Europe Aluminum Composite Panel Market Size

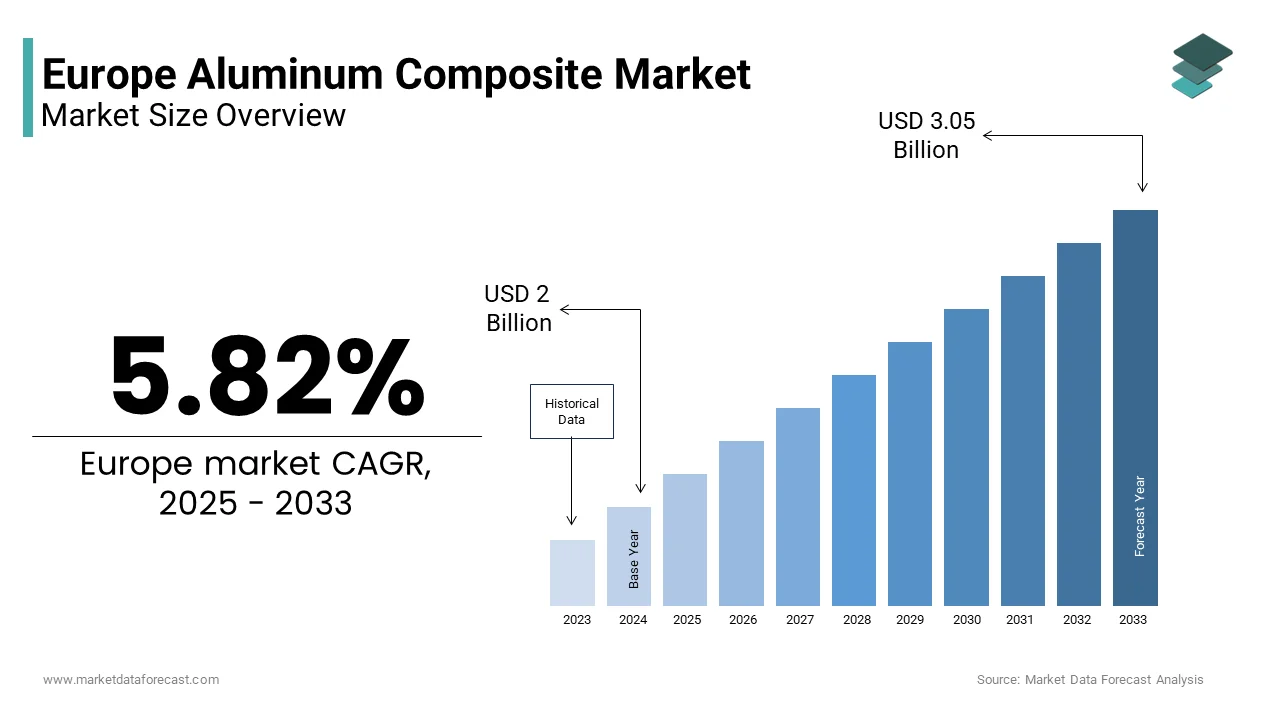

The Europe aluminium composite panel market size was valued at USD 1.9 billion in 2024 and is anticipated to reach USD 2 billion in 2025 to USD 3.05 billion by 2033, growing at a CAGR of 5.41% during the forecast period from 2025 to 2033.

Current Introduction of the Europe Aluminum Composite Panel Market

Aluminum composite panels to flat sandwich panels consisting of two thin aluminum sheets bonded to a non-aluminum core, typically polyethylene mineral-filled or fire-retardant compounds, used primarily for exterior cladding, ng interior finishes,hes and signage in commercial and institutional buildings. These panels are valued for their lightweight nature, dimensional stability, aesthetic versatility, and ease of fabrication. According to the European Commission, over 35 million square meters of building façade are renovated annually across the E, U with facade systems required to meet strict reaction to fire classifications under EN 13501 1. As per the European Construction Industry Federation, the average service life of a commercial building envelope in Western Europe is 25 to 30 years, with over 40% of structures built between 1980 and 2005 now requiring façade modernization. In this context, aluminum composite panels have evolved from a purely architectural choice to a regulated construction product where fire performance, core composition,,n and recyclability determine market viability across the European single market.

MARKET DRIVERS Post Grenfell Fire Safety Regulations Drive Demand foNon-Combustiblele Panels

The implementation of stringent fire safety codes following the 2017 Grenfell Tower tragedy has fundamentally reshaped material selection in European facade construction, which is expanding the growth of Europe aluminum composite panel market. As per the European Fire Safety Alliance, over 22 EU member states now prohibit the use of combustible cladding materials defined as Euroclass B or lower on residential buildings above specific height thresholds typically between 10 and 18 meters. In the United Kingdom, all new residential buildings over 11 meters must use materials rated A1 or A2 s1 d0 under EN 13501,,1 effectively banning standard polyethylene cored panels. Germany’s Model High Rise Guideline similarly mandates non-combustible façades for all new buildings over 22 meters. France’s CSTB certification body reported a 300% increase in approvals forA2-ratedd panels between 2020 and 2023. This regulatory shift has transformed fire performance from an optional feature into a legal prerequisite by making non-combustible aluminum composite panels the de facto standard for new construction and deep renovation across Europe’s urban landscape.

Urban Building Renovation Wave Fuels Cladding Modernization

The aging building stock and binding energy efficiency mandates are a continent-wide wave of facade retrofits that rely on aluminum composite panels for rapid aesthetic and functional upgrades. This factor is escalating the growth of Europe aluminum composite panel market. According to the European Commission, over 35 million buildings in the EU require deep energy renovation by 2030 to meet the Fit for 55 climate target,,s with facades accounting for up to 30% of heat loss in unrenovated structures. The revised Energy Performance of Buildings Directive requires all public buildings to undergo energy upgrades every 10 years and mandates minimum energy performance standards for private buildings undergoing major renovation. In Germany, the Federal Ministry for Housing reported that over 180000 residential and commercial facades were modernized in 2023 alone,e with aluminum composite panels selected in 68% of cases due to their lightweight nature, minimal structural reinforcement needs, and ability to integrate external insulation. Similarly, in France,e the MaPrimeRenov scheme subsidized facade cladding as part of thermal envelope upgrades for over 420000 buildings between 2021 and 2023. The speed of installation of ACP retrofits can be completed 40% faster than traditional masonry makes them ideal for urban environments with limited construction windows and noise restrictions.

MARKET RESTRAINTS High Cost of Fire Retardant and Non-Combustible Panels Limits Adoption

The premium pricing of fire-safe aluminum composite panels to widespread adoption in cost-sensitive renovation projects and Southern European countries, which is limiting the growth of Europe aluminum composite panel market. Non-combustible ACP withmineral-filledd or ceramic cores typically cost 2.5 to 3.5 times more than standard polyethylene cored panels by adding 15 to 25 euros per square meter to facade budgets, as confirmed by the European Construction Industry Federation. According to the European Central Bank’s 2023 SME financing survey,y 48% of construction firms in Italy, Spain, and Greece cited material cost inflation as the top obstacle to energy renovation projects. In social housing, where public budgets are tightly constrained, the additional expense often exceeds available subsidies. The Spanish Ministry of Transport reported that 32% of planned public façade retrofits in 2023 were delayed or downgraded due to the inability to afford A2-rated panels. Although lifecycle cost analyses demonstrate long-term savings through reduced insurance premiums and compliance risk, the upfront capital remains prohibitive for many stakeholders. Until national governments expand grant coverage or EU cohesion funds specifically allocate fire-safe claddingg the market will remain bifurcated between high safety premium segments and cost-driven legacy material use.

Fragmented National Fire Testing and Certification Standards Increase Complexity

The significant divergence in national fire safety interpretation and certification processes creates technical and commercial friction for aluminum composite panel manufacturers operating across borders, which is additionally restricting the growth of Europe aluminum composite panel market. While EN 13501 1 provides a common classification system, many member states apply it inconsistently. France requires additional SBI testing for façade systems, while Germany mandates full-scale facade fire tests under DIN 4102 Part 14 for high-rise applications. According to the European Committee for Standardization, over 15 national deviations from harmonized testing protocols persisted in 2023, causing delays and duplicated costs. A single ACP product may require three separate certification paths to sell in France, Germany,ny and the UK, adding 6 to 9 months and over 80000 euros in testing fees, as noted by the European Association of Facade Manufacturers. This fragmentation discourages SMEs from pan-European expansion and complicates compliance for public procurement tenders.

MARKET OPPORTUNITIES Integration of Aluminum Composite Panels in Circular Construction Systems

The European Union’s Circular Economy Action Plan is creating new demand for aluminum composite panels designed for disassembly, reuse,y reuse and high-value recycling at the end of life. This factor is expected to boost the growth of Europe aluminum composite panel market. Aluminum is infinitely recyclable with 95% less energy than primary production,,n and the EU now mandates that all construction products declare recycled content and recyclability, under the upcoming Ecodesign for Sustainable Products Regulation. According to the European Aluminium Association, over 75% of aluminum ever produced in Europe is still in use today, with building products achieving collection rates above 90%. Leading manufacturers like 3A Composites and Alucobond have responded by launching panels with mono-material cores and separable layers that enable clean aluminum recovery. In the Netherlands, the Green Building Council now awards BREEAM credits for facade systems using ACP with verified post-consumer recycled content above 50%. The German Federal Environment Agency reports that pilot projects in Berlin and Hamburg have successfully deconstructed and reused ACP from office retrofits in new interior applications, extending service life without downcycling.

Expansion into Green Facade and Smart Building Integration

Aluminum composite panels are increasingly serving as structural substrates for next-generation green and smart facades that contribute to urban sustainability and building intelligence. The expansion into green facade and smart building integration is additionally fuelling the growth of Europe aluminum composite panel market. In cities like Copenhagen, Paris, and Vienna,,na municipal climate action plans mandate that new commercial buildings incorporate vegetation or solar elements on facades to mitigate urban heat island effects and generate renewable energy. ACP’s flat, t-rigid surface and lightweight nature make it ideal for supporting green wall modules or thin film photovoltaic laminates without excessive structural reinforcement. According to the City of Paris’s Climate Resilience Office, over 120000 square meters of ACP-based green façades were installed in 2023 as part of the “Parisculteurs” program. Similarly, in Swe, den the RISE Research Institute developed ACP integrated with sensors that monitor surface temperature,,e humidity, and air quality, feeding data to building management systems for adaptive HVAC control. The European Innovation Partnership on Smart Cities confirms that 35 pilot projects across Europe now use ACP as a multifunctional envelope layer combining aesthetics e, energy generation, and environmental monitoring.

MARKET CHALLENGES Shortage of Skilled Façade Installers Compromises Safety and Performance

The trained professionals capable of correctly installing fire-safe aluminum composite panel systems are a gap that undermines both safety and regulatory compliance. According to Eurofound, the EU is projected to experience a shortfall of over 300000 skilled construction workers by 202,5 with façade specialists among the most scarce due to aging demographics and low vocational enrollment. In Germany, the Federal Employment Agency reports that 58% of ACP installer vacancies remained unfilled for more than 90 days in 2023 for projects requiring certified fire stopping and thermal break detailing. Improper installation, such as incorrect cavity barrier,s insufficient fire barrier, or poor joint sealing,g can negate the fire resistance of even A2-rated panels. Without standardized certification programs and digital training tools such as augmented reality work instruction,,s the performance promised by advanced ACP systems will remain unrealized on thousands of European building sites,s posing ongoing risks to occupants and liability to developers.

Volatility in Aluminum and Energy Prices Disrupts Supply Stability

Vulnerable to fluctuations in primary aluminum prices and energy costs, which directly impact production economics and lead time,,s is likely to degrade the growth of Europe’s aluminum composite panel market is likely to degrade. Aluminum smeltingextremely energy-intensiveeesiv,e requiring 13 to 15 megawatt hours per ton, and European producers faced natural gas prices exceeding 200 euros per megawatt hour during the 2022 energy crisis. According to the European Aluminium Association, primary aluminum production in the EU fell by 23% between 2021 and 2023 due to plant curtailments leading to supply shortages and price spikes. The London Metal Exchange reported that aluminum prices averaged 2450 dollars per ton in 2023, where 35% higher than the pre-energy crisis level,s directly increasing ACP material costs. Simultaneously, the cost of polymer cores like polyethylene rose by 40% due to petrochemical feedstock volatility, as per Plastics Europe. These dual pressures squeeze margins for panel fabricators who operate on tight profitability, typically 10 to 15%, as confirmed by industry data from Italy and Poland.

REPORT COVERAGE

REPORT METRIC

DETAILS

Market Size Available

2024 to 2033

Base Year

2024

Forecast Period

2025 to 2033

CAGR

5.41%

Segments Covered

By Top Coating, Application, End-User, and Country Analysis

Various Analyses Covered

Global, Regional, andCountry-Level Segment-Level Analysis; DROC, PESTLE Analysis; Porter’s Five Forces Analysis, Competitive Landscape; Analyst Overview of Investment Opportunities

Regions Covered

UK, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, Turkey, Czech Republic, and the Rest of Europe

Market Leaders Profiled

A Composites, Alubond USA, ALUCOIL, Alumax Europe GmbH, Arconic Inc, Euramax, Euro Panel Products Pvt Ltd, Fairview, Guangzhou Goodsense Decorative Building Materials Co., Ltd., Jyi Shyang Industrial Co., Ltd, Mitsubishi Chemical Corporation, Mulford, STACBOND, Valcan, Xxentria, Yingjia Aluminium Co , Ltd

SEGMENT ANALYSIS By Top Coating Insights

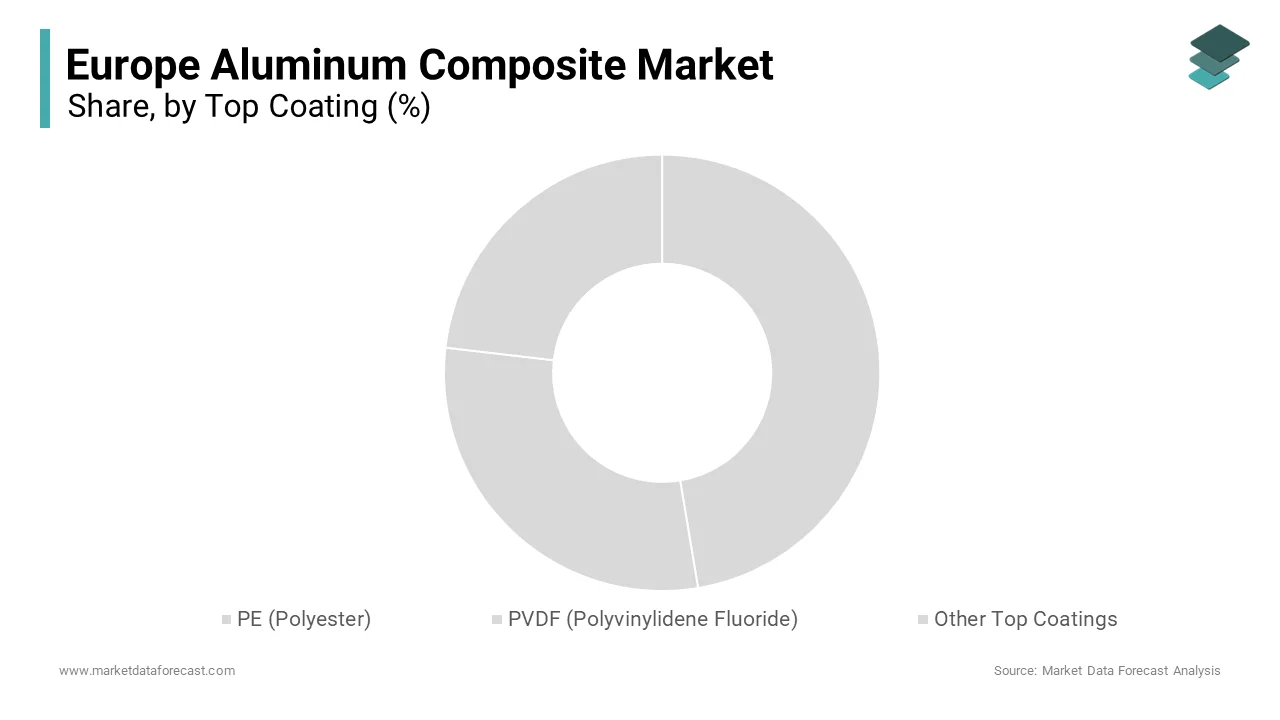

The polyester (PE) coating segment held 52.3% of the Europe aluminum composite panel market share in 202,4 with itscost-effectiveness,s ease of fabrication,n and suitability for interior and short-term exterior applications where extreme weather resistance is not required. The extensive use ofPE-coatedd panels in interior decoration,,n retail fit-outs, and temporary hoardings applications that prioritize color variety, ty surface finish, ish and affordability odecades-longlong durability. In renovation projects with 5 to 10 year design horizons, such aspop-upp stores or event pavilions,s PE’s 5 to 8 year lifespan is sufficient. The German Federal Ministry for Economic Affairs reports that PE-coated panels accounted for 58% of all ACP used in non-structural interior applications in 2023 in urban refurbishment programs targeting public buildings and cultural institutions. The lower energy and emission footprint of PE application compared to fluoropolymer alternatives is additionally fuelling the growth of Europe aluminum composite panel market. PE curing requires temperatures around 220 to 240 degrees Celsius,s whereas PVDF needs 270 degrees or higher,,r increasing natural gas consumption during coil coating. According to the European Environment AgencPE-coatedted products generate 18% less CO2 per square meter during manufacturing. In countries like Italy and Spain, where SMEs dominate construction and operate under tight budget,s PE offers a practical balance of aesthetic,,s performanc,,e and environmental compliance without premium pricing.

The PVDF (polyvinylidene fluoride) top coating segment is projected to expand at a CAGR of 8.6% during the forecast period. The mandatory use of high-performance coatings on buildings in aggressive environments in Nordic and Mediterranean regions is also elevating the growth of Europe aluminum composite panel market. PVDF offers exceptional resistance to UV degradation, charging, and color fade with a proven service life exceeding 2,0 years even under intense solar exposure. According to the Danish Building Research Institutee facades in Copenhagen exposed to marine salts andfreeze-thaww cycles retained over 95% of gloss and color integrity after 15 years when using PVDF versus 60% for PE. Similarlyy in Southern Europe,e Spain’s Technical Building Code requires façade materials in coastal municipalities like Barcelona and Valencia to pass 10000-hour QUV accelerated weathering tests, only achievable with PVDF or equivalent fluoropolymer systems. The alignment of PVDF with premium architectural branding and public infrastructure longevity is also to level up the growth of Europe aluminum composite panel market. Iconic projects like the Louvre Abu Dhabi replica in Paris or the new Amsterdam Central Station extension demand materials that maintain aesthetic integrity for decades. PVDF’s self-cleaning properties due to its low surface energy reduce maintenance costs in urban settings where cleaning facades is logistically complex and expensive. In Switzerland, the Federal Office of Construction mandates that all federal buildings use façade materials with a minimum 25 year performance warrantys effectively requiring PVDF.

By Application Insights

The interior decoration segment was the largest by occupying 48.3% of the Europe aluminum composite panel market share in 202,4 with the ACP’s versatility in creating seamless aesthetic surfaces for walls,s ceilings, partitions, and furniture in commercial and institutional spaces. The material’s ease of fabrication into complex shapes, curvess, es and integrated lighting coves capabilities unmatched by traditional building materials. In healthcare and education sectors, where hygiene and durability are critical, cal ACnon-porousrous surface resists microbial growth and withstands frequent cleaning requirements codified in Germany’s DIN 18041 acoustic and hygiene standards. The French Ministry of Education reported that over 1200 school renovation projects in 2023 usedfire-retardantt ACP for interior cladding to meet both safety and aesthetic mandates. Furthermore, ACP enables rapid installation with minimal dust or disruptionn ideal for urban retrofits, where buildings remain operational during refurbishment. The growing demand for experiential and branded interiors in hospital,,ity retai,,l and corporate environments is alsexpected o expected to escalate the growth of this segment. ACP can be finished in high gloss matte wood grain or brushed metal texture,,s allowing designers to craft immersive environments that reflect brand identity. According to Eurostat, over 85% of new hotel and restaurant openings in Western Europe in 2023 featured custom ACP wall panels with integrated lighting or digital graphics. The material’s compatibility with CNC routing also enables 3D relief patterns and acoustic perforations used extensively in concert halls and conference centers across Scandinavia.

The hoarding and signage application segment is likely to grow at an expected CAGR of 9.4% from 2025 to 2033, owing to the explosion of large-scale construction projects across Europe’s cities requiring durable, visually striking site hoardings that double as advertising space. ACP’s flat rigid surface achieves high-resolution digital prints that remain vibrant for 3 to 5 years, far outperforming vinyl or plywood alternatives. In London, Transport for London mandates that all construction hoardings on public land feature anti-graffiti coatings and community messaging requirements met by PE orPVDF-coatedd ACP. Similarly, Paris’s “Chantier Propre” initiative requires construction sites to present aesthetically integrated façades using recyclable material,,s directly benefiting ACP adoption.

By End User Industry Insights

The building and construction sector was the largest by capturing a dominant share of the Europe aluminum composite panel market in 2024 with the material’s integration into facade modernization programs mandated by the Energy Performance of Buildings Directive. As per the European Commission, over 35 million buildings require deep energy renovation by 2030 with façades being a critical intervention point. ACP’s lightweight nature allows it to be installed over existing masonry without structural reinforcement, thereby reducing cost and disruption in dense urban areas. In Germany, the Federal Ministry for Housing confirmed that ACP was used in some of the public building facade retrofits in 2023 due to its compatibility with external insulation systems and rapid installation. The post Grenfell emphasis on fire-safe building envelopes is also accelerating the growth of Europe aluminum composite panel market. While standard ACP faces restrictions, s non- combustible mineral filled variants are widely specified for new construction. According to the UK’s Ministry of Housing, over 95% of new public and social housing projects in 2023 mandatedA2-ratedd ACP for exterior use. In Scandinavia, national building codes require façade materials to achieve 60-minute fire resistance, as met by ceramic core ACP systems. This regulatory environment has transformed ACP from a purely aesthetic choice to a regulated safety component.

The transportation segment is likely to growat the fastest CAGR of 10.2% during the forecast period,,d with the need for lightweight, ht durable interior surfaces in trains, aircraft, and marine vessels that meet strict safety and design standards. The modernization of Europe’s rail fleet under the EU’s Green Deal mobility initiatives is also leveraging thegrowth ofw Europe’s aluminum composite panel market. High-speed and urban transit trains require interior wall and ceiling panels that are lightweight fire resistant and easy to clean. In aviation, the European Union Aviation Safety Agency mandates that all cabin materials pass rigorous burn rate and fume toxicitytests requirements, met by fire-retardant ACP with phenolic cores.

COUNTRY ANALYSIS Germany Aluminium Composite Panel Market Analysis

Germany was the top performer of the Europe aluminum composite panel market by occupying 22.3% ofthe the share in 202,4 with its dense construction activity, stringent fire safety enforcement,nt and advanced manufacturing ecosystem. The German Institute for Building Technology mandatA2-ratedted materials for all new buildings over 22 meters by ensuring consistent demand for fire-safe panels. Furthermore, Germany hosts leading ACP producers like Alucobond and 3A Composites with R&D centers in Singen and Heidelberg, developing next-generation mineral core and recyclable panels.

United Kingdom Aluminium Composite Panel Market Analysis

The United Kingdom was positioned second by holding 17.3% of the Europe aluminum composite panel market share in 202,4 with its post Grenfell fire safety overhaul,l massive urban regeneration pipeline,ne and high density of commercial real estate. The UK’s Construction Products Regulation aligns with EU standards but enforces stricter on-site inspection, driving demand for certified, field-traceable panels from reputable suppliers. Companies like Kingspan and Aliva UK have expanded fire testing facilities to meet verification demands.

France Aluminium Composite Panel Market Analysis

France’srance aluminum composite panel market growth is likely to grow with its ambitious urban renewal strategy, strict coastal building codes, and sustainable public architecture. In Mediterranean regions like Provence and Corsica, national building codes require facade materials to withstand 10000 hours of UV exposure and salt spray with PVDF-coated ACP. Furthermore, Paris’s “Reinventing Paris” initiative mandates that all new public buildings use recyclable and low-carbon materials, which is acceleratingthe theadoptionn of ACP with high recycled aluminum content.

Italy Aluminium Composite Panel Market Analysis

Aluminum composite panel market growth is likely to grow with its historic preservation needs,s vibranretail sector,r, and high seismic activity. According to Italy’s National Institute of Architecture, over 12000 heritage buildings in city centers like Rome, Florence, anVenicene, equire facade interventions that respect historical integrity while improving energy performance. ACP’s lightweight nature avoids overloading fragile structures. The country’s fashion and luxury industry also drives demand for premium interior About unique hotels and showrooms.MS Milan Design Week alone features over 2000 temporary installations using custom printed panels annually. Furthermore, Italy’s seismic building code mandates lightweight non-structural cladding to reduce inertial forces during earthquakes by making ACP preferable to a stone or concrete alternative.

Netherlands Aluminium Composite Panel Market Analysis

The Netherlands aluminum composite panel market growth is likely to grow with its circular economy lleadershipp high construction densities an,d progressive green building policies. According to the Dutch Green Building Council, over 85% of new commercial projects in Amsterdam and Rotterdam target BREOutstanding certificationation which awards credits for façade systems using ACP with verified recycled content above 50%. The Netherlands’ “Green Deal for Sustainable Construction” mandates that all public buildings use materials designed for disassemband reused r,euse driving innovation in separable ACP systems. Furthermore, the country’s flat terrain and high water table necessitate lightweight building envelopes to minimize foundation loads by making ACP ideal for both new builds and retrofits.

COMPETITIVE LANDSCAPE

Competition in the Europe aluminum composite panel market is characterized by a tiered structure featuring global material innovators,s regional manufacturers, rs and specialized converters. Leading brands like 3A Composi, Tes Aluco, Bond,d and Alpolic compete on fire performance, aesthetics, sustainability credentials, and technical support rather than price alone. Differentiation hinges on cor compositi, on, coatintechnologyog,,y andrecycled cont,,e nt and compatibility with circular construction principles. While large projects favor globally recognized brands with proven compliance rrecordsecords smaller renovations often use regional or private label panels where cost is decisive. The post Grenfell safety imperative has elevated technical standardsacross the bboard yet fragmentation in certification processes and uneven enforcement in Southern Europe sustain a dual market.

KEY MARKET PLAYERS

A few of the market players dominating the Europe aluminum composite panel market are

3A Composites Alubond USA Alpolic 3A Composites ALUCOIL Alumax Europe GmbH Arconic Inc. Euramax Euro Panel Products Pvt Ltd Fairview Guangzhou Goodsense Decorative Building Materials Co., Ltd. Jyi Shyang Industrial Co., Ltd. Mitsubishi Chemical Corporation Mulford STACBOND Valcan Xxentria Yingjia Aluminium Co. Ltd Top Players In The Market 3A Composites is a European pioneer in aluminum composite panel manufacturing with a strong heritage in sustainable and high-performance façade solutions. Headquarters in Switzerland,d the company supplies ALUCOBOND and ALUCORE panels across Europe’s building, transportation,n and engineering sectors, with a focus on fire-safe mineral-filled cores and recyclable constructions. 3A Composites expanded its circularity program by launching A2-rated panels made with up to 85% recycled aluminum and mono material layers that enable clean end of life separation. The company also enhanced its digital design platform to support architects with BIM-compliant specifications and fire classification data aligned with national building codes. Through continuous innovation in safety aesthetics and circularity,y 3A Composites reinforces its global reputation as a benchmark for responsible façade engineering across more than 100 countries. Alucobond is a globally recognized brand in the aluminum composite panel market with deep integration across Europe’s architectural and construction industries. The brand offers a comprehensive portfolio of PE, ,F, and fire-retardant panels tailored to iinteriorerior exterior, and transportation applications. In response to post Grenfell regulati,ons Alucobond accelerated the productionof A2-certified variants with non-combustible mineral cores meeting EN 13501 1 standards across all EU member states. The company introduced its Alucobond Spectra, featuring advanced color stability and self-cleaning properties for coastal urban high-rise projects. By combining decades of architectural expertise with rigorous compliance and design support, Alucobond maintains its position as a preferred specification choice for landmark buildings and public infrastructure worldwide. Alpolic is a leading innovator in aluminum composite panels known for its advanced core technologies and premium surface finishes serving Europe’high-endnd architectural and transportation markets. The brand ofoffers fire-retardantnd non-combustible panels that comply with the strictest European safety standards, including EN 13501 1 and DIN 4102. In 23, Alpolic launched its Alpolic/fr nano series in Germany anFrancera,nce featuring photocatalytic coatings that break down airborne pollutants under sunlight by aligning with urban air quality initiatives in cities like Paris and Berlin. The company also expanded its digcolor-matching service to support custom RAL and metallic finishes for luxury retail and hospitality projects. Through material science innovation and environmental performance,e Alpolic strengthens its global influence in sustainable and intelligent building envelope solutions. Top Strategies Used by the Key Market Participants

Key players in the Europe aluminum composite panel market prioritize fire safety by developing and promoting A2-rated non-combustible panels with mineral or ceramic cores to comply with post Grenfell regulations across member states. They invest in circular economy initiatives by increasing recycled aluminum content,,t designing fordisassemblyb,l,y and enabling end of life material recovery. Companies enhancedigital toolsc, , ts including BIM lilibrariesies fire classification databases, and color visualization platforms, streamline specifications s, eamline spespecificationstrategic expansion of production capacity for PVDF and specialty coated panels supports premium exterior applications in coastal and high-rise segments.

MARKET SEGMENTATION

This research report on the Europe aluminium composite project market is segmented and sub-segmented into the following categories.

By Top Coating

PE (Polyester) PVDF (Polyvinylidene Fluoride) Other Top Coatings

By Application

Interior Decoration Hoarding and Signage Insulation Cladding Railway Carrier Column Cover and Beam Wrap

By End-User Industry

Building and Construction Transportation (Rail, Auto, Bus, Marine) Other End-User Industries

By Country

UK France Spain Germany Italy Russia Sweden Denmark Switzerland Netherlands Turkey Czech Republic Rest of Europe