U.S. dollar bills at Hana Bank in Seoul, Dec. 3, 2025. Yonhap

Korea’s foreign exchange (FX) reserves in December declined at the sharpest rate in 28 years, strained by the government’s aggressive currency market intervention to limit further weakening of the Korean won against the U.S. dollar, central bank data showed Tuesday.

The measures partially stabilized the currency, but doubts persist over the long-term effectiveness of such short-term interventions, especially if market volatility intensifies.

Experts warn that FX reserves could face additional pressure in the near term, as financial institutions move to withdraw foreign currency temporarily deposited at the central bank to meet year-end regulatory ratio requirements.

Still, large withdrawals of funds are likely to be limited because authorities are now paying interest on extra foreign currency deposits. There’s also hope that government intervention could ease, helping to stabilize FX reserves.

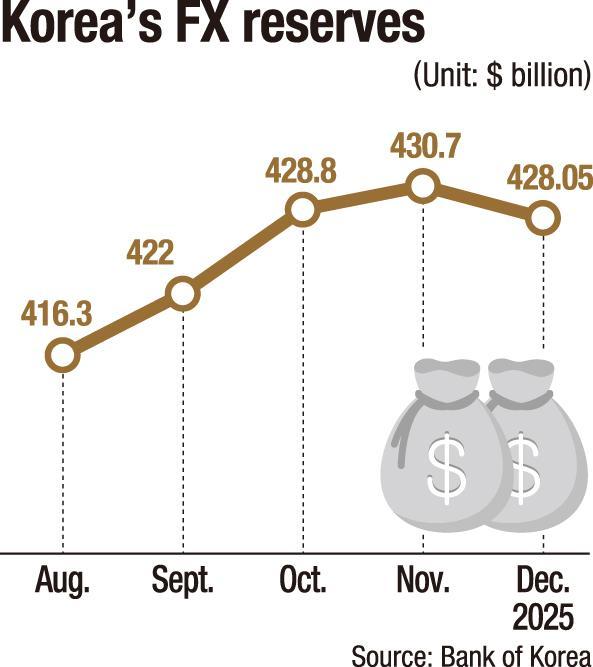

According to Bank of Korea data, the country’s FX reserves stood at $428.05 billion at the end of December, down $2.6 billion from November. The drop was the second-sharpest December decline on record and the steepest fall in 28 years.

The biggest drop came in December 1997, when FX reserves fell $4 billion during the Asian financial crisis.

Korea’s FX reserves saw sharp monthly declines of $5 billion in April and $4.5 billion in January last year, but last month’s drop is notable because December is usually a month of reserve gains.

This is because financial institutions deposit foreign currency with the central bank to meet the Bank for International Settlements’ capital ratio requirements, leading to a temporary inflow of U.S. dollars.

“The monthly fall was explained in large part by intensified Korean currency trajectory against the U.S. dollar right around the fourth week of December, when authorities issued strong verbal warnings and followed up with direct market intervention,” Standard Chartered Bank Korea strategist Hong Dong-hee said.

“The government’s aggressive hedging measures using FX swap arrangements with the National Pension Service also helped strengthen the won, stabilizing the currency to around 1,430 won level, helping it gain from the nearly 1,490 won level in just four trading days. The authorities are expected to face a tall task to strike a balance between defending the currency and preserving reserves.”

Also, concerns over the longer-term trade-off linger, according to KB Securities strategist Mun Jung-hui.

“The FX reserve was visibly eroded,” he said, adding that the measures to limit further volatility led to the decline in FX reserves.

“The U.S. reserve currency weakened broadly in December, boosting in turn the value of reserves held in euros, pounds and yen when converted into dollars; this failed to offset the amount of dollars sold as part of the authority intervention,” Mun said.