Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Quanta Services Investment Narrative Recap

To own Quanta Services, you need to believe that long term spending on grid modernization, renewables, and data center power will continue to support its large project pipeline. Seaport Global’s upgrade reinforces this thesis but does not materially change the near term focus on execution risk from acquisitions and on project timing, which remain key swing factors for results.

Against this backdrop, Quanta’s recent work tied to data centers and large energy projects, such as the 3 GW thermal hybrid plant for NiSource, is particularly relevant. These complex jobs sit at the heart of the company’s catalyst around rising power demand while also magnifying exposure to possible delays, cost pressures, or slower capital spending by utilities and technology customers.

Yet, behind Quanta’s growing role in critical power infrastructure, investors should still be aware of the risk that large, politically sensitive projects could…

Read the full narrative on Quanta Services (it’s free!)

Quanta Services’ narrative projects $37.5 billion revenue and $1.7 billion earnings by 2028.

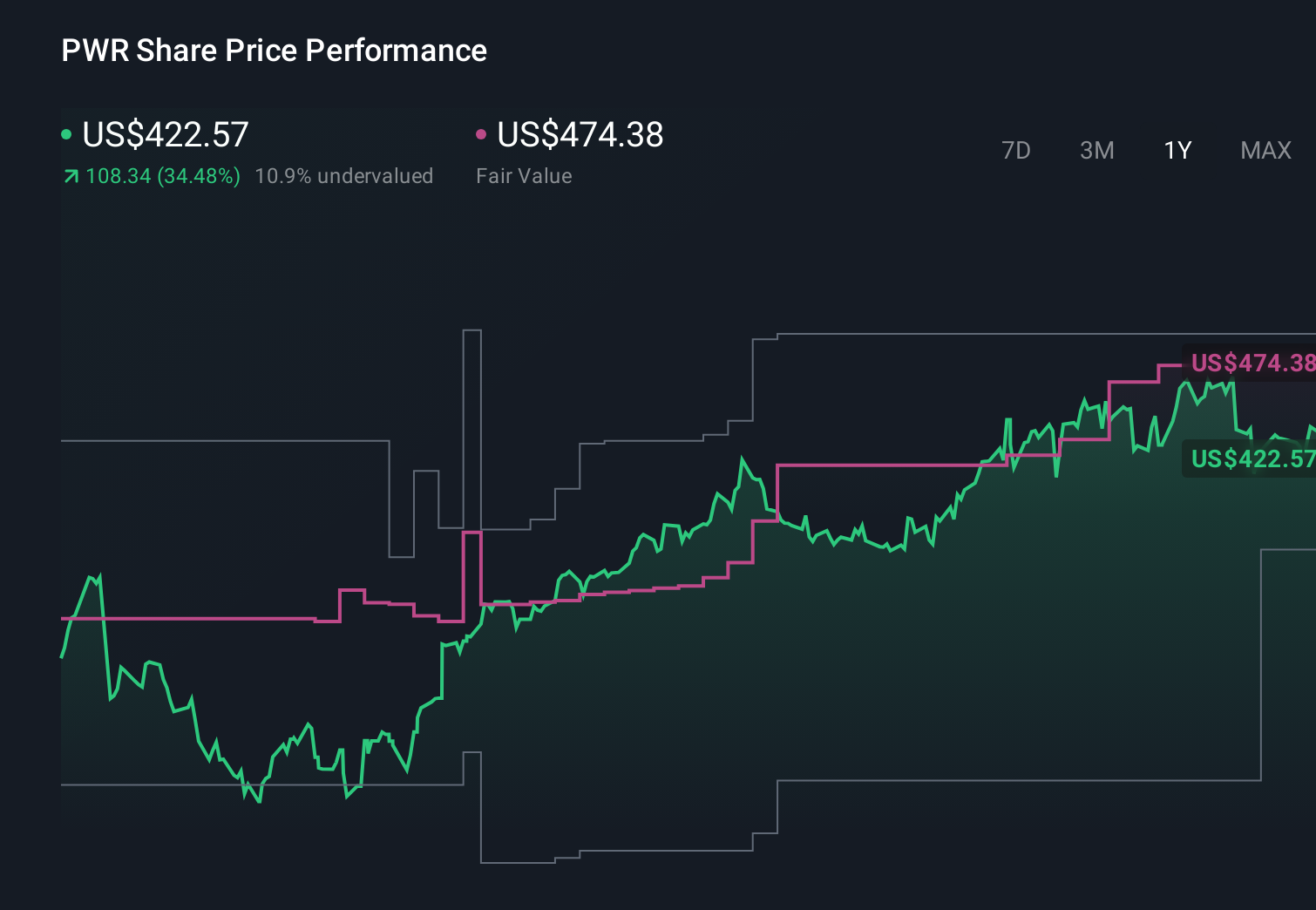

Uncover how Quanta Services’ forecasts yield a $474.38 fair value, a 12% upside to its current price.

Exploring Other Perspectives PWR 1-Year Stock Price Chart

PWR 1-Year Stock Price Chart

Four fair value estimates from the Simply Wall St Community span about US$300 to roughly US$474 per share, showing a wide spread of views. When you set those opinions against Quanta’s reliance on multi year transmission and data center build outs, it becomes clear why exploring several alternative viewpoints can be useful before forming your own expectations for the business.

Explore 4 other fair value estimates on Quanta Services – why the stock might be worth 29% less than the current price!

Build Your Own Quanta Services Narrative

Disagree with existing narratives? Create your own in under 3 minutes – extraordinary investment returns rarely come from following the herd.

Looking For Alternative Opportunities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don’t delay:

This article by Simply Wall St is general in nature. We provide commentary based on historical data

and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your

financial situation. We aim to bring you long-term focused analysis driven by fundamental data.

Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Simply Wall St has no position in any stocks mentioned.

Discover if Quanta Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com