These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump’s tariffs. Discover why before your portfolio feels the trade war pinch.

CVS Health Investment Narrative Recap

To own CVS Health, I think you need to believe its integrated model across insurance, pharmacy, and care delivery can eventually translate into healthier margins despite current pressure on profitability. The latest dividend affirmation and Illinois Medicaid partnership support the existing story but do not materially change the key near term swing factors, which still center on margin recovery efforts in Health Care Delivery and the risk that elevated medical cost trends persist longer than expected.

The most relevant update here is CVS Health’s AI native consumer engagement platform, which sits at the heart of its digital push. If it improves coordination across Aetna, Caremark, and care delivery assets while being commercialized to external payers and employers, it could support the longer term catalysts around better customer retention, higher utilization of in house services, and more efficient care delivery.

Yet while this all sounds promising, investors should still be aware of how persistent medical cost pressures could…

Read the full narrative on CVS Health (it’s free!)

CVS Health’s narrative projects $445.1 billion revenue and $8.3 billion earnings by 2028. This requires 5.0% yearly revenue growth and about a $3.8 billion earnings increase from $4.5 billion today.

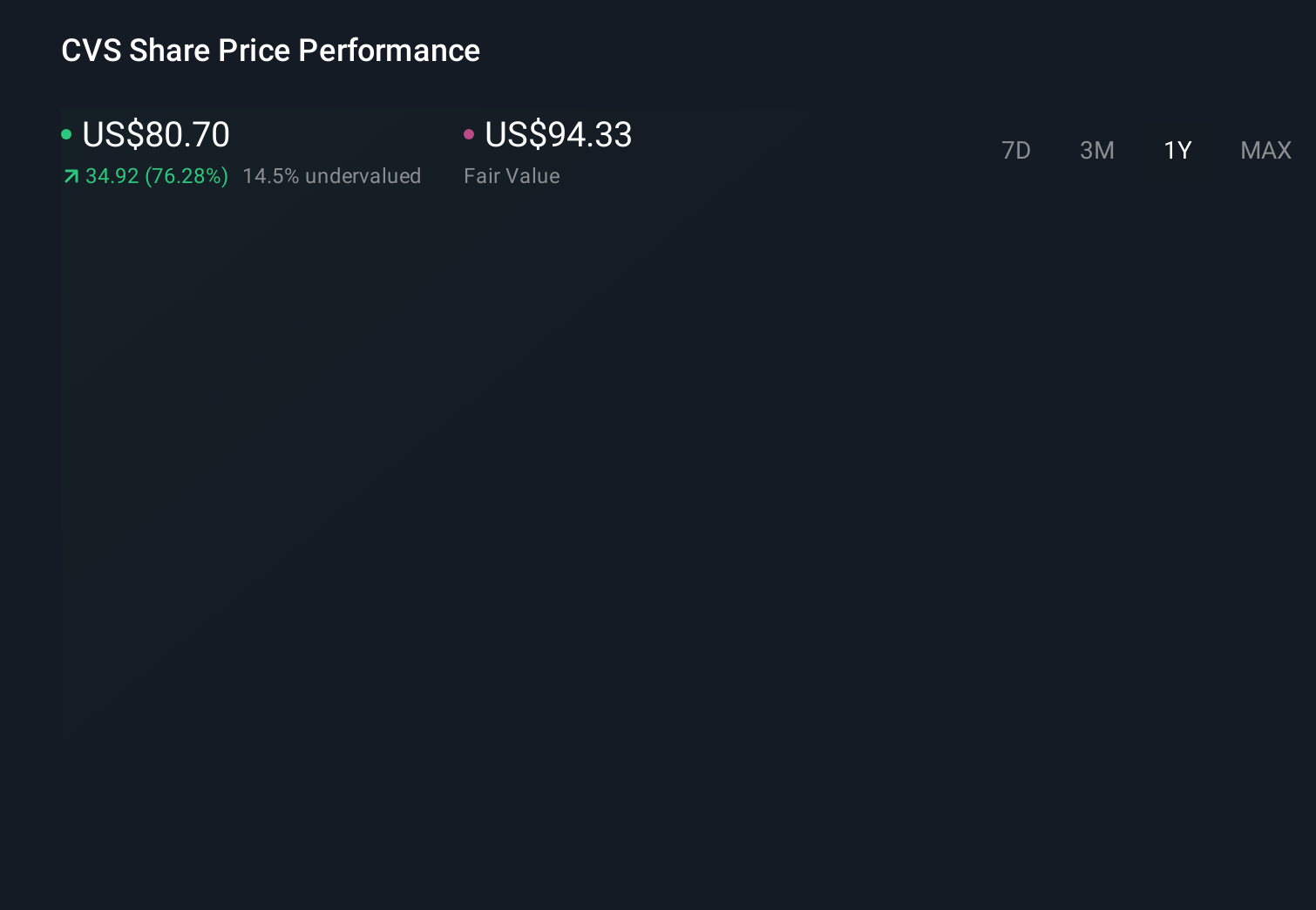

Uncover how CVS Health’s forecasts yield a $94.33 fair value, a 17% upside to its current price.

Exploring Other Perspectives CVS 1-Year Stock Price Chart

CVS 1-Year Stock Price Chart

Five members of the Simply Wall St Community currently estimate CVS Health’s fair value between US$94.33 and US$226.72, reflecting very different expectations for the business. When you set those views against ongoing concerns about elevated medical benefit ratios and pressure on net margins, it becomes even more important to compare multiple perspectives on how durable CVS Health’s earnings power might be.

Explore 5 other fair value estimates on CVS Health – why the stock might be worth just $94.33!

Build Your Own CVS Health Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Searching For A Fresh Perspective?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com