Virentech, ZpuAI, Minimax, etc.

AI, Semiconductor companies are investing in strong technology independence from the beginning of the year

![ZfuAI Listed on the Hong Kong Stock Exchange on the 8th [AFP Yonhap News]](https://www.europesays.com/wp-content/uploads/2026/01/news-p.v1.20260111.575c7c0206474b1fbb3595aedba0f10d_P1.png) 사진 확대

사진 확대 ZfuAI Listed on the Hong Kong Stock Exchange on the 8th [AFP Yonhap News]

Shares of artificial intelligence (AI) and semiconductor companies listed on the Hong Kong stock market have been on a steep rise since the beginning of the year. Amid the competition for AI supremacy between the U.S. and China, the Chinese government is speeding up its independence of AI and semiconductors, and investors’ interest in related companies is also rapidly increasing.

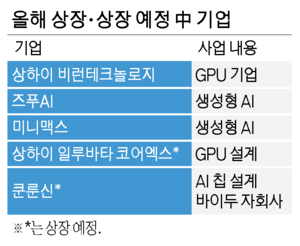

According to the Hong Kong Stock Exchange on the 11th, Shanghai Birn Technology closed at HK$34.06 on the 9th, up 1.31% from the previous trading day. Since going public on the 2nd, the stock price of BirnTech has remained significantly above the public offering price (HK$19.60) for six consecutive trading days, rising more than 75% on a cumulative basis.

VirunTech is one of China’s leading GPU manufacturers. Jang Won, who led SenseTime, a Chinese AI industry starter, and Zhao Guofang, a native of Qualcomm and Huawei, were co-founded in 2019. When the U.S. tightened regulations on AI chip exports in 2022, it also drew attention from the industry by unveiling chips with performance comparable to Nvidia’s high-performance GPU “H100.”

The stock price trend of Chinese AI companies listed on the Hong Kong stock market this year, following BirnTech’s lead, is also strong. ZpuAI, which was listed on the 8th, finished trading at HK$131.5 which is 13.1% higher than the public offering price, performing well from the first day of listing. ZpuAI is the leader of the “六 Small Generative AI,” which refers to six Chinese Generative AI model startups with an enterprise value of more than $1 billion, and OpenAI has publicly mentioned it as a competitor.

Rival Minimax, which went public on the 9th, a day later than ZpuAI, also closed at 338.6 Hong Kong dollars, up 105.2% from the public offering price (165 Hong Kong dollars) on the day of listing.

사진 확대

사진 확대 Not only newly listed companies but also Chinese semiconductor companies listed on the Hong Kong stock market are showing an upward trend. SMIC, China’s largest foundry company, rose about 4% in the new year, while Huahong Semiconductor’s stock price also rose more than 20% during the same period.

The market seems to interpret this trend as a structural change beyond short-term events. Analysts say that related companies are expecting to benefit from the policy as the Chinese government puts forward independence of the AI ecosystem as a core industrial strategy. It is reported that the Chinese government has recently started operating an “autonomous AI system” that conducts scientific research on its own without human intervention. Hong Kong’s South China Morning Post (SCMP) said, “The recent listing of technology stocks shows that China’s technology independence strategy is rekindling investment fever in the AI sector.”

In particular, it is notable that these companies are listed on the Hong Kong stock market one after another. The Hong Kong stock market, which used to be centered on real estate and financial stocks in the past, is rapidly changing its constitution, focusing on high-tech industries such as AI, semiconductors, and biotech. The strength of the Hong Kong market is that the listing system is more flexible and accessible to global investors compared to mainland China’s stock market. Regarding the background of the listing in Hong Kong, AI CEO Zhang Feng Zfu also said, “Hong Kong serves as an excellent gateway and bridgehead for global expansion as an international city.”

The Hong Kong listing procession of Chinese AI companies is likely to continue for the time being. Kunlunxin (Baidu’s AI chip design subsidiary), already called “NVIDIA’s antagonist” in China, submitted an application for listing on the Hong Kong stock market earlier this year, while Chinese GPU design company Shanghai Ilubata Core X Semiconductor also launched a public offering to list on the Hong Kong stock market at the end of last month.