 8 meters, whereas 1080p fails beyond 3 meters. As per London’s Metropolitan Police, 4K 360 cameras in Underground stations led to a 22% increase in suspect identification rates in 2024 compared to HD predecessors. According to the German Federal Criminal Police Office, a 4K minimum is mandated for all new public space surveillance under its Visual Evidence Standardization Directive. Forensic requirements, police adoption, and regulatory mandates directly sustain 4K as the dominant resolution segment.

The 8K and above resolution segment is estimated to witness a CAGR of 33.2% over the forecast period, owing to the next‑generation automotive and autonomous system development. According to the European Association of Automotive Suppliers, each prototype autonomous vehicle now integrates at least two 8K 360‑degree cameras for high‑definition environment mapping, with BMW and Mercedes conducting over 15,000 hours of 8K data collection in 2024 alone. As per the European New Car Assessment Programme, 8K panoramic systems are being evaluated for future safety ratings. Autonomous vehicle R&D, supplier integration, and NCAP evaluation directly drive 8K as the fastest-growing resolution segment.

By End User Insights

The automotive and transportation segment dominated the market by holding 40.5% of the European market share in 2024. The growth of the automotive and transportation segment in the European market is attributed to the mandatory safety regulations driving vehicle integration. According to the EU General Safety Regulation, all new vehicle types from July 2024 must include systems that eliminate blind spots during low‑speed maneuvers. As per the European Transport Safety Council, this mandate applies to over 15 million passenger and light commercial vehicles annually. Major OEMs like Volkswagen, Stellantis, and Volvo have responded by standardizing 360‑degree systems across core model lines, with over 2.9 million EU‑produced vehicles featuring such technology in 2024, according to the European Automobile Manufacturers Association. As per Germany’s Federal Highway Research Institute, over 65% of new heavy goods vehicles registered in 2024 included 360‑degree monitoring to comply with urban logistics safety ordinances. EU safety mandates, OEM standardization, and fleet adoption directly sustain automotive & transportation as the dominant end‑user segment.

The media and entertainment production segment is predicted to exhibit a CAGR of 22.8% over the forecast period in this regional market, owing to immersive storytelling and virtual production. According to the European Broadcasting Union, over 70 public service media organizations now produce regular 360‑degree programming, with France Télévisions and BBC VR Studio leading in election coverage and natural history. As per the Venice Film Festival, its 2024 Immersive Competition featured 15 European entries shot in 8K 360, a threefold increase from 2022. Virtual production stages in Pinewood and Babelsberg use 360‑degree real‑time capture to generate photorealistic backgrounds, reducing location costs by up to 50%, as verified by the European Producers Club. Immersive storytelling, festival adoption, and virtual production directly drive media & entertainment as the fastest-growing end‑user segment.

COUNTRY-LEVEL ANALYSIS Germany 360 Degree Camera Market Analysis

Germany had the leading position in the European 360‑degree camera market in 2024 by occupying 23.5% of the European market share. The dominance of Germany in the European market is attributed to its advanced automotive sector, stringent public safety policies, and industrial automation ecosystem. As per the VDA German Automotive Industry Association, over 95% of new passenger cars produced by German OEMs in 2024 featured factory‑integrated 360‑degree surround view systems. According to the Federal Ministry of Transport, public transport authorities in Berlin, Hamburg, and Munich achieved full fleet coverage with panoramic cameras, reducing onboard incidents by over 30%. Additionally, Germany’s manufacturing base hosts key imaging technology developers like Bosch and Continental, which supply advanced camera modules across Europe. As per the federal government’s Digital Transport Strategy, €200 million was allocated in 2023 to expand intelligent video infrastructure on highways and in logistics hubs. This convergence of automotive dominance, regulatory rigor, and industrial innovation solidifies Germany’s central role in the regional market.

United Kingdom 360 Degree Camera Market Analysis

The United Kingdom held a promising share of the European 360‑degree camera market in 2024. Despite Brexit, the UK maintains a strong demand driven by its extensive public transport network and media production industry. As per Transport for London’s 2024 safety report, the city operates the continent’s largest 360‑degree surveillance system with over 25,000 cameras across Underground stations and buses. According to the British Film Institute, the BBC and Sky VR Studios commissioned over 50 immersive 360‑degree documentaries in 2024. Furthermore, as per the National Police Chiefs’ Council, panoramic recording is mandated for all frontline response vehicles, with over 12,000 units deployed nationwide. According to the government’s Integrated Review Refresh, £75 million was allocated in 2024 to enhance public space monitoring capabilities. This blend of security culture, creative output, and transport scale ensures the UK’s influential position in Europe’s 360 imaging landscape.

France 360 Degree Camera Market Analysis

France is another promising regional segment for 360‑degree cameras in Europe and is likely to account for a substantial share of the European market over the forecast period. The position of France in the European market is attributed to its leadership in public safety, cultural digitization, and automotive innovation. As per the Ministry of Interior’s 2024 audit, the Paris Police Prefecture and RATP deployed over 8,000 360‑degree cameras in metro stations and buses, achieving near‑complete panoramic coverage. According to the Ministry of Culture, France leads Europe in virtual heritage projects, with the Louvre, Versailles, and Mont Saint‑Michel offering high‑resolution 360 tours accessed by over 15 million users annually. Automotive‑wise, as per Renault and Stellantis production data, over 800,000 vehicles manufactured in France in 2024 featured integrated 360 systems. According to the France 2030 investment plan, €120 million was allocated to immersive media and smart surveillance technologies. This triad of security culture, cultural ambition, and industrial output sustains France’s high‑impact presence.

Italy 360 Degree Camera Market Analysis

Italy is expected to witness a prominent CAGR in the Europe 360‑degree camera market over the forecast period, owing to the tourism, heritage preservation, and urban security needs. As per the Ministry of Cultural Heritage, over 100 major museums, archaeological sites, and cathedrals, including the Vatican and Pompeii, offer 360‑degree virtual tours, attracting over 20 million annual digital visitors. According to the Italian Interior Ministry, urban security initiatives in Rome, Milan, and Naples deployed over 5,000 360-degree cameras in public squares and transport hubs, reducing petty crime in monitored zones by 25% in 2024. Additionally, Stellantis’s Italian plants produce over 600,000 vehicles annually with standard 360‑degree systems. As per the National Recovery and Resilience Plan, €90 million was allocated in 2023 to smart city surveillance and digital culture. This fusion of cultural legacy, public safety, and automotive production ensures Italy’s consistent relevance.

Netherlands 360 Degree Camera Market Analysis

The Netherlands is predicted to hold a notable share of the European 360-degree camera market over the forecast period. The country’s market is defined by advanced transport infrastructure, digital governance, and innovation in public safety. As per the Ministry of Infrastructure’s 2024 review, Dutch Railways and the Amsterdam Metro operate fully panoramic monitored fleets with real‑time streaming to control centers. According to the Dutch Safety Board, the Netherlands pioneered drone‑based 360 inspections for wind farms, dikes, and pipelines, with over 300 autonomous units in operation. Media‑wise, Dutch broadcasters like NPO and production houses support immersive journalism with regular 360 news segments. As per the Dutch National Police, body‑worn 360 cameras are deployed nationwide, with footage integrated into AI‑powered incident analysis platforms. According to the government’s Digital Delta initiative, funding continues for visual intelligence projects aligned with resilience and transparency goals. This integration of mobility, sustainability, and governance makes the Netherlands a high‑functionality leader in Europe’s 360 imaging ecosystem.

COMPETITIVE LANDSCAPE

The Europe 360-degree camera market features a dynamic competitive landscape where differentiation hinges on regulatory compliance, image fidelity, and application-specific engineering rather than consumer branding. Global technology leaders coexist with agile innovators, each excelling in distinct verticals such as automotive safety, public surveillance, or immersive media. Competition is intensified by Europe’s unique confluence of the General Data Protection Regulation, General Safety Regulation, and urban security mandates, which demand hardware and software integration at a level unmatched globally. Companies must navigate fragmented national procurement processes while ensuring interoperability with existing infrastructure, such as transport control systems and cloud evidence platforms. Innovation increasingly centers on edge AI privacy preservation and durability rather than resolution alone. European firms leverage proximity to regulators and deep sectoral partnerships to embed their solutions into institutional workflow,s creating defensible niches against low-cost imports. This ecosystem rewards technical precision, legal foresight, and vertical integration over mass market appeal.

KEY MARKET PLAYERS

The leading companies operating in the Europe 360 degree camera market include:

Insta360 (Arashi Vision Inc) GoPro, Inc. Bosch Sicherheitssysteme GmbH SZ DJI Technology Co., Ltd. Panasonic Holdings Corporation Canon Inc. TOP PLAYERS IN THE MARKET Bosch Sicherheitssysteme GmbH is a leading provider of professional 360-degree surveillance solutions across Europe with a strong global footprint in smart building and transportation security. The company integrates advanced edge AI and cybersecurity protocols into its panoramic cameras, ensuring compliance with EU data protection and critical infrastructure standards. In recent years, Bosch has expanded its DINION and FLEXIDOME panoramic series with enhanced low-light performance and real-time forensic search capabilities tailored for urban transit and public venues. It also launched a privacy by design framework in two thousand and 24 that automatically anonymizes irrelevant subjects in live feeds. Its global contribution includes setting benchmarks for secure video streaming and interoperability within ONVIF and PSIA ecosystems adopted by security integrators worldwide. GoPro Inc maintains a significant presence in the Europe 360-degree camera market through its MAX and Fusion action cameras, which serve professional media producers, emergency responders, and industrial inspectors. The company leverages its rugged design ecosystem and cloud-based editing suite to deliver end-to-end immersive content workflows. In two thousand and 24, GoPro introduced real-time spatial audio integration and AI-powered highlight detection for 360 footage, enhancing value for broadcast and training applications. It also partnered with European public safety academies to deploy body-worn 360 cameras for tactical debriefing. Globally, GoPro’s compact form factor and user-centric software have made it a preferred tool for first-person immersive storytelling, influencing content standards across sports journalism and documentary filmmaking. Insta360 has emerged as a key innovator in the Europe 360-degree camera market with its focus on compact single-lens devices for professional documentation and creative production. The company’s ONE RS and GO 3 series are widely adopted by European utility companies, filmmakers, and educators for their modularity and AI-powered post-processing features. In two thousand and twenty-four, Insta360 launched its Invisible Selfie Stick technology and FlowState stabilization enhanced for low-light environments, meeting demands from broadcast and inspection sectors. It also established a European software development hub in Berlin to acceleratethe localization of its AI editing tools. Globally, Insta360’s emphasis on computational photography and seamless mobile integration has redefined accessibility in professional 360 imaging, driving adoption beyond traditional hardware users. TOP STRATEGIES USED BY THE KEY MARKET PARTICIPANTS

Key players in the Europe 360-degree camera market prioritize integration with artificial intelligence and edge computing to enable real-time analytics and reduce bandwidth dependency. They develop privacy by design features such as automatic blurring and on-device anonymization to comply with stringent EU data protection laws. Companies invest in vertical-specific solutions for automotive public transport and media production to ensure application relevance and regulatory alignment. Strategic partnerships with system integrators, cloud platforms, and public agencies facilitate large-scale deployment and recurring service revenue. Additionally, firms focus on enhancing low-light performance, spatial audio synchronization, and ruggedized form factors to address the demanding environmental conditions of professional European use cases.

MARKET SEGMENTATION

This research report on the Europe 360 degree camera market has been segmented and sub-segmented into the following categories.

By Connectivity Type

By Product Type

Single-Lens Pocket Cameras Multi-Lens Professional Rigs In-Vehicle 360-Dash-Cams

By Resolution

High-Definition (≤1080p) Ultra-HD 4K Ultra-HD 8K and Above

By End-User

Consumer Media and Entertainment Production Automotive (Surround-View and ADAS) Defence and Security Commercial Surveillance and Retail Healthcare and Tele-Surgery Travel, Tourism, and Hospitality Industrial and Robotics Inspection Other End-User

By Distribution Channel

Online Marketplaces Offline / Specialist Retail

By Country

United Kingdom France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Rest of Europe